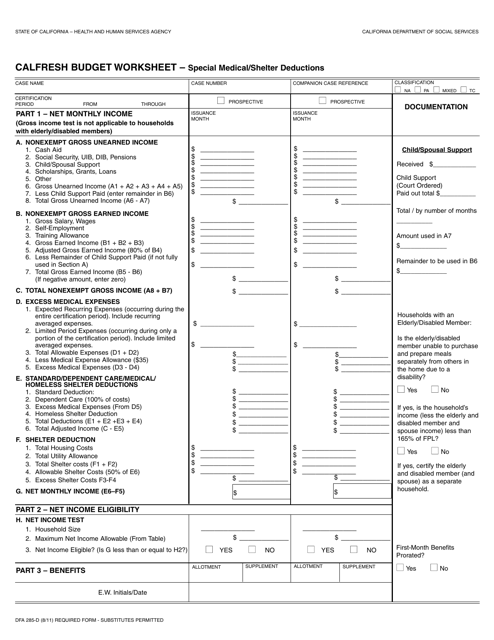

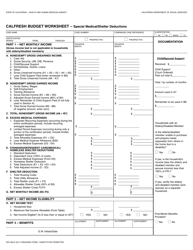

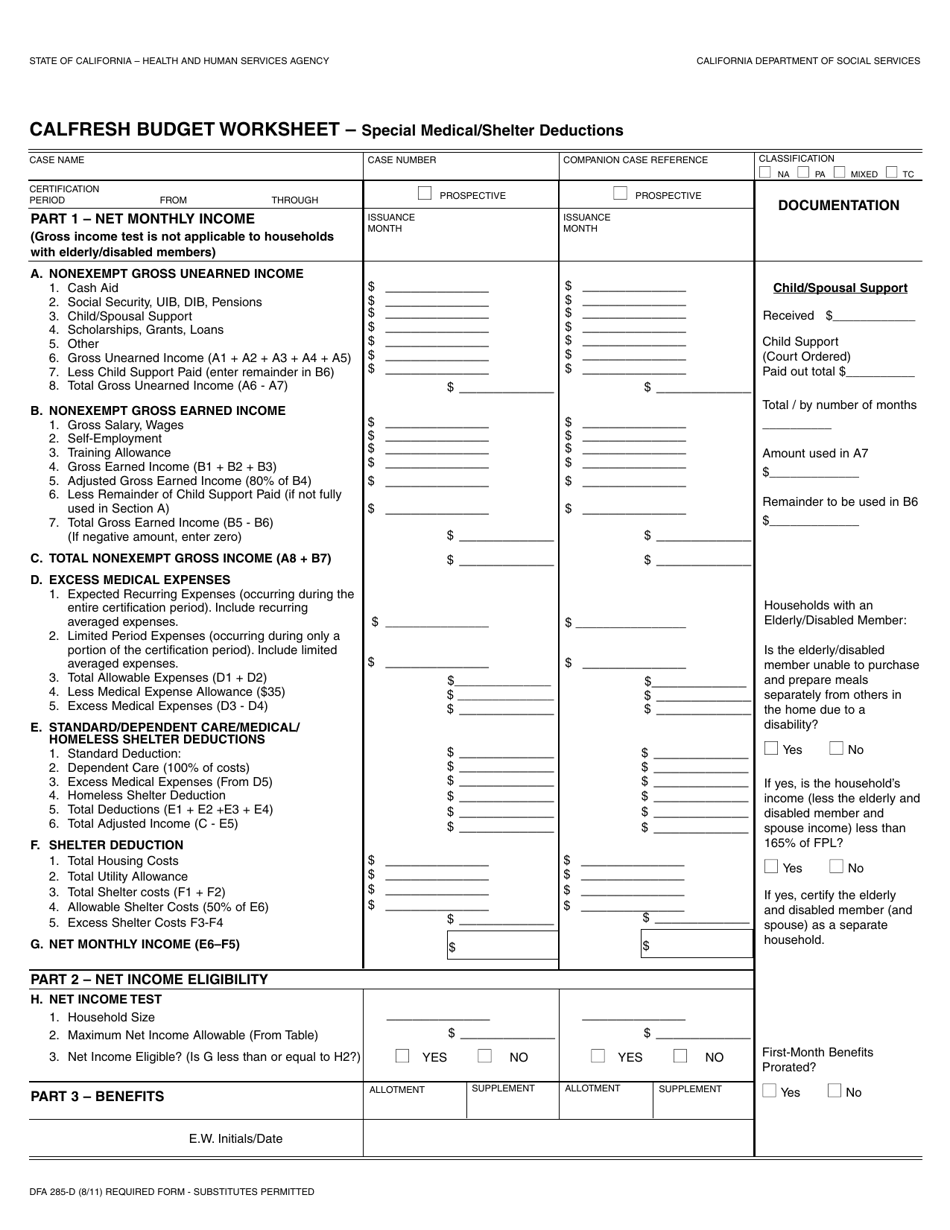

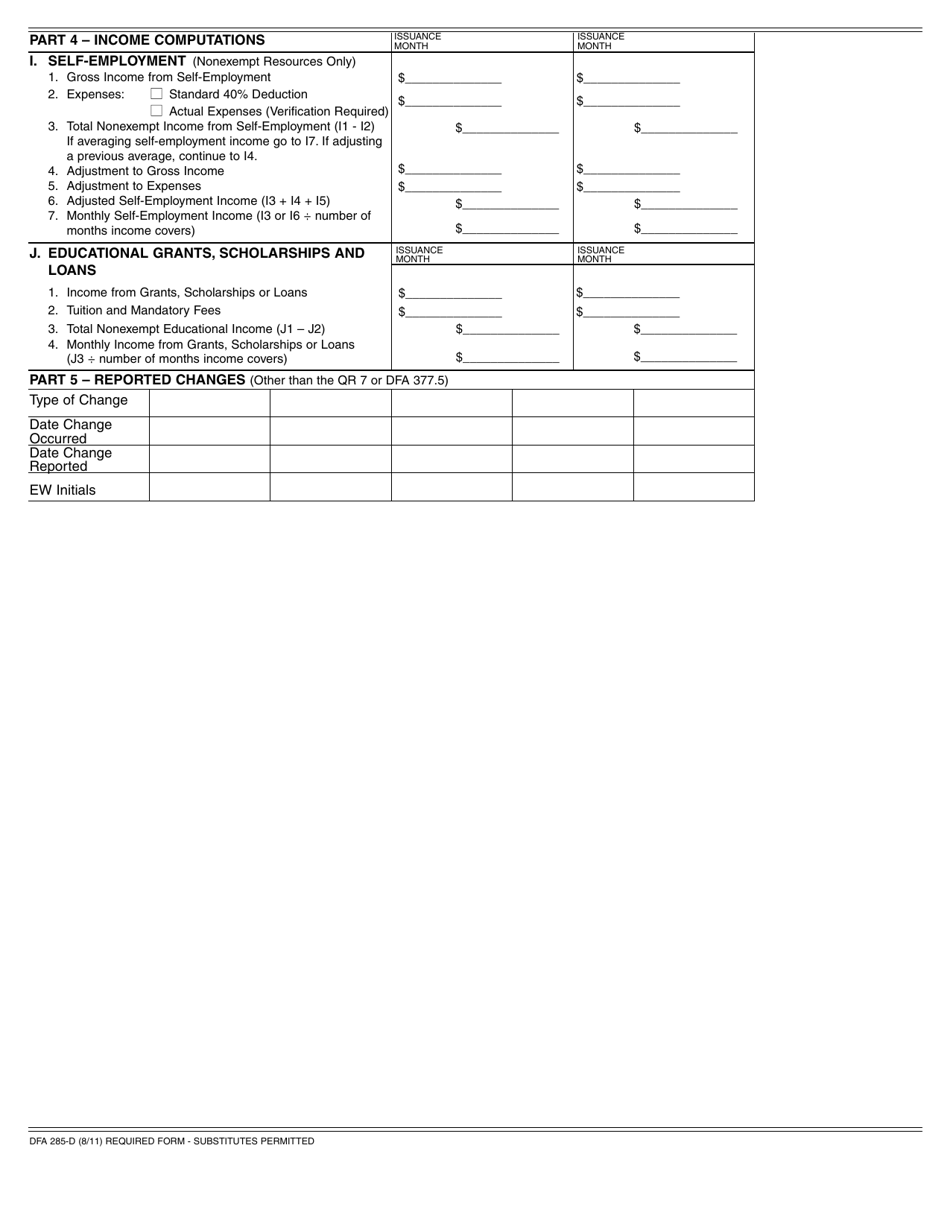

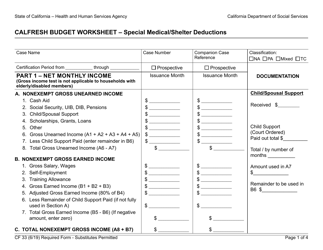

Form DFA285-D CalFresh Budget Worksheet - Special Medical / Shelter Deductions - California

What Is Form DFA285-D?

This is a legal form that was released by the California Department of Social Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is DFA285-D?

A: DFA285-D is a CalFresh Budget Worksheet used in California.

Q: What is CalFresh?

A: CalFresh is a food assistance program in California, formerly known as the Supplemental Nutrition Assistance Program (SNAP).

Q: What is the purpose of the DFA285-D form?

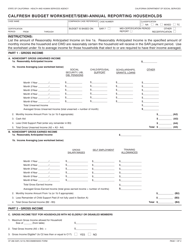

A: The purpose of the DFA285-D form is to calculate the CalFresh benefits for households with special medical/shelter deductions.

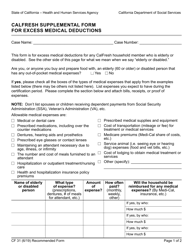

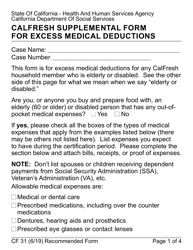

Q: What are special medical deductions?

A: Special medical deductions are expenses related to medical care and treatment that can reduce the amount of income considered when determining eligibility for CalFresh.

Q: What are shelter deductions?

A: Shelter deductions are expenses related to housing, such as rent or mortgage payments, utilities, and other housing costs, that can reduce the amount of income considered when determining eligibility for CalFresh.

Q: Who can use the DFA285-D form?

A: The DFA285-D form can be used by individuals or households in California who have special medical or shelter deductions and are applying for or receiving CalFresh benefits.

Q: Are special medical or shelter deductions available in other states?

A: The availability of special medical or shelter deductions may vary by state, so it is best to consult the specific guidelines of your state's food assistance program.

Form Details:

- Released on August 1, 2011;

- The latest edition provided by the California Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DFA285-D by clicking the link below or browse more documents and templates provided by the California Department of Social Services.