This version of the form is not currently in use and is provided for reference only. Download this version of

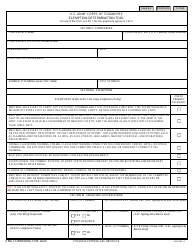

Form CW2186B

for the current year.

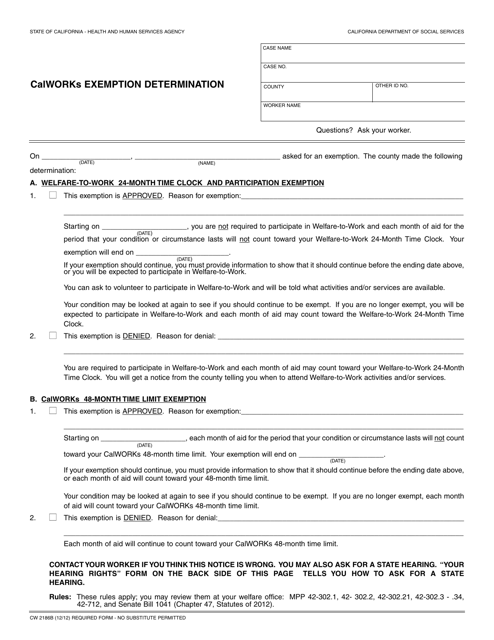

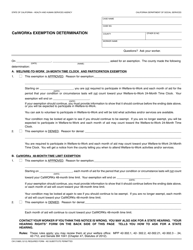

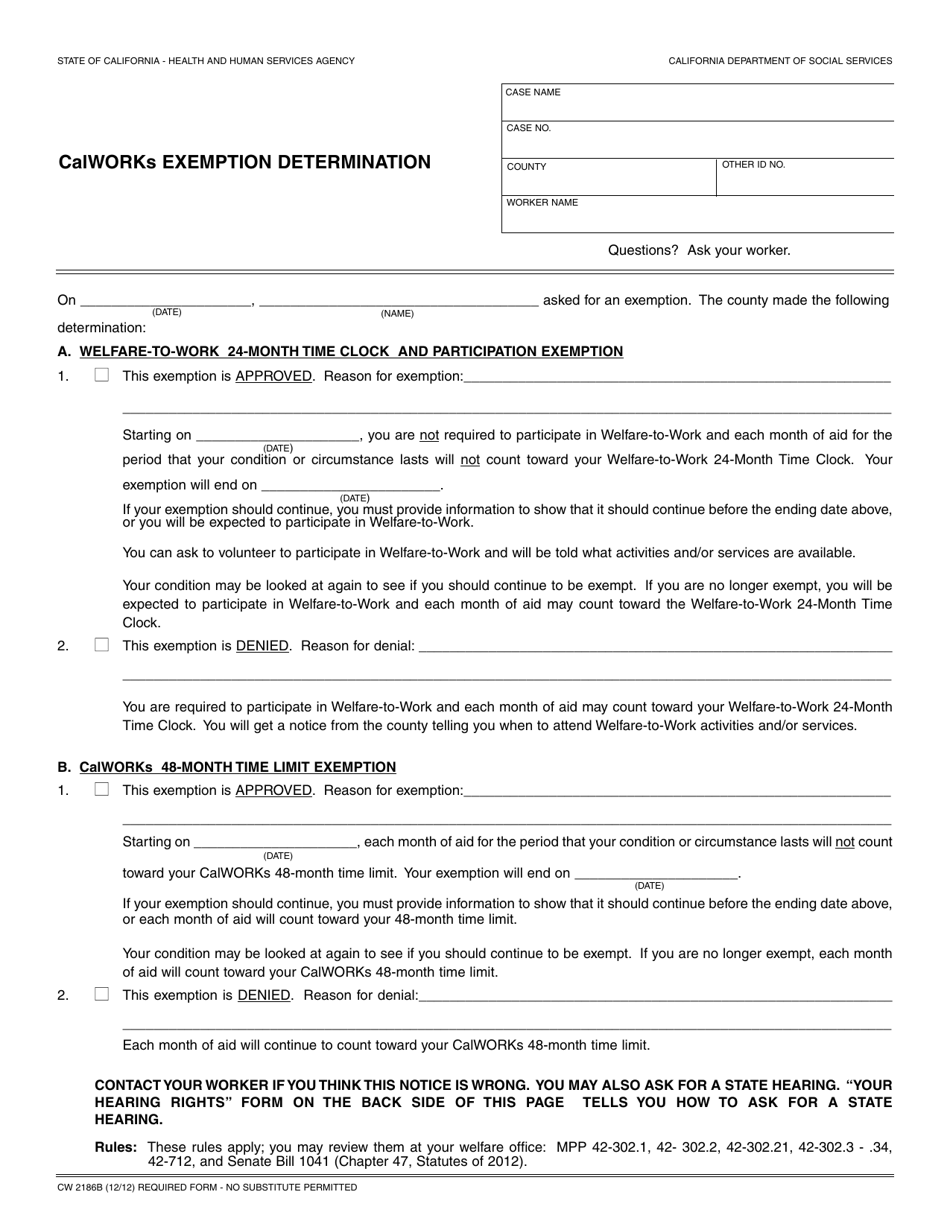

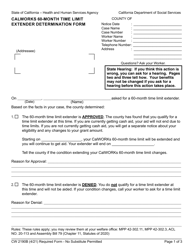

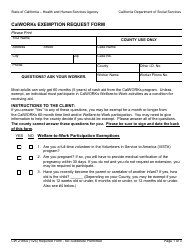

Form CW2186B Calworks Exemption Determination - California

What Is Form CW2186B?

This is a legal form that was released by the California Department of Social Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CalWORKs?

A: CalWORKs is California's welfare-to-work program that provides cash aid and employment services to low-income families.

Q: What is a CW2186B form?

A: CW2186B is a form used to determine if a CalWORKs recipient is eligible for an exemption from the welfare-to-work requirements.

Q: Who is eligible for a CalWORKs exemption?

A: Certain individuals, such as pregnant women, individuals with a disability, and individuals caring for a disabled family member, may qualify for a CalWORKs exemption.

Q: How do I apply for a CalWORKs exemption?

A: To apply for a CalWORKs exemption, you need to fill out and submit the CW2186B form, providing the necessary information and documentation as required.

Q: What happens after I submit the CW2186B form?

A: After you submit the CW2186B form, your county's social services agency will review your application and determine if you qualify for a CalWORKs exemption.

Q: What are the benefits of a CalWORKs exemption?

A: If you are approved for a CalWORKs exemption, you may be exempted from the welfare-to-work requirements, allowing you to receive cash aid without having to participate in work activities.

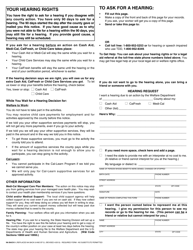

Q: Can I appeal if my CalWORKs exemption application is denied?

A: Yes, if your CalWORKs exemption application is denied, you have the right to appeal the decision and request a hearing to present your case.

Form Details:

- Released on December 1, 2012;

- The latest edition provided by the California Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CW2186B by clicking the link below or browse more documents and templates provided by the California Department of Social Services.