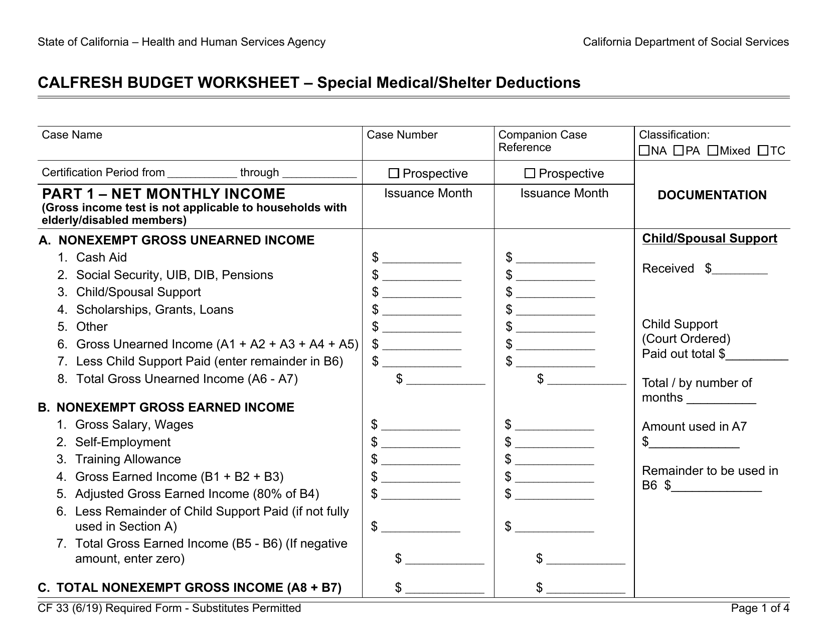

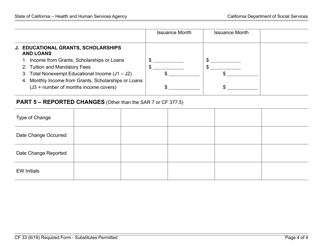

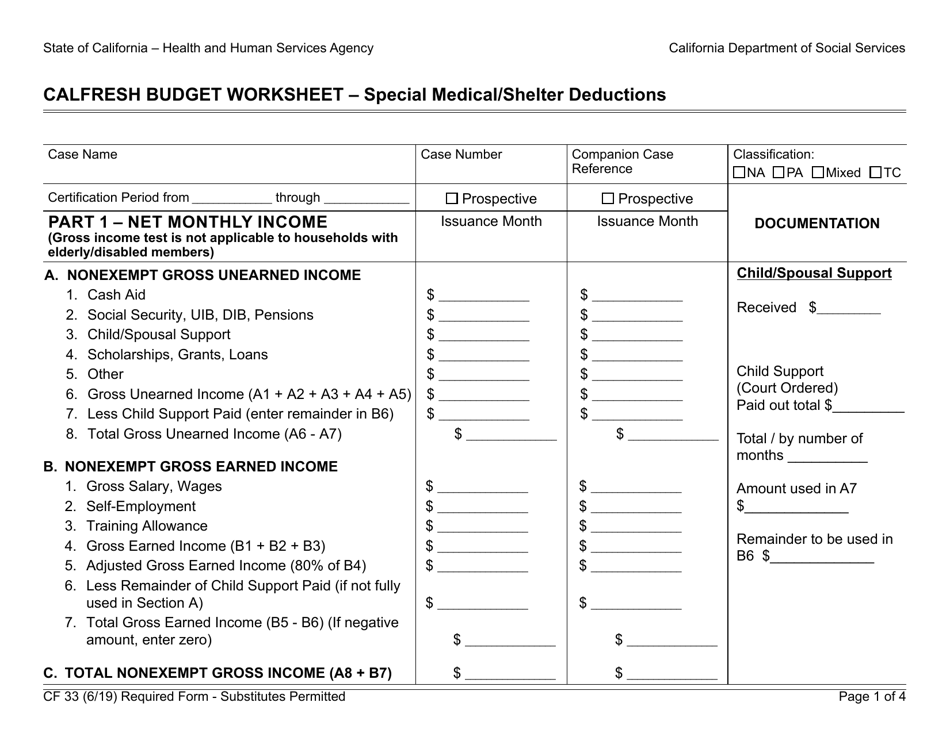

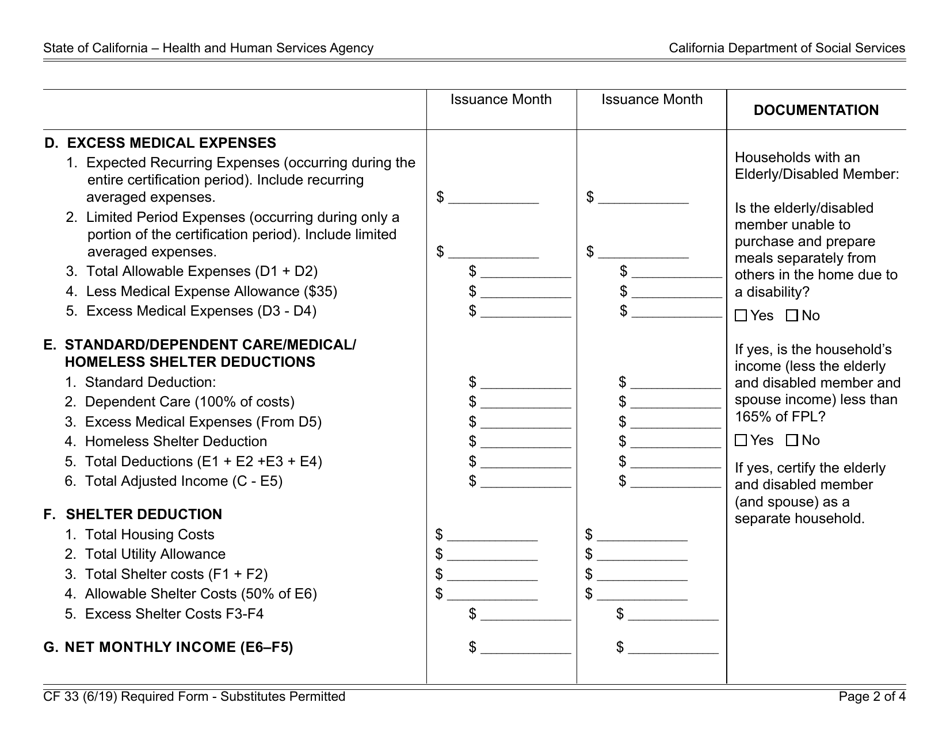

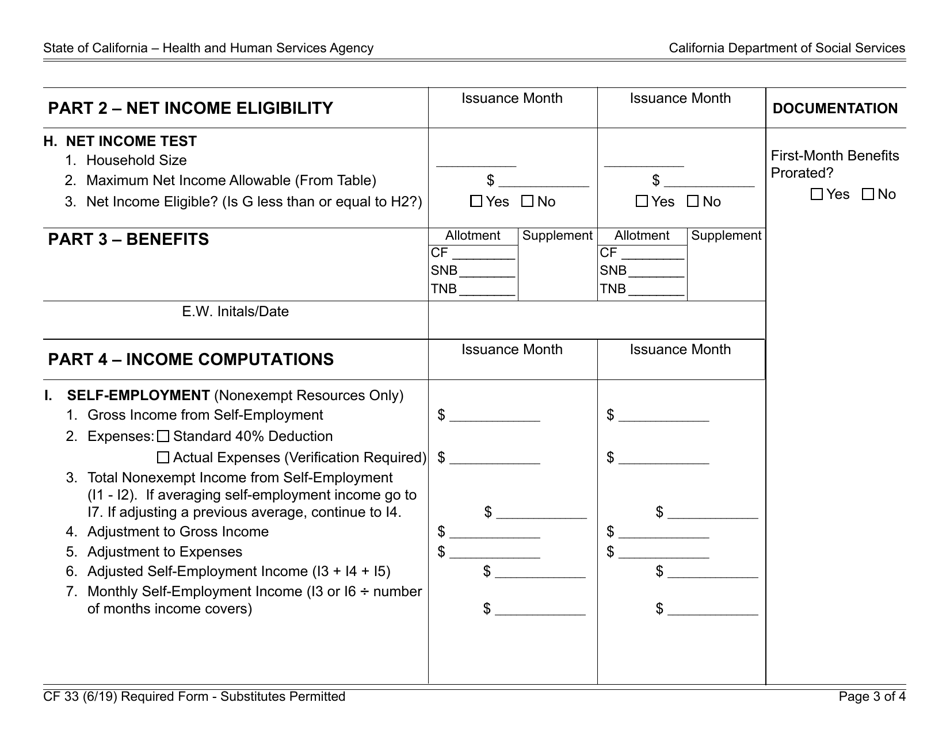

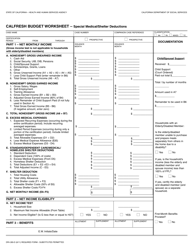

Form CF33 CalFresh Budget Worksheet - Special Medical / Shelter Deductions - California

What Is Form CF33?

This is a legal form that was released by the California Department of Social Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form CF33?

A: Form CF33 is the CalFresh Budget Worksheet.

Q: What is CalFresh?

A: CalFresh is a program in California that provides nutrition assistance to low-income individuals and families.

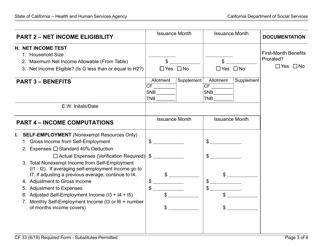

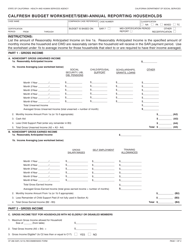

Q: What is the purpose of Form CF33?

A: Form CF33 is used to calculate the CalFresh benefits for an individual or household.

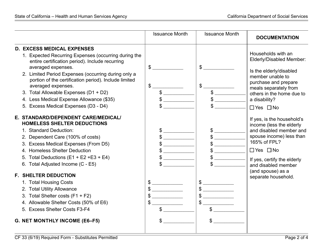

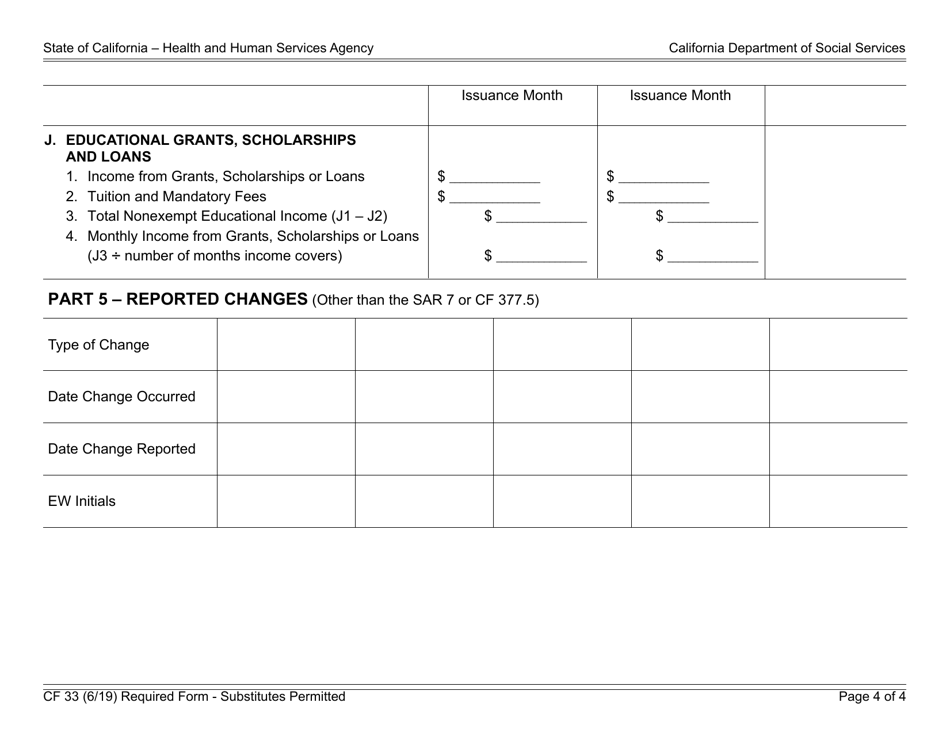

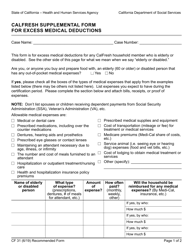

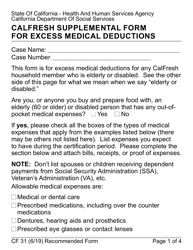

Q: What are special medical/shelter deductions?

A: Special medical/shelter deductions are specific expenses related to medical or housing costs that can be deducted from the total income to determine the eligibility and benefit amount for CalFresh.

Q: Who can claim special medical/shelter deductions?

A: Individuals or households who have eligible medical or housing expenses may claim special medical/shelter deductions.

Q: How do I fill out Form CF33?

A: You need to provide information about your income, expenses, and any special medical or shelter deductions you have.

Q: Do I need to submit Form CF33 with my CalFresh application?

A: Yes, Form CF33 should be submitted along with your CalFresh application to determine your eligibility and benefit amount.

Q: Are special medical/shelter deductions guaranteed to be approved?

A: Special medical/shelter deductions are subject to approval based on the eligibility criteria set by the California Department of Social Services.

Q: What should I do if I have questions about Form CF33?

A: If you have any questions about Form CF33 or need assistance in filling it out, you should contact your local county Department of Social Services for guidance.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the California Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CF33 by clicking the link below or browse more documents and templates provided by the California Department of Social Services.