This version of the form is not currently in use and is provided for reference only. Download this version of

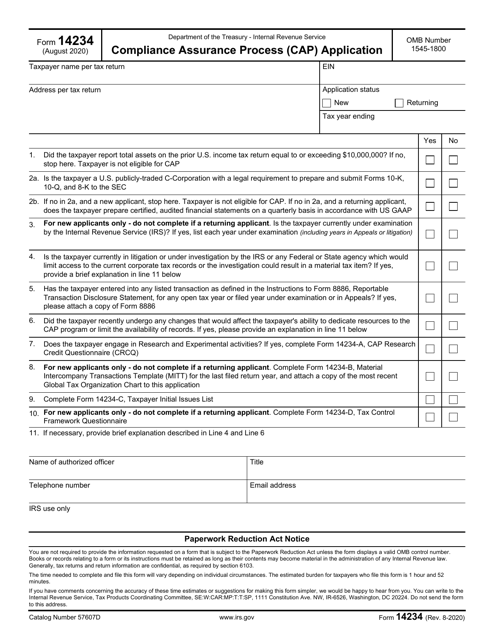

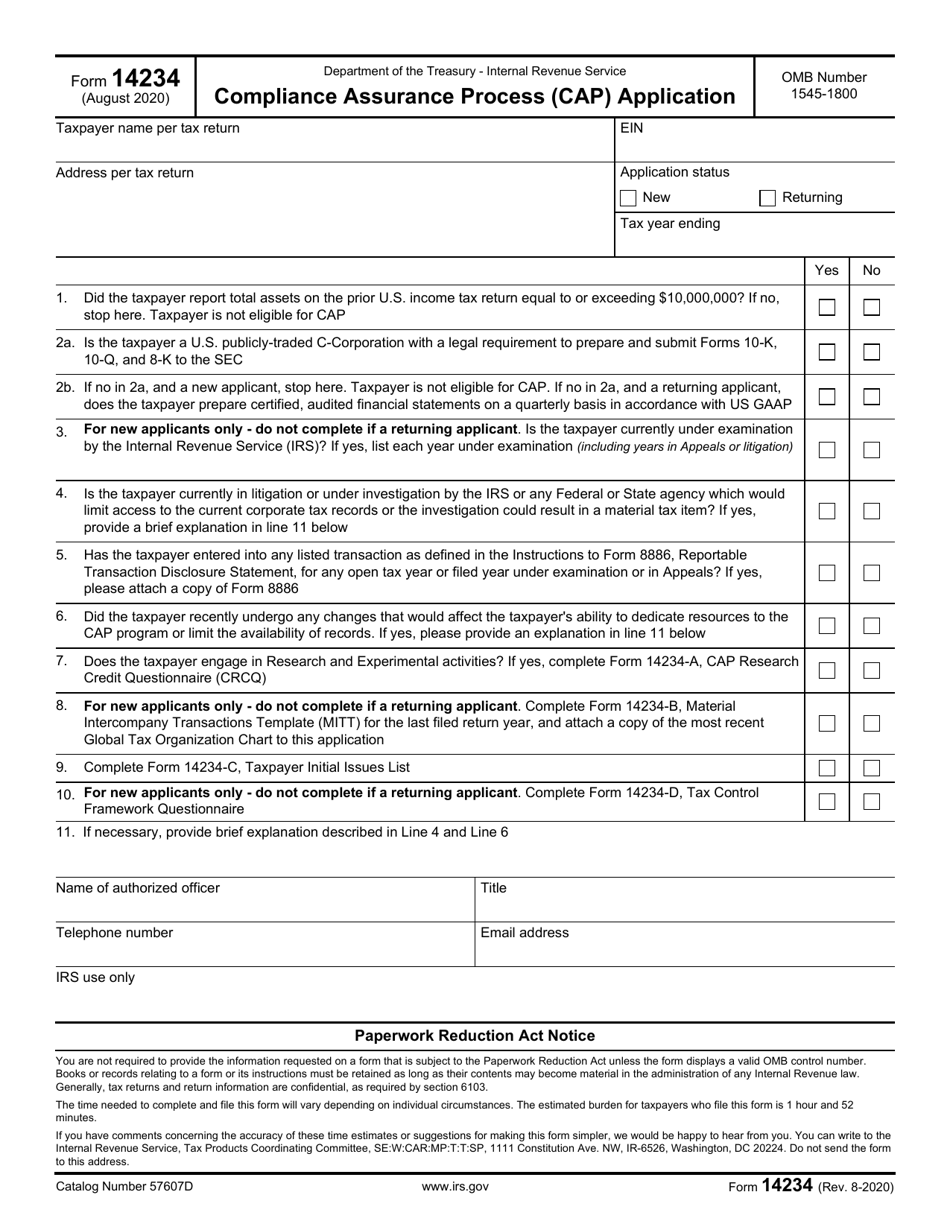

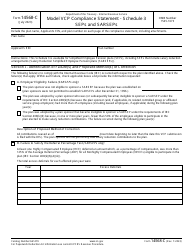

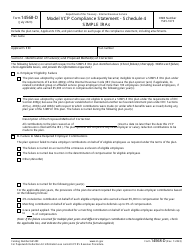

IRS Form 14234

for the current year.

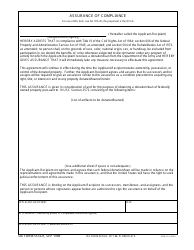

IRS Form 14234 Compliance Assurance Process (CAP) Application

What Is IRS Form 14234?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on August 1, 2020. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14234?

A: IRS Form 14234 is the application for the Compliance Assurance Process (CAP).

Q: What is the Compliance Assurance Process (CAP)?

A: The Compliance Assurance Process (CAP) is a program offered by the IRS to certain large corporate taxpayers that allows them to resolve potential tax issues in real-time before filing their tax returns.

Q: Who is eligible to participate in the CAP program?

A: The CAP program is available to large corporate taxpayers who meet specific eligibility criteria set by the IRS.

Q: What are the benefits of participating in the CAP program?

A: Participating in the CAP program allows taxpayers to work collaboratively with the IRS to resolve potential tax issues before filing their tax returns, providing greater certainty and reducing the risk of future disputes.

Q: Is participation in the CAP program mandatory?

A: Participation in the CAP program is voluntary and requires taxpayers to submit an application using IRS Form 14234.

Q: Are there any fees associated with participating in the CAP program?

A: There are no fees associated with participating in the CAP program.

Q: Can I apply for the CAP program if I am not a large corporate taxpayer?

A: No, the CAP program is specifically designed for large corporate taxpayers.

Q: What is the purpose of the CAP program?

A: The CAP program aims to improve tax compliance by providing taxpayers with greater certainty regarding their tax obligations and reducing the likelihood of disputes.

Q: How long does the CAP program last?

A: The CAP program generally lasts for a three-year cycle, with the possibility of renewal for additional cycles.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14234 through the link below or browse more documents in our library of IRS Forms.