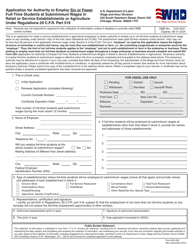

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 400-00810

for the current year.

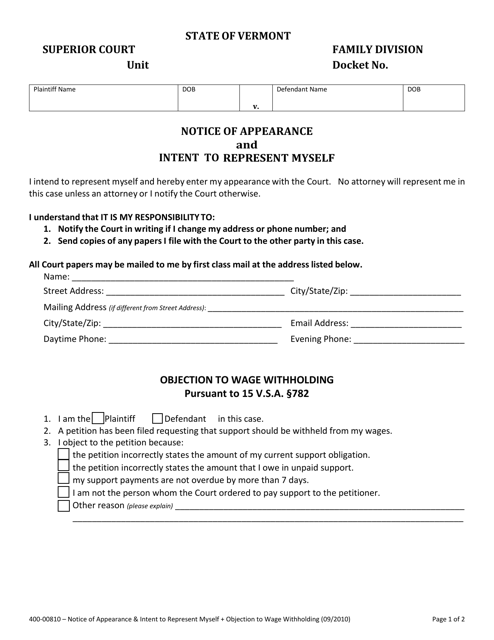

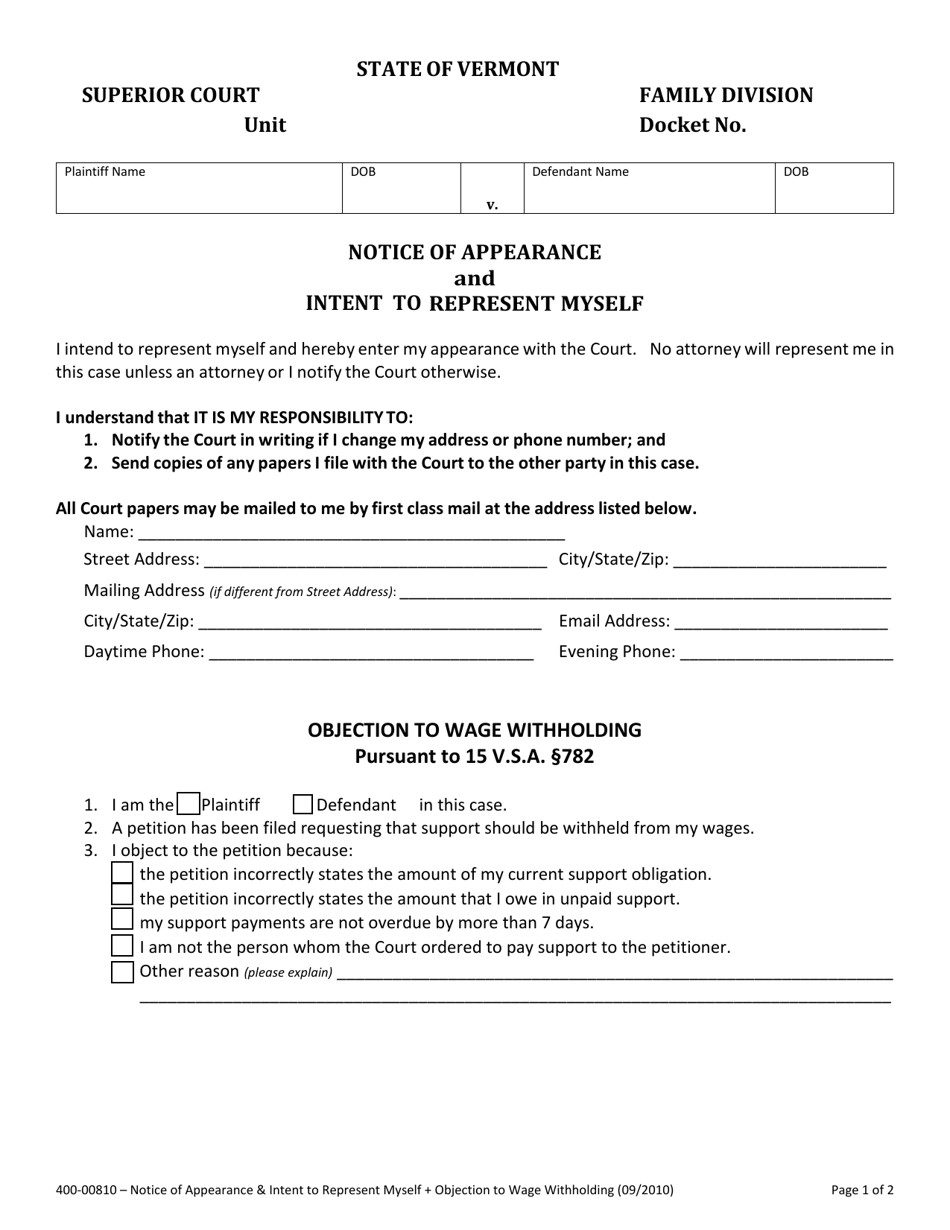

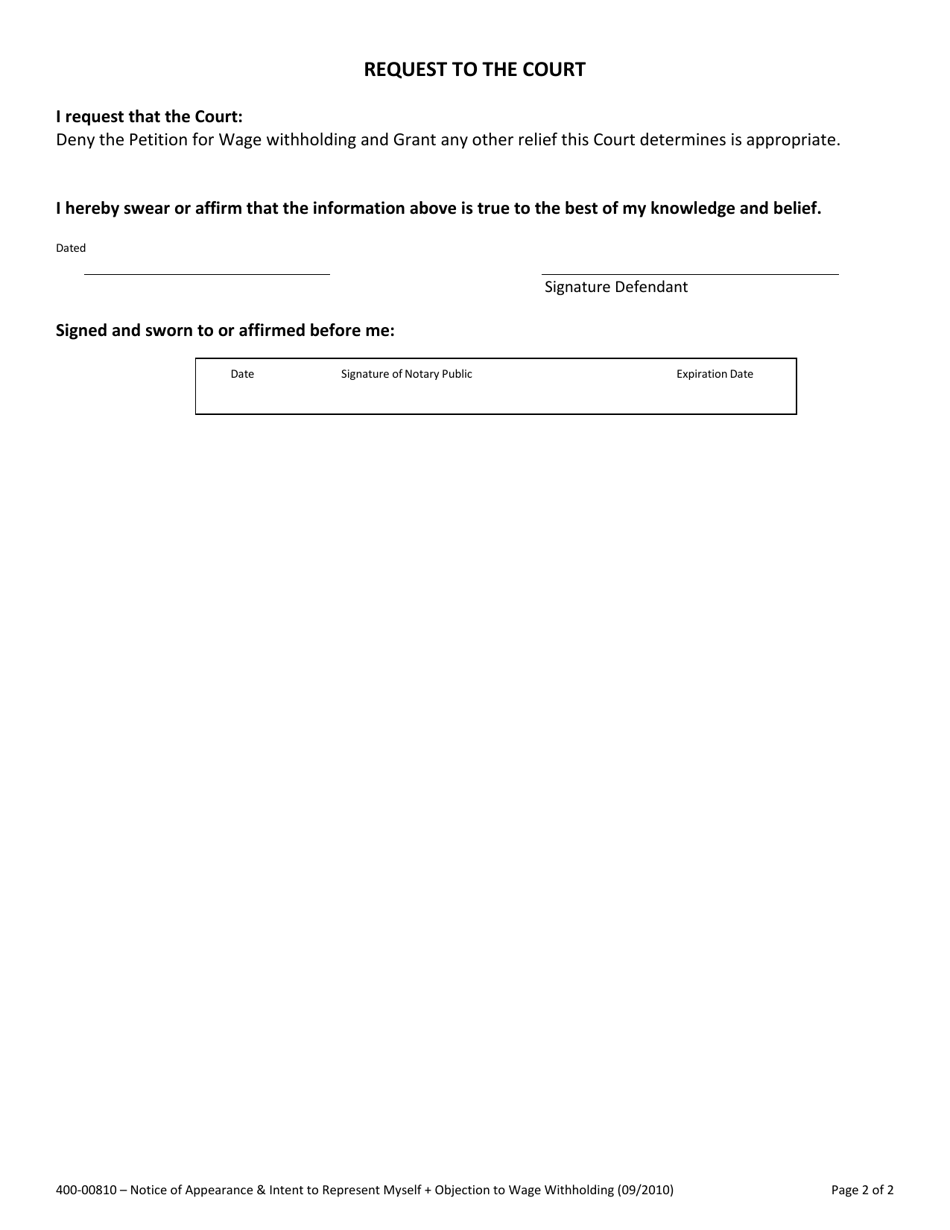

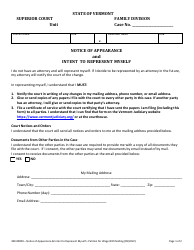

Form 400-00810 Objection to Wage Withholding - Vermont

What Is Form 400-00810?

This is a legal form that was released by the Vermont Superior Court - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 400-00810?

A: Form 400-00810 is the Objection to Wage Withholding form in Vermont.

Q: What is the purpose of Form 400-00810?

A: The purpose of Form 400-00810 is to object to the withholding of wages.

Q: Who can use Form 400-00810?

A: Any individual in Vermont who wants to object to the withholding of their wages can use Form 400-00810.

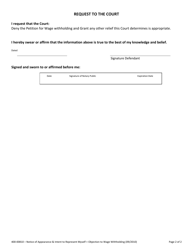

Q: How do I fill out Form 400-00810?

A: You need to provide your personal information, the reason for your objection, and sign the form to complete it.

Q: What do I do with the completed Form 400-00810?

A: Once completed, you should submit the form to the Vermont Department of Taxes.

Q: Is there a deadline for filing Form 400-00810?

A: There is no specific deadline mentioned for filing Form 400-00810, but it is recommended to submit it as soon as possible.

Q: Can I object to wage withholding for any reason?

A: Yes, you can object to wage withholding for any reason that is valid under Vermont law.

Q: Can I object to wage withholding if I owe taxes?

A: Yes, you can still object to wage withholding even if you owe taxes.

Q: Can I object to wage withholding if I am in bankruptcy?

A: Yes, you have the right to object to wage withholding even if you are in bankruptcy.

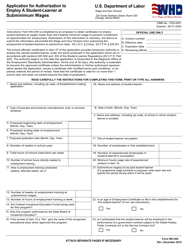

Form Details:

- Released on September 1, 2010;

- The latest edition provided by the Vermont Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 400-00810 by clicking the link below or browse more documents and templates provided by the Vermont Superior Court.