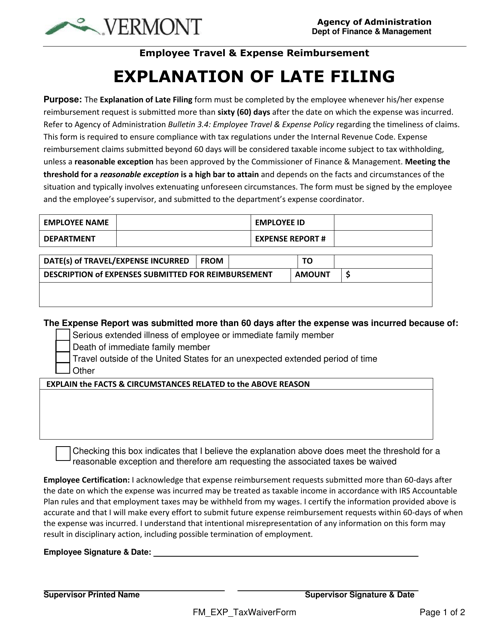

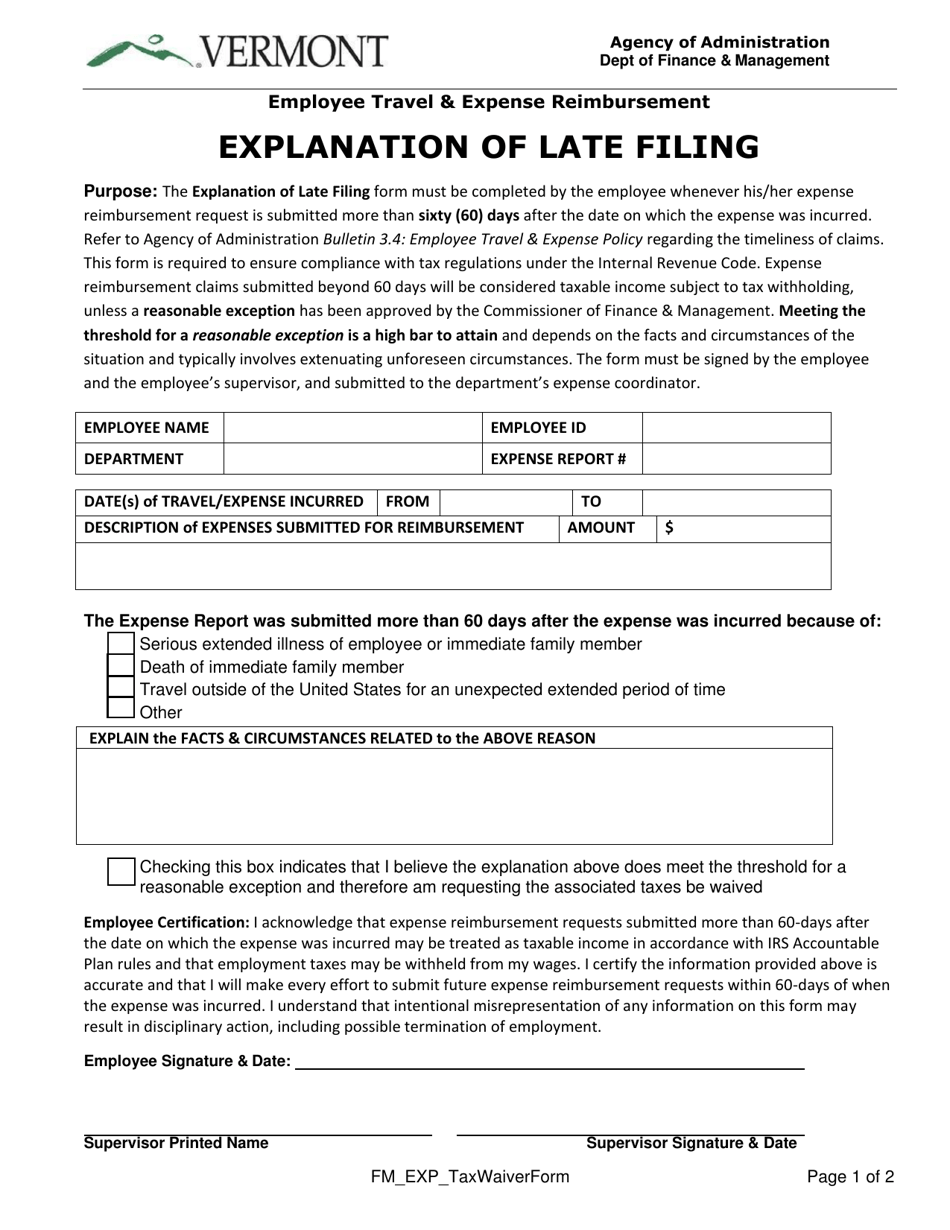

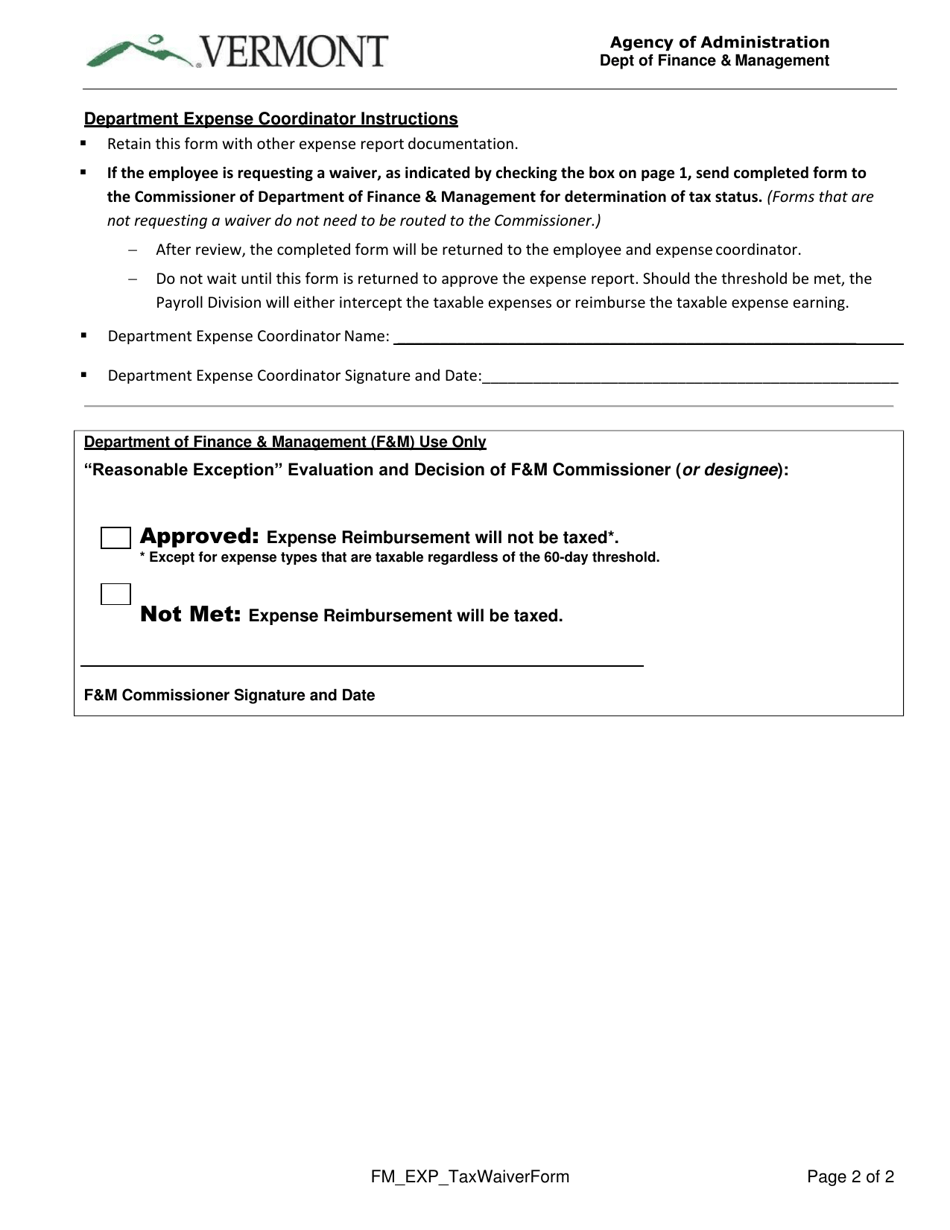

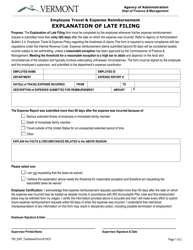

Explanation of Late Filing - Vermont

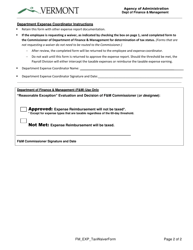

Explanation of Late Filing is a legal document that was released by the Vermont Department of Finance & Management - a government authority operating within Vermont.

FAQ

Q: What is late filing?

A: Late filing refers to filing a document or tax return after the deadline has passed.

Q: What are the consequences of late filing in Vermont?

A: In Vermont, there may be penalties and interest imposed for late filing, which can vary depending on the type of document or tax return.

Q: How can I avoid late filing penalties in Vermont?

A: To avoid late filing penalties in Vermont, it is important to file your documents or tax returns on time or request an extension if necessary.

Q: Can I request an extension for filing my taxes in Vermont?

A: Yes, you can request an extension for filing your taxes in Vermont. The deadline for requesting an extension is typically the same as the original filing deadline.

Form Details:

- The latest edition currently provided by the Vermont Department of Finance & Management;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Vermont Department of Finance & Management.