This version of the form is not currently in use and is provided for reference only. Download this version of

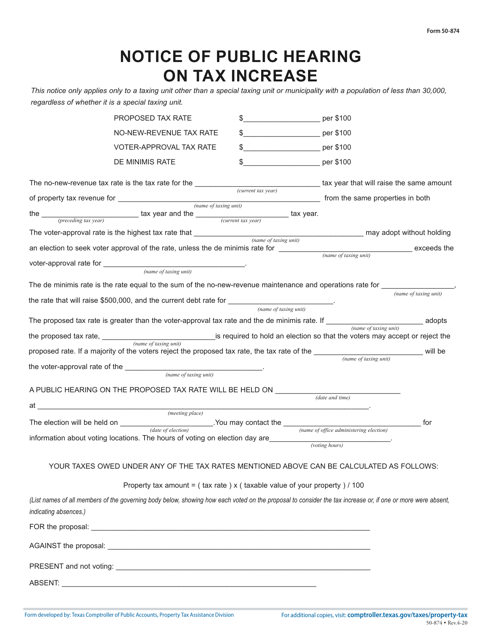

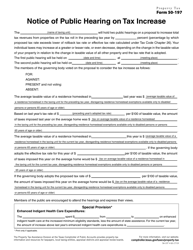

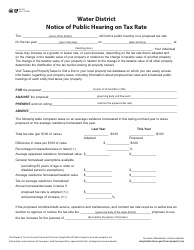

Form 50-874

for the current year.

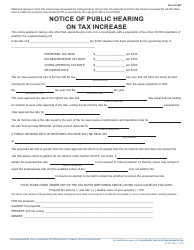

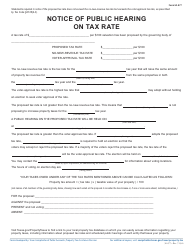

Form 50-874 Notice of Public Hearing on Tax Increase - Proposed Rate Greater Than Voter-Approval Tax Rate and De Minimis Rate - Texas

What Is Form 50-874?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 50-874?

A: Form 50-874 is a Notice of Public Hearing on Tax Increase in Texas.

Q: What is the purpose of form 50-874?

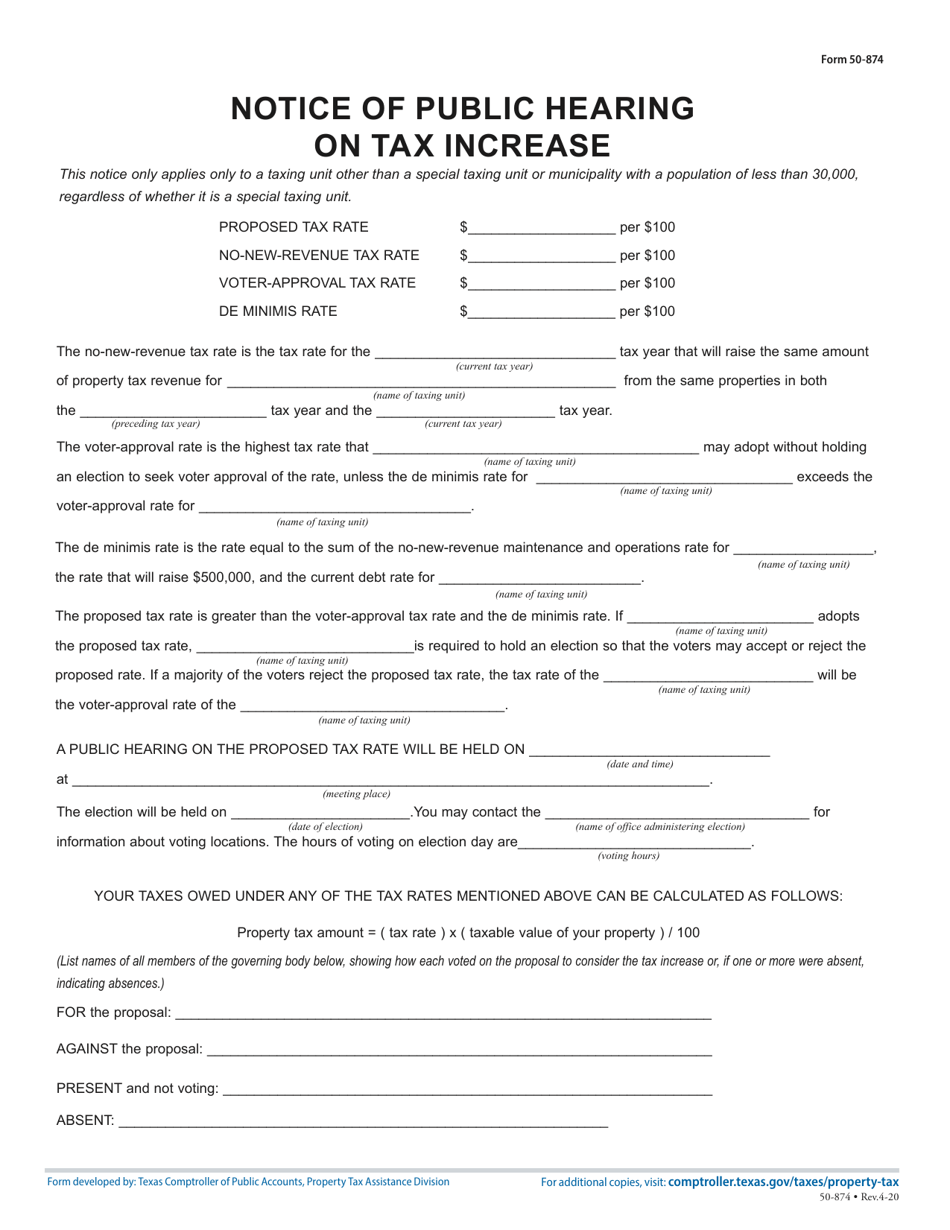

A: The purpose of form 50-874 is to notify the public about a proposed tax increase that exceeds the voter-approved tax rate and de minimis rate.

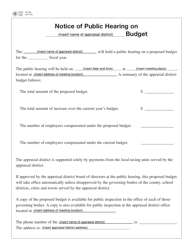

Q: What is the voter-approved tax rate?

A: The voter-approved tax rate is the maximum tax rate that can be imposed without triggering a public hearing.

Q: What is the de minimis rate?

A: The de minimis rate is a very small tax rate increase that does not require a public hearing.

Q: Why is a public hearing required for a tax increase above the voter-approved tax rate and de minimis rate?

A: A public hearing is required for tax increases above the voter-approved tax rate and de minimis rate to ensure transparency and give the public an opportunity to voice their opinions.

Q: Who needs to be notified about the public hearing?

A: The public and all interested parties need to be notified about the public hearing on the tax increase.

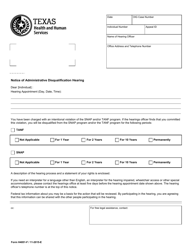

Q: How is form 50-874 submitted?

A: Form 50-874 is submitted to the appropriate governing body or tax office in Texas.

Q: Is form 50-874 specific to Texas?

A: Yes, form 50-874 is specific to Texas and is used to notify about tax increases in the state.

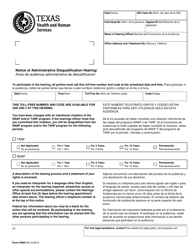

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-874 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.