This version of the form is not currently in use and is provided for reference only. Download this version of

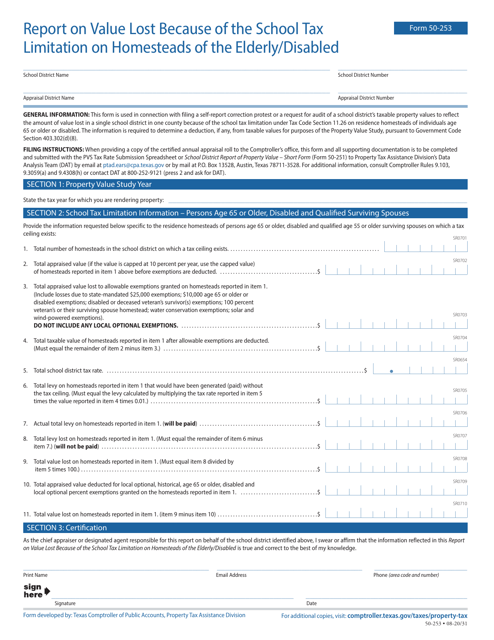

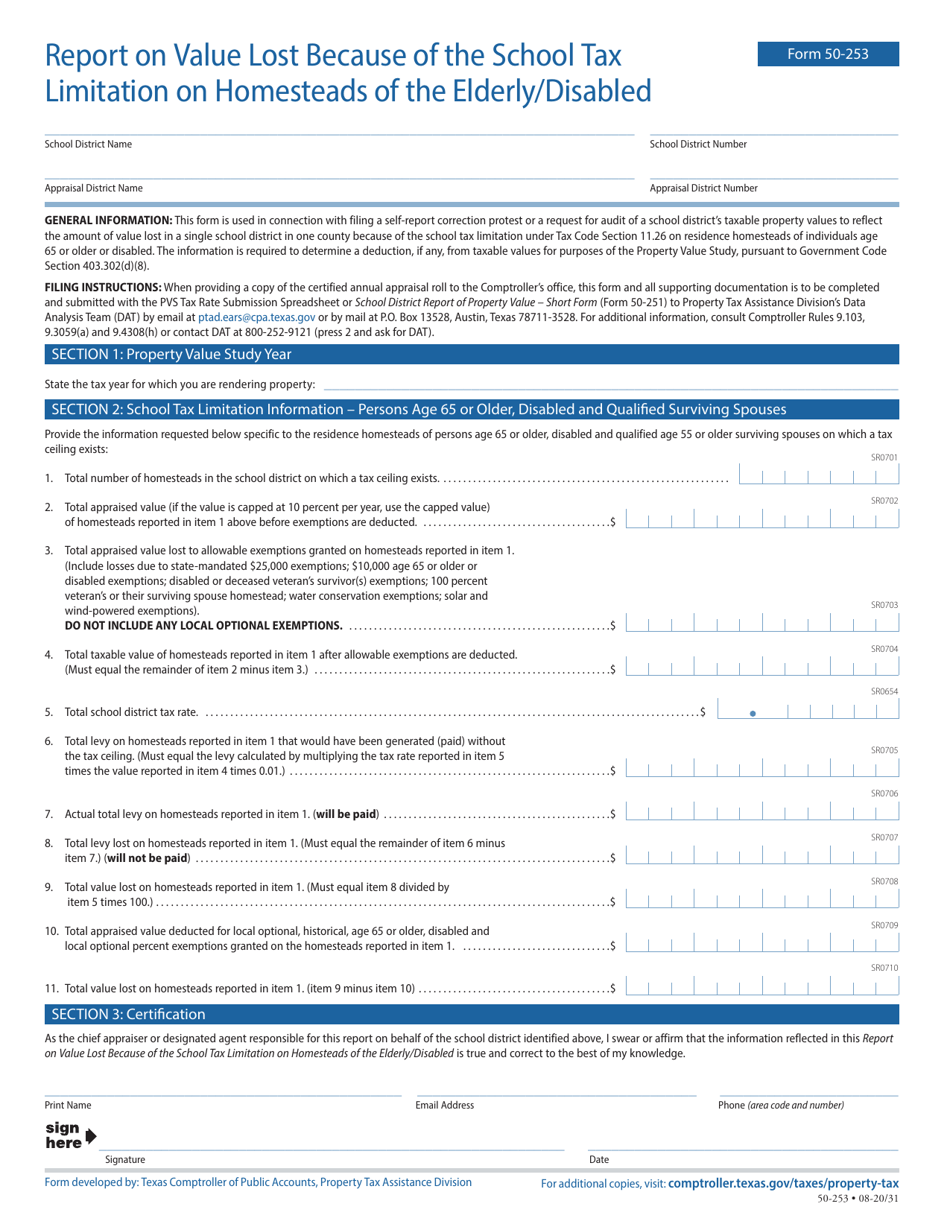

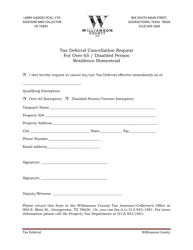

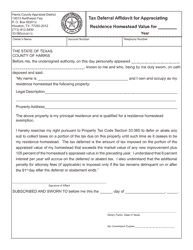

Form 50-253

for the current year.

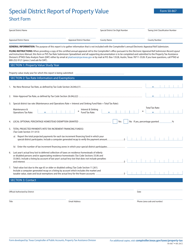

Form 50-253 Report on Value Lost Because of the School Tax Limitation on Homesteads of the Elderly / Disabled - Texas

What Is Form 50-253?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-253?

A: Form 50-253 is a report used in Texas to calculate the value lost because of the school tax limitation on homesteads of the elderly or disabled.

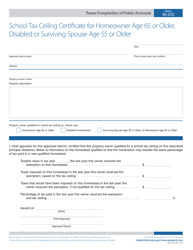

Q: Who is eligible for the school tax limitation on homesteads of the elderly/disabled?

A: Elderly or disabled homeowners in Texas are eligible for the school tax limitation.

Q: What is the purpose of Form 50-253?

A: The purpose of Form 50-253 is to determine the reduction in property value and calculate the amount of tax savings for qualifying elderly or disabled homeowners.

Q: How is the value lost calculated?

A: The value lost is calculated by subtracting the school taxes paid without the limitation from the school taxes that would have been paid without the limitation.

Q: When is Form 50-253 due?

A: Form 50-253 is due on or before April 30th of each year.

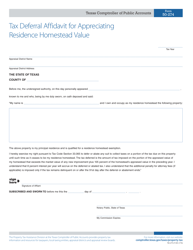

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-253 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.