This version of the form is not currently in use and is provided for reference only. Download this version of

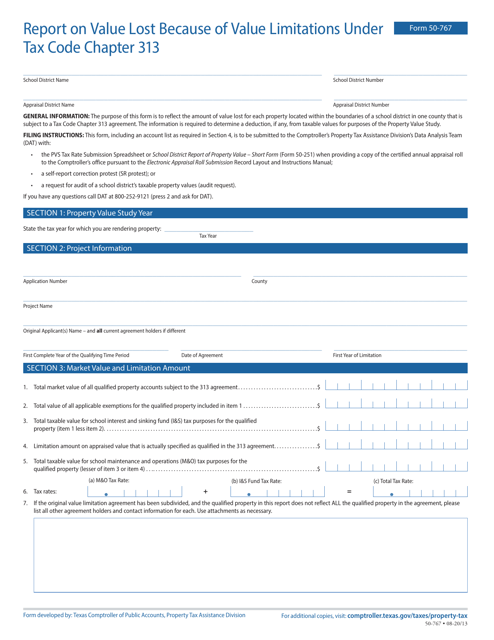

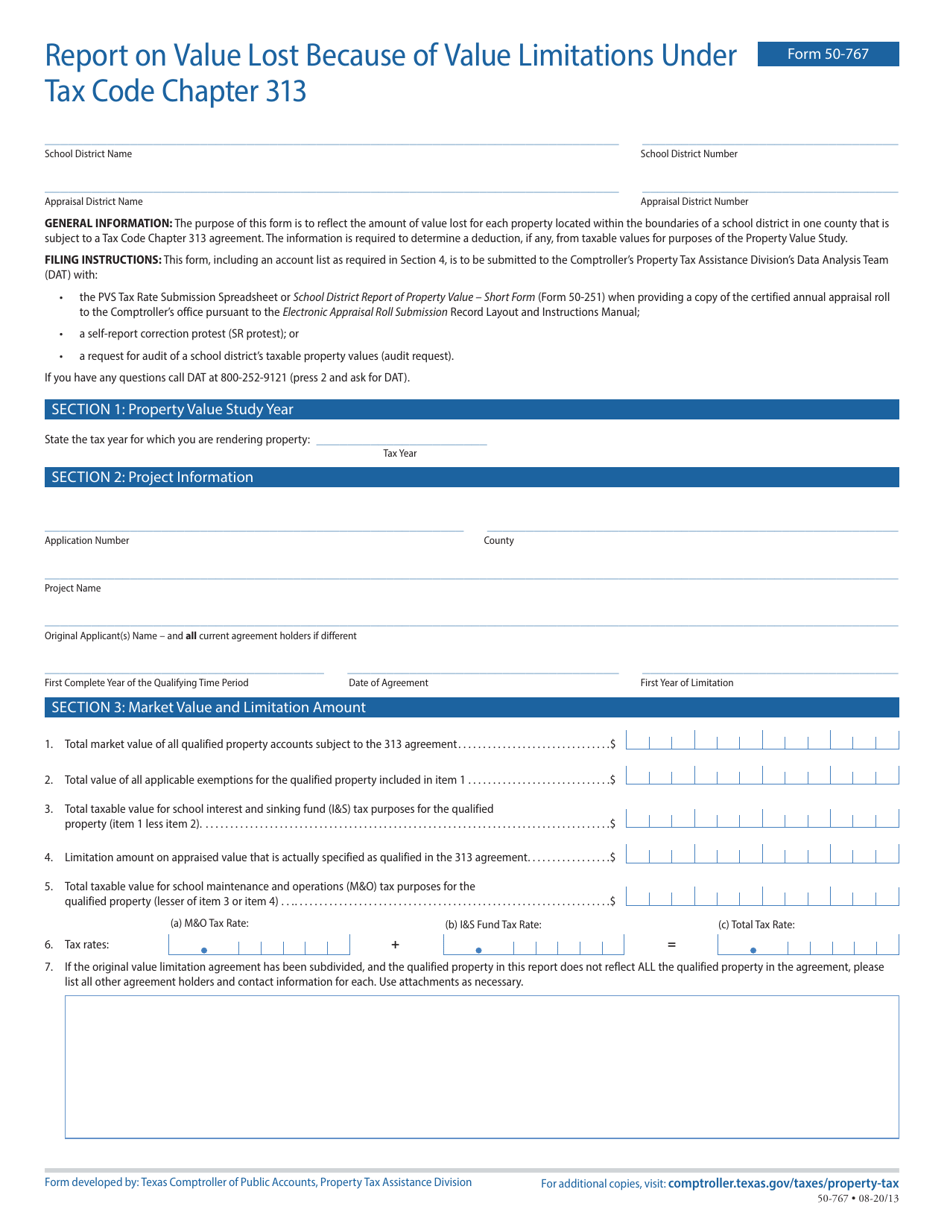

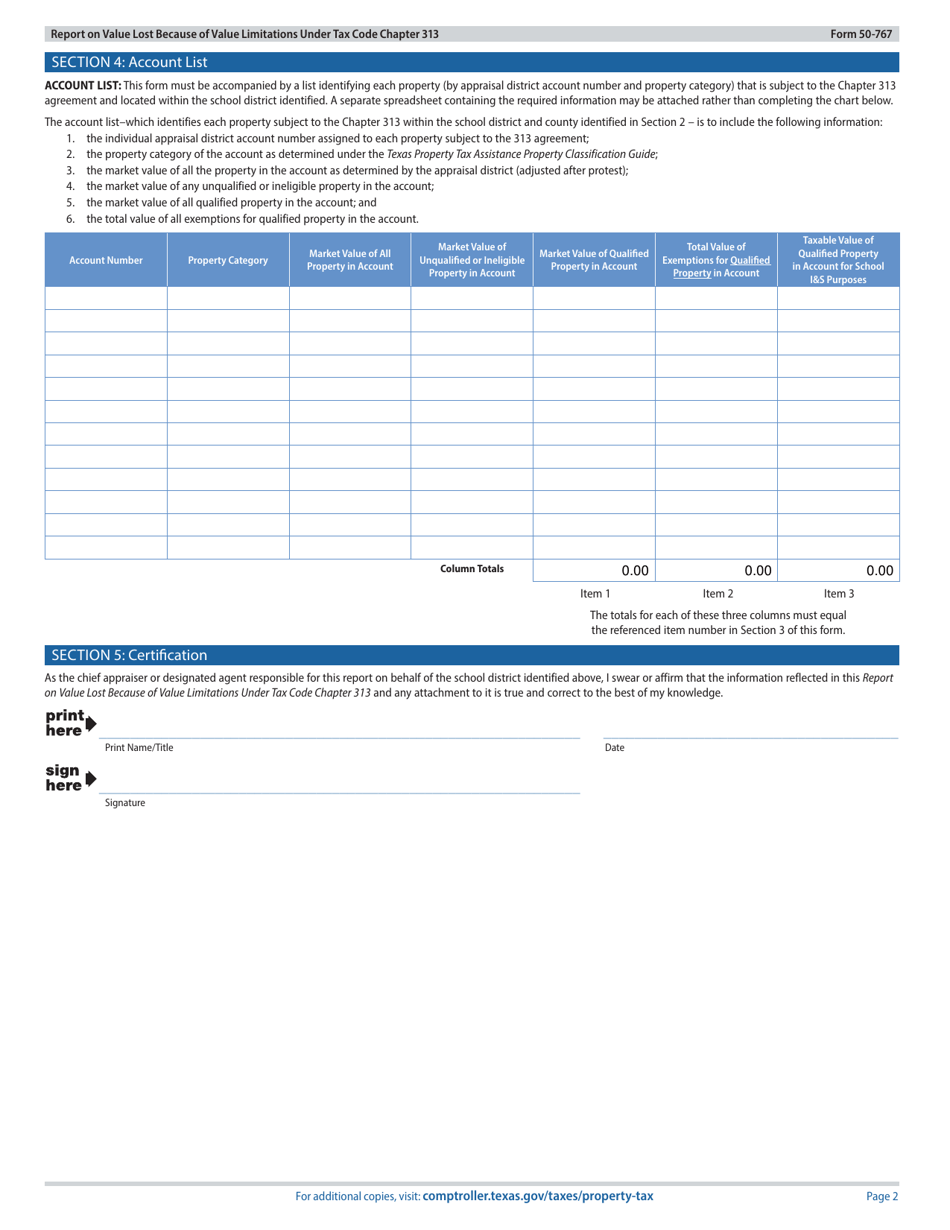

Form 50-767

for the current year.

Form 50-767 Report on Value Lost Because of Value Limitations Under Tax Code Chapter 313 - Texas

What Is Form 50-767?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form 50-767?

A: Form 50-767 is a report used to calculate the value lost due to value limitations under Tax Code Chapter 313 in Texas.

Q: What is Tax Code Chapter 313 in Texas?

A: Tax Code Chapter 313 in Texas allows school districts to offer property tax limitations to attract certain industries.

Q: Who is required to file Form 50-767?

A: In Texas, companies receiving tax limitations under Tax Code Chapter 313 are required to file Form 50-767 annually.

Q: What does Form 50-767 calculate?

A: Form 50-767 calculates the value lost by the taxing unit due to the value limitations provided under Tax Code Chapter 313.

Q: Why is Form 50-767 important?

A: Form 50-767 is important because it helps determine the impact of tax limitations on the revenue of the taxing unit, such as school districts.

Q: Is Form 50-767 specific to any industry?

A: No, Form 50-767 is not specific to any industry. It is used by any company receiving tax limitations under Tax Code Chapter 313 in Texas.

Q: Are there any deadlines for filing Form 50-767?

A: Yes, Form 50-767 must be filed by April 15th of each year.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-767 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.