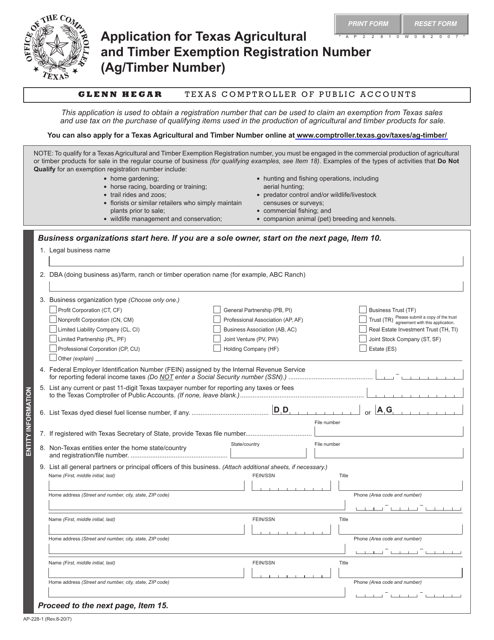

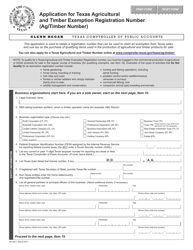

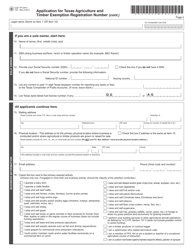

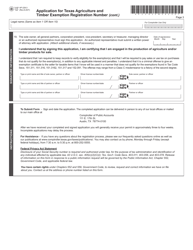

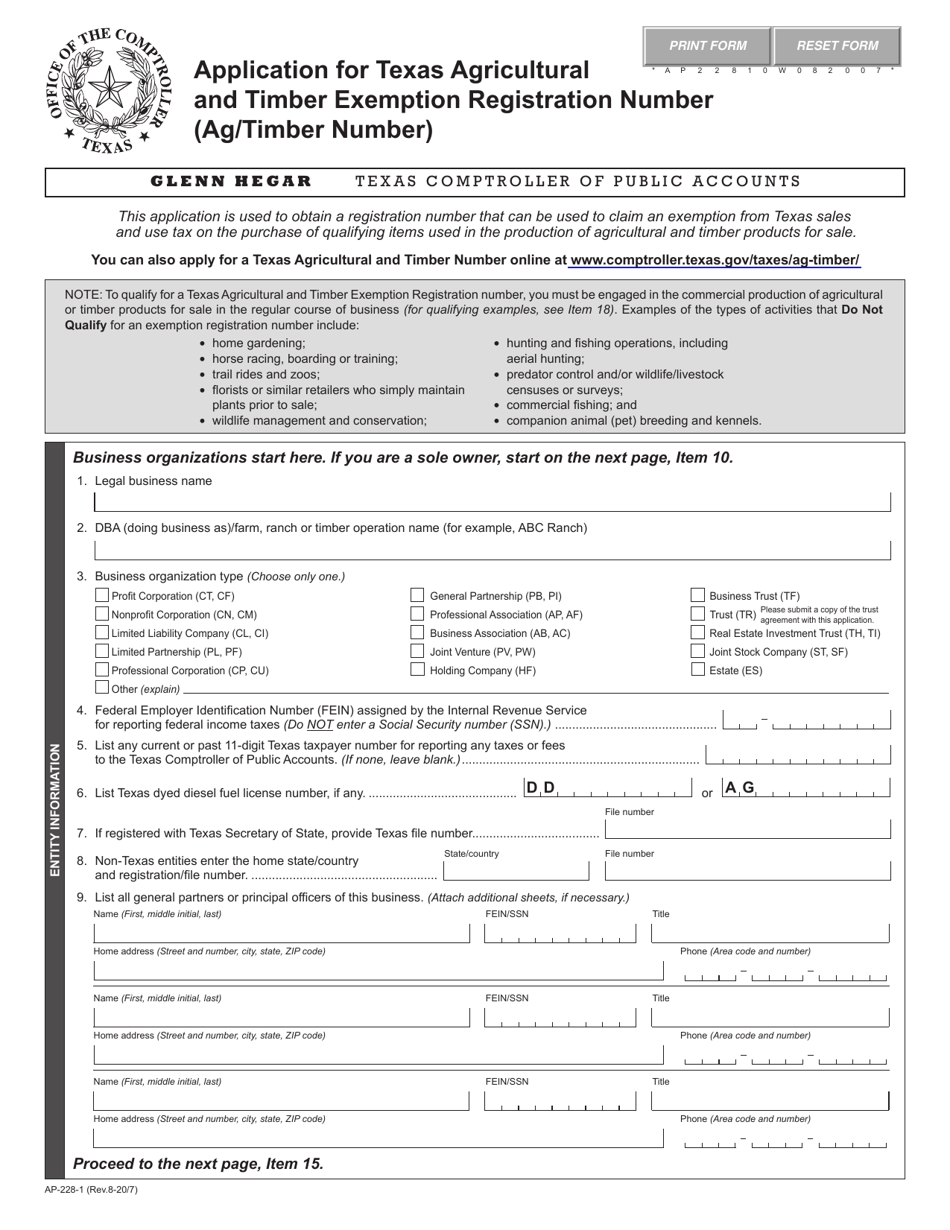

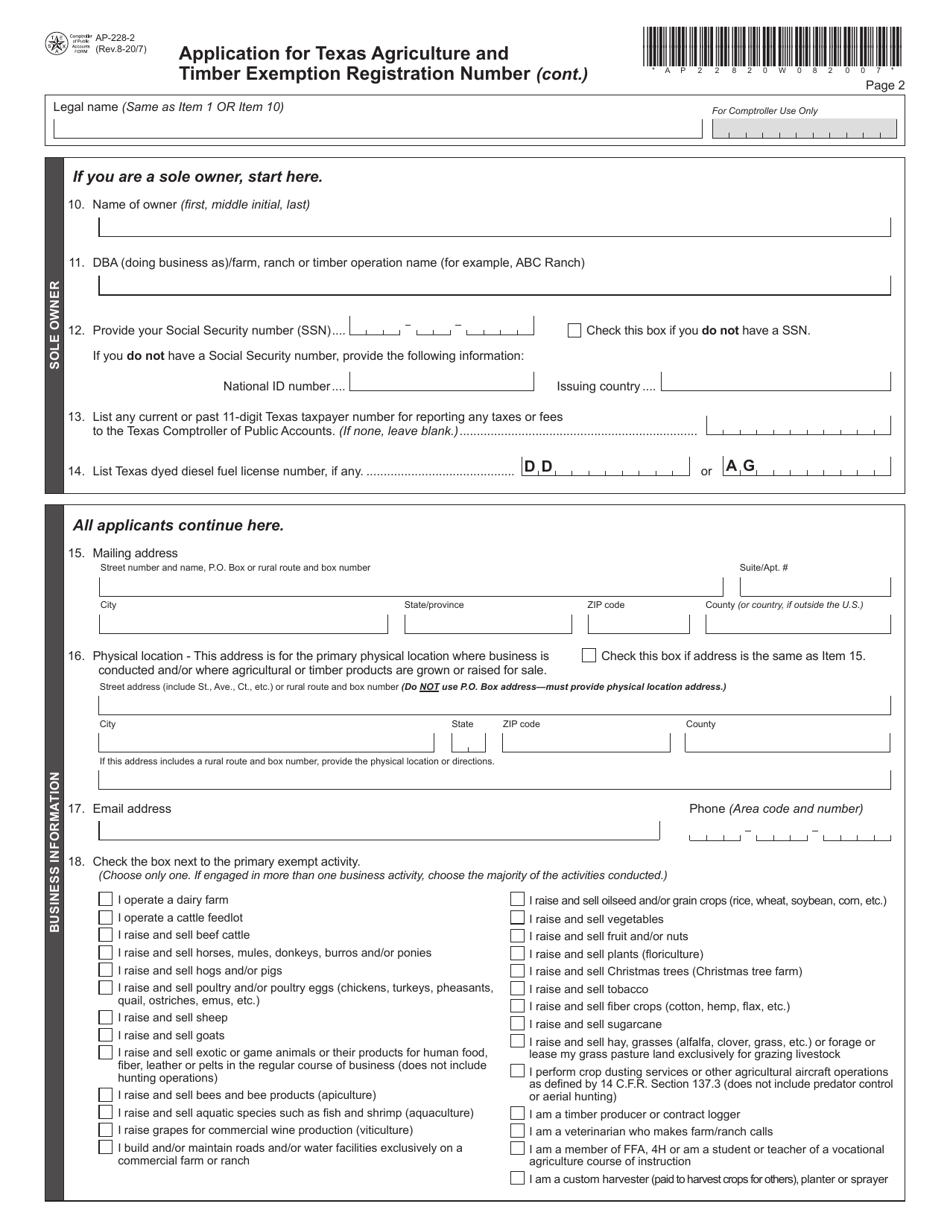

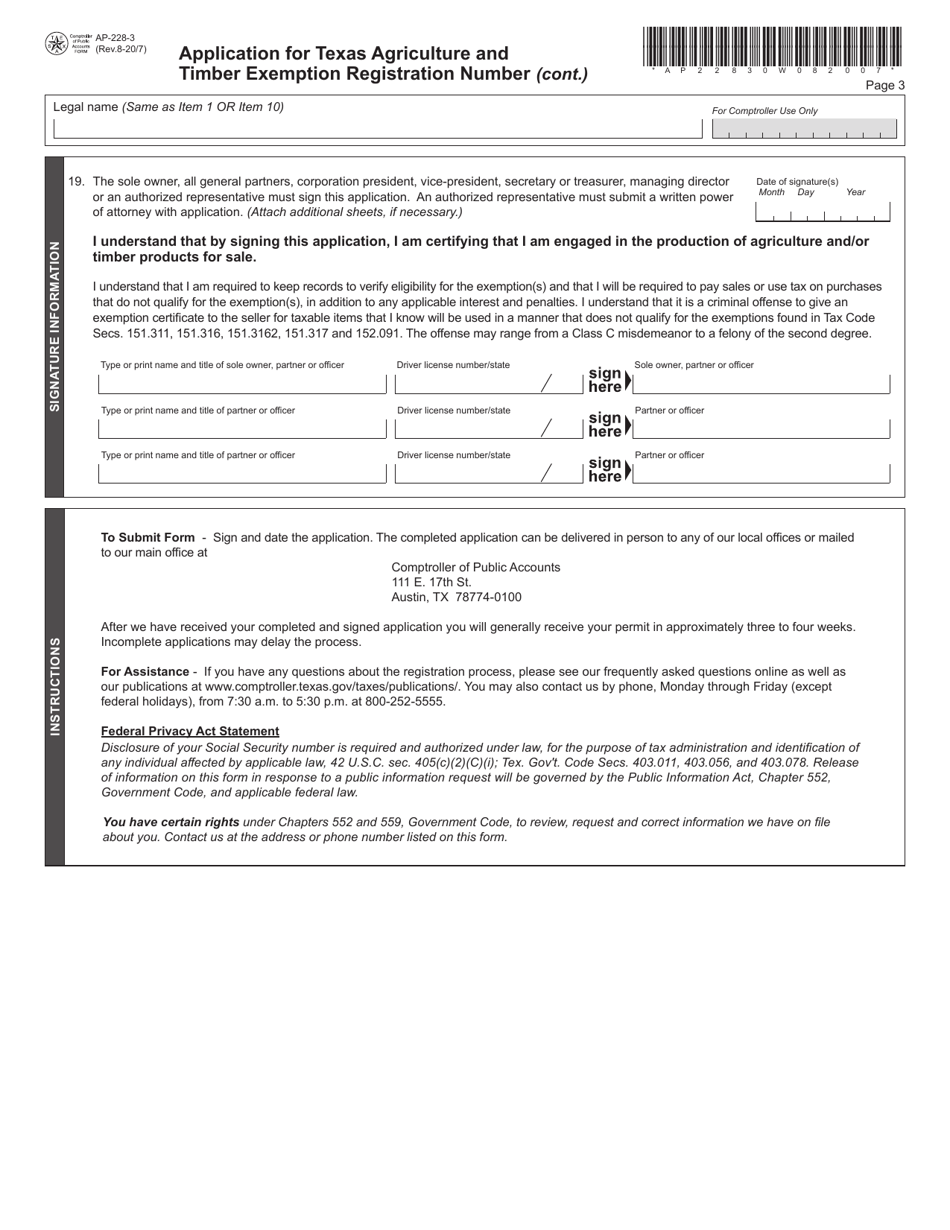

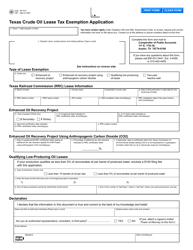

Form AP-228 Application for Texas Agricultural and Timber Exemption Registration Number (Ag / Timber Number) - Texas

What Is Form AP-228?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AP-228?

A: Form AP-228 is the Application for Texas Agricultural and Timber Exemption Registration Number (Ag/Timber Number) in Texas.

Q: What is the purpose of Form AP-228?

A: The purpose of Form AP-228 is to apply for an Agricultural and Timber Exemption Registration Number (Ag/Timber Number) in Texas.

Q: Who needs to fill out Form AP-228?

A: Anyone who wants to claim an agricultural or timber exemption in Texas needs to fill out Form AP-228.

Q: Is there a fee to submit Form AP-228?

A: No, there is no fee to submit Form AP-228.

Q: What information do I need to provide on Form AP-228?

A: You will need to provide information about your agricultural or timber operation, such as the name and address of the owner, property description, and proof of eligibility.

Q: How long does it take to process Form AP-228?

A: The processing time for Form AP-228 can vary, but typically it takes a few weeks to receive your Agricultural and Timber Exemption Registration Number (Ag/Timber Number).

Q: What is an Agricultural and Timber Exemption Registration Number (Ag/Timber Number)?

A: An Agricultural and Timber Exemption Registration Number (Ag/Timber Number) is a unique identification number issued by the Texas Comptroller of Public Accounts to eligible agricultural and timber operations.

Q: What are the benefits of having an Agricultural and Timber Exemption Registration Number (Ag/Timber Number)?

A: Having an Agricultural and Timber Exemption Registration Number (Ag/Timber Number) allows eligible agricultural and timber operations in Texas to claim certain tax exemptions and benefits.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AP-228 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.