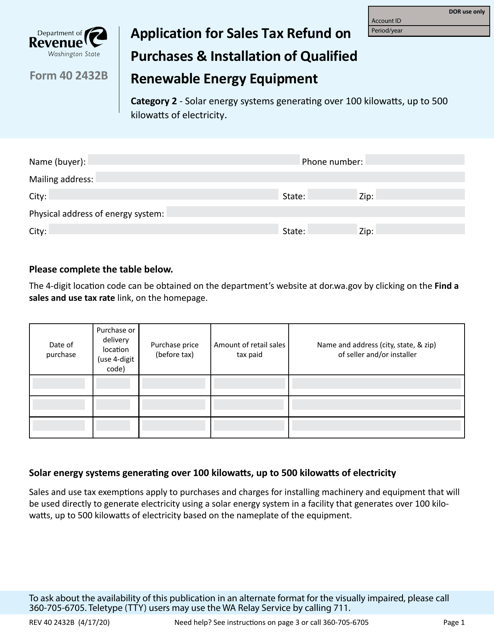

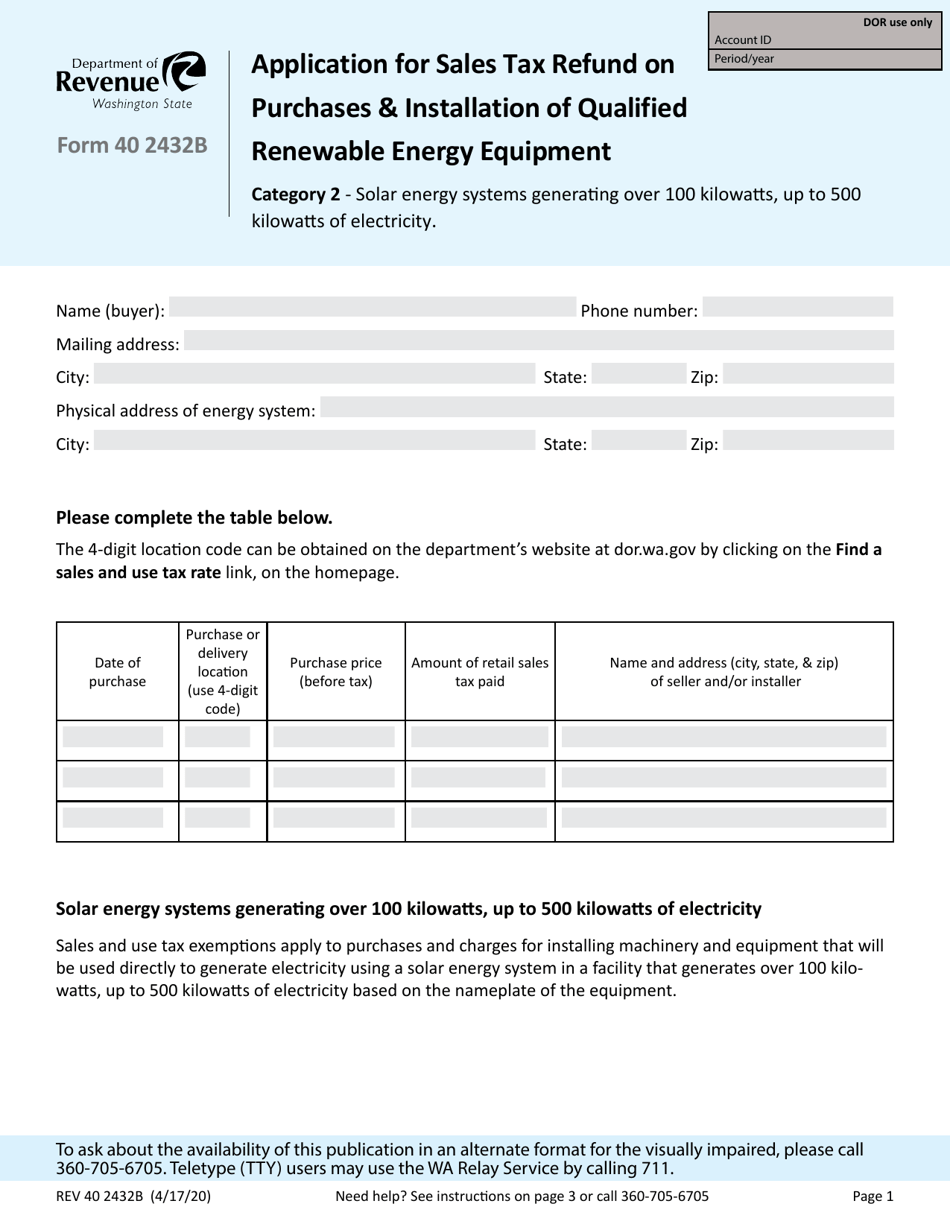

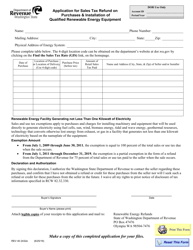

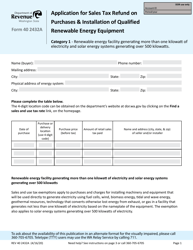

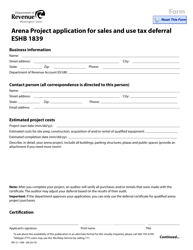

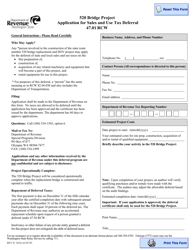

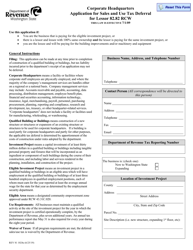

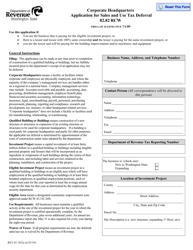

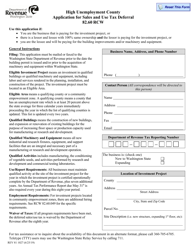

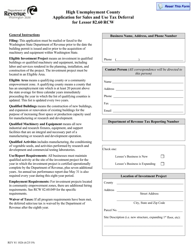

Form 40 2432B Application for Sales Tax Refund on Purchases & Installation of Qualified Renewable Energy Equipment - Washington

What Is Form 40 2432B?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

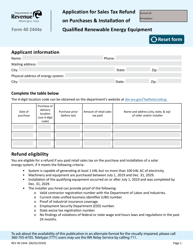

Q: What is Form 40 2432B?

A: Form 40 2432B is an application for sales tax refund on purchases and installation of qualified renewable energy equipment in Washington.

Q: What is the purpose of Form 40 2432B?

A: The purpose of Form 40 2432B is to apply for a refund of sales tax paid on the purchase and installation of qualified renewable energy equipment.

Q: Who can use Form 40 2432B?

A: Any taxpayer in Washington who has purchased and installed qualified renewable energy equipment may use Form 40 2432B to apply for a sales tax refund.

Q: What is considered qualified renewable energy equipment?

A: Qualified renewable energy equipment includes solar, wind, biomass, geothermal, and hydroelectric energy systems.

Q: What information is needed to complete Form 40 2432B?

A: To complete Form 40 2432B, you will need to provide information about the equipment, installation costs, and proof of payment for sales tax.

Q: How do I submit Form 40 2432B?

A: You can submit Form 40 2432B by mail to the address provided on the form.

Q: Is there a deadline for submitting Form 40 2432B?

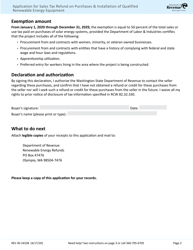

A: Yes, Form 40 2432B must be submitted within 12 months from the date of purchase.

Q: How long does it take to receive a sales tax refund?

A: The processing time for a sales tax refund can vary, but it generally takes around 30 days from the date the application is received.

Q: Are there any limitations or restrictions for the sales tax refund?

A: Yes, there are certain limitations and restrictions for the sales tax refund. It is recommended to carefully review the instructions provided with Form 40 2432B or contact the Washington State Department of Revenue for more information.

Form Details:

- Released on April 17, 2020;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 40 2432B by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.