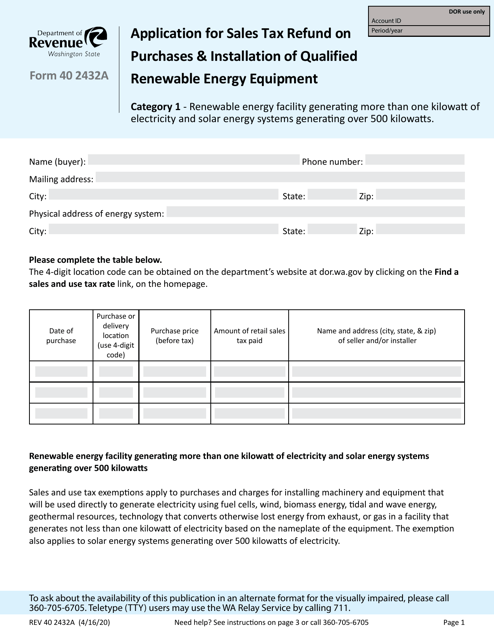

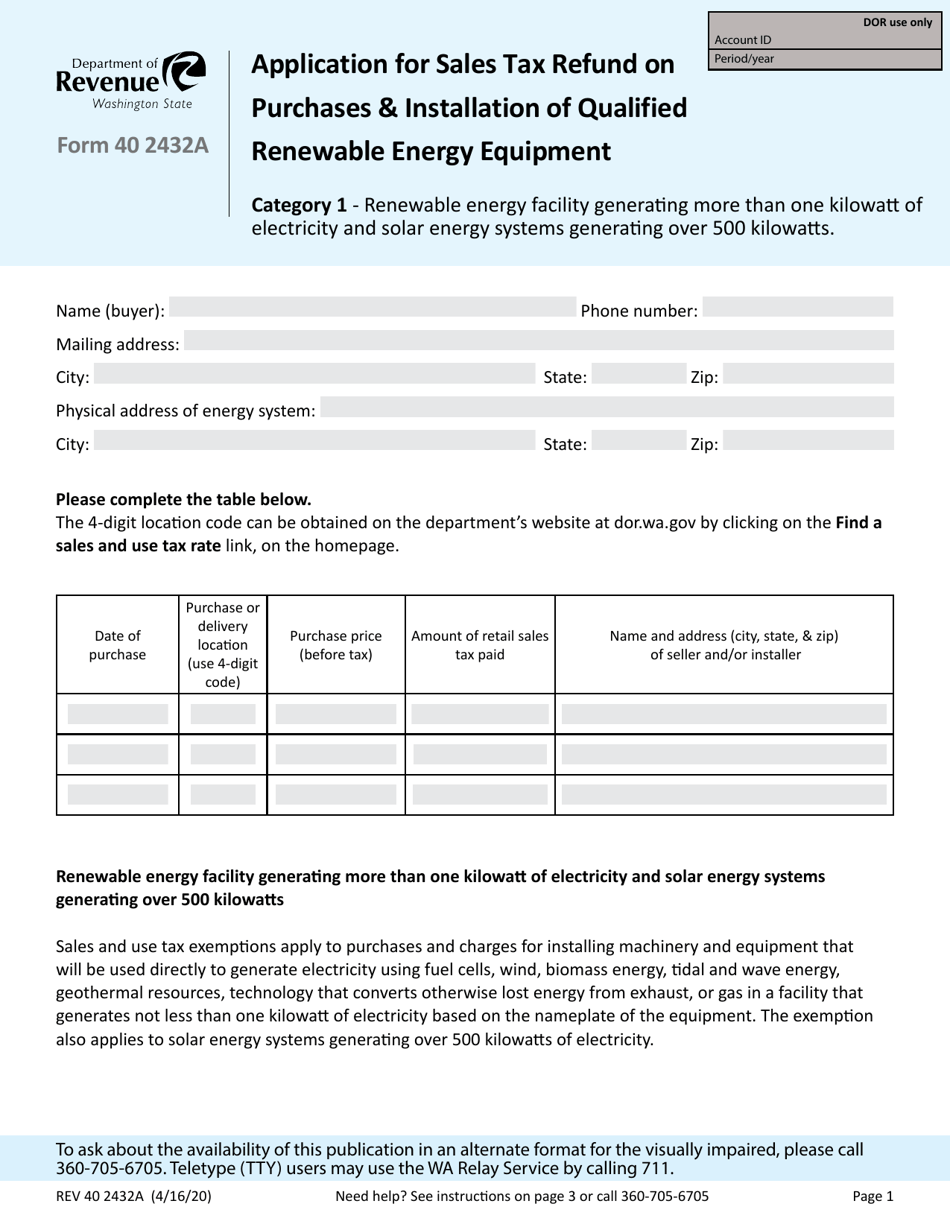

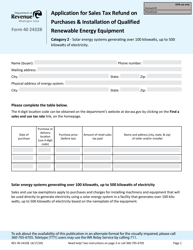

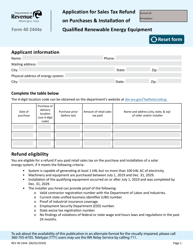

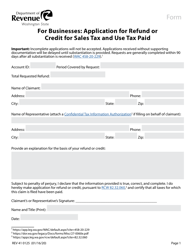

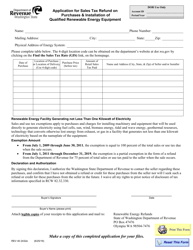

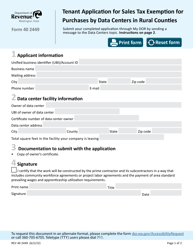

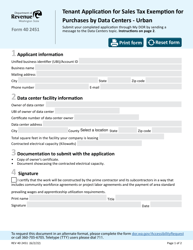

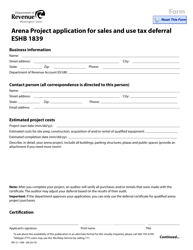

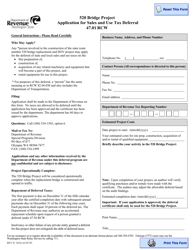

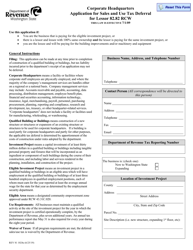

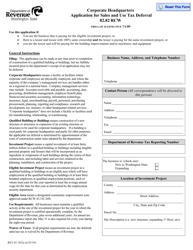

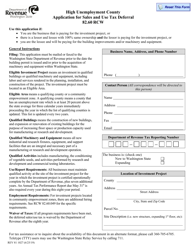

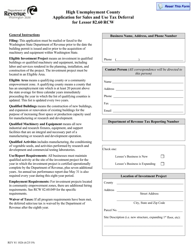

Form REV40 2432A Application for Sales Tax Refund on Purchases & Installation of Qualified Renewable Energy Equipment - Washington

What Is Form REV40 2432A?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form REV40 2432A?

A: Form REV40 2432A is the application for sales tax refund on purchases and installation of qualified renewable energy equipment in Washington.

Q: What is the purpose of form REV40 2432A?

A: The purpose of form REV40 2432A is to apply for a sales tax refund on qualified renewable energy equipment purchases and installations.

Q: Who can use form REV40 2432A?

A: Anyone who has purchased and installed qualified renewable energy equipment in Washington may use form REV40 2432A.

Q: What is qualified renewable energy equipment?

A: Qualified renewable energy equipment refers to equipment that meets the criteria set by the Washington Department of Revenue for sales tax refund eligibility.

Q: What is the process for applying for a sales tax refund with form REV40 2432A?

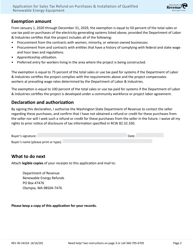

A: To apply for a sales tax refund with form REV40 2432A, you need to complete the form with the required information and submit it to the Washington Department of Revenue.

Q: Are there any eligibility requirements for the sales tax refund?

A: Yes, there are eligibility requirements for the sales tax refund. You must meet the criteria set by the Washington Department of Revenue for qualified renewable energy equipment purchases and installations.

Q: Is there a deadline for submitting form REV40 2432A?

A: Yes, there is a deadline for submitting form REV40 2432A. The specific deadline can be obtained from the Washington Department of Revenue.

Q: What should I do if I have further questions about form REV40 2432A?

A: If you have further questions about form REV40 2432A, you can contact the Washington Department of Revenue for assistance.

Form Details:

- Released on April 16, 2020;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV40 2432A by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.