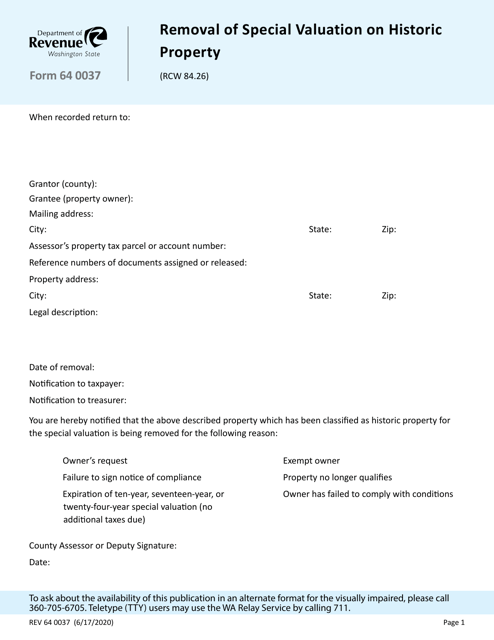

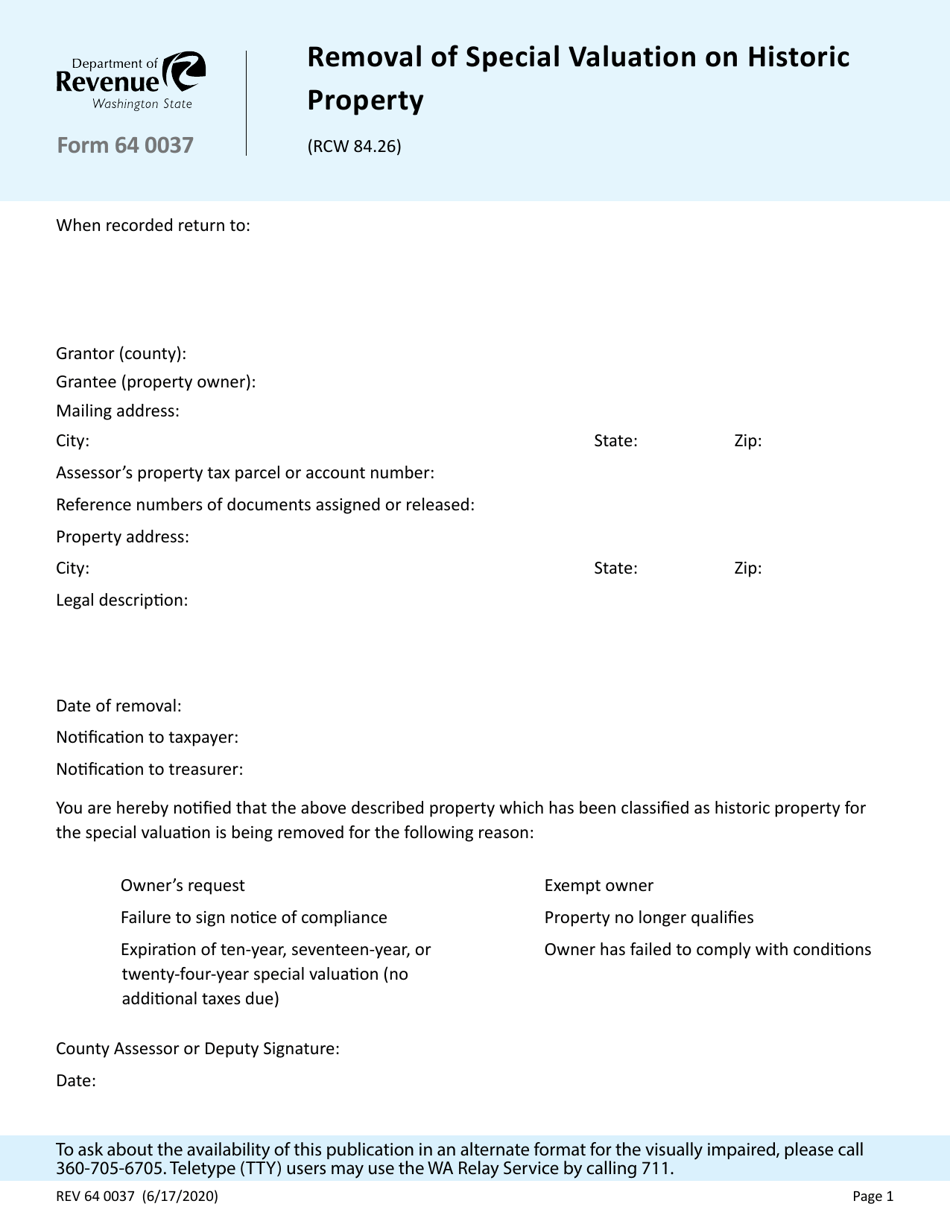

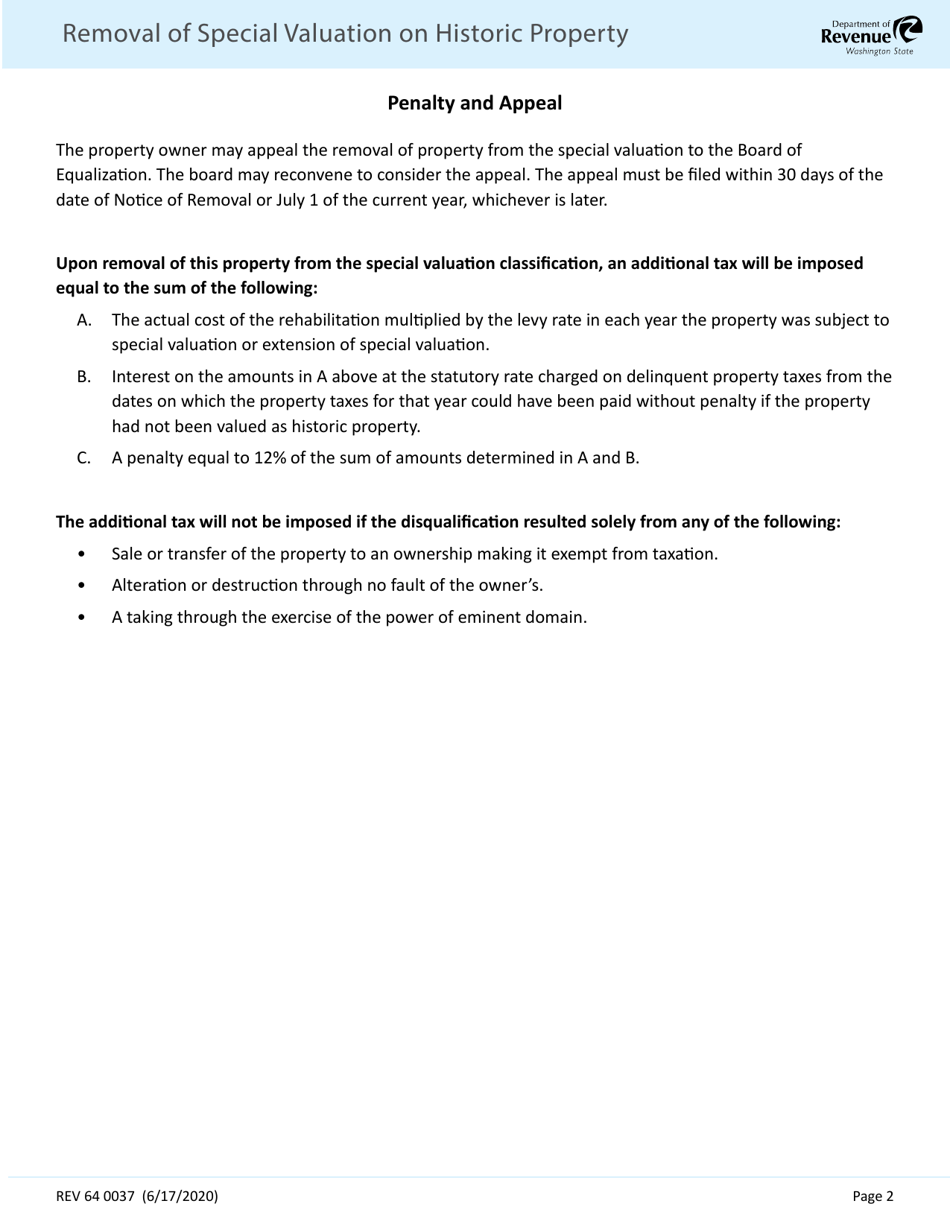

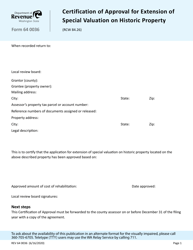

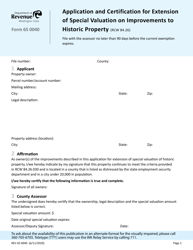

Form REV64 0037 Removal of Special Valuation on Historic Property - Washington

What Is Form REV64 0037?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV64 0037?

A: Form REV64 0037 is a form used to request the removal of special valuation on historic properties in Washington.

Q: What is special valuation?

A: Special valuation is a property tax reduction that is available to historic properties in Washington.

Q: What is a historic property?

A: A historic property is a property that has been designated as historically significant either nationally, locally, or within a specific historic district.

Q: Who can use Form REV64 0037?

A: Property owners of historic properties in Washington can use Form REV64 0037 to request the removal of special valuation.

Q: What is the purpose of Form REV64 0037?

A: The purpose of Form REV64 0037 is to request the removal of special valuation on historic properties in Washington.

Q: Is there a deadline to submit Form REV64 0037?

A: Yes, there is a deadline to submit Form REV64 0037. The deadline is usually specified by the local county assessor's office.

Q: How long does it take to process Form REV64 0037?

A: The processing time for Form REV64 0037 may vary, but it typically takes a few weeks to several months.

Q: Are there any fees associated with Form REV64 0037?

A: There may be fees associated with Form REV64 0037, such as recording fees or administrative fees. These fees vary by county.

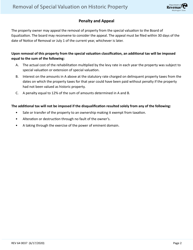

Q: What happens if Form REV64 0037 is approved?

A: If Form REV64 0037 is approved, the special valuation on your historic property will be removed, resulting in a higher property tax assessment.

Form Details:

- Released on June 17, 2020;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV64 0037 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.