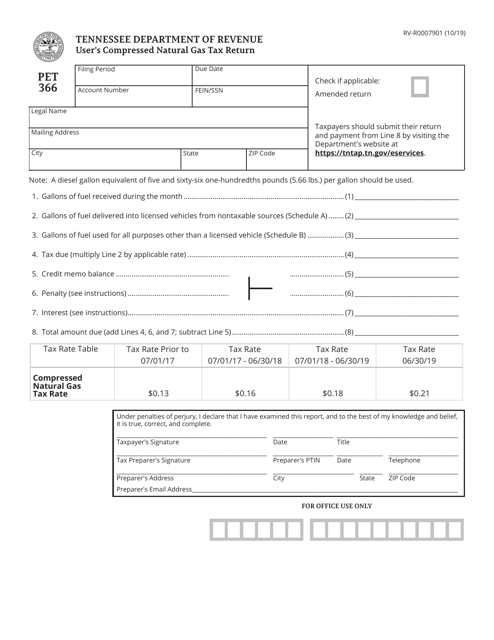

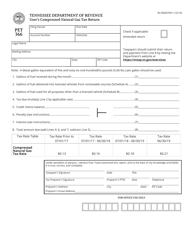

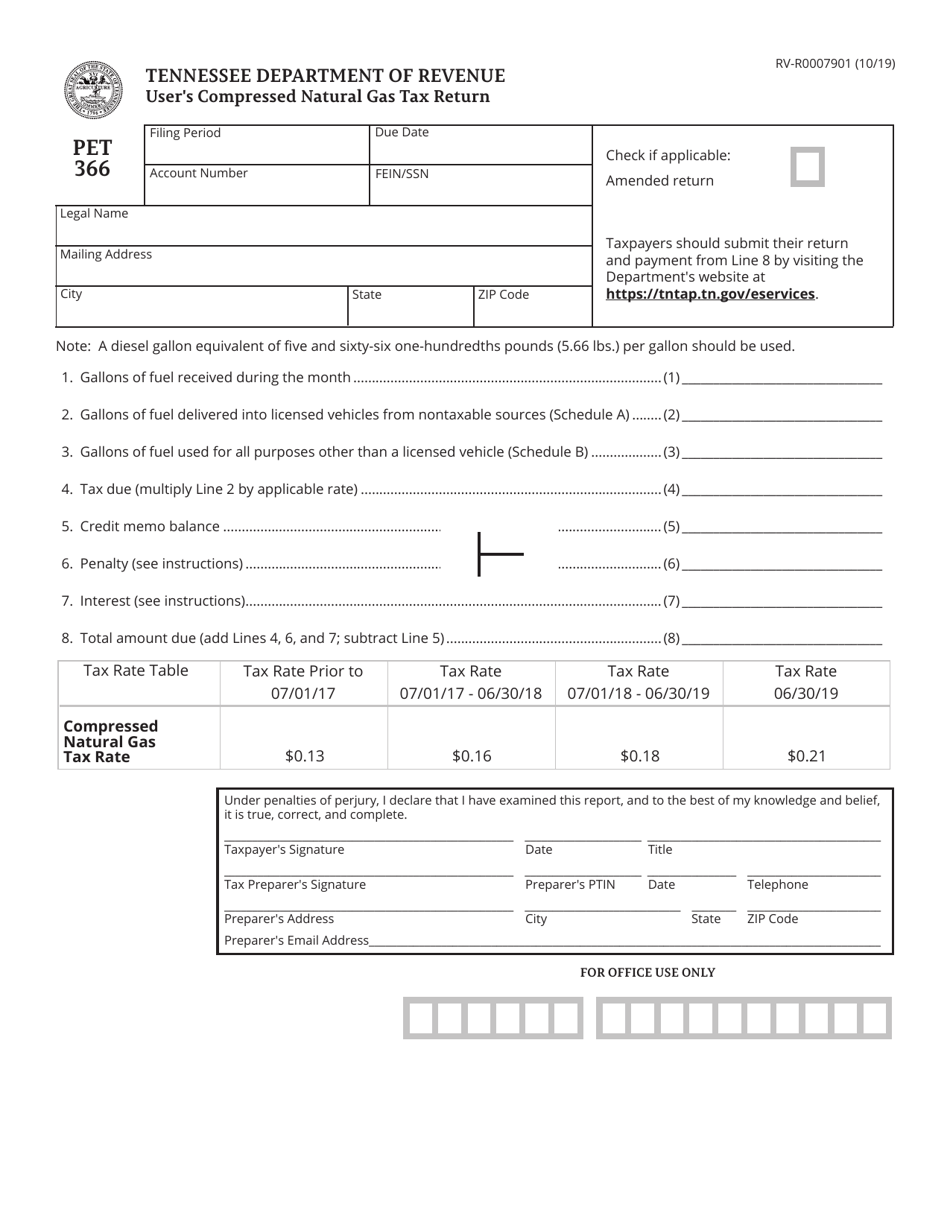

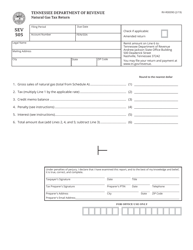

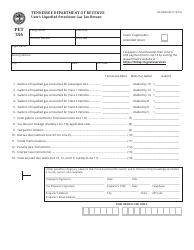

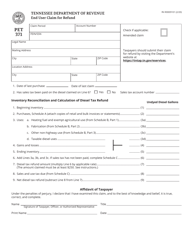

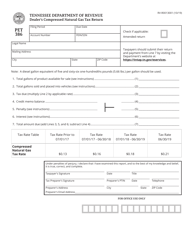

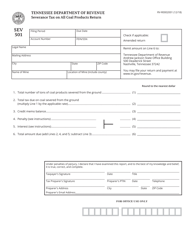

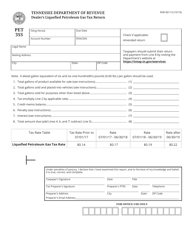

Form RV-R0007901 (PET366) User's Compressed Natural Gas Tax Return - Tennessee

What Is Form RV-R0007901 (PET366)?

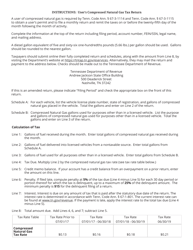

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RV-R0007901 (PET366)?

A: Form RV-R0007901 (PET366) is the Compressed Natural Gas (CNG) Tax Return for the state of Tennessee.

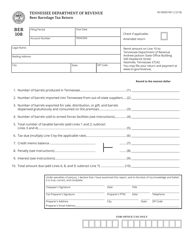

Q: Who needs to file Form RV-R0007901 (PET366)?

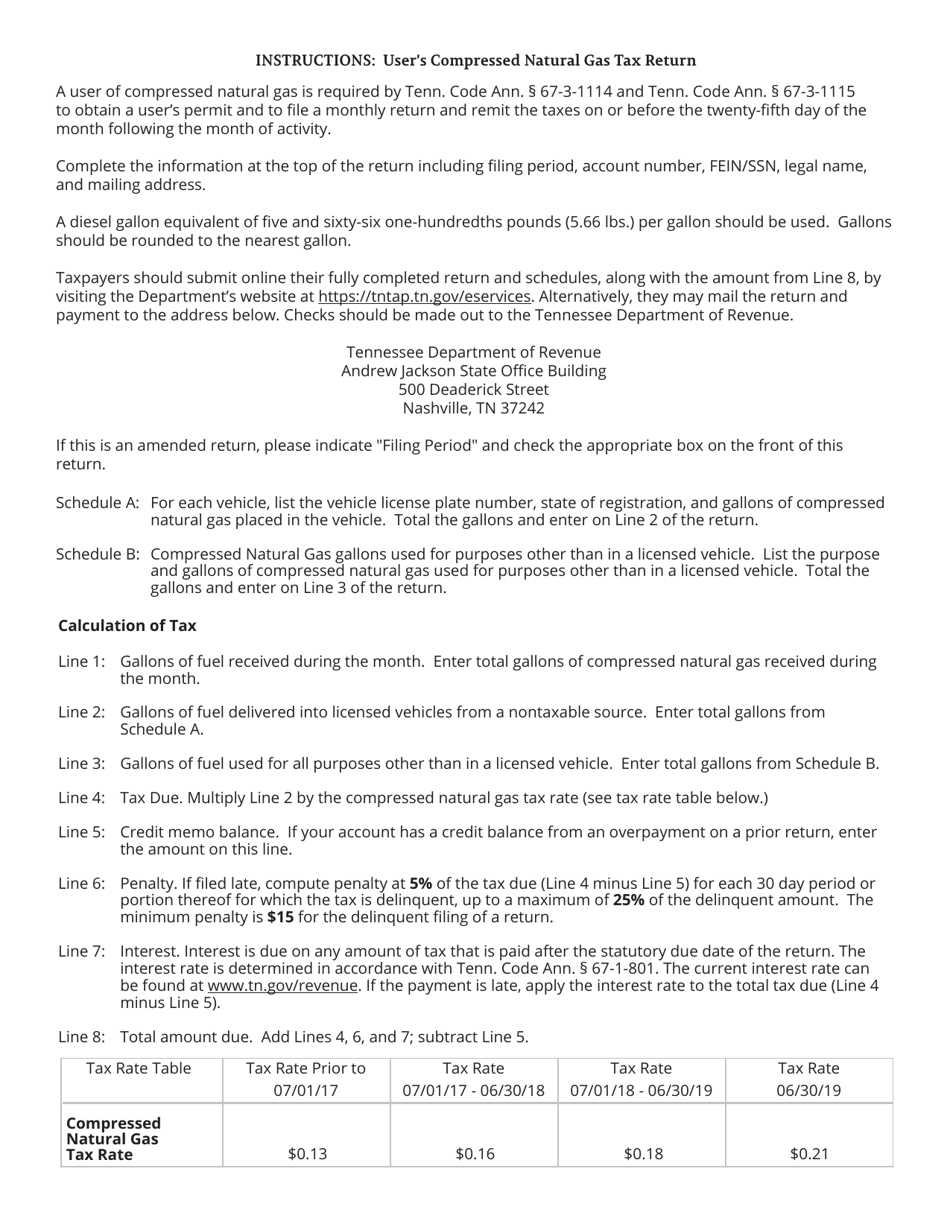

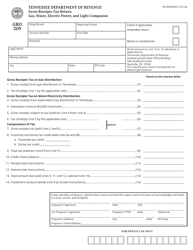

A: Any Tennessee taxpayer who is responsible for paying the compressed natural gas (CNG) tax is required to file Form RV-R0007901 (PET366).

Q: What is the purpose of Form RV-R0007901 (PET366)?

A: The purpose of Form RV-R0007901 (PET366) is to report and pay the compressed natural gas (CNG) tax owed to the state of Tennessee.

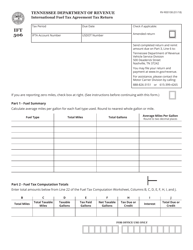

Q: When is Form RV-R0007901 (PET366) due?

A: Form RV-R0007901 (PET366) is due on the 20th of each month for the previous month's CNG tax liabilities.

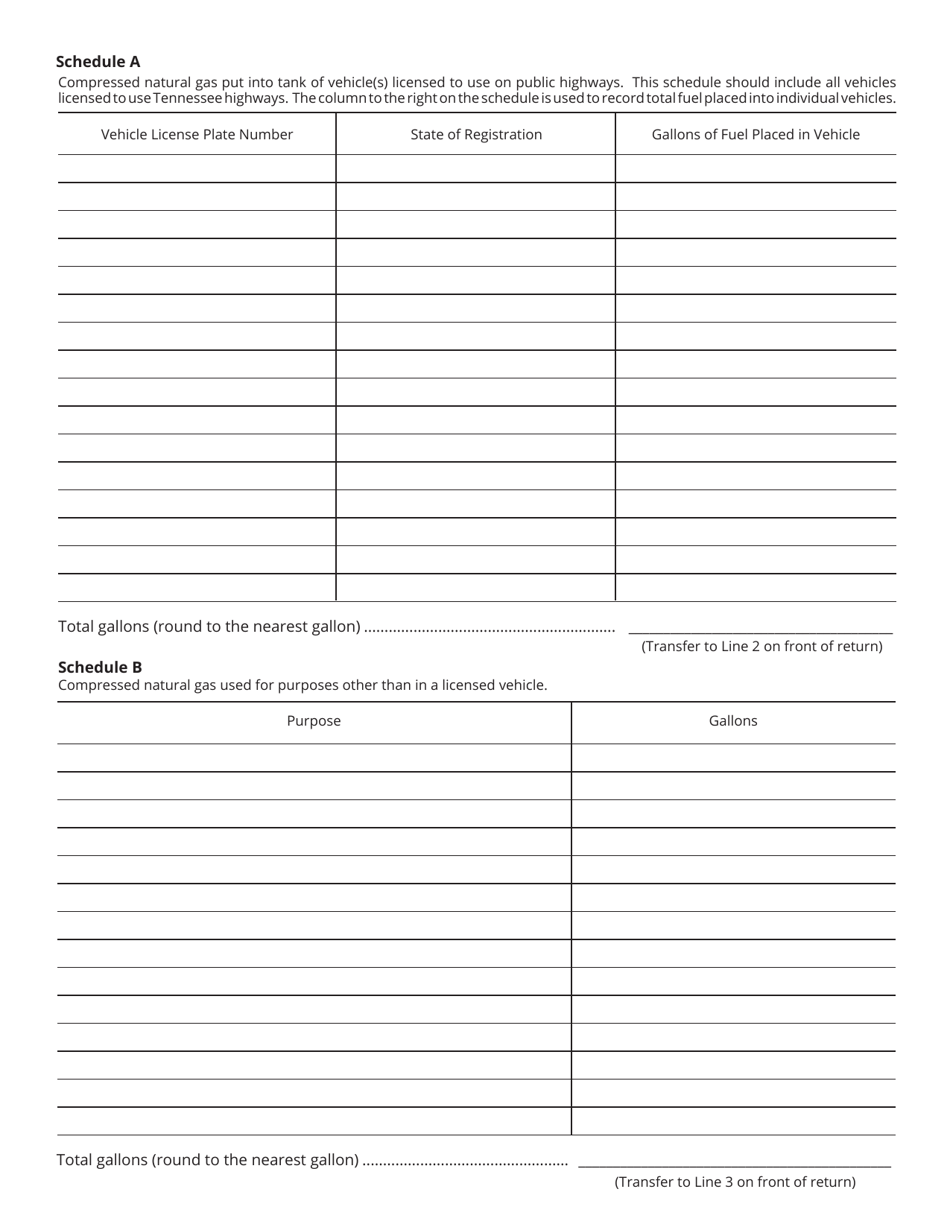

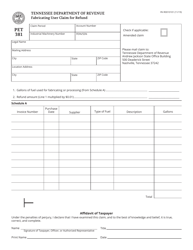

Q: What information do I need to complete Form RV-R0007901 (PET366)?

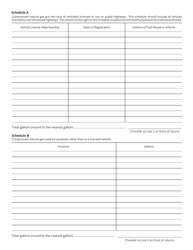

A: You will need the total number of gallons of compressed natural gas (CNG) sold or used in Tennessee during the reporting period, as well as the applicable tax rate.

Q: Are there any penalties for late filing or non-payment of the CNG tax?

A: Yes, there are penalties for late filing or non-payment of the CNG tax, including interest charges and potential legal action.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-R0007901 (PET366) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.