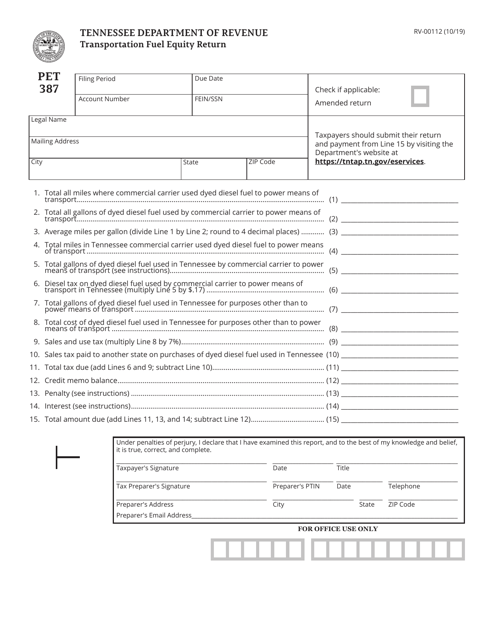

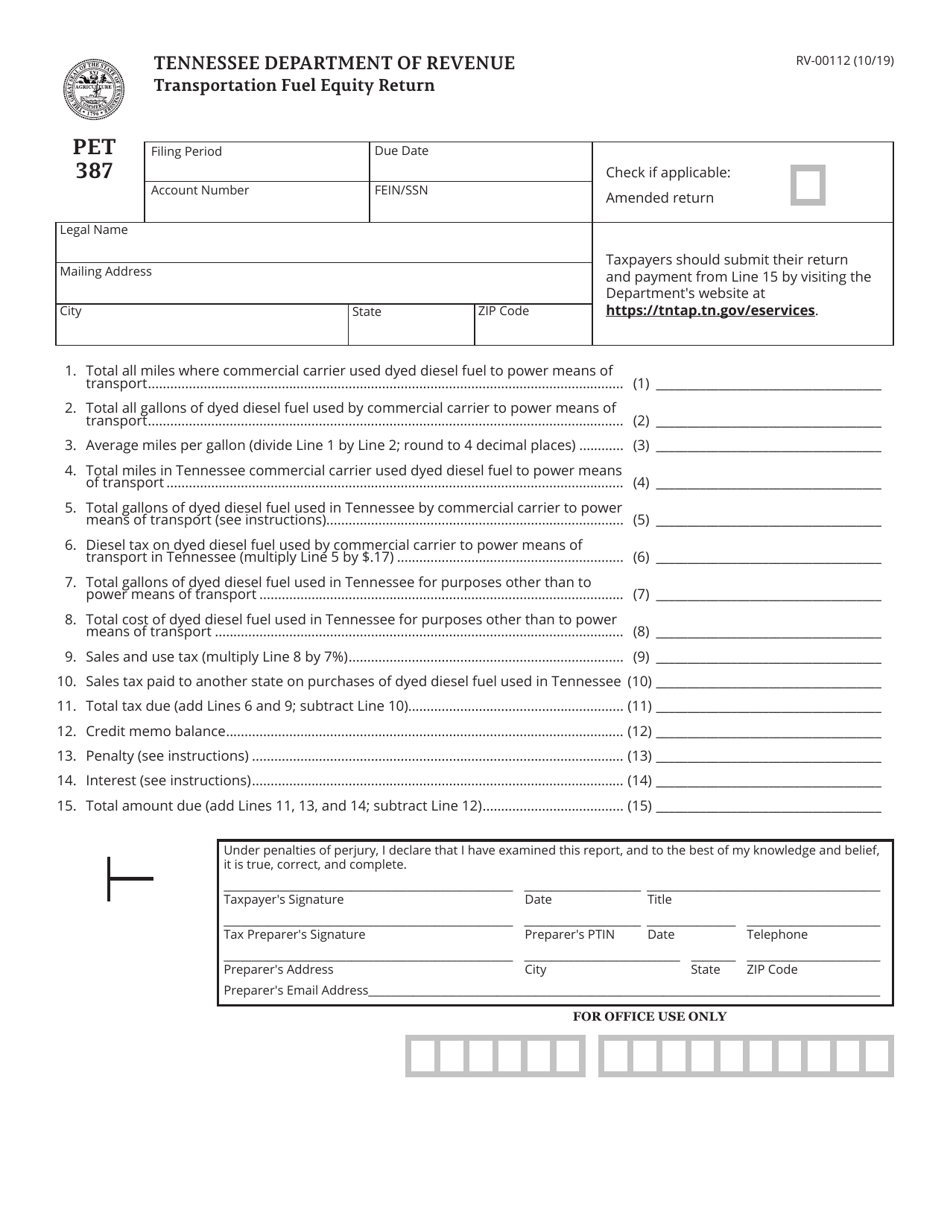

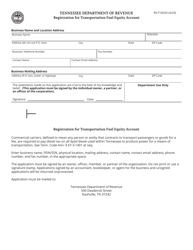

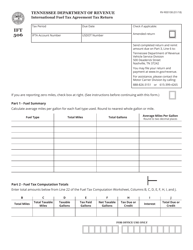

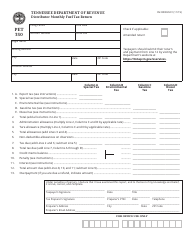

Form PET387 (RV-00112) Transportation Fuel Equity Return - Tennessee

What Is Form PET387 (RV-00112)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PET387?

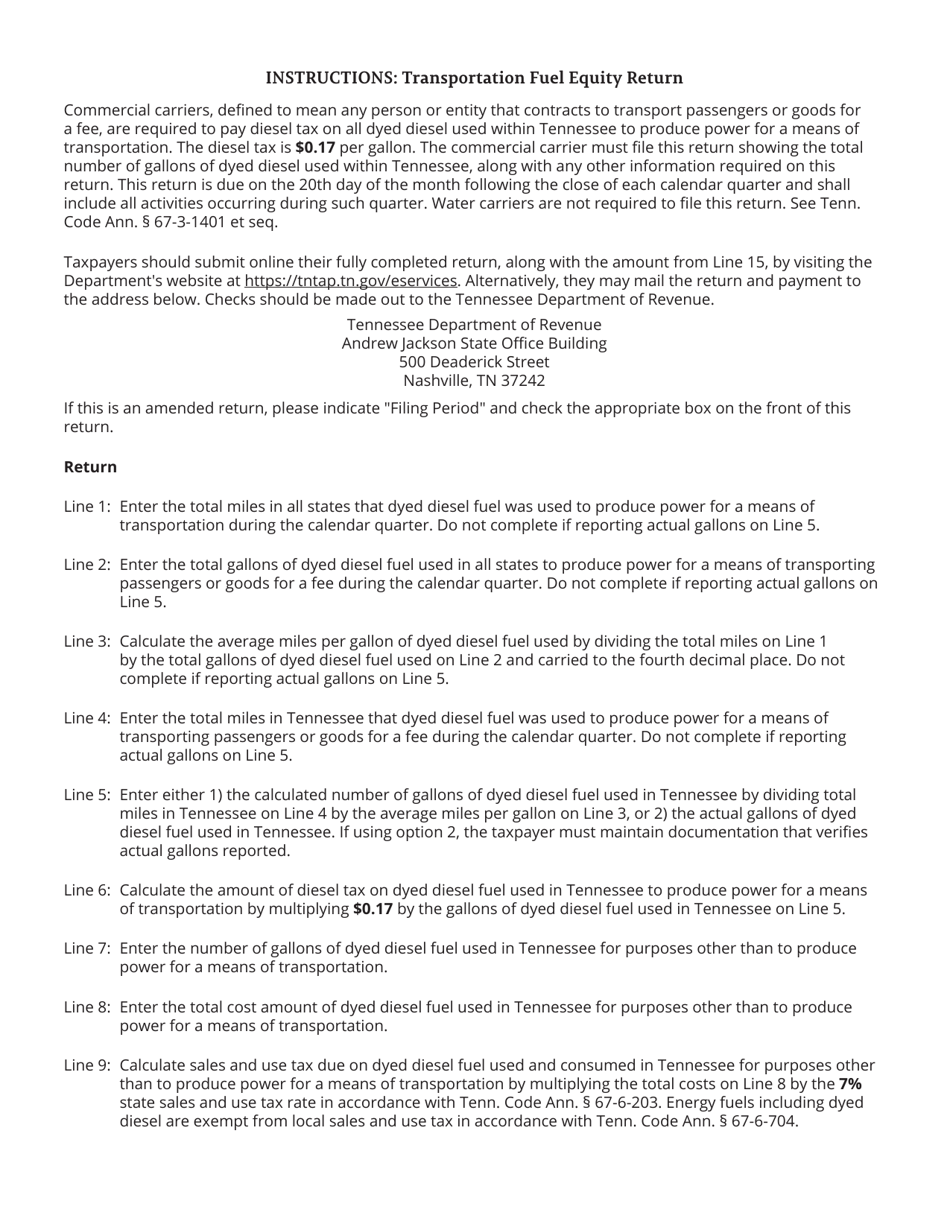

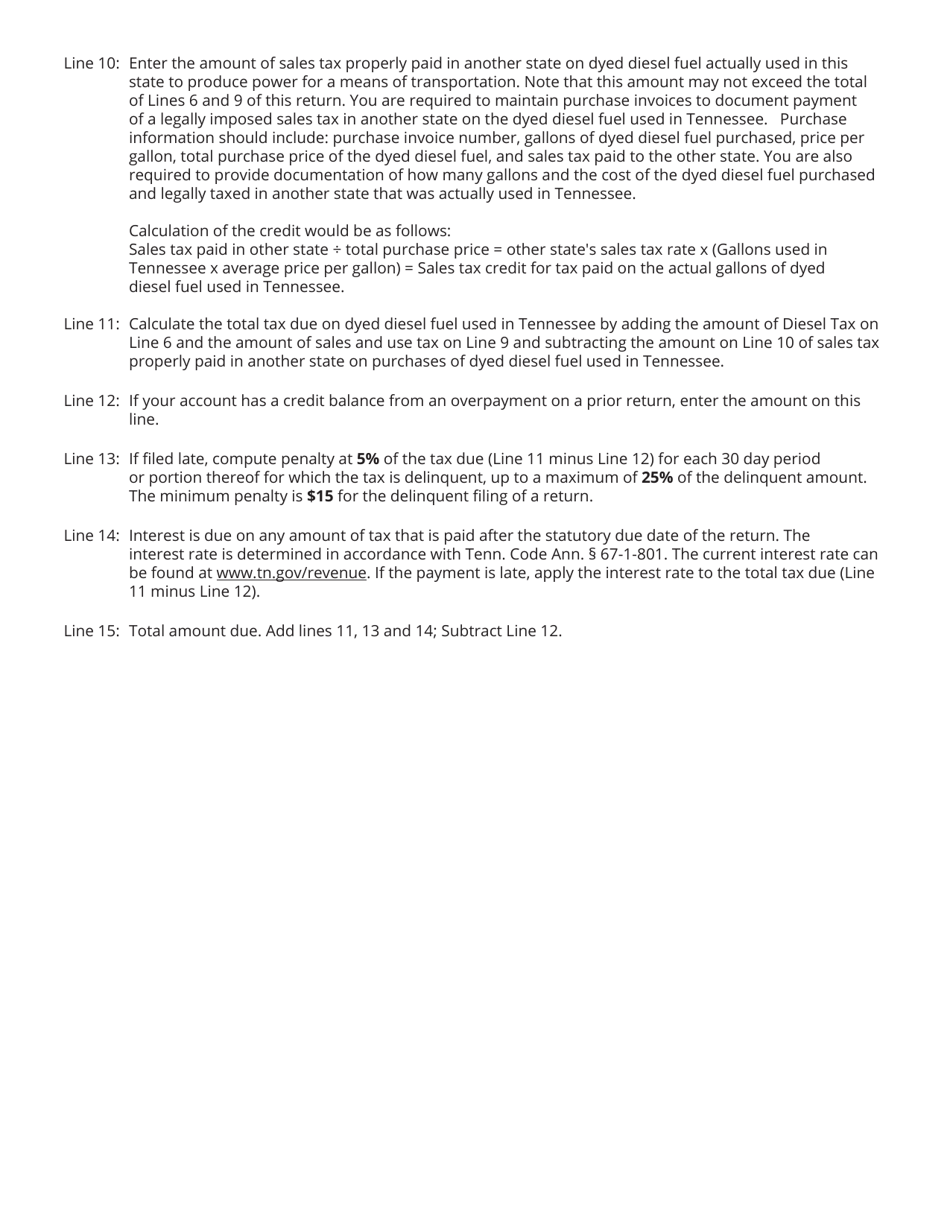

A: Form PET387 is a return form used in Tennessee to report and calculate the Transportation Fuel Equity fee.

Q: What is the purpose of Form PET387?

A: Form PET387 is used to determine and report the required Transportation Fuel Equity fee that motor fuel distributors must pay in Tennessee.

Q: Who needs to file Form PET387?

A: Motor fuel distributors in Tennessee are required to file Form PET387.

Q: What is the Transportation Fuel Equity fee?

A: The Transportation Fuel Equity fee is a fee imposed on motor fuel distributors in Tennessee to create equity among distributors and reduce unfair competition.

Q: How often does Form PET387 need to be filed?

A: Form PET387 needs to be filed monthly by motor fuel distributors in Tennessee.

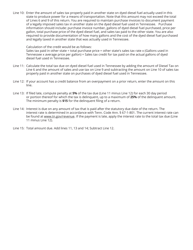

Q: Are there any penalties for not filing Form PET387?

A: Yes, there are penalties for not filing Form PET387 or filing it late. It is important to comply with the filing requirements to avoid penalties.

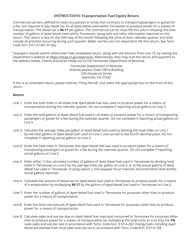

Q: What information is required to fill out Form PET387?

A: The form requires information such as the distributor's name, address, fuel sales volume, and other details related to the calculation of the Transportation Fuel Equity fee.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PET387 (RV-00112) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.