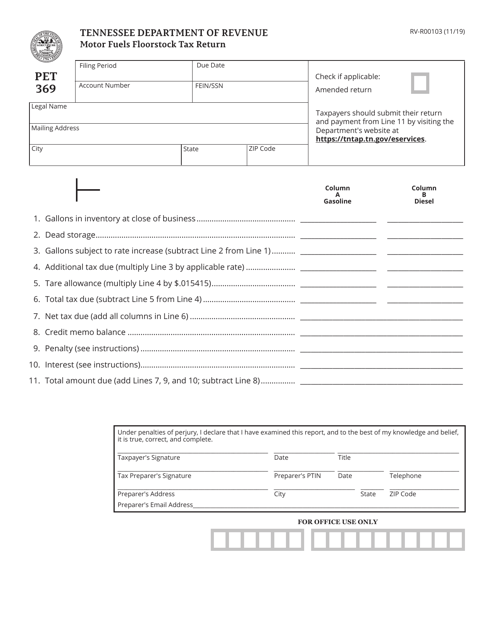

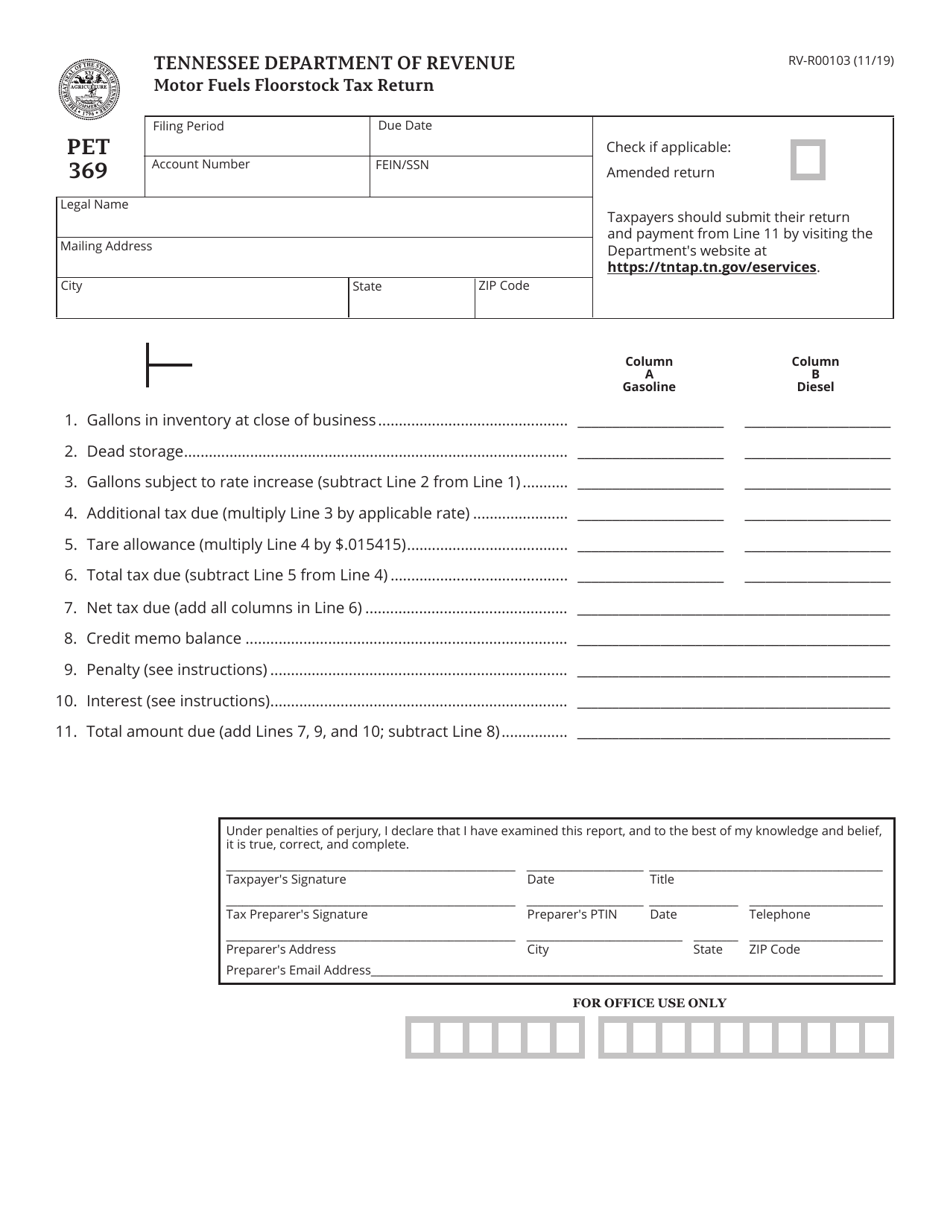

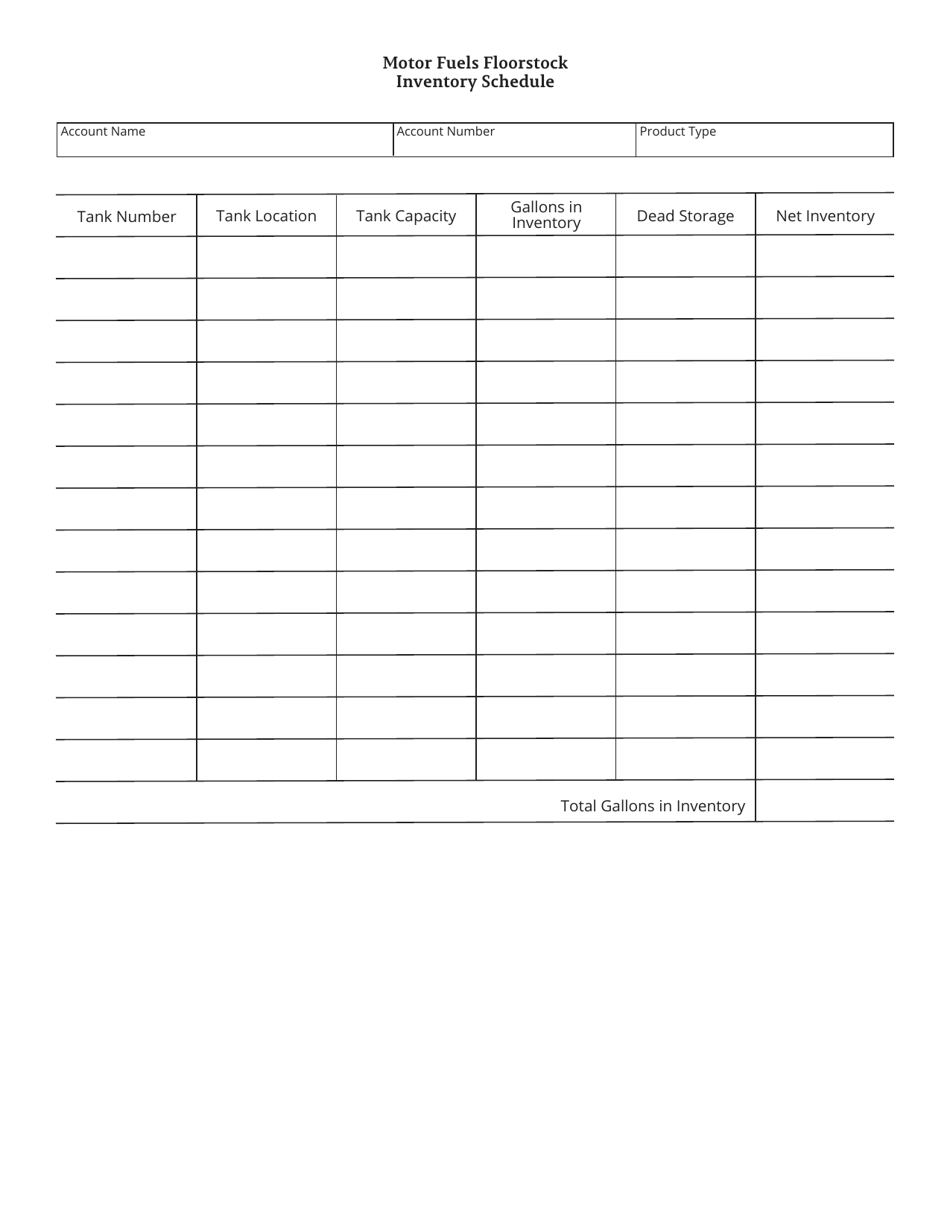

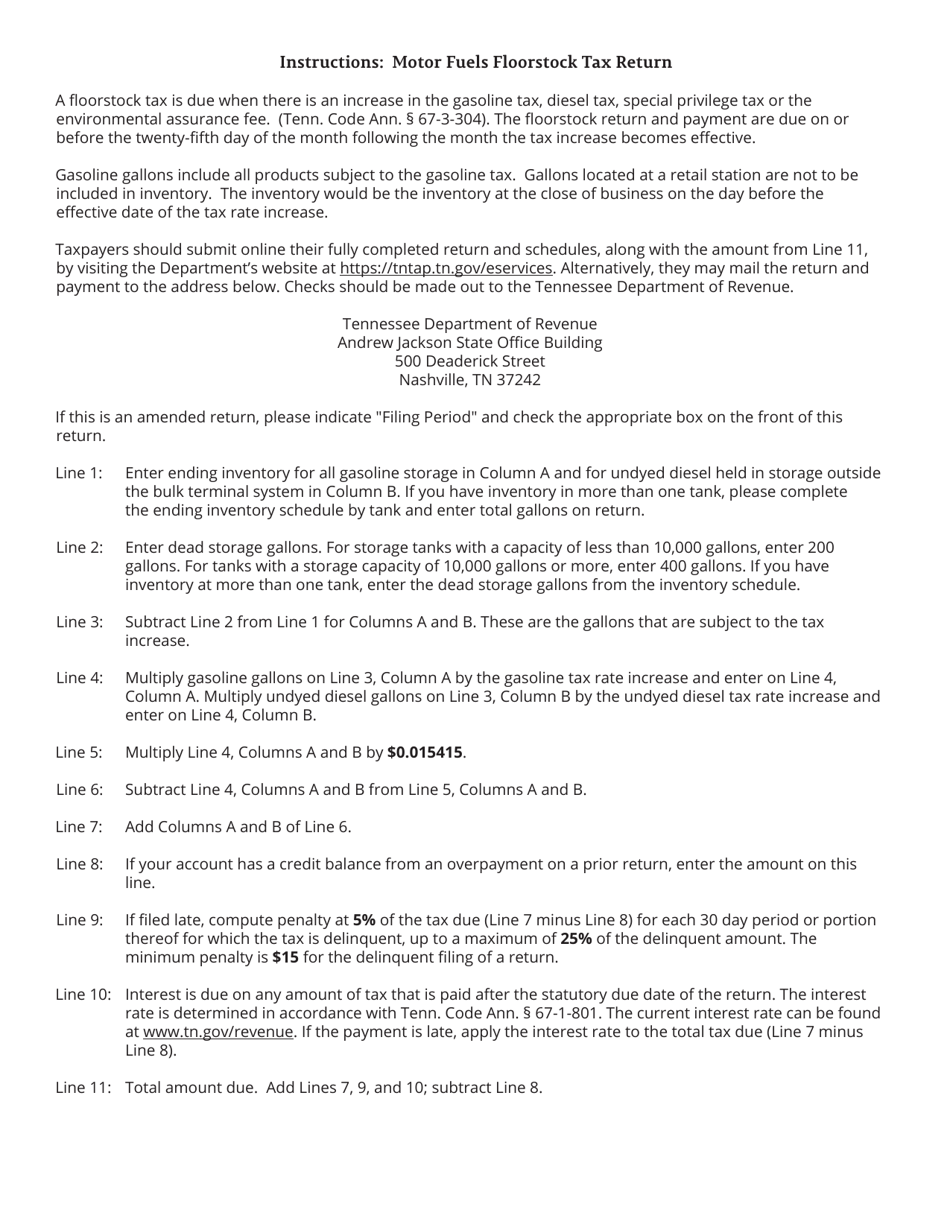

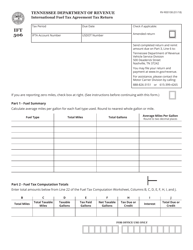

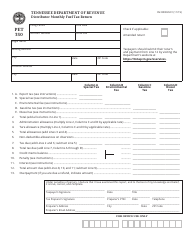

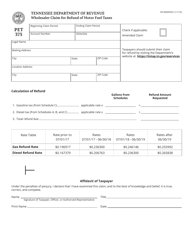

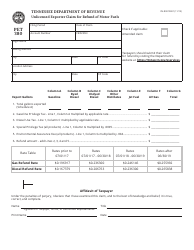

Form PET369 (RV-R00103) Motor Fuels Floorstock Tax Return - Tennessee

What Is Form PET369 (RV-R00103)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PET369?

A: Form PET369 is the Motor Fuels Floorstock Tax Return for Tennessee.

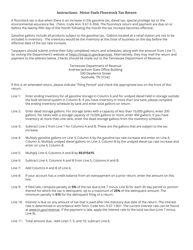

Q: Who needs to file Form PET369?

A: Businesses in Tennessee that store motor fuels for retail sale or for use in vehicles need to file Form PET369.

Q: What is the purpose of Form PET369?

A: Form PET369 is used to report and pay the Motor Fuels Floorstock Tax in Tennessee.

Q: When is Form PET369 due?

A: Form PET369 is due quarterly, with the due dates falling on the last day of the month following the end of the quarter.

Q: Are there any penalties for late filing of Form PET369?

A: Yes, there are penalties for late filing and late payment of the Motor Fuels Floorstock Tax in Tennessee. It is advisable to file and pay on time to avoid these penalties.

Q: Is Form PET369 specific to Tennessee?

A: Yes, Form PET369 is specific to Tennessee and is used to report and pay the Motor Fuels Floorstock Tax in the state.

Q: What other documents or information do I need to file Form PET369?

A: You will need to have information about your motor fuel inventory and sales for the reporting period, as well as your business information and identification number.

Q: Can I seek assistance in filing Form PET369?

A: Yes, if you need assistance in filing Form PET369, you can contact the Tennessee Department of Revenue's Motor Fuel Tax Section for guidance and support.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PET369 (RV-R00103) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.