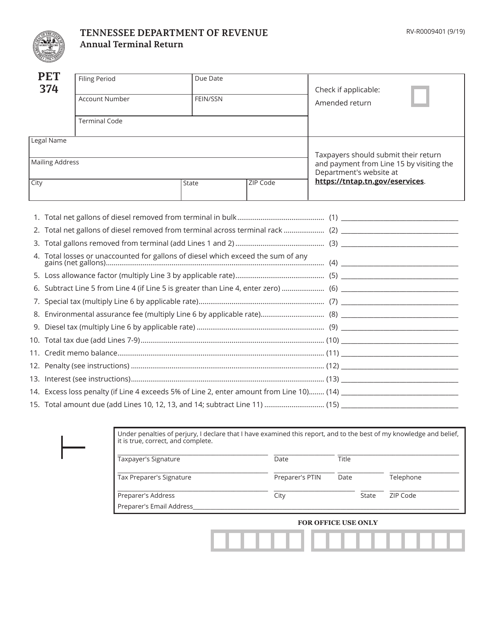

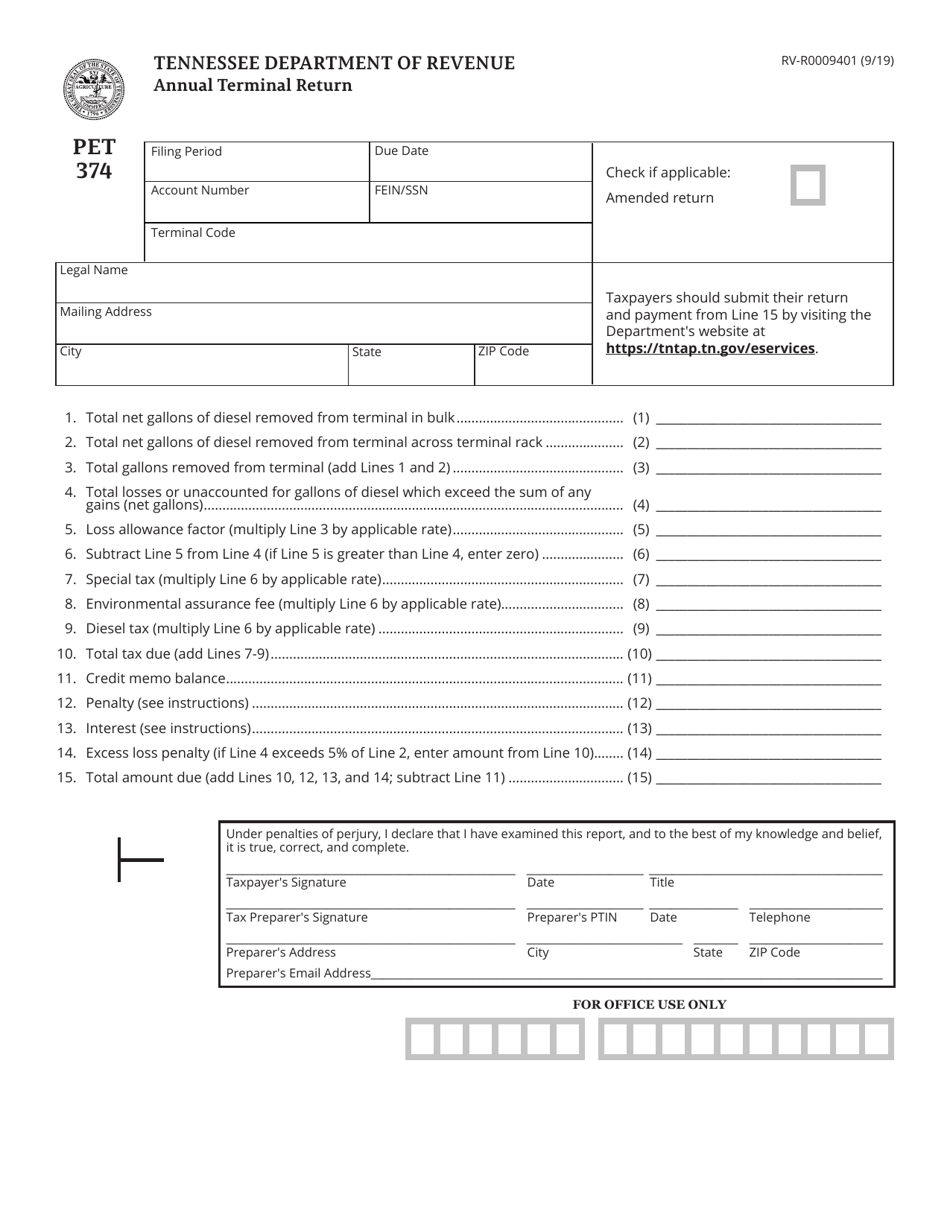

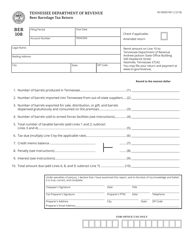

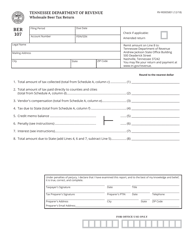

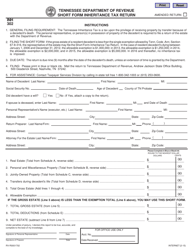

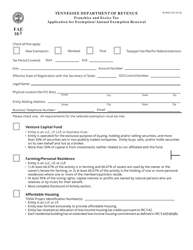

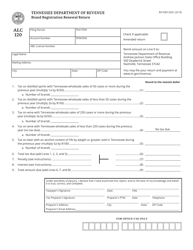

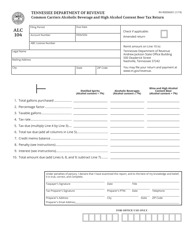

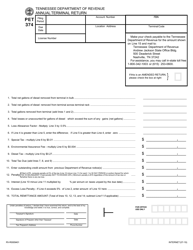

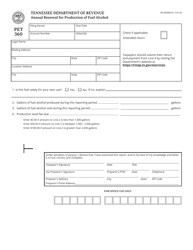

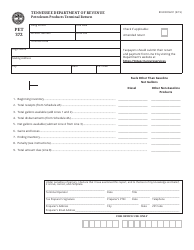

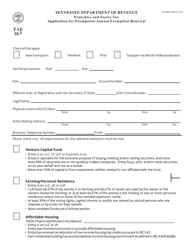

Form RV-R0009401 Annual Terminal Return - Tennessee

What Is Form RV-R0009401?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

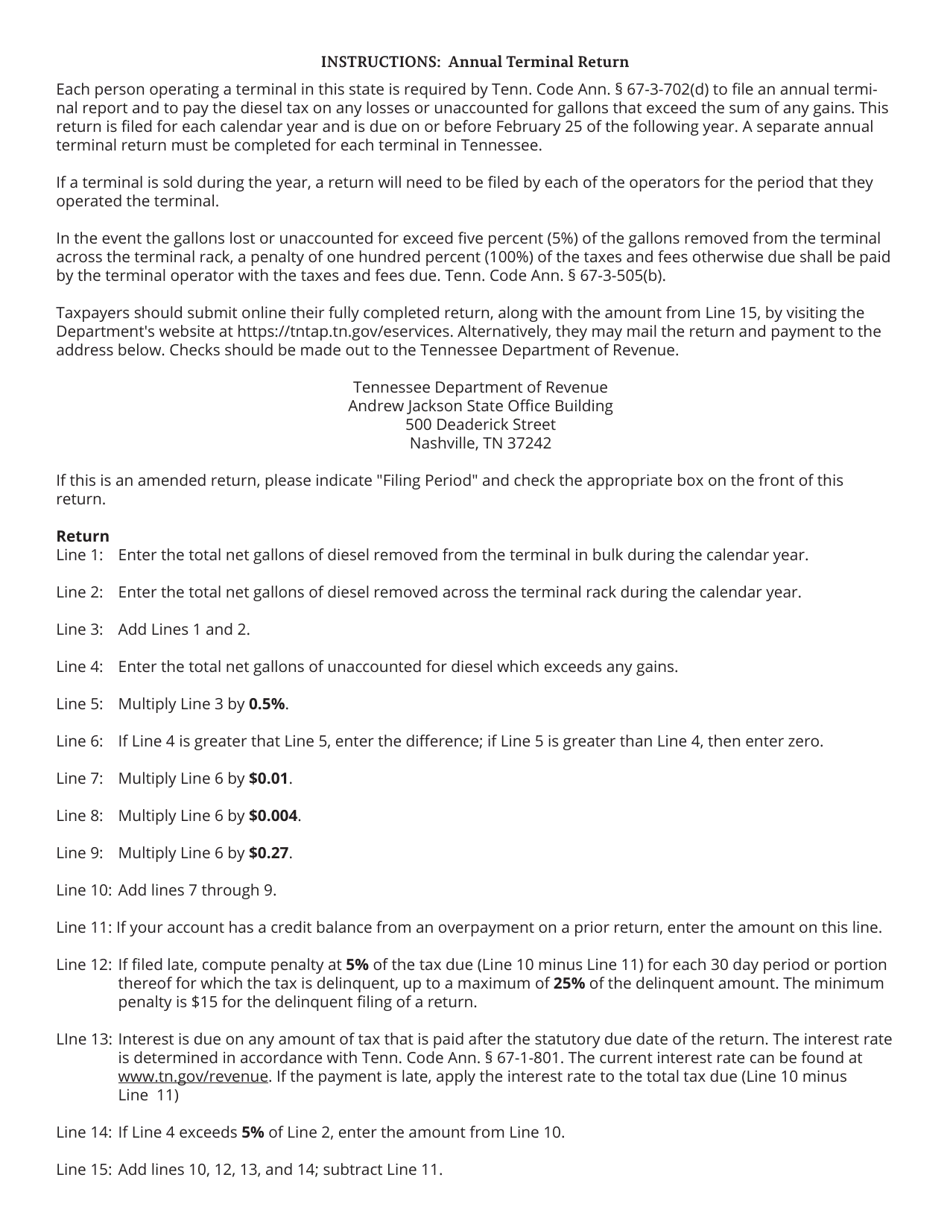

Q: What is the RV-R0009401 Annual Terminal Return?

A: The RV-R0009401 Annual Terminal Return is a form used in Tennessee to report certain information related to the operation of fuel terminals.

Q: Who needs to file the RV-R0009401 Annual Terminal Return?

A: Fuel terminal operators in Tennessee are required to file the RV-R0009401 Annual Terminal Return.

Q: What information is reported on the RV-R0009401 Annual Terminal Return?

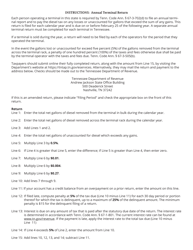

A: The RV-R0009401 Annual Terminal Return requires the reporting of specific details regarding fuel transactions, such as the type and quantity of fuel received or delivered.

Q: When is the deadline to file the RV-R0009401 Annual Terminal Return?

A: The RV-R0009401 Annual Terminal Return is due on the last day of the month following the calendar quarter being reported.

Q: Are there any penalties for late filing of the RV-R0009401 Annual Terminal Return?

A: Yes, late filing of the RV-R0009401 Annual Terminal Return may result in penalties and interest being assessed by the Tennessee Department of Revenue.

Q: Do I need to include payment with the RV-R0009401 Annual Terminal Return?

A: Yes, if you have a tax liability based on your fuel transactions, you must include payment with your RV-R0009401 Annual Terminal Return.

Q: Can I file the RV-R0009401 Annual Terminal Return electronically?

A: Yes, the Tennessee Department of Revenue allows for electronic filing of the RV-R0009401 Annual Terminal Return.

Q: What should I do if I have questions about the RV-R0009401 Annual Terminal Return?

A: If you have questions about the RV-R0009401 Annual Terminal Return, you should contact the Tennessee Department of Revenue for assistance.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-R0009401 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.