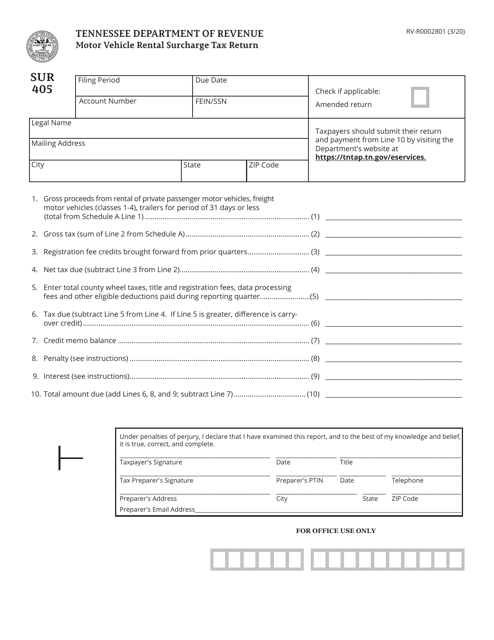

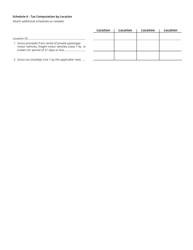

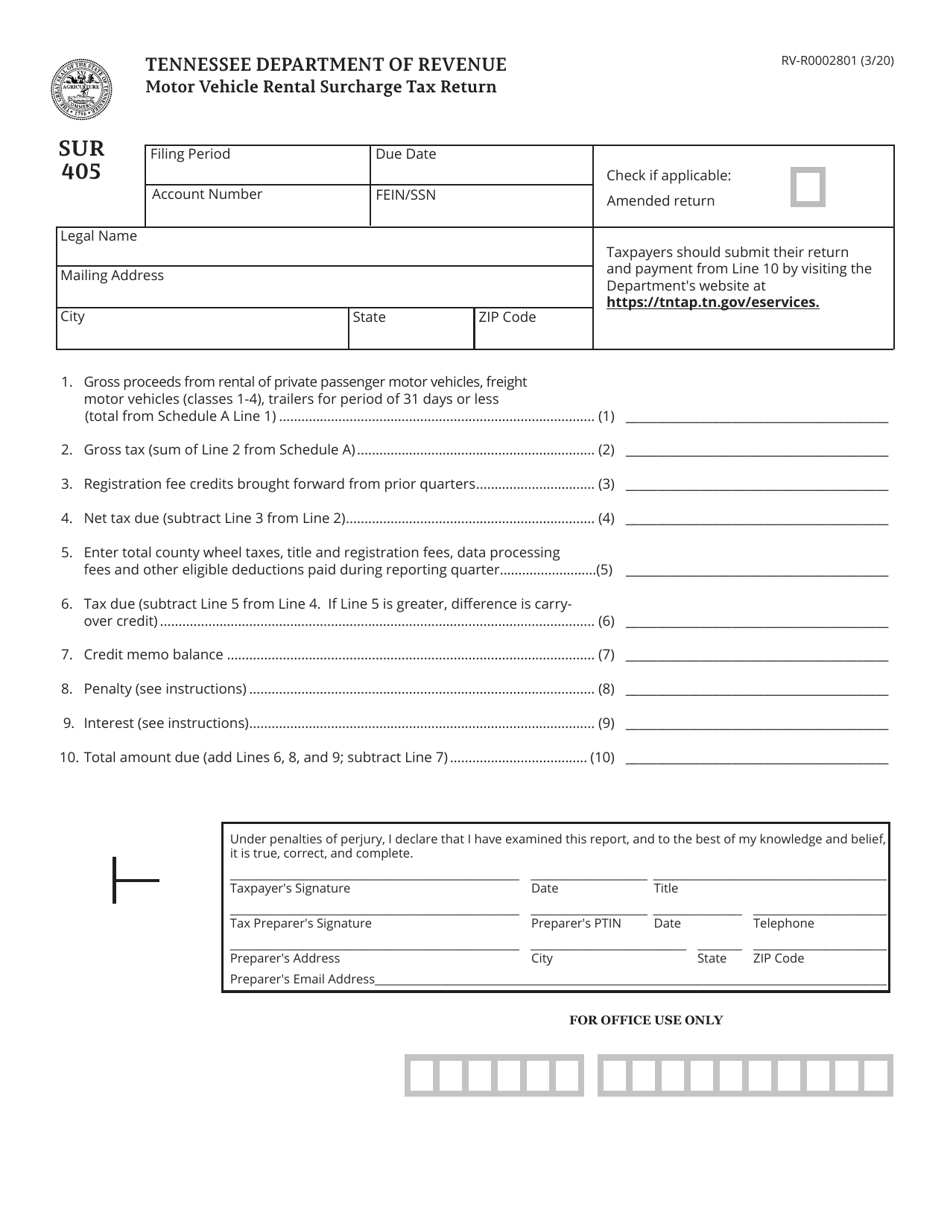

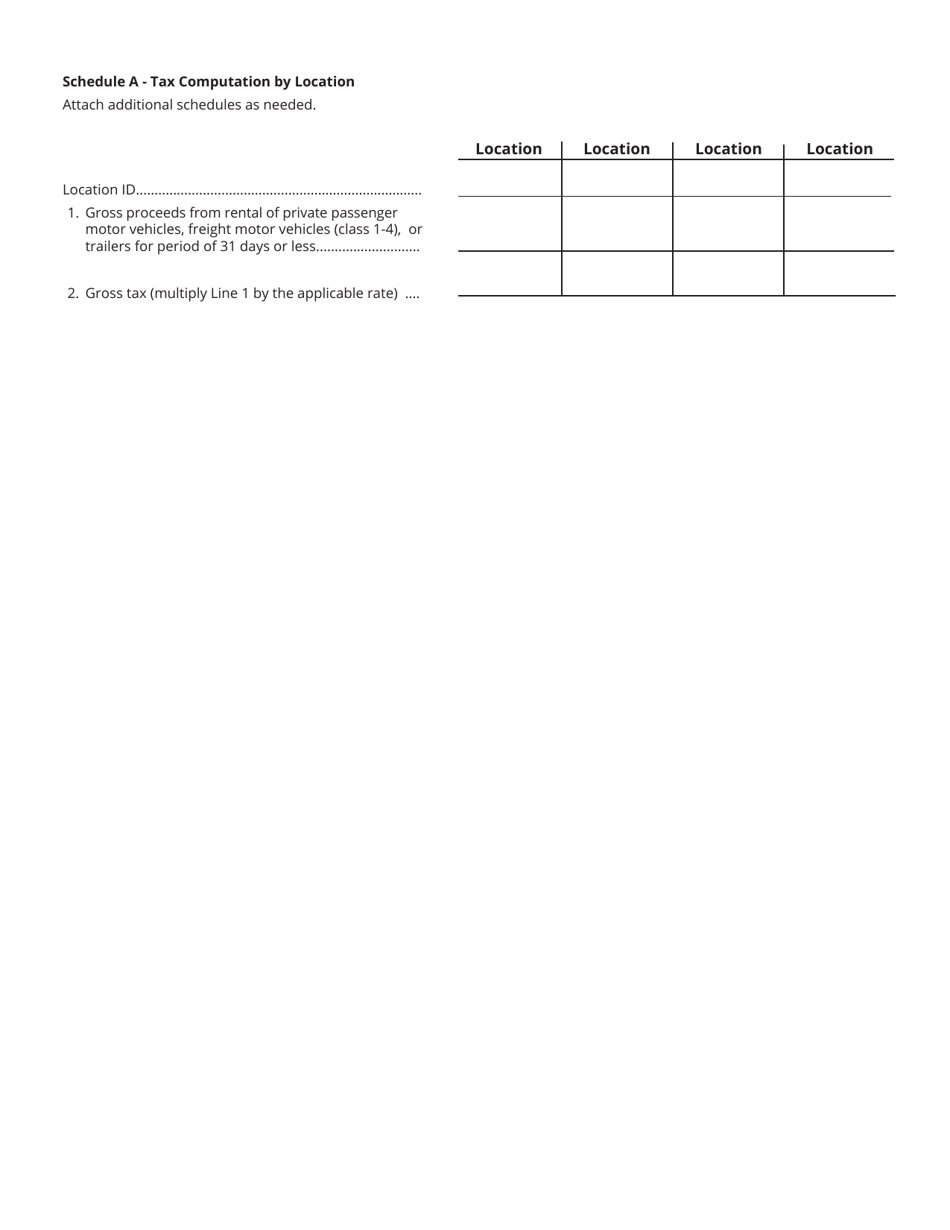

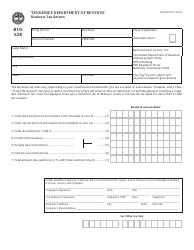

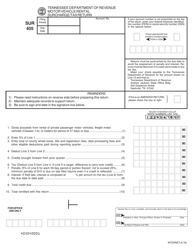

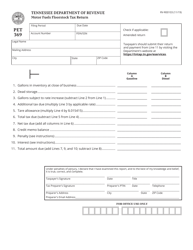

Form SUR405 (RV-R0002801) Motor Vehicle Rental Surcharge Tax Return - Tennessee

What Is Form SUR405 (RV-R0002801)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SUR405?

A: Form SUR405 is the Motor Vehicle RentalSurcharge Tax Return for Tennessee.

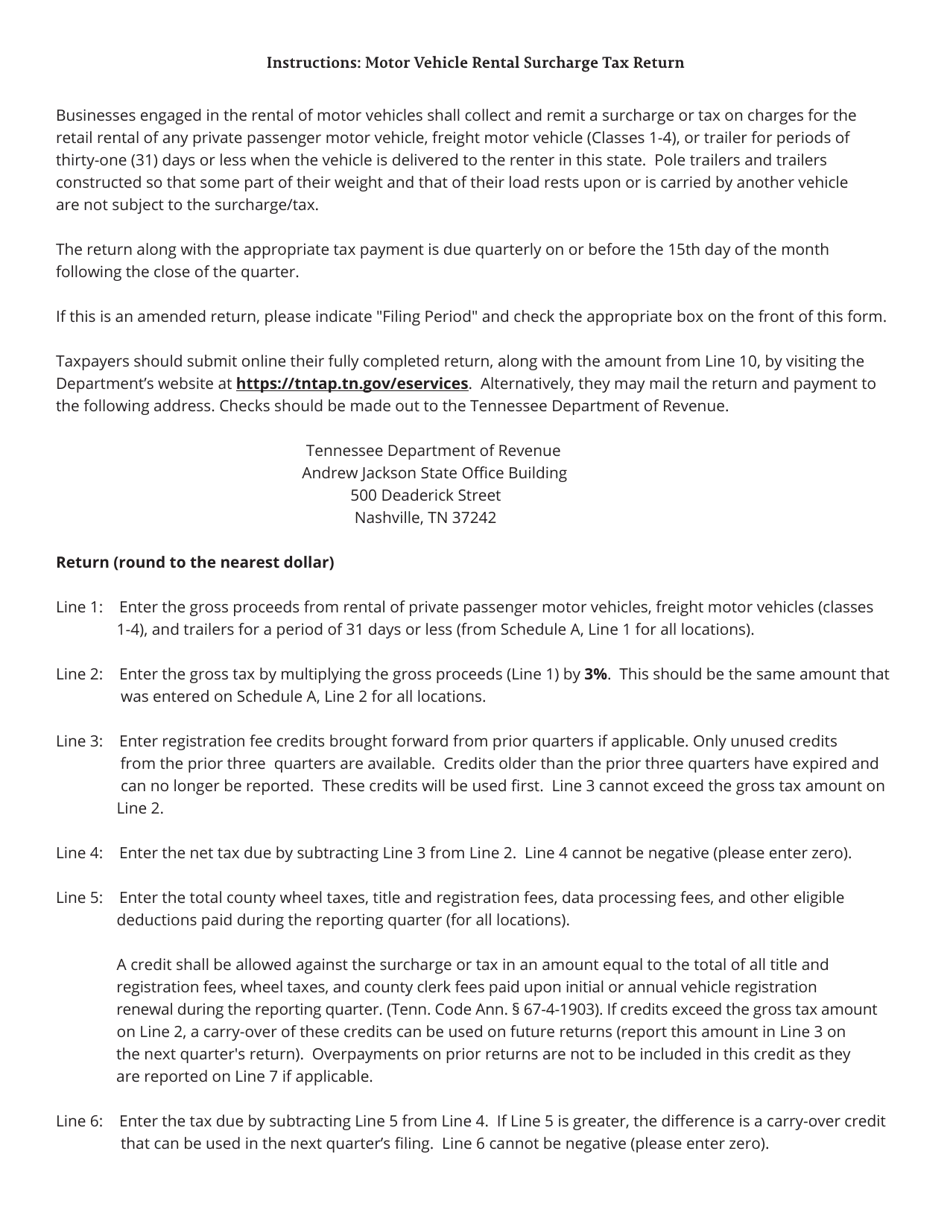

Q: Who should file Form SUR405?

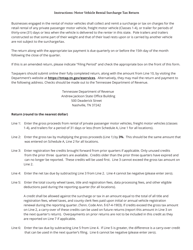

A: Motor vehicle rental companies operating in Tennessee should file Form SUR405.

Q: What is the purpose of Form SUR405?

A: The purpose of Form SUR405 is to report and remit the motor vehicle rental surcharge tax owed to the state of Tennessee.

Q: What is the motor vehicle rental surcharge tax?

A: The motor vehicle rental surcharge tax is a tax imposed on the rental of motor vehicles in Tennessee.

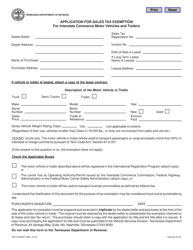

Q: How often should Form SUR405 be filed?

A: Form SUR405 should be filed monthly.

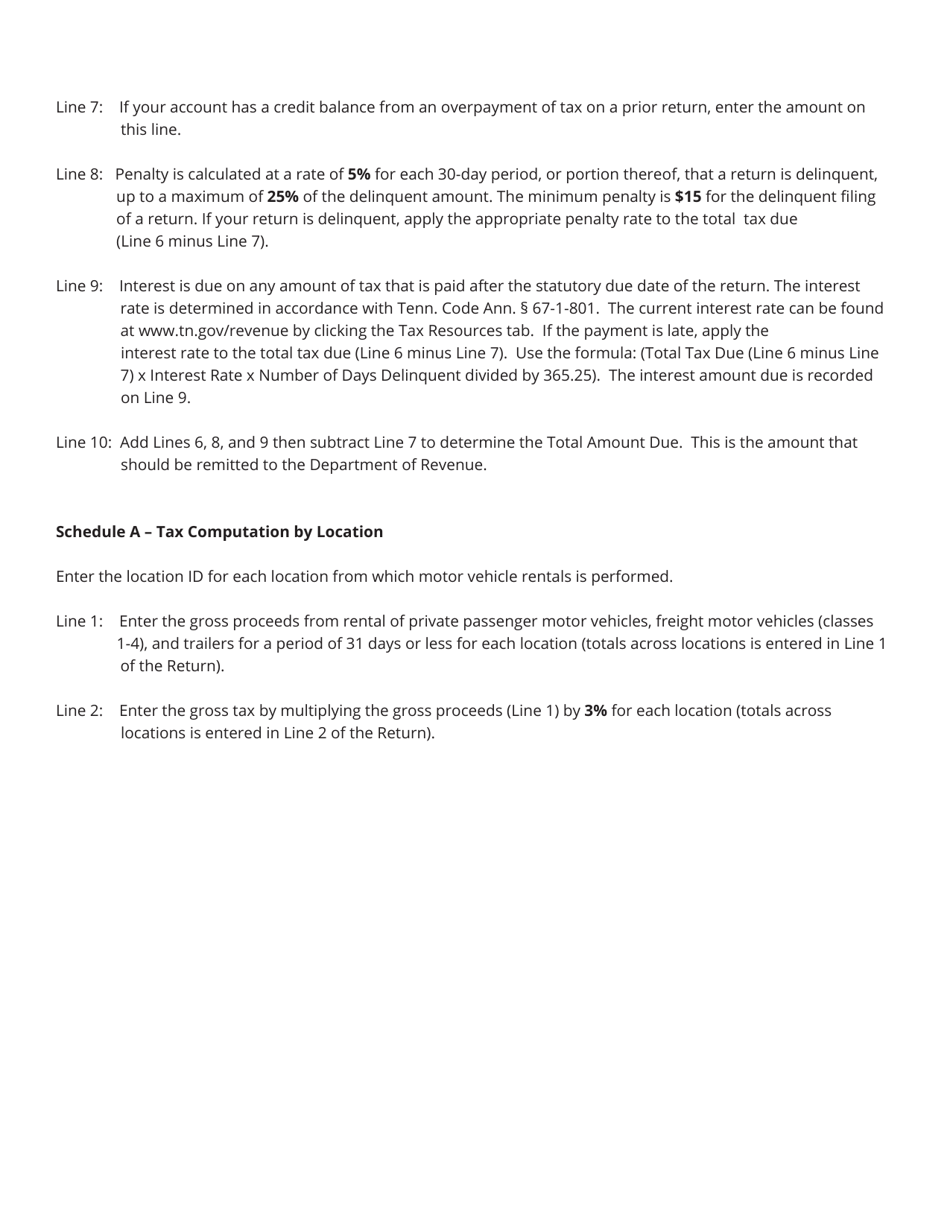

Q: Are there any penalties for late filing or non-payment?

A: Yes, there are penalties for late filing or non-payment of the motor vehicle rental surcharge tax. It is important to file and pay on time to avoid penalties.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SUR405 (RV-R0002801) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.