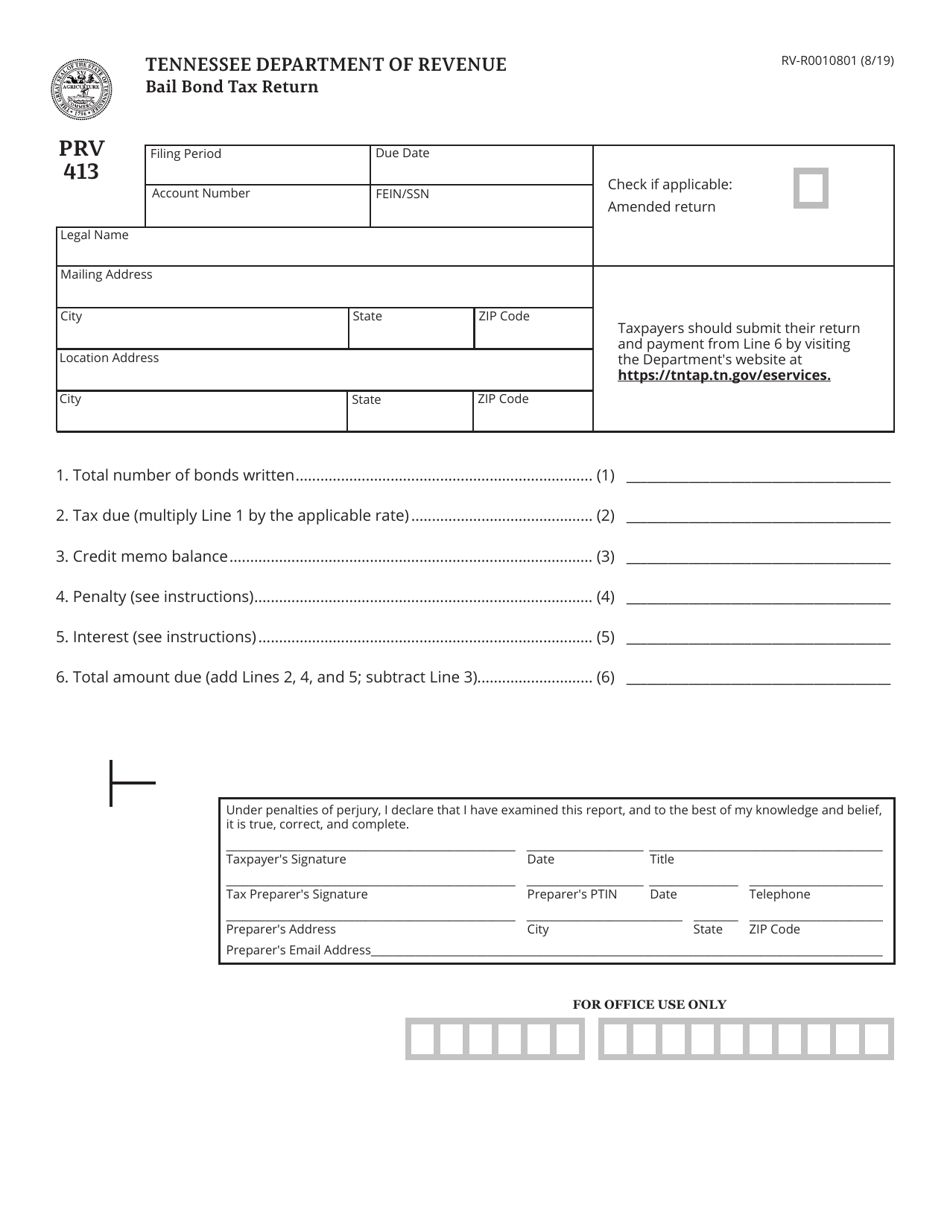

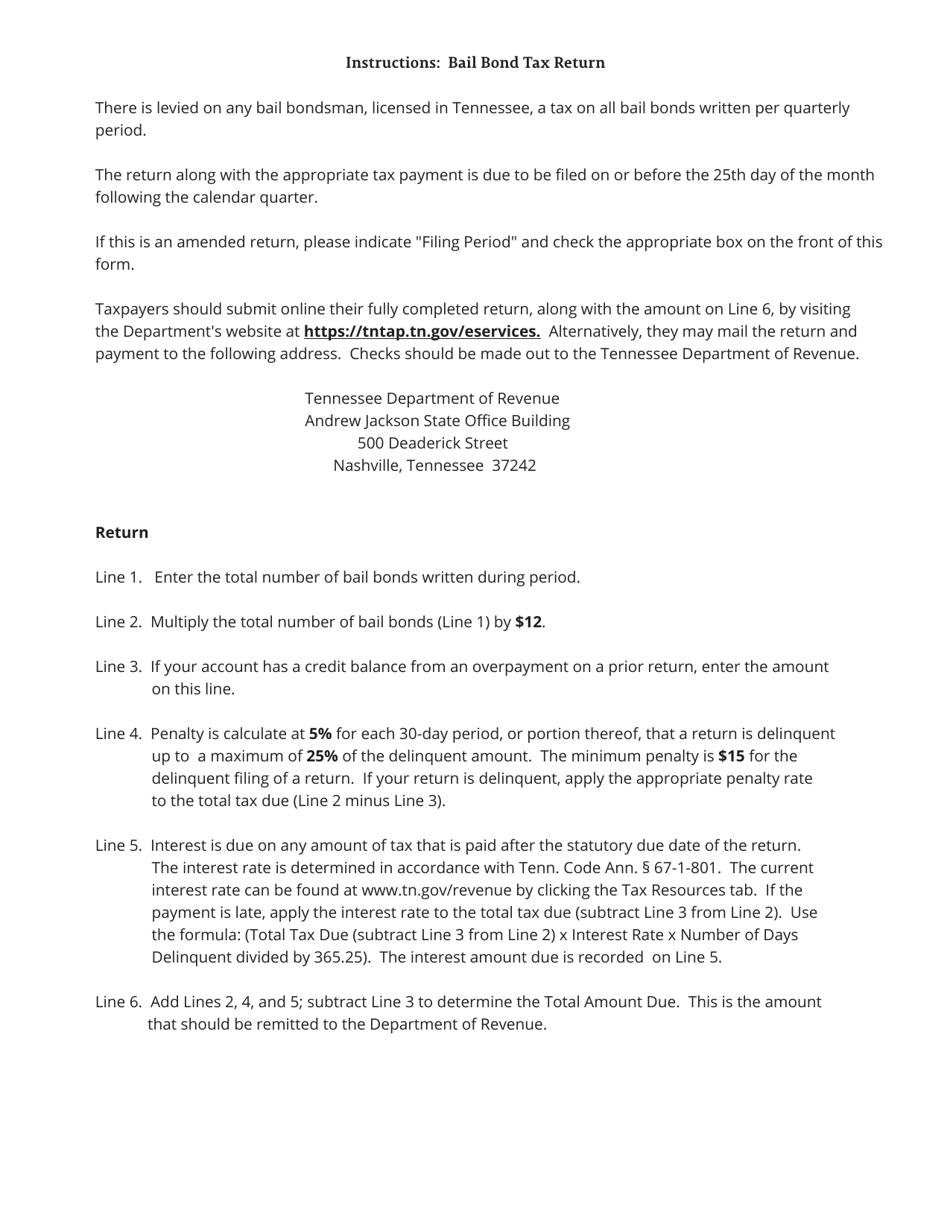

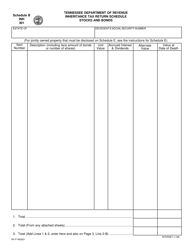

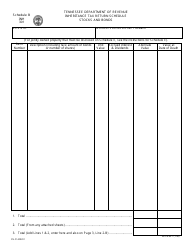

Form PRV413 (RV-R0010801) Bail Bond Tax Return - Tennessee

What Is Form PRV413 (RV-R0010801)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form PRV413?

A: Form PRV413 is a Bail Bond Tax Return.

Q: What is the purpose of form PRV413?

A: The purpose of form PRV413 is to report and pay bail bond taxes.

Q: Who should file form PRV413?

A: Bail bond companies in Tennessee should file form PRV413.

Q: What is the due date for form PRV413?

A: Form PRV413 is due on the 20th day of each month.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PRV413 (RV-R0010801) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.