This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

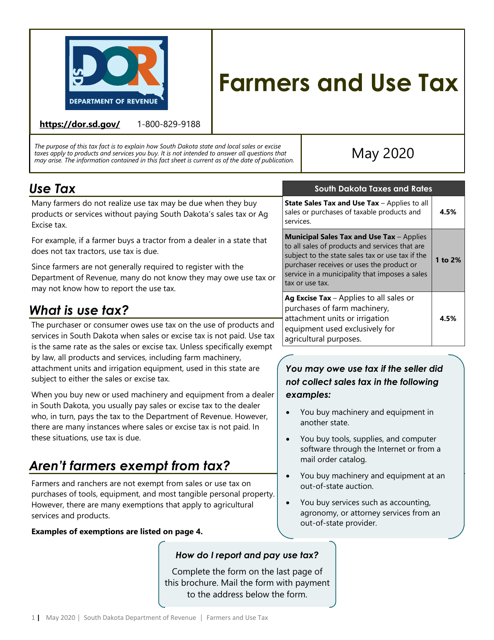

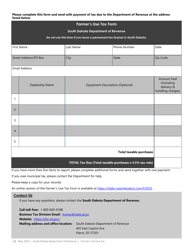

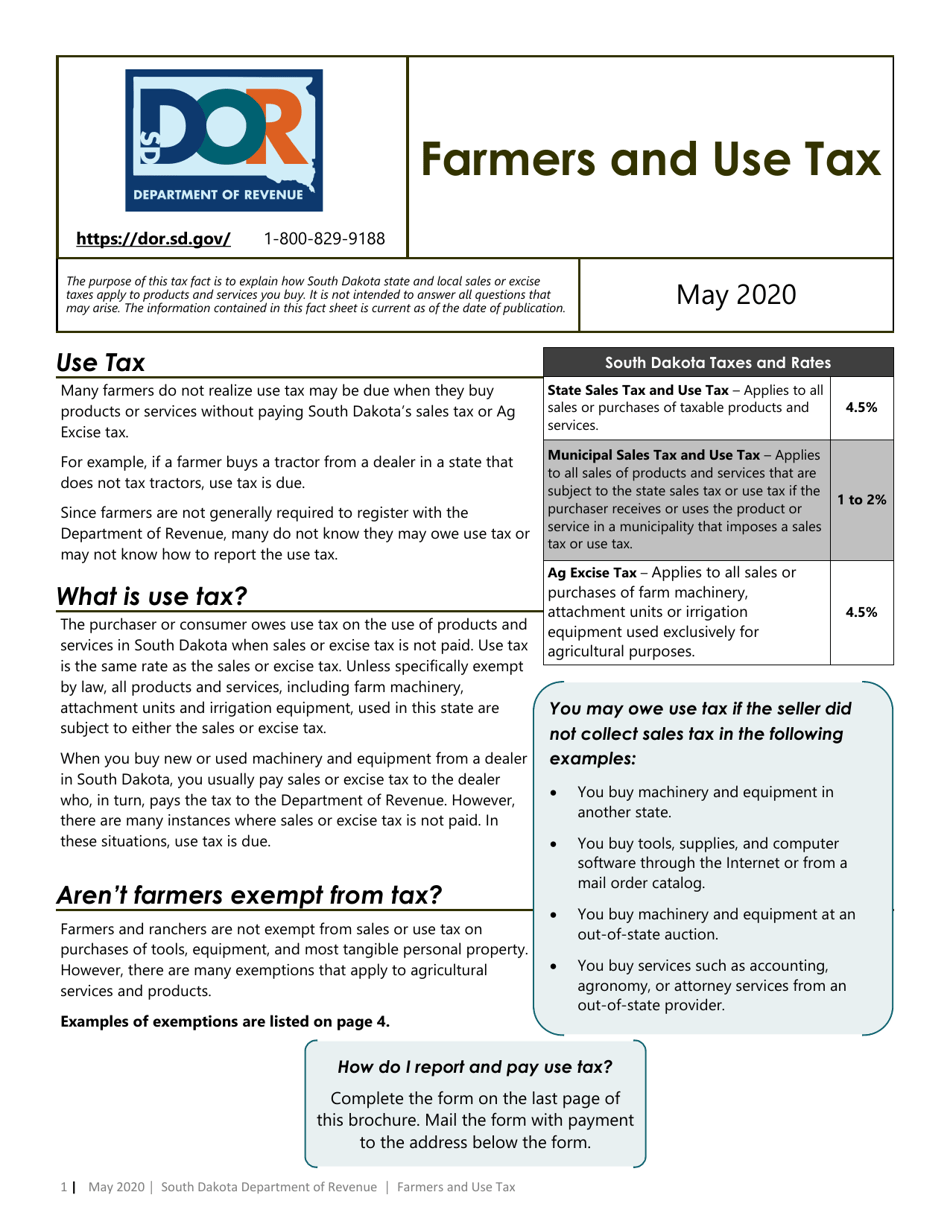

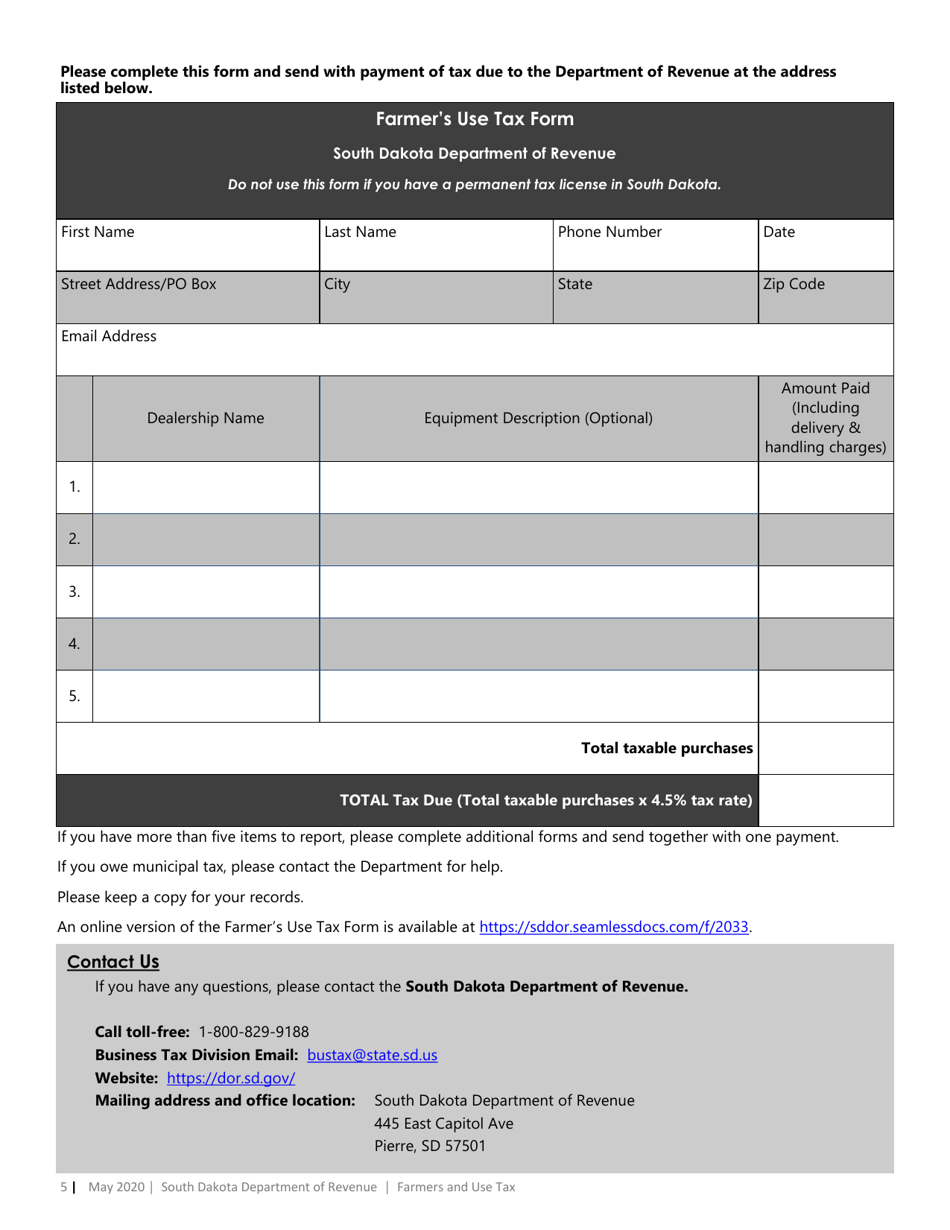

Farmer's Use Tax Form - South Dakota

Farmer's Use Tax Form is a legal document that was released by the South Dakota Department of Revenue - a government authority operating within South Dakota.

FAQ

Q: What is the Farmer's Use Tax Form?

A: The Farmer's Use Tax Form is a tax form specific to farmers in South Dakota.

Q: Who is required to file the Farmer's Use Tax Form?

A: Farmers in South Dakota are required to file the Farmer's Use Tax Form if they meet certain criteria.

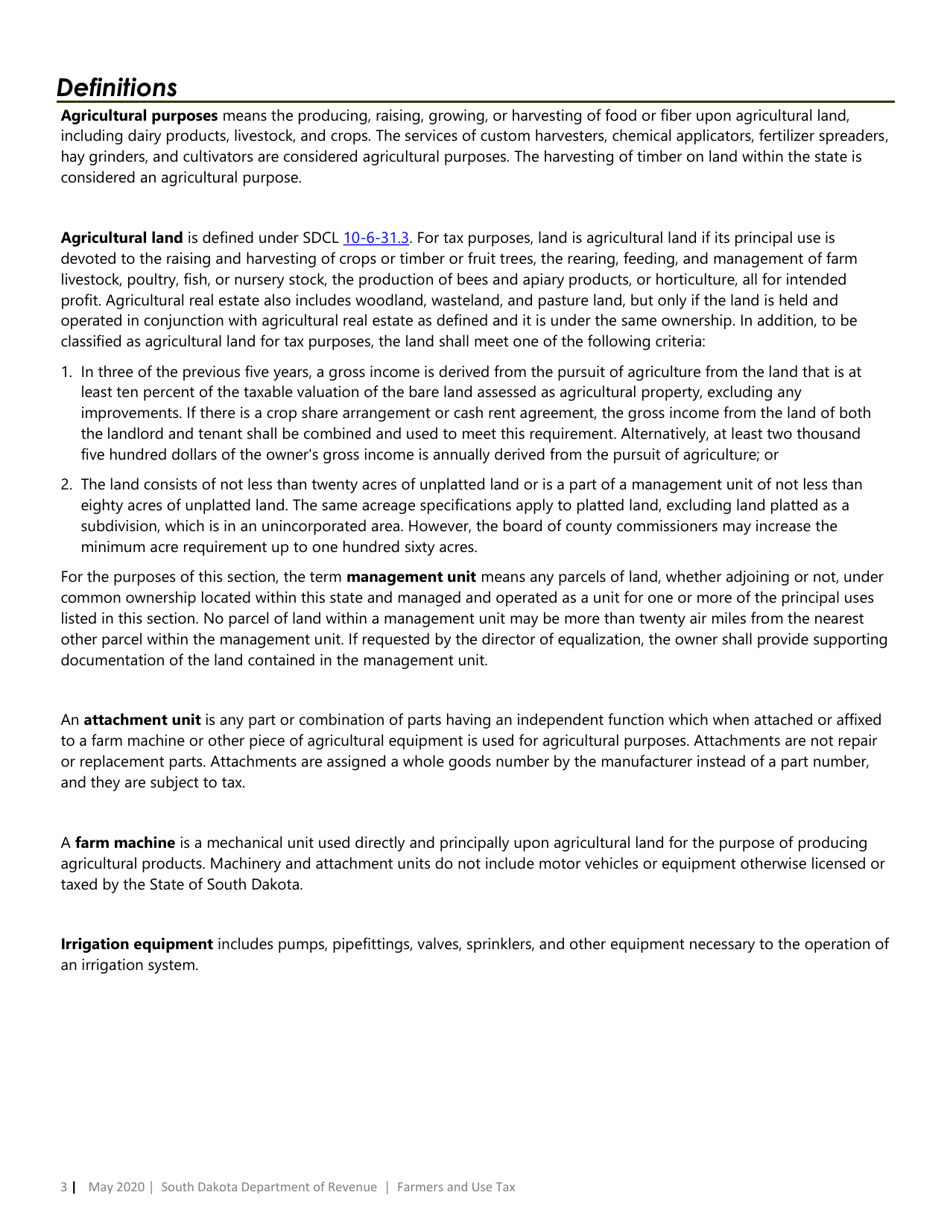

Q: What is the purpose of the Farmer's Use Tax Form?

A: The purpose of the Farmer's Use Tax Form is to report and pay tax on items purchased for farming purposes.

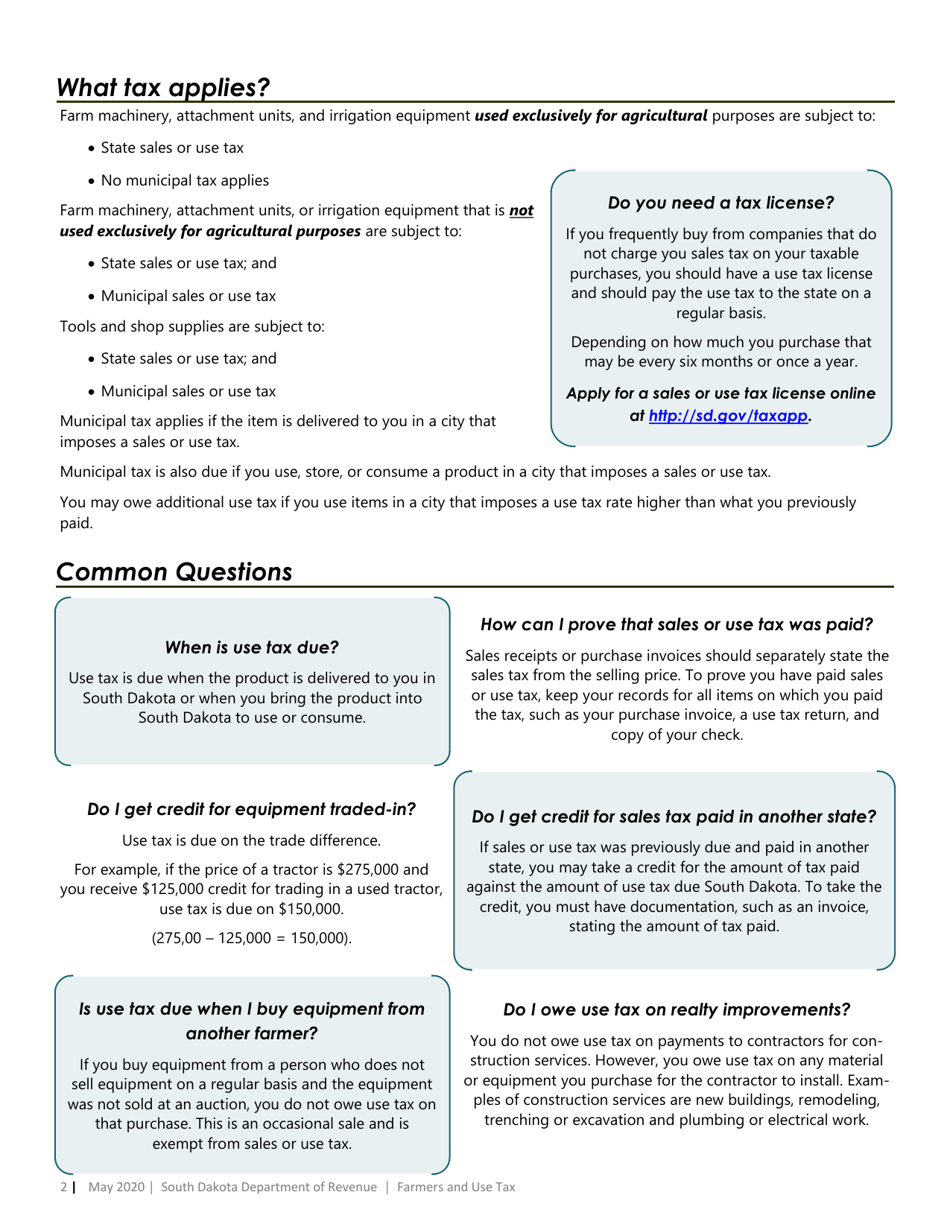

Q: What items are subject to the Farmer's Use Tax?

A: Items such as machinery, equipment, and fertilizer purchased for farming purposes are subject to the Farmer's Use Tax.

Q: How often do farmers need to file the Farmer's Use Tax Form?

A: Farmers in South Dakota need to file the Farmer's Use Tax Form on a quarterly basis.

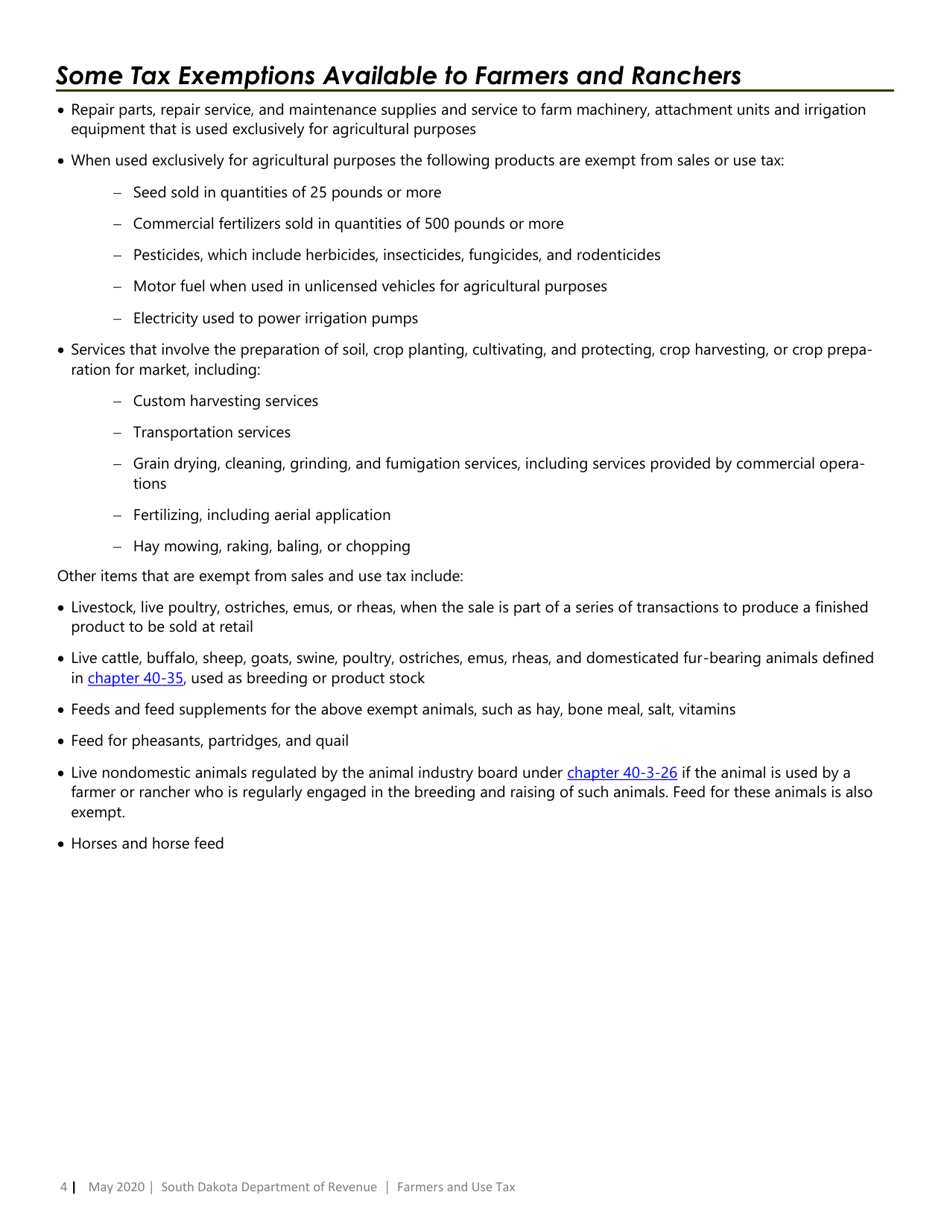

Q: Are there any exemptions to the Farmer's Use Tax?

A: Certain items, such as livestock and seeds, are exempt from the Farmer's Use Tax.

Q: What happens if a farmer fails to file the Farmer's Use Tax Form?

A: If a farmer fails to file the Farmer's Use Tax Form, they may be subject to penalties and interest on the unpaid taxes.

Q: Can farmers claim a refund on the Farmer's Use Tax?

A: Yes, farmers can claim a refund on the Farmer's Use Tax if they overpaid or if they exported the taxed items out of South Dakota.

Q: Is the Farmer's Use Tax the same as the sales tax?

A: No, the Farmer's Use Tax is a separate tax specifically for farmers, while the sales tax is a general tax on goods and services sold in South Dakota.

Form Details:

- Released on May 1, 2020;

- The latest edition currently provided by the South Dakota Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the South Dakota Department of Revenue.