This version of the form is not currently in use and is provided for reference only. Download this version of

Form 501

for the current year.

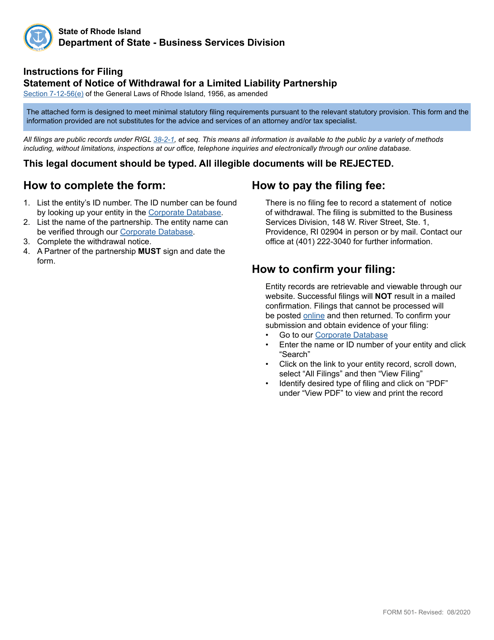

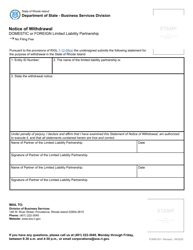

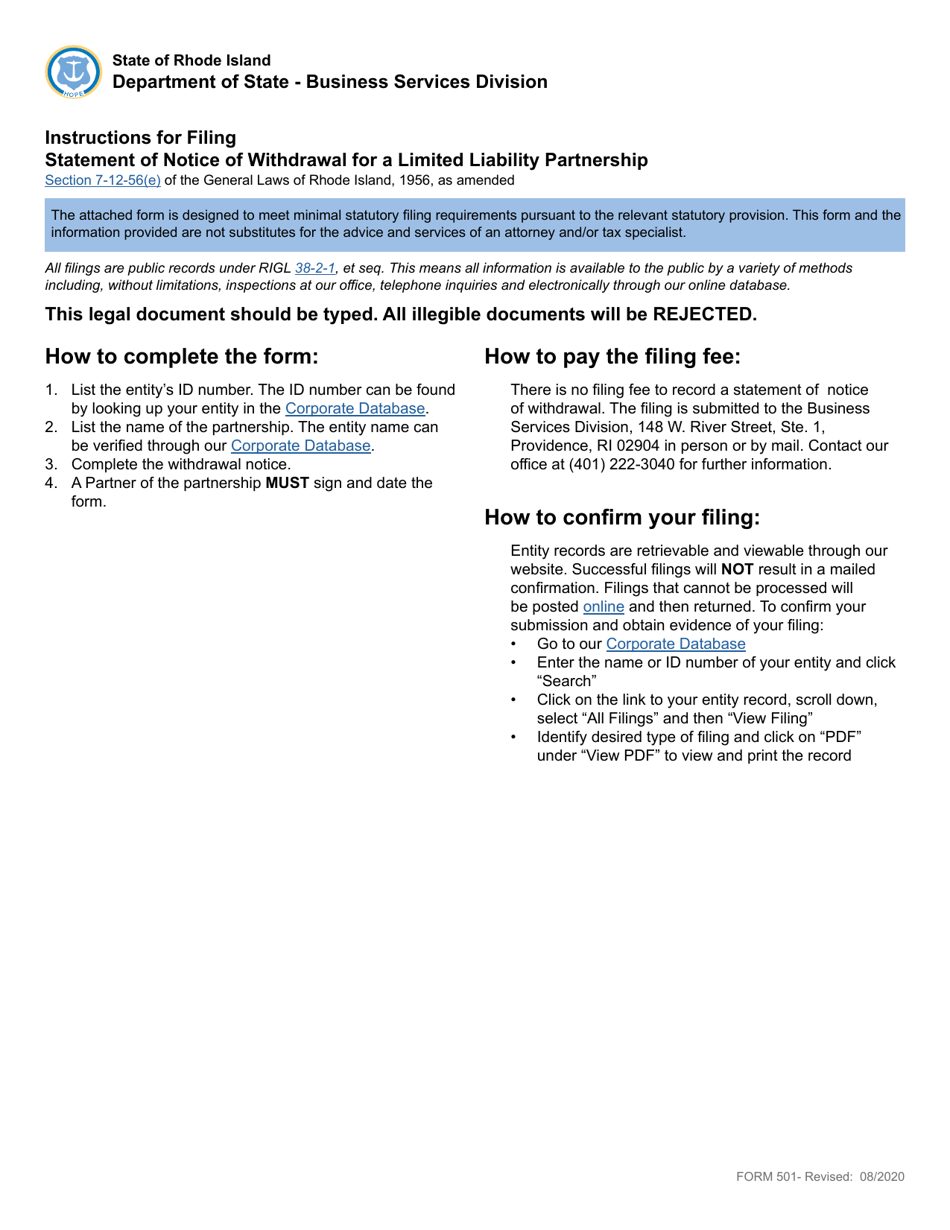

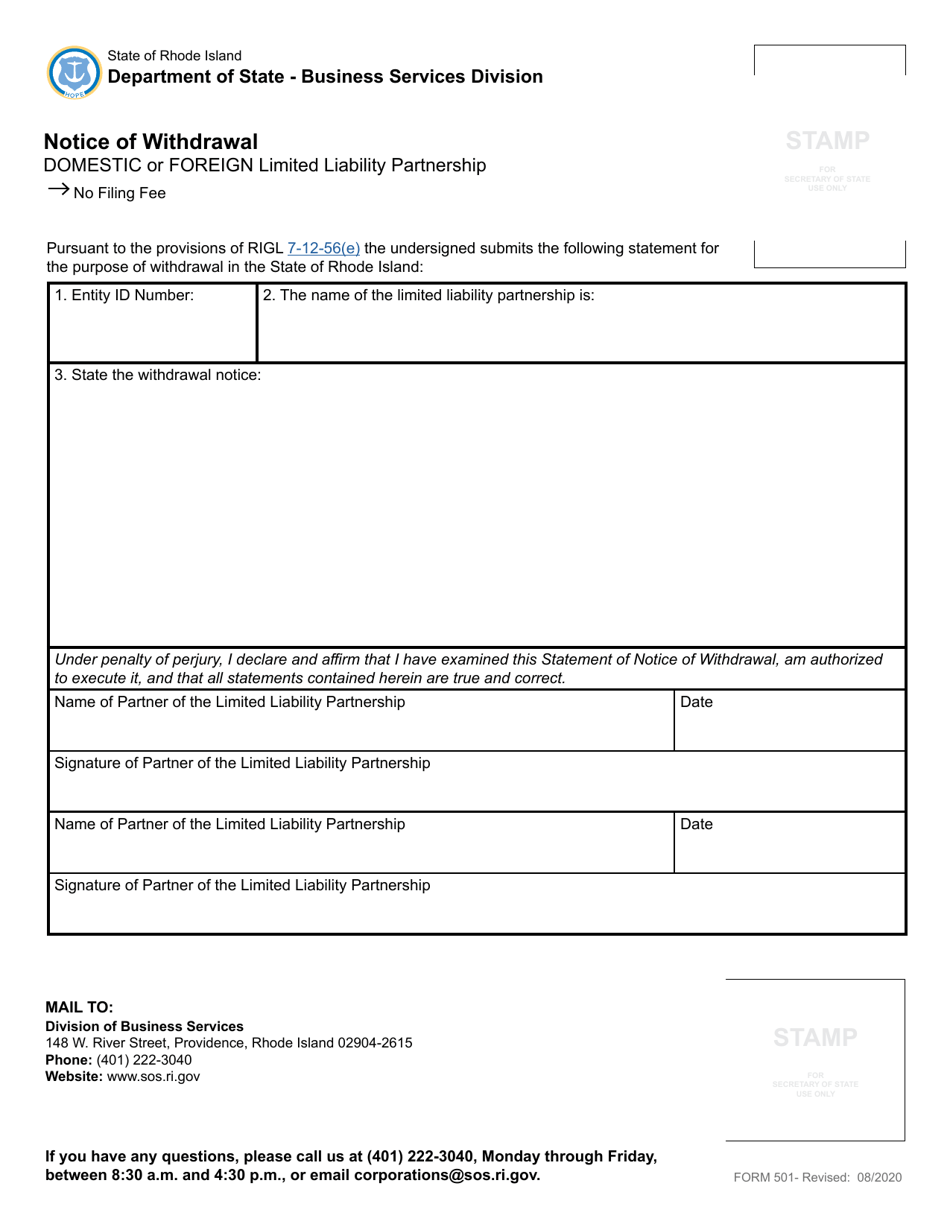

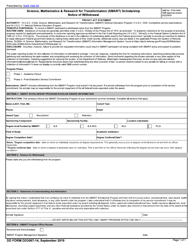

Form 501 Notice of Withdrawal - Domestic or Foreign Limited Liability Partnership - Rhode Island

What Is Form 501?

This is a legal form that was released by the Rhode Island Secretary of State - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 501?

A: Form 501 is a Notice of Withdrawal for a Domestic or Foreign Limited Liability Partnership in Rhode Island.

Q: Who can use Form 501?

A: This form can be used by domestic or foreign limited liability partnerships in Rhode Island who wish to withdraw from business.

Q: What is the purpose of Form 501?

A: The purpose of Form 501 is to officially notify the Rhode Island Secretary of State that a limited liability partnership is withdrawing from business.

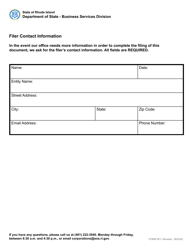

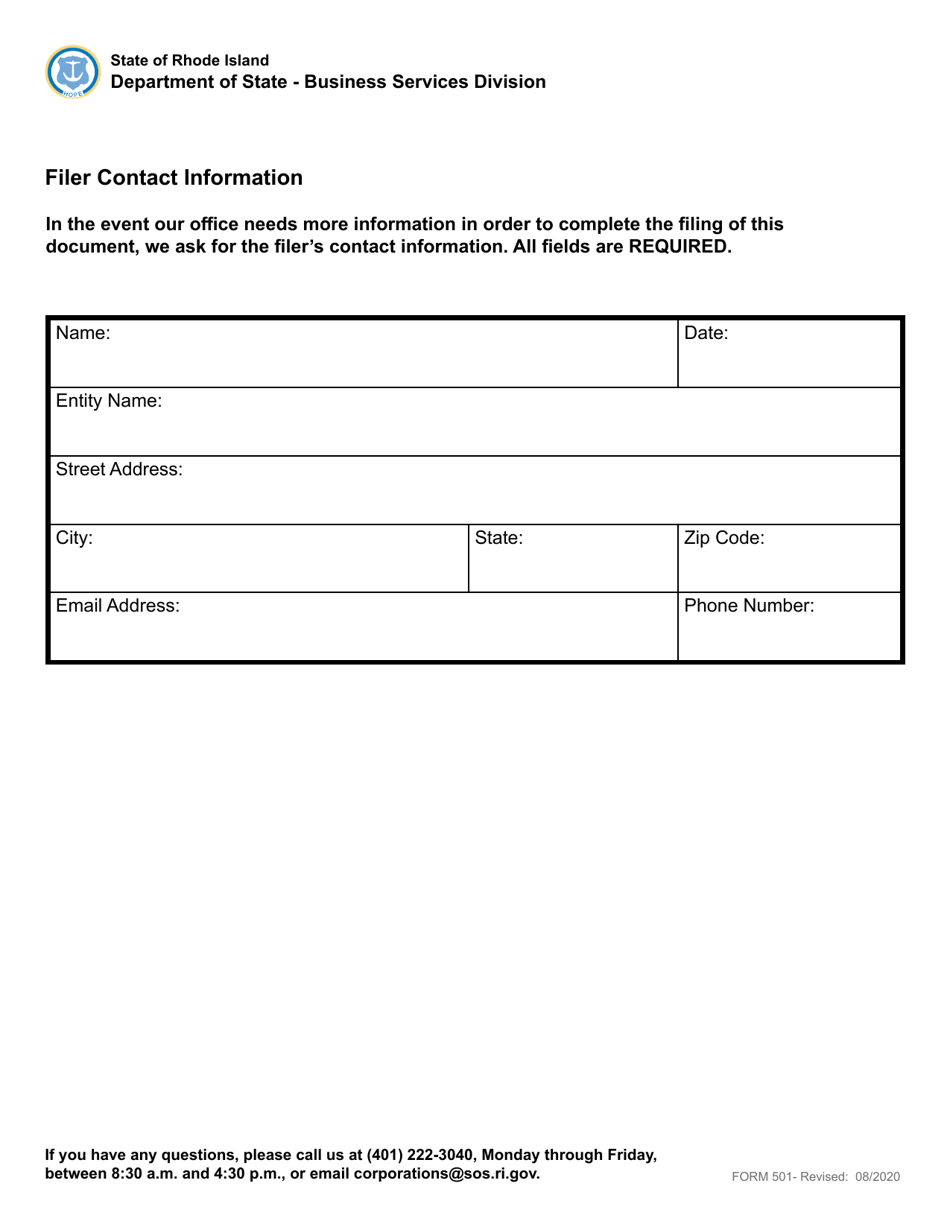

Q: What information is required on Form 501?

A: Form 501 requires information such as the name of the limited liability partnership, the date of formation, and the reason for withdrawal.

Q: Are there any additional requirements for withdrawal?

A: Yes, there may be additional requirements for withdrawal, such as filing tax returns and paying any outstanding taxes or fees.

Q: Can I withdraw my limited liability partnership without filing Form 501?

A: No, filing Form 501 is a necessary step to officially withdraw a limited liability partnership in Rhode Island.

Q: What happens after filing Form 501?

A: After filing Form 501, the Rhode Island Secretary of State will process the withdrawal and update the status of the limited liability partnership.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Rhode Island Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 501 by clicking the link below or browse more documents and templates provided by the Rhode Island Secretary of State.