This version of the form is not currently in use and is provided for reference only. Download this version of

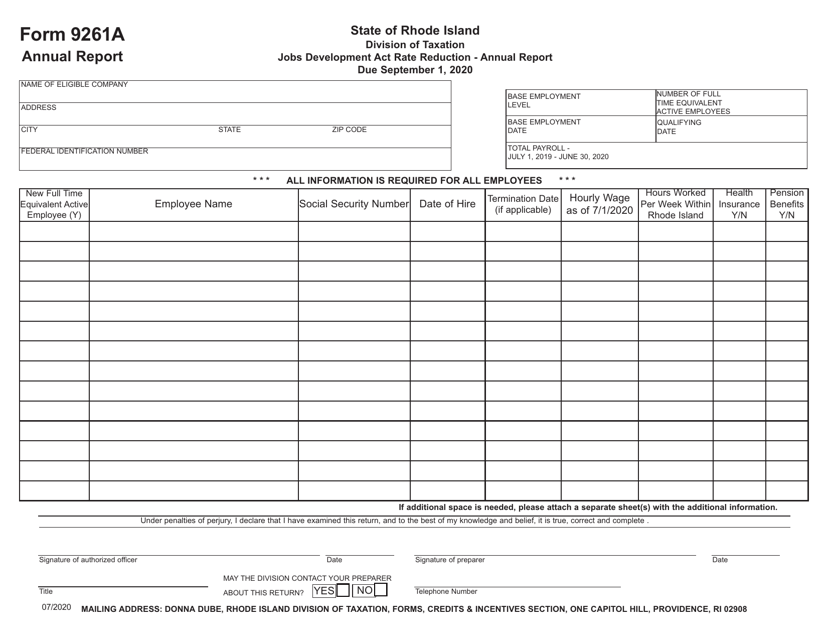

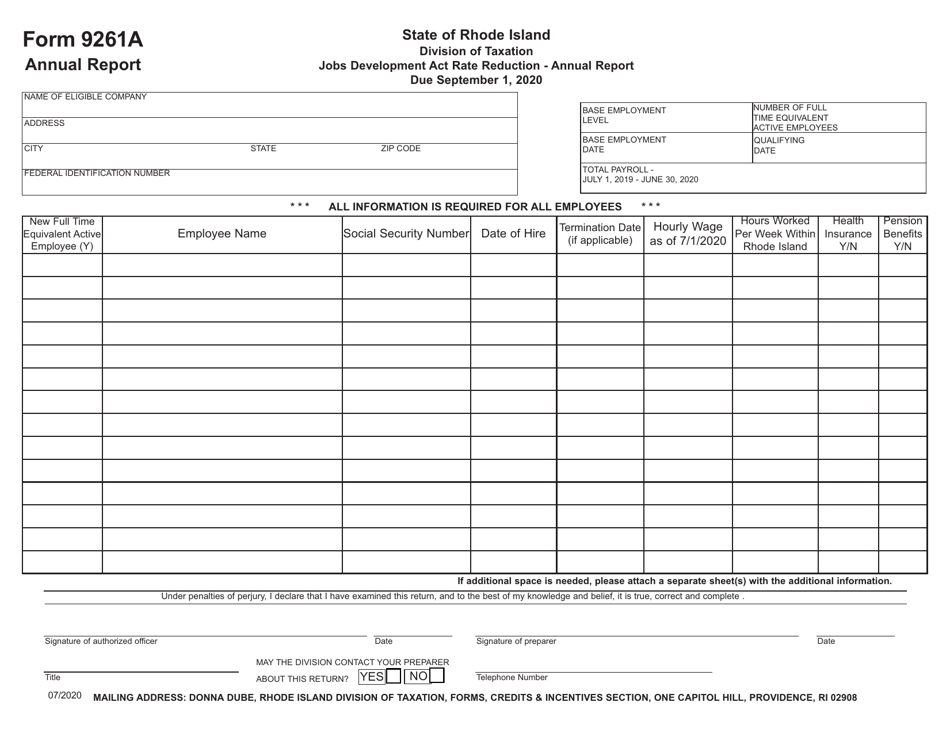

Form 9261A

for the current year.

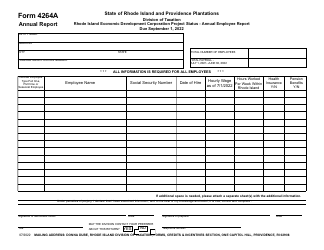

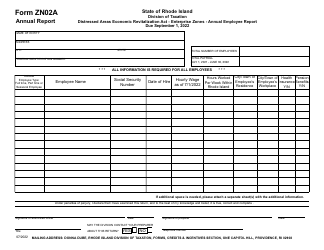

Form 9261A Jobs Development Act Rate Reduction - Annual Report - Rhode Island

What Is Form 9261A?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 9261A?

A: Form 9261A is an Annual Report for the Jobs Development Act Rate Reduction in Rhode Island.

Q: What is the Jobs Development Act Rate Reduction?

A: The Jobs Development Act Rate Reduction is a program aimed at reducing rates in Rhode Island to attract businesses and encourage job creation.

Q: Who needs to file Form 9261A?

A: Businesses that have been approved for the Jobs Development Act Rate Reduction in Rhode Island need to file Form 9261A.

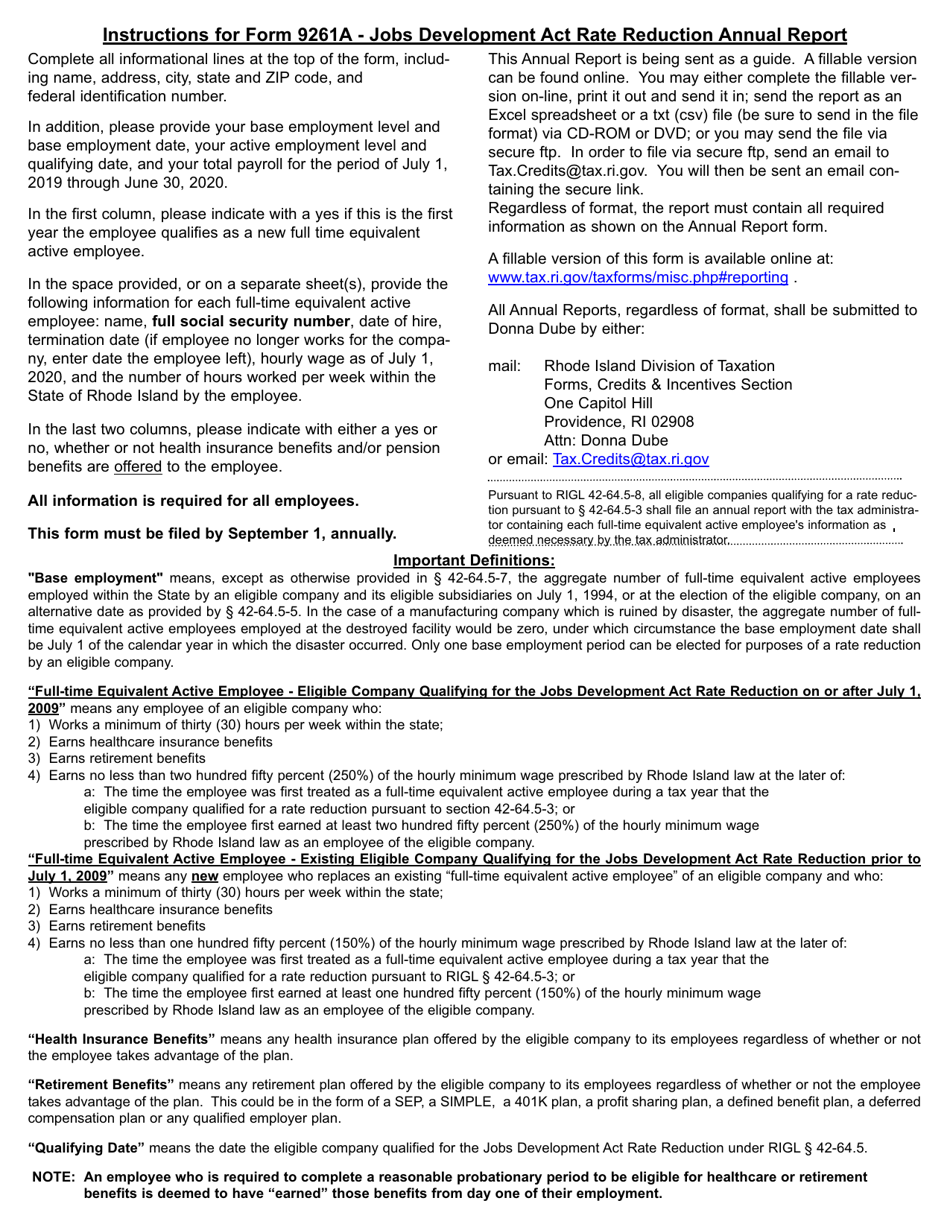

Q: What information is required on Form 9261A?

A: Form 9261A requires information about the business, including financials, employment numbers, and details of the Jobs Development Act Rate Reduction.

Q: When is the deadline to file Form 9261A?

A: The deadline to file Form 9261A for the Jobs Development Act Rate Reduction in Rhode Island is typically on an annual basis.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 9261A by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.