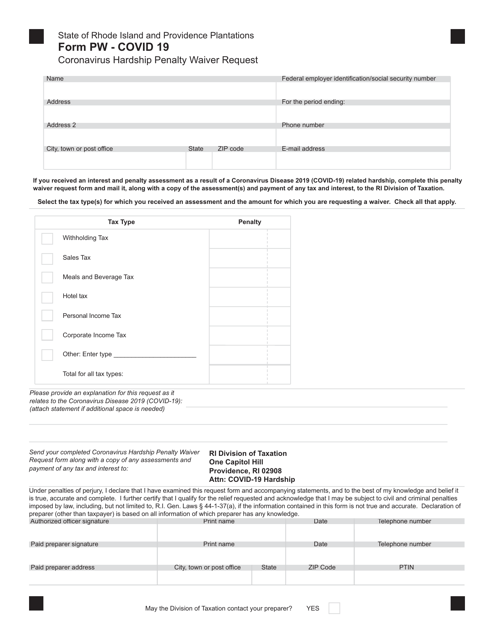

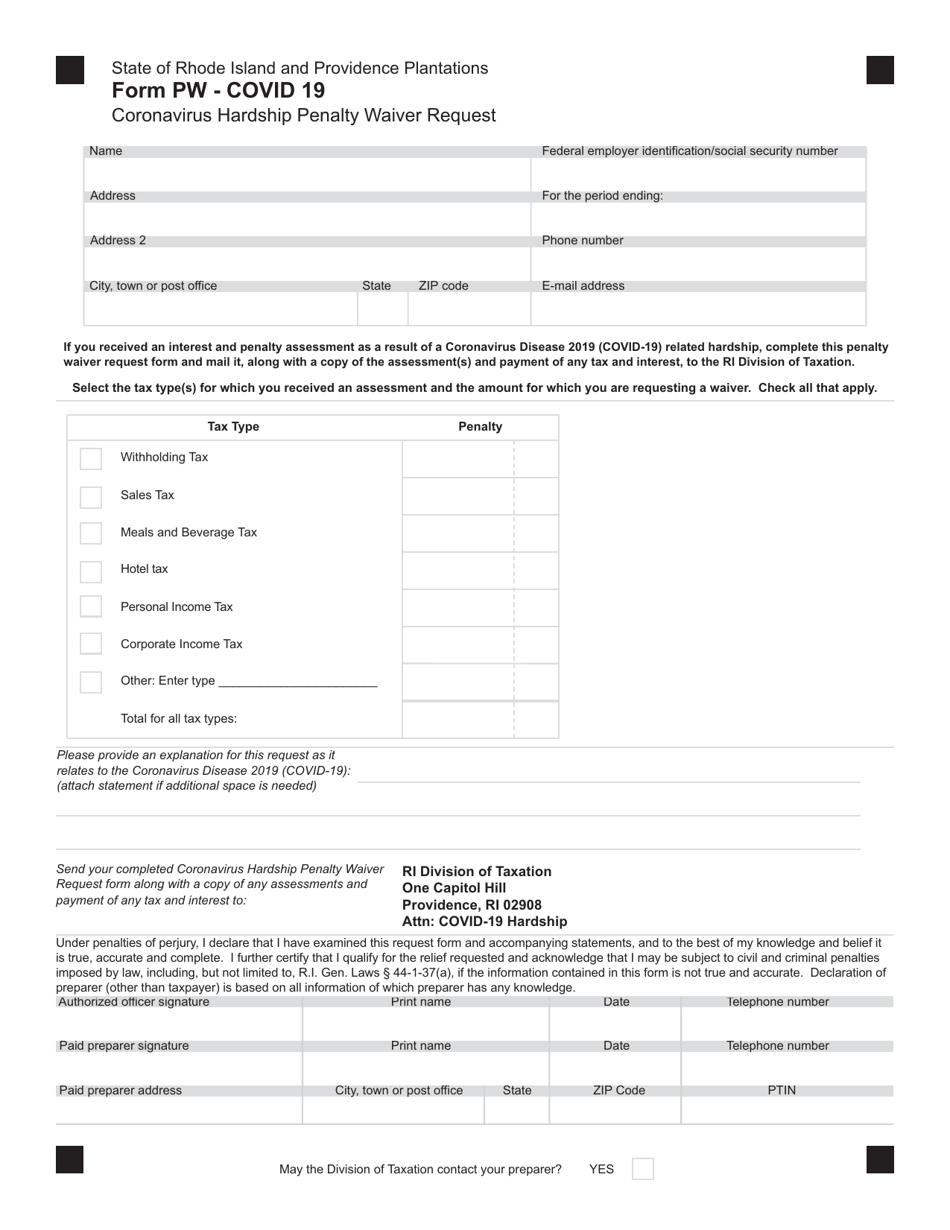

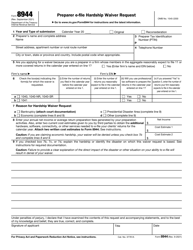

Form PW - COVID 19 Coronavirus Hardship Penalty Waiver Request - Rhode Island

What Is Form PW - COVID 19?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PW?

A: Form PW is a COVID-19 Coronavirus Hardship Penalty Waiver Request specific to Rhode Island.

Q: What is the purpose of Form PW?

A: The purpose of Form PW is to request a waiver for penalties related to COVID-19 hardships in Rhode Island.

Q: Who can use Form PW?

A: Form PW can be used by individuals or businesses in Rhode Island who have been financially impacted by COVID-19 and need to request a waiver for penalties.

Q: Do I need to provide documentation with Form PW?

A: Yes, you will need to provide supporting documentation with Form PW to demonstrate the financial impact of COVID-19.

Q: What happens after I submit Form PW?

A: After submitting Form PW, the Rhode Island government will review your request and supporting documentation to determine if a penalty waiver will be granted.

Q: Is there a deadline to submit Form PW?

A: The deadline to submit Form PW may vary, so it is important to check the instructions and guidelines provided by the Rhode Island government for specific information.

Q: Can I appeal if my request for a penalty waiver is denied?

A: Yes, if your request for a penalty waiver is denied, you may have the opportunity to appeal the decision by following the appeals process outlined by the Rhode Island government.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PW - COVID 19 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.