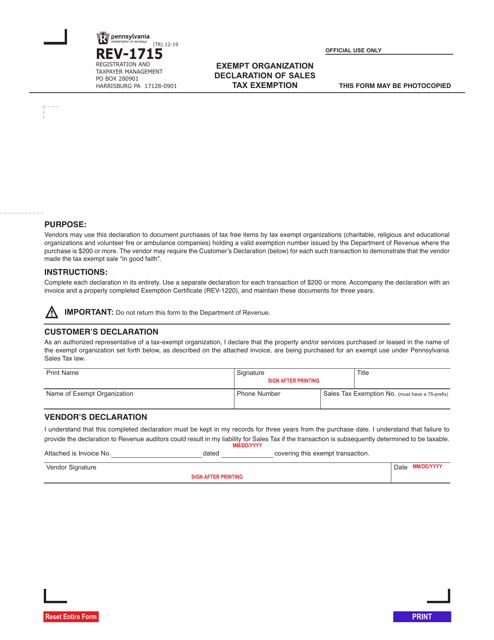

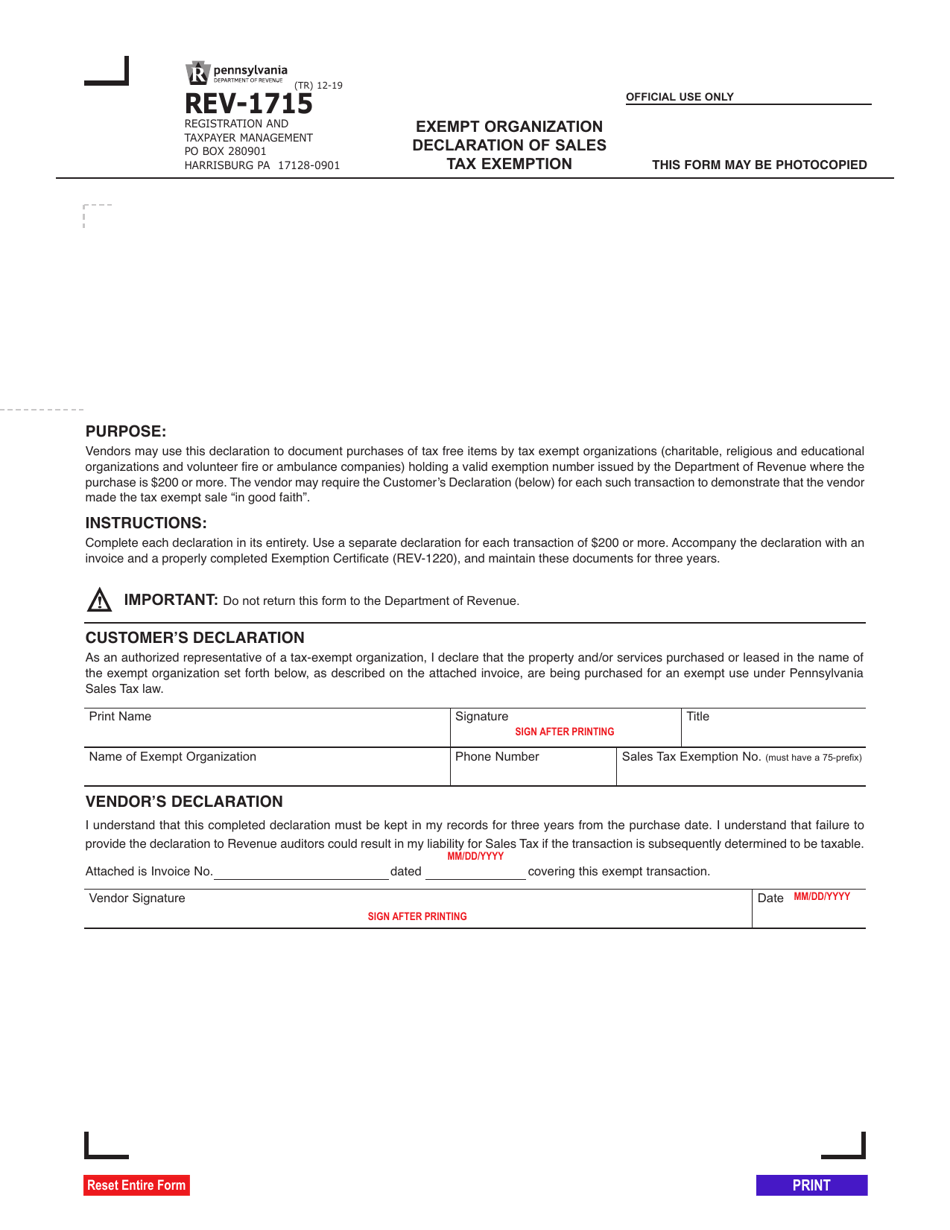

Form REV-1715 Exempt Organization Declaration of Sales Tax Exemption - Pennsylvania

What Is Form REV-1715?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form REV-1715?

A: The Form REV-1715 is the Exempt Organization Declaration of Sales Tax Exemption specific to Pennsylvania.

Q: Who needs to fill out the Form REV-1715?

A: This form needs to be filled out by organizations seeking to claim sales tax exemption in Pennsylvania.

Q: What is the purpose of the Form REV-1715?

A: The Form REV-1715 is used by organizations to declare their eligibility for sales tax exemption in Pennsylvania.

Q: Is there a fee for filing the Form REV-1715?

A: No, there is no fee for filing the Form REV-1715.

Q: Are all organizations eligible for sales tax exemption in Pennsylvania?

A: No, only certain organizations that meet specific criteria are eligible for sales tax exemption in Pennsylvania.

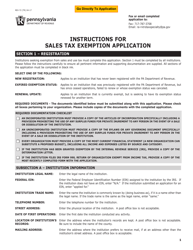

Q: What supporting documents are required to be submitted with the Form REV-1715?

A: There are no specific supporting documents required to be submitted with the Form REV-1715, but the organization may need to provide proof of eligibility if requested by the Pennsylvania Department of Revenue.

Q: How often does the Form REV-1715 need to be filed?

A: The Form REV-1715 needs to be filed only once, unless there are changes in the organization's eligibility status.

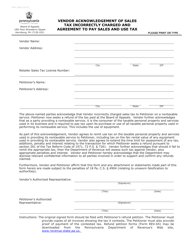

Q: What happens after submitting the Form REV-1715?

A: After submitting the Form REV-1715, the organization will receive notification from the Pennsylvania Department of Revenue regarding the approval or denial of their sales tax exemption.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1715 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.