This version of the form is not currently in use and is provided for reference only. Download this version of

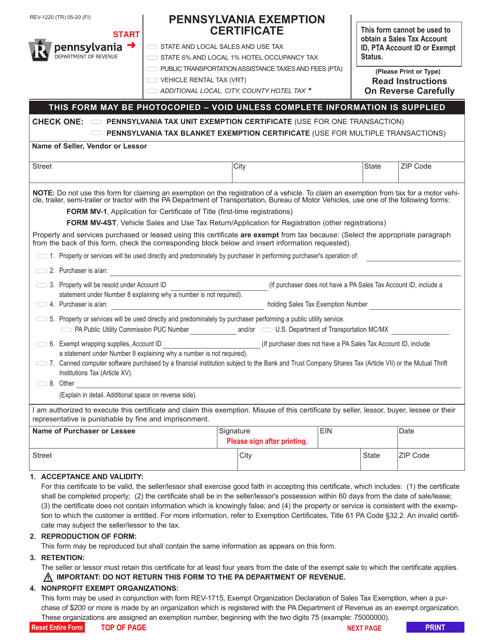

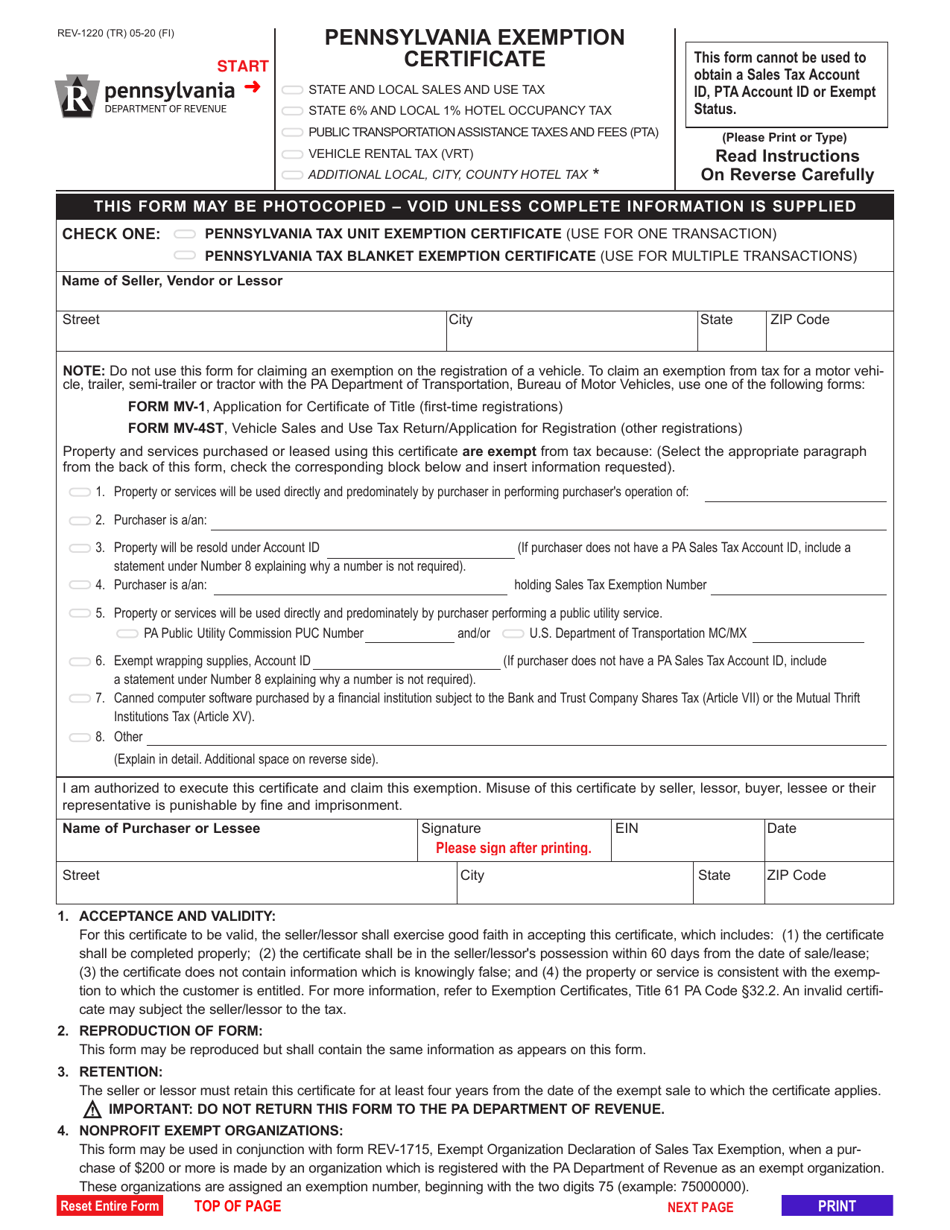

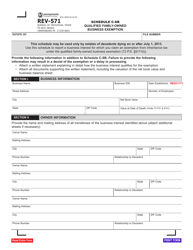

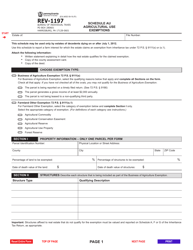

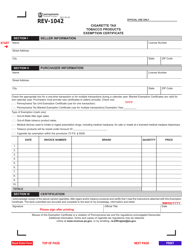

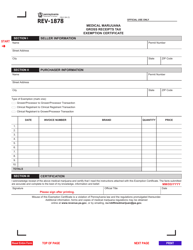

Form REV-1220

for the current year.

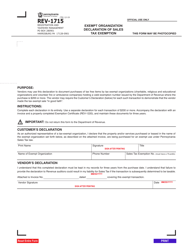

Form REV-1220 Pennsylvania Exemption Certificate - Pennsylvania

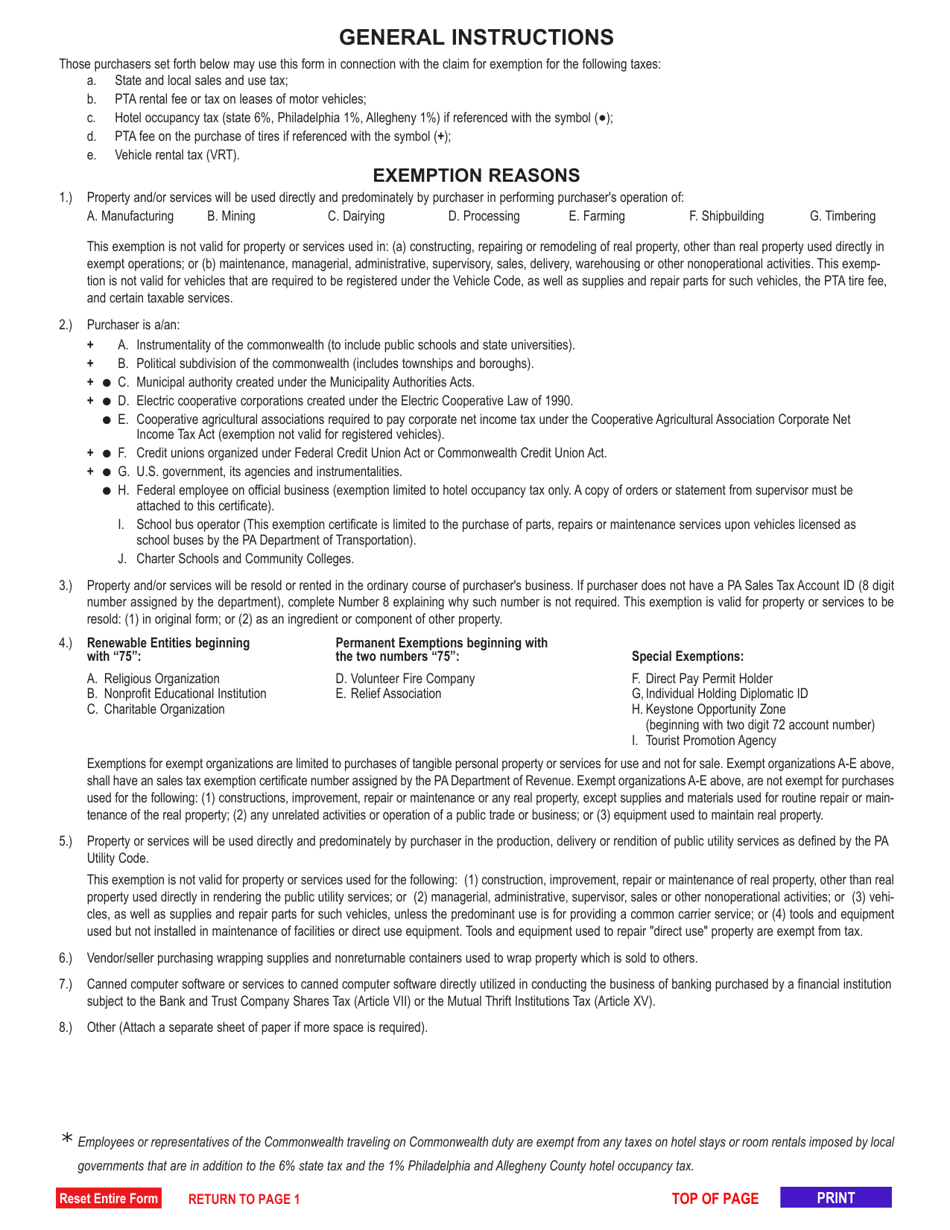

What Is Form REV-1220?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is REV-1220?

A: REV-1220 is the Pennsylvania Exemption Certificate.

Q: What is the purpose of REV-1220?

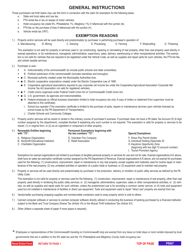

A: The purpose of REV-1220 is to claim exemption from Pennsylvania sales tax.

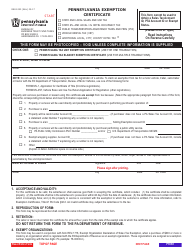

Q: Who should use REV-1220?

A: REV-1220 should be used by individuals and businesses who are eligible for sales tax exemption in Pennsylvania.

Q: What information is required on REV-1220?

A: REV-1220 requires information such as the taxpayer's name, address, tax identification number, and a description of the exempted items.

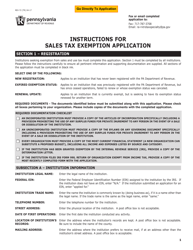

Q: How long is REV-1220 valid for?

A: REV-1220 is generally valid for five years, unless the taxpayer's exemption status changes.

Q: Is REV-1220 accepted by all Pennsylvania vendors?

A: While REV-1220 is widely accepted, some vendors may require additional documentation to verify the claimed exemption.

Q: What should I do if REV-1220 is lost or damaged?

A: If REV-1220 is lost or damaged, a replacement form can be obtained from the Pennsylvania Department of Revenue.

Q: Can I use REV-1220 for purchases outside of Pennsylvania?

A: No, REV-1220 is only valid for claiming sales tax exemption within the state of Pennsylvania.

Form Details:

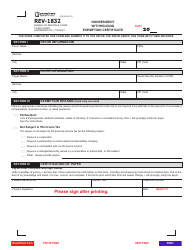

- Released on May 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1220 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.