This version of the form is not currently in use and is provided for reference only. Download this version of

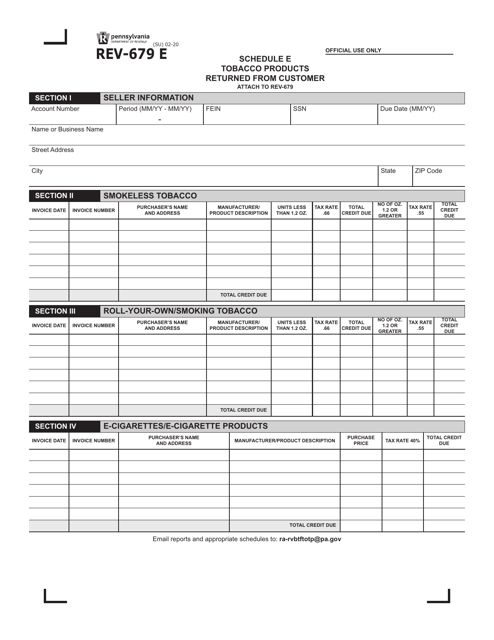

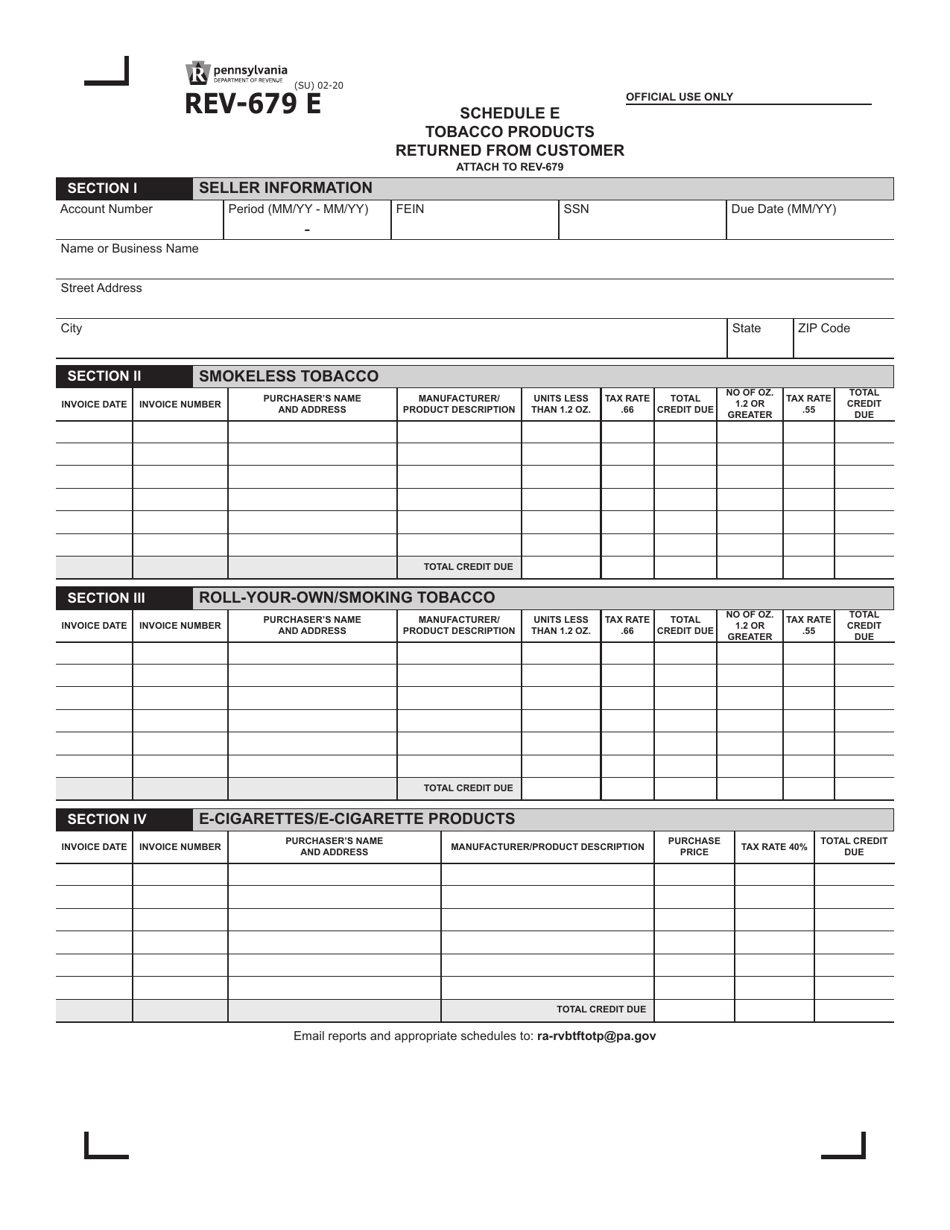

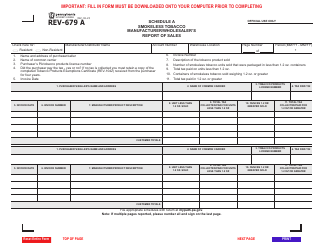

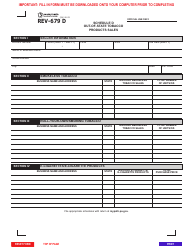

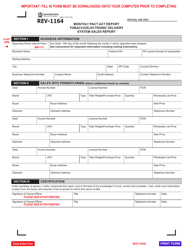

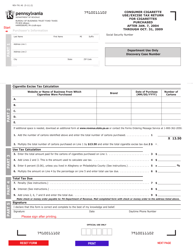

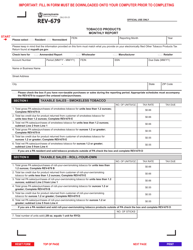

Form REV-679 E Schedule E

for the current year.

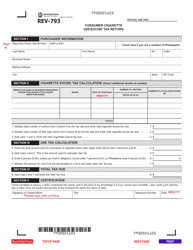

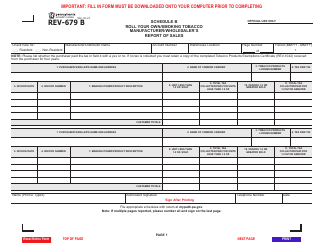

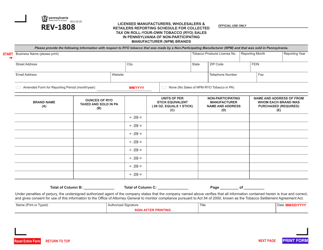

Form REV-679 E Schedule E Tobacco Products Returned From Customer - Pennsylvania

What Is Form REV-679 E Schedule E?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-679 E?

A: Form REV-679 E is a schedule that is used in Pennsylvania for reporting returned tobacco products from customers.

Q: Who is required to file Form REV-679 E?

A: Any person or business that sells tobacco products in Pennsylvania and receives returned products from customers needs to file Form REV-679 E.

Q: What is the purpose of Form REV-679 E?

A: The purpose of Form REV-679 E is to report and document the return of tobacco products from customers in Pennsylvania.

Q: Are there any specific requirements for completing Form REV-679 E?

A: Yes, there are specific requirements for completing Form REV-679 E, including providing detailed information about the returned tobacco products and the customer.

Q: Is Form REV-679 E only applicable to tobacco products?

A: Yes, Form REV-679 E is specifically designed for reporting returned tobacco products in Pennsylvania.

Q: When is the deadline for filing Form REV-679 E?

A: The deadline for filing Form REV-679 E is generally on a quarterly basis, along with the other tobacco tax returns.

Q: Are there any penalties for not filing Form REV-679 E?

A: Yes, failure to file Form REV-679 E can result in penalties and interest on the overdue amount.

Q: What should I do with the completed Form REV-679 E?

A: You should keep a copy for your records and submit the original Form REV-679 E to the Pennsylvania Department of Revenue along with any required payments.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV-679 E Schedule E by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.