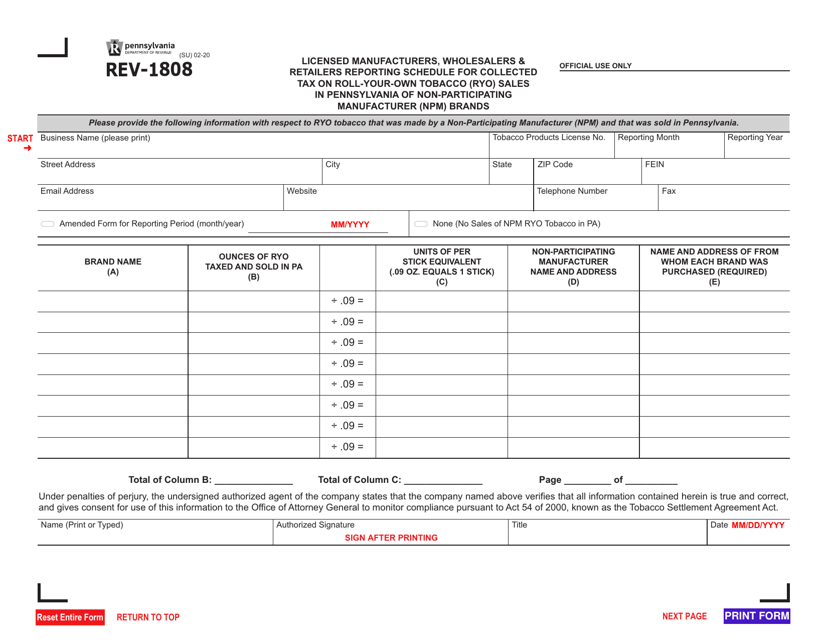

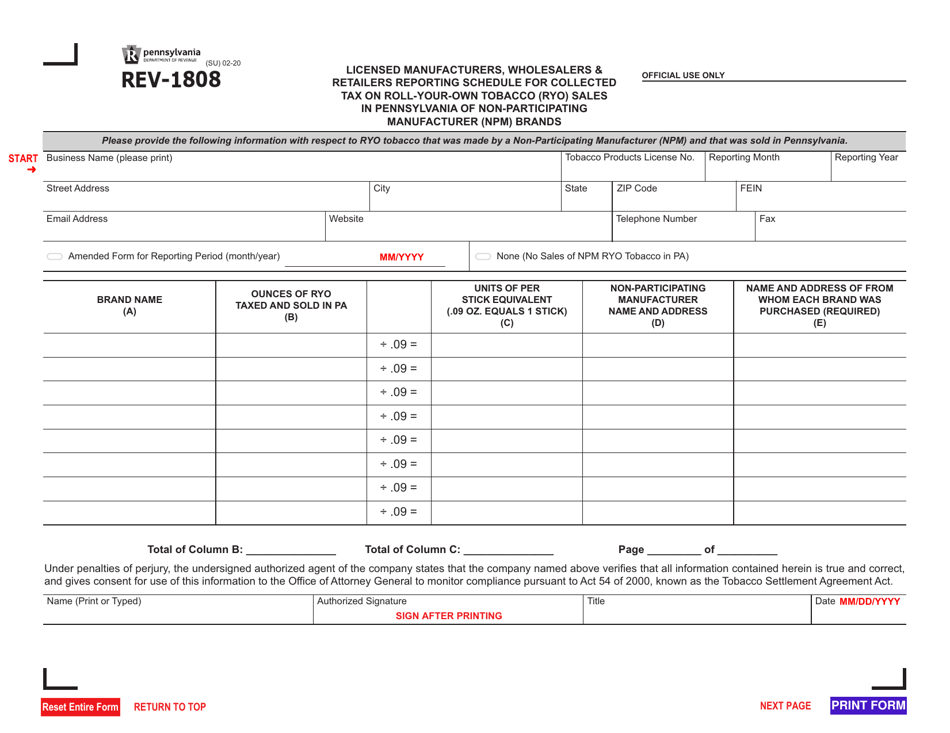

Form REV-1808 Licensed Manufacturers, Wholesalers & Retailers Reporting Schedule for Collected Tax on Roll-Your-Own Tobacco (Ryo) Sales in Pennsylvania of Non-participating Manufacturer (Npm) Brands - Pennsylvania

What Is Form REV-1808?

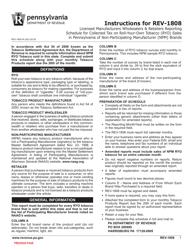

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form REV-1808?

A: Form REV-1808 is a reporting schedule for collected tax on Roll-Your-Own Tobacco (RYO) sales in Pennsylvania of Non-participating Manufacturer (NPM) brands.

Q: Who needs to file form REV-1808?

A: Licensed Manufacturers, Wholesalers & Retailers who sell Roll-Your-Own Tobacco (RYO) of Non-participating Manufacturer (NPM) brands in Pennsylvania need to file form REV-1808.

Q: What is the purpose of form REV-1808?

A: The purpose of form REV-1808 is to report the collected tax on Roll-Your-Own Tobacco (RYO) sales in Pennsylvania of Non-participating Manufacturer (NPM) brands.

Q: Is form REV-1808 specific to Pennsylvania?

A: Yes, form REV-1808 is specific to Pennsylvania and is used to report RYO tobacco sales in the state.

Q: What is a Non-participating Manufacturer (NPM) brand?

A: A Non-participating Manufacturer (NPM) brand refers to a tobacco brand that has not joined the Master Settlement Agreement (MSA) and is therefore subject to different tax requirements.

Q: When is the deadline to file form REV-1808?

A: The deadline to file form REV-1808 is determined by the Pennsylvania Department of Revenue and can vary from year to year. It is important to check the specific deadline for the current reporting period.

Q: What penalties apply for late or incorrect filing of form REV-1808?

A: Penalties for late or incorrect filing of form REV-1808 are determined by the Pennsylvania Department of Revenue and can include fines or other punitive measures. It is important to ensure timely and accurate filing.

Q: Are there any exemptions to filing form REV-1808?

A: It is important to consult the official guidelines and regulations of the Pennsylvania Department of Revenue to determine if any exemptions apply to your specific situation.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1808 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.