This version of the form is not currently in use and is provided for reference only. Download this version of

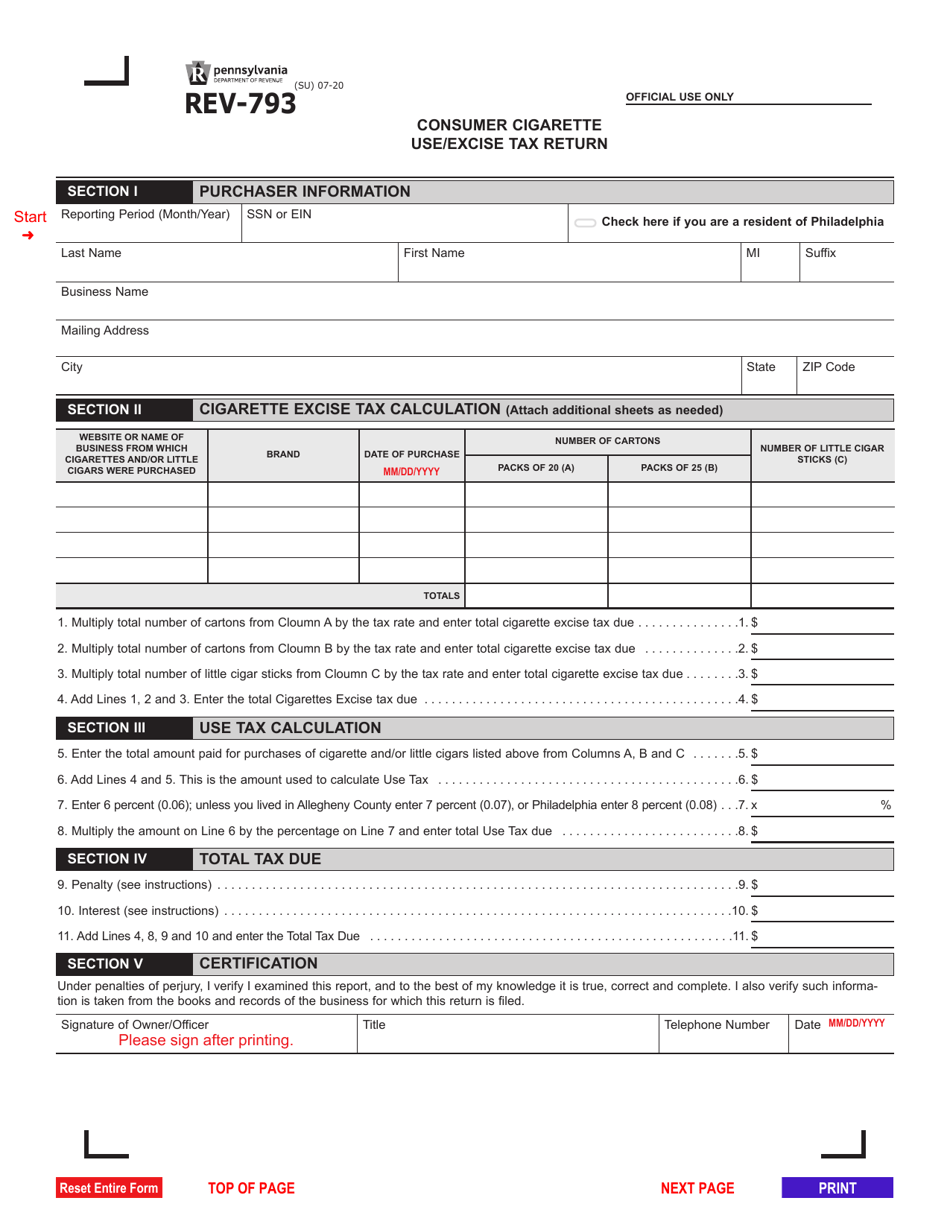

Form REV-793

for the current year.

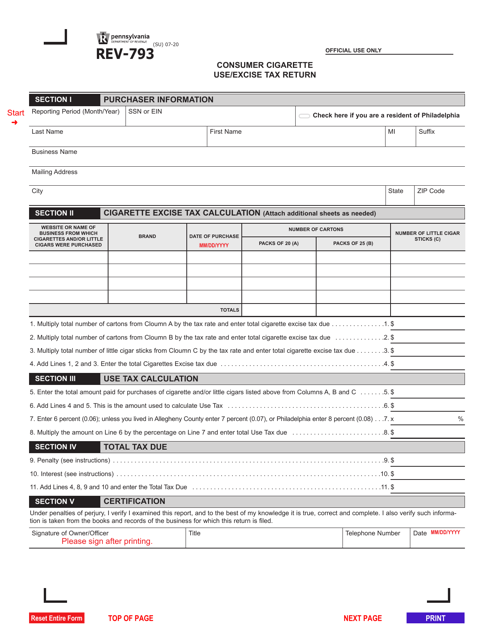

Form REV-793 Consumer Cigarette Use / Excise Tax Return - Pennsylvania

What Is Form REV-793?

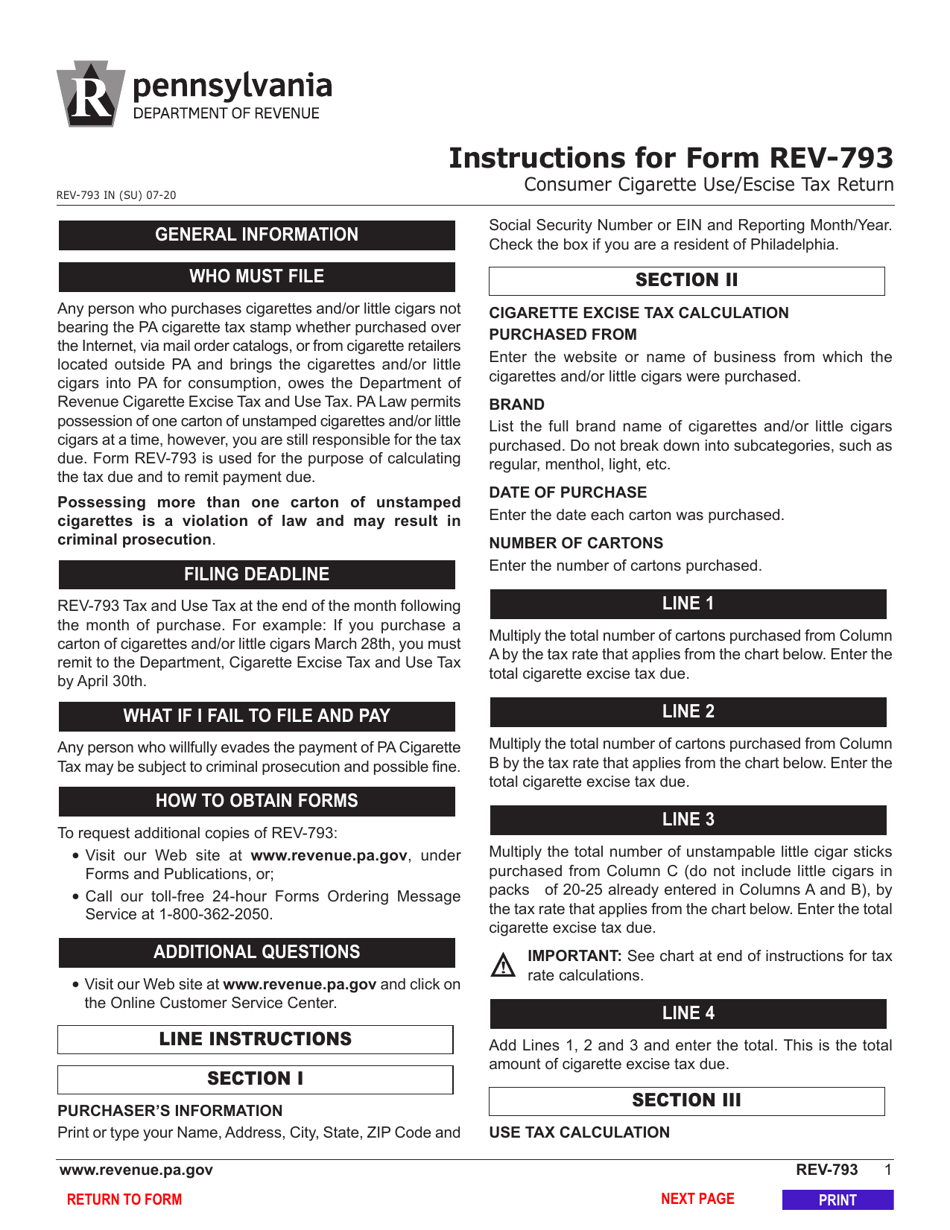

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-793?

A: Form REV-793 is the Consumer Cigarette Use/Excise Tax Return specifically for the state of Pennsylvania.

Q: Who needs to file Form REV-793?

A: Any consumer or distributor of cigarettes in Pennsylvania needs to file Form REV-793.

Q: What is the purpose of Form REV-793?

A: Form REV-793 is used to report and calculate the consumer cigarette use tax and excise tax owed in Pennsylvania.

Q: When is Form REV-793 due?

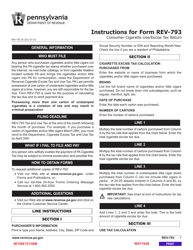

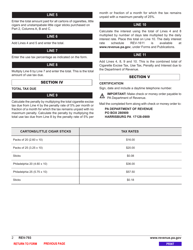

A: Form REV-793 is due on a monthly basis and must be filed by the 20th of the following month.

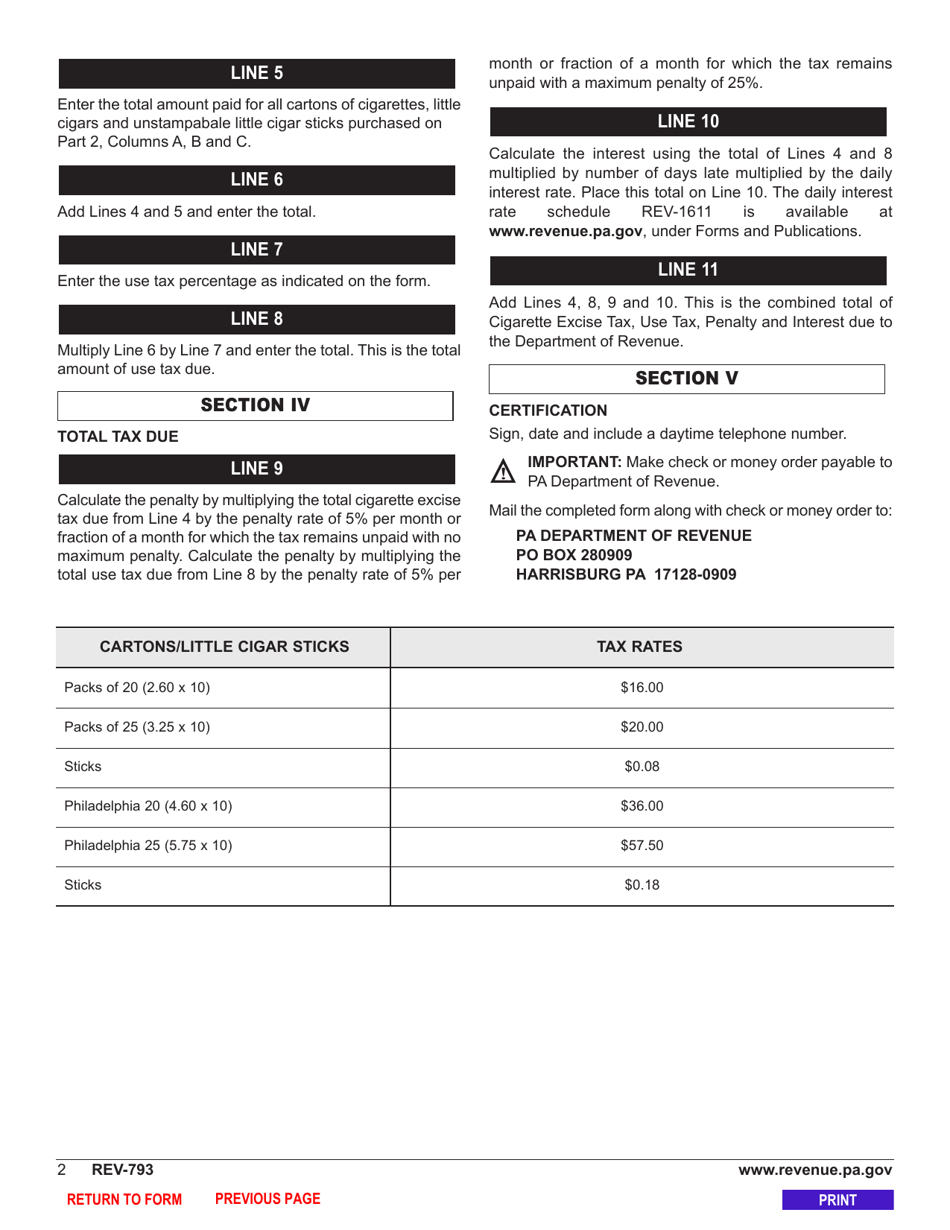

Q: How do I fill out Form REV-793?

A: Form REV-793 requires you to provide information about the number of cigarettes purchased or received, as well as the total tax due.

Q: Are there any penalties for late or incorrect filing of Form REV-793?

A: Yes, failure to file or filing late can result in penalties and interest charges.

Q: Can I file Form REV-793 electronically?

A: Yes, the Pennsylvania Department of Revenue offers an electronic filing option for Form REV-793.

Q: Is Form REV-793 specific to Pennsylvania only?

A: Yes, Form REV-793 is specific to the state of Pennsylvania and its cigarette tax requirements.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-793 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.