This version of the form is not currently in use and is provided for reference only. Download this version of

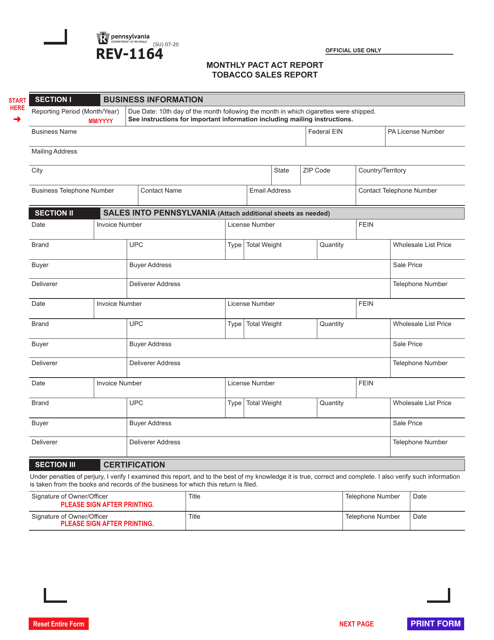

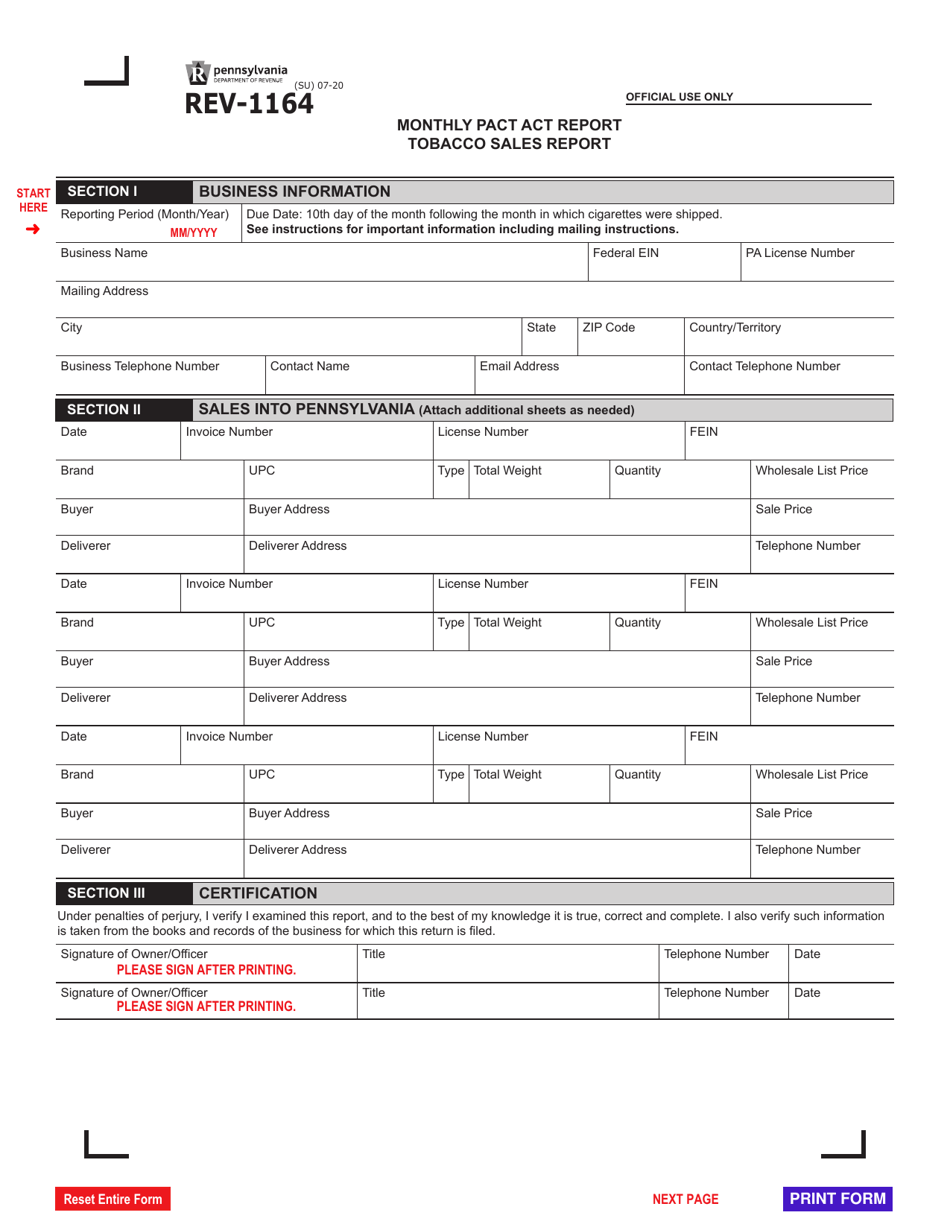

Form REV-1164

for the current year.

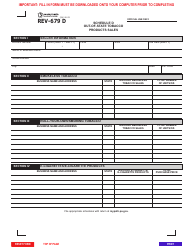

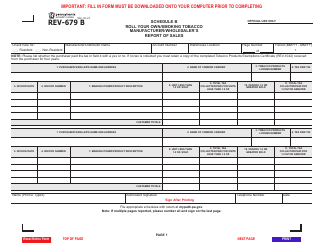

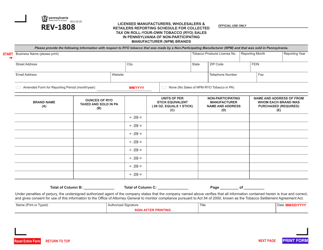

Form REV-1164 Monthly Pact Act Report - Tobacco Sales Report - Pennsylvania

What Is Form REV-1164?

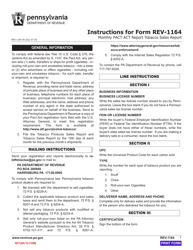

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the REV-1164 form?

A: The REV-1164 form is the Monthly Pact Act Report - Tobacco Sales Report in Pennsylvania.

Q: What is the purpose of the REV-1164 form?

A: The purpose of the REV-1164 form is to report monthly tobacco sales in accordance with the Pact Act in Pennsylvania.

Q: Who needs to fill out the REV-1164 form?

A: Businesses and individuals engaged in tobacco sales in Pennsylvania need to fill out the REV-1164 form.

Q: When is the REV-1164 form due?

A: The REV-1164 form is due on a monthly basis. The specific due date can be found on the form itself or by checking with the Pennsylvania Department of Revenue.

Q: Are there any penalties for not submitting the REV-1164 form?

A: Yes, there can be penalties for not submitting the REV-1164 form or for submitting it late. It is important to comply with the reporting requirements to avoid potential penalties.

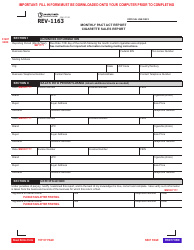

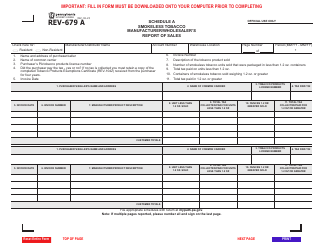

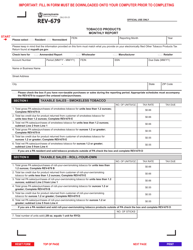

Q: What information is required on the REV-1164 form?

A: The REV-1164 form requires information such as the total amount of tobacco sales, the names and addresses of purchasers, and other details related to tobacco sales.

Q: Can the REV-1164 form be filed electronically?

A: Yes, the REV-1164 form can be filed electronically through the Pennsylvania Department of Revenue's e-Services platform.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1164 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.