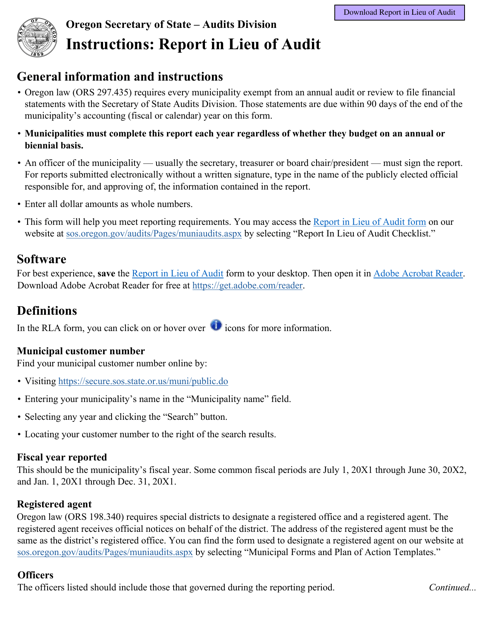

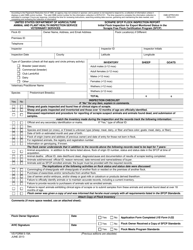

Instructions for Report in Lieu of Audit - Oregon

This document was released by Oregon Secretary of State and contains official instructions for Report in Lieu of Audit . The up-to-date fillable form is available for download through this link.

FAQ

Q: What is a Report in Lieu of Audit?

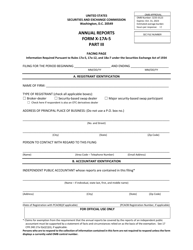

A: A Report in Lieu of Audit is a financial statement prepared by an independent accountant that replaces a full audit.

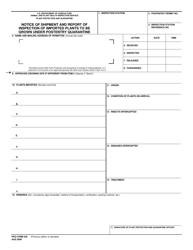

Q: When is a Report in Lieu of Audit required in Oregon?

A: A Report in Lieu of Audit is required for certain organizations in Oregon that receive public funds and have annual revenues below a certain threshold.

Q: Who can prepare a Report in Lieu of Audit?

A: A Report in Lieu of Audit must be prepared by an independent accountant who meets certain qualifications.

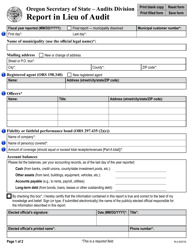

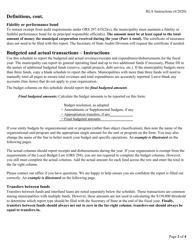

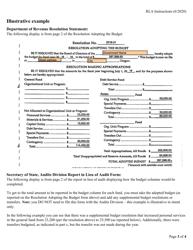

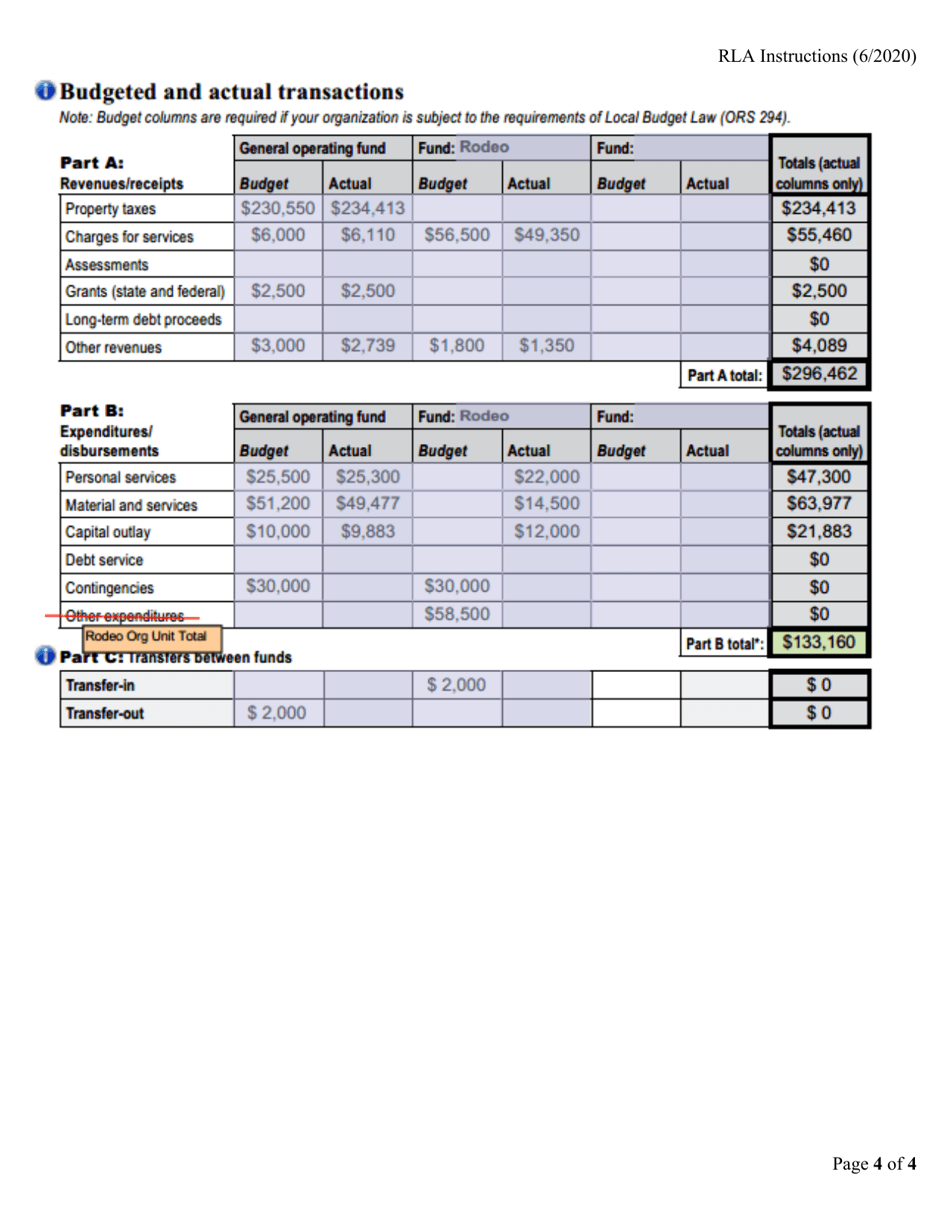

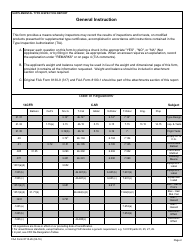

Q: What information is included in a Report in Lieu of Audit?

A: A Report in Lieu of Audit includes financial statements, notes to the financial statements, and a summary of accounting policies and procedures.

Q: Can a Report in Lieu of Audit be used for tax purposes?

A: A Report in Lieu of Audit is generally not acceptable for tax purposes. Separate tax returns may need to be filed.

Q: Are there penalties for not submitting a Report in Lieu of Audit when required?

A: Yes, there are penalties for failing to submit a Report in Lieu of Audit when required.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Oregon Secretary of State.