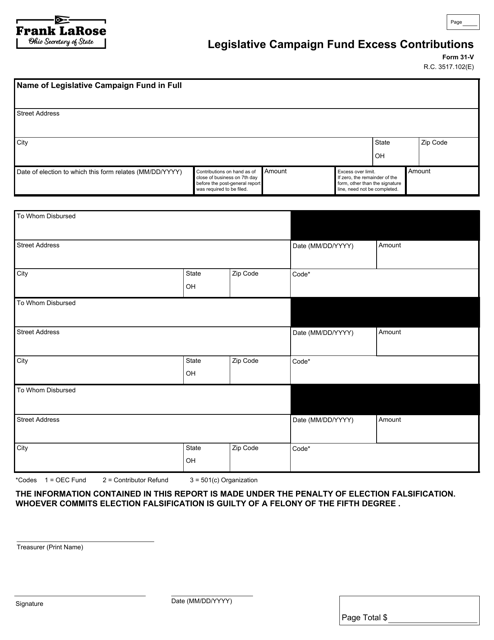

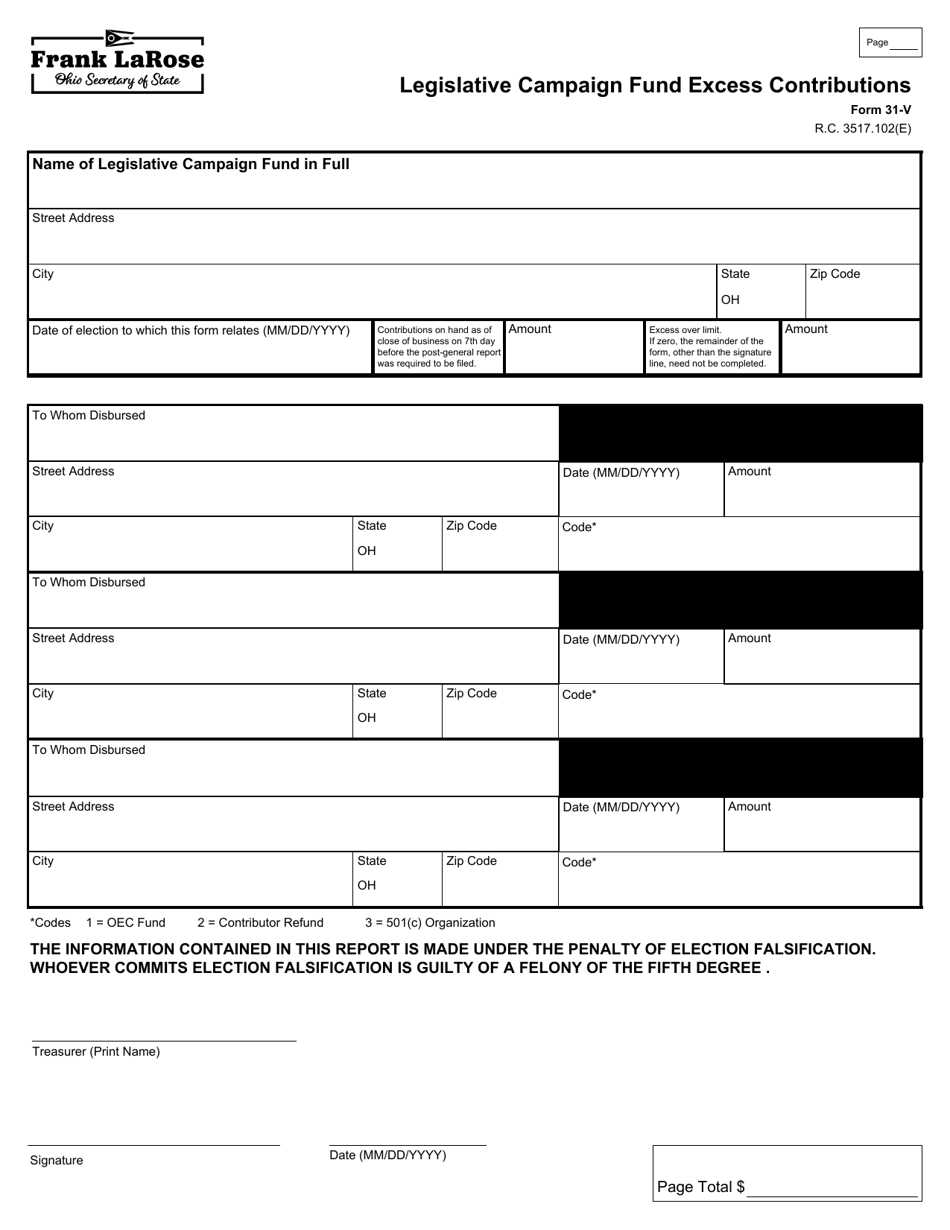

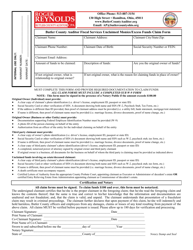

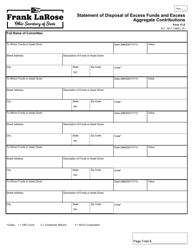

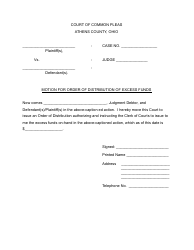

Form 31-V Legislative Campaign Fund Excess Contributions - Ohio

What Is Form 31-V?

This is a legal form that was released by the Ohio Secretary of State - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 31-V?

A: Form 31-V is a tax form used in Ohio to report excess contributions to a Legislative Campaign Fund.

Q: What is a Legislative Campaign Fund?

A: A Legislative Campaign Fund is a political fund used to support candidates running for the Ohio General Assembly.

Q: What are excess contributions?

A: Excess contributions are campaign donations that exceed the legal limits set by Ohio state law.

Q: Who needs to file Form 31-V?

A: Individuals or organizations who have made excess contributions to a Legislative Campaign Fund in Ohio need to file Form 31-V.

Q: What is the purpose of filing Form 31-V?

A: The purpose of filing Form 31-V is to report and disclose excess contributions made to a Legislative Campaign Fund in Ohio.

Q: When is the deadline for filing Form 31-V?

A: The deadline for filing Form 31-V is determined by the Ohio Elections Commission and may vary depending on the election cycle.

Q: Are there penalties for not filing Form 31-V?

A: Yes, failure to file Form 31-V or reporting false information can result in penalties and fines as determined by Ohio state law.

Form Details:

- The latest edition provided by the Ohio Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 31-V by clicking the link below or browse more documents and templates provided by the Ohio Secretary of State.