This version of the form is not currently in use and is provided for reference only. Download this version of

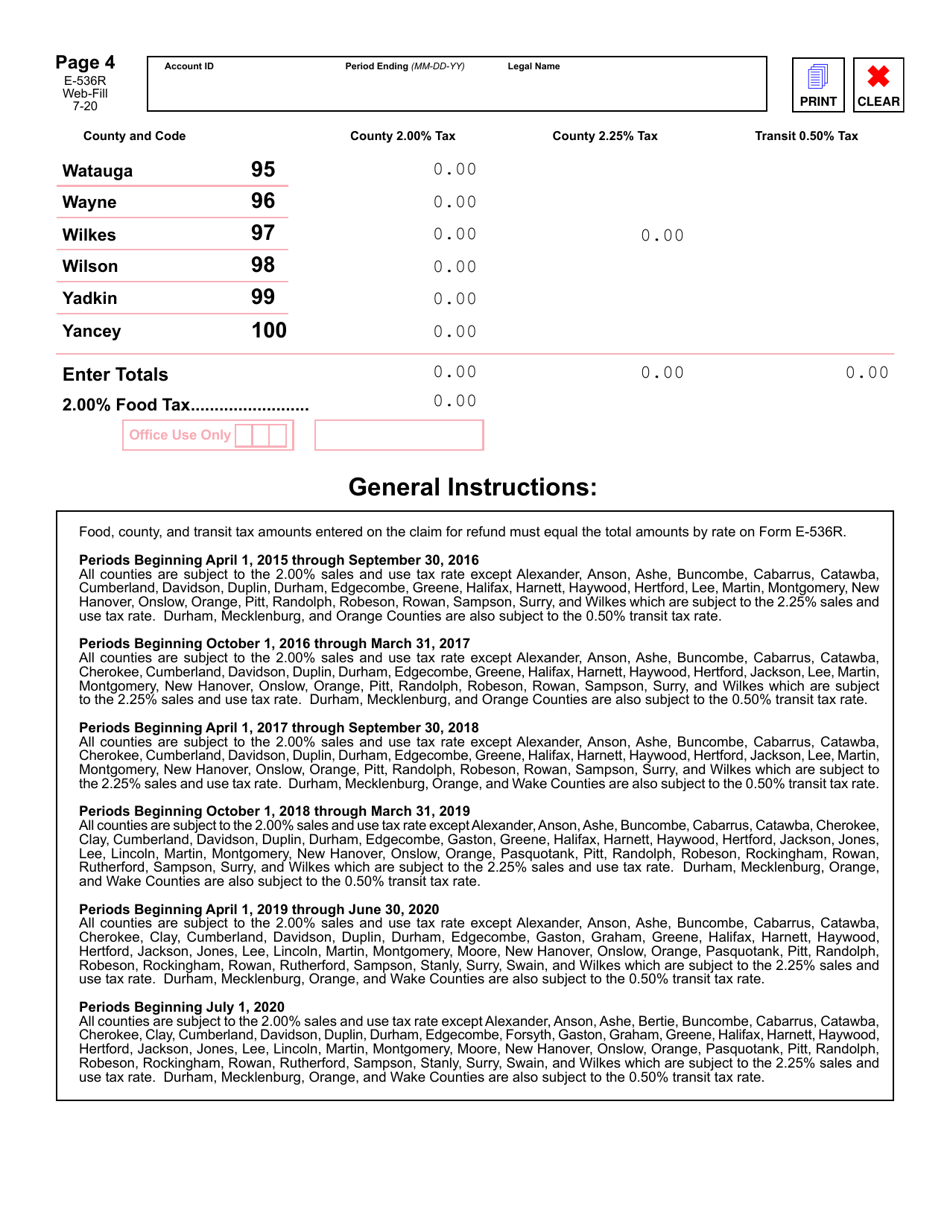

Form E-536R

for the current year.

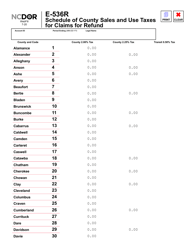

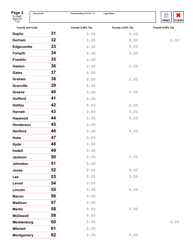

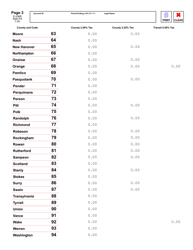

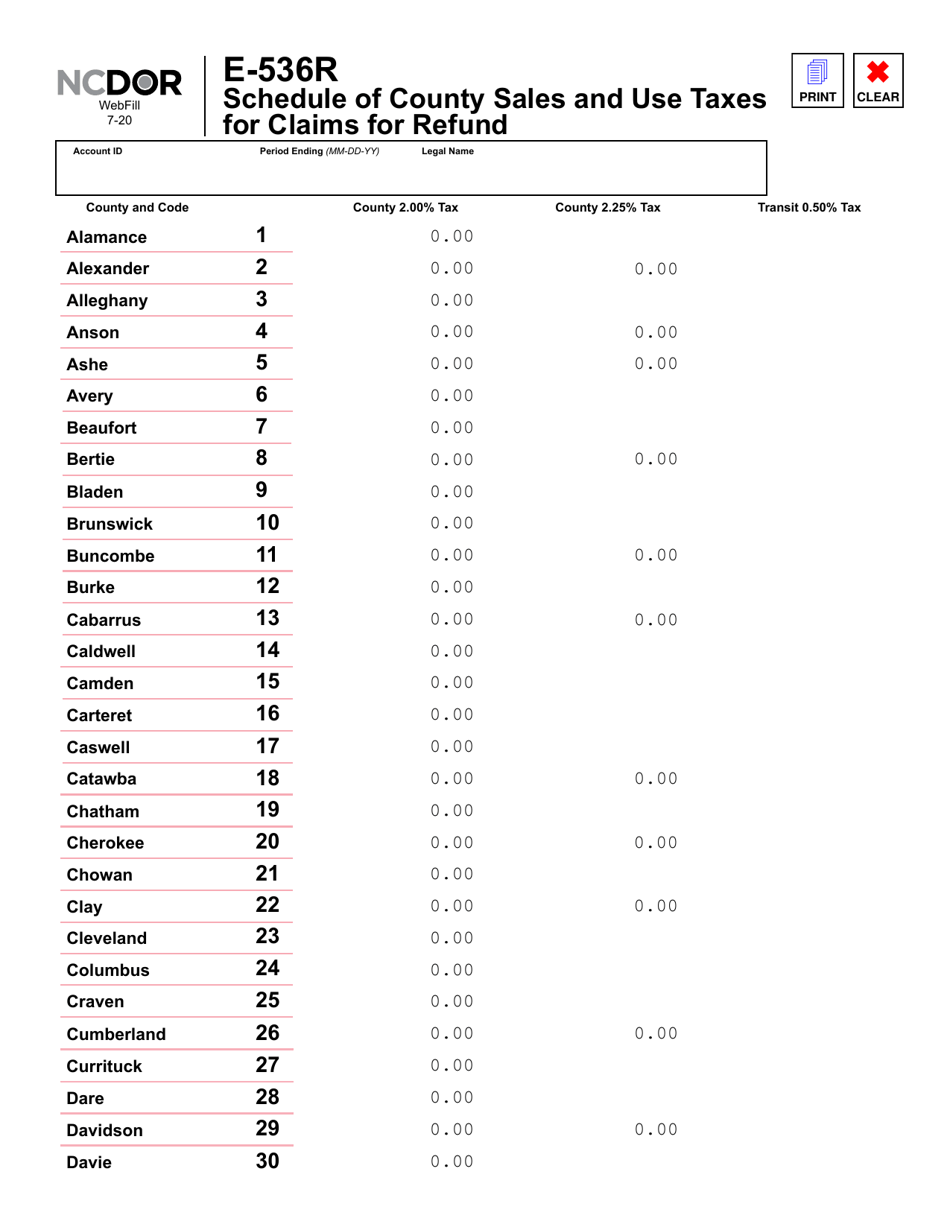

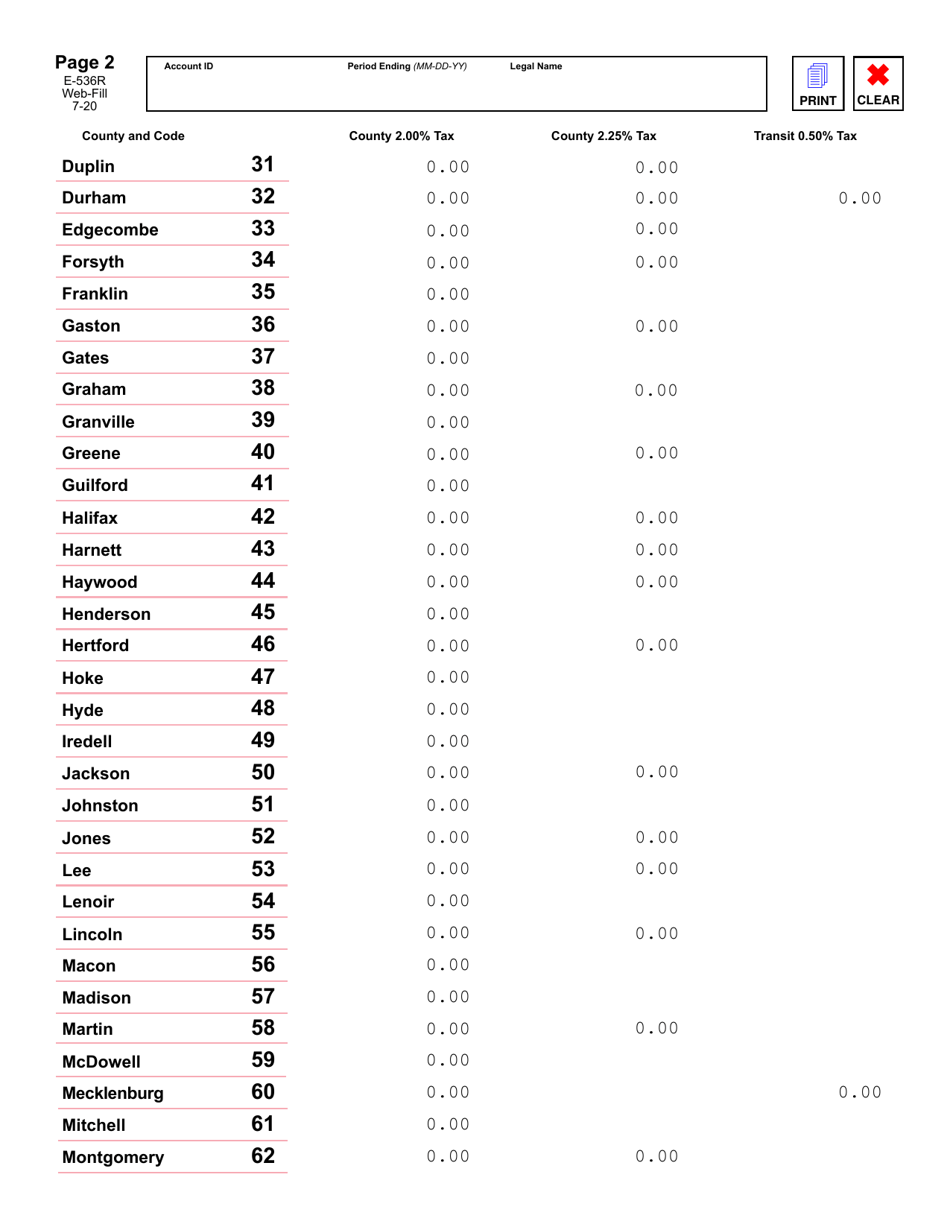

Form E-536R Schedule of County Sales and Use Taxes for Claims for Refund - North Carolina

What Is Form E-536R?

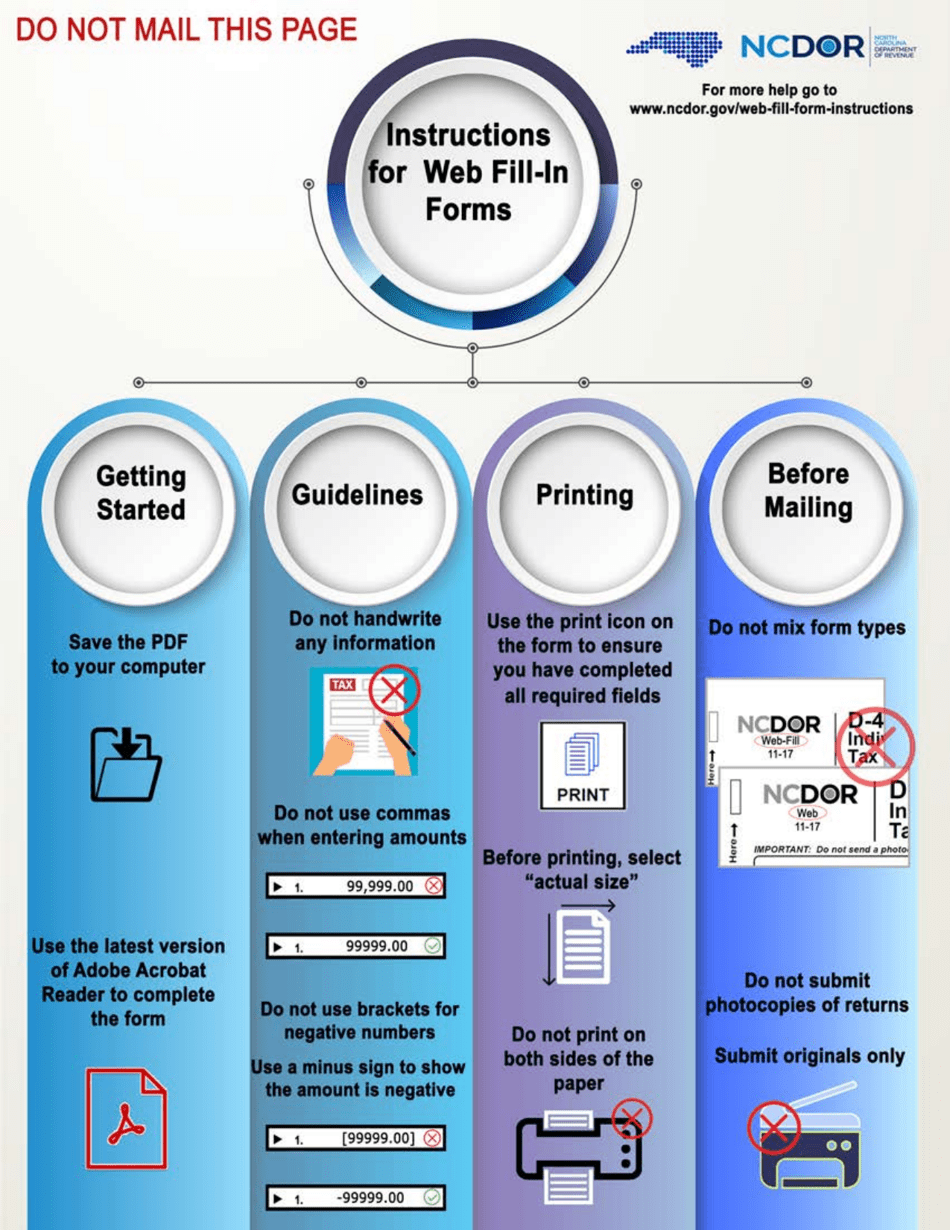

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-536R?

A: Form E-536R is the Schedule of County Sales and Use Taxes for Claims for Refund in North Carolina.

Q: What is the purpose of Form E-536R?

A: The purpose of Form E-536R is to report county sales and use taxes for claims for refund.

Q: Who needs to fill out Form E-536R?

A: Anyone who is claiming a refund for county sales and use taxes in North Carolina.

Q: Do I need to attach Form E-536R to my other tax forms?

A: Yes, if you are claiming a refund for county sales and use taxes, you need to attach Form E-536R to your other tax forms.

Q: Are there any specific deadlines for filing Form E-536R?

A: Yes, Form E-536R must be filed within three years from the date the tax was paid or the date the return was filed, whichever is later.

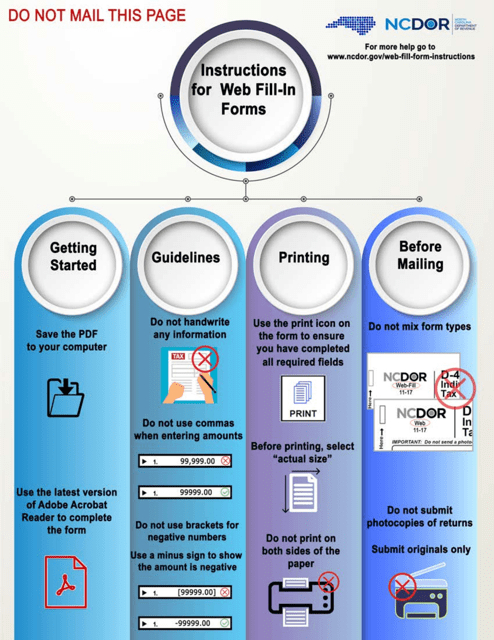

Q: Can I file Form E-536R electronically?

A: No, Form E-536R cannot be filed electronically. It must be filed by mail.

Q: Is there a fee for filing Form E-536R?

A: No, there is no fee for filing Form E-536R.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form E-536R by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.