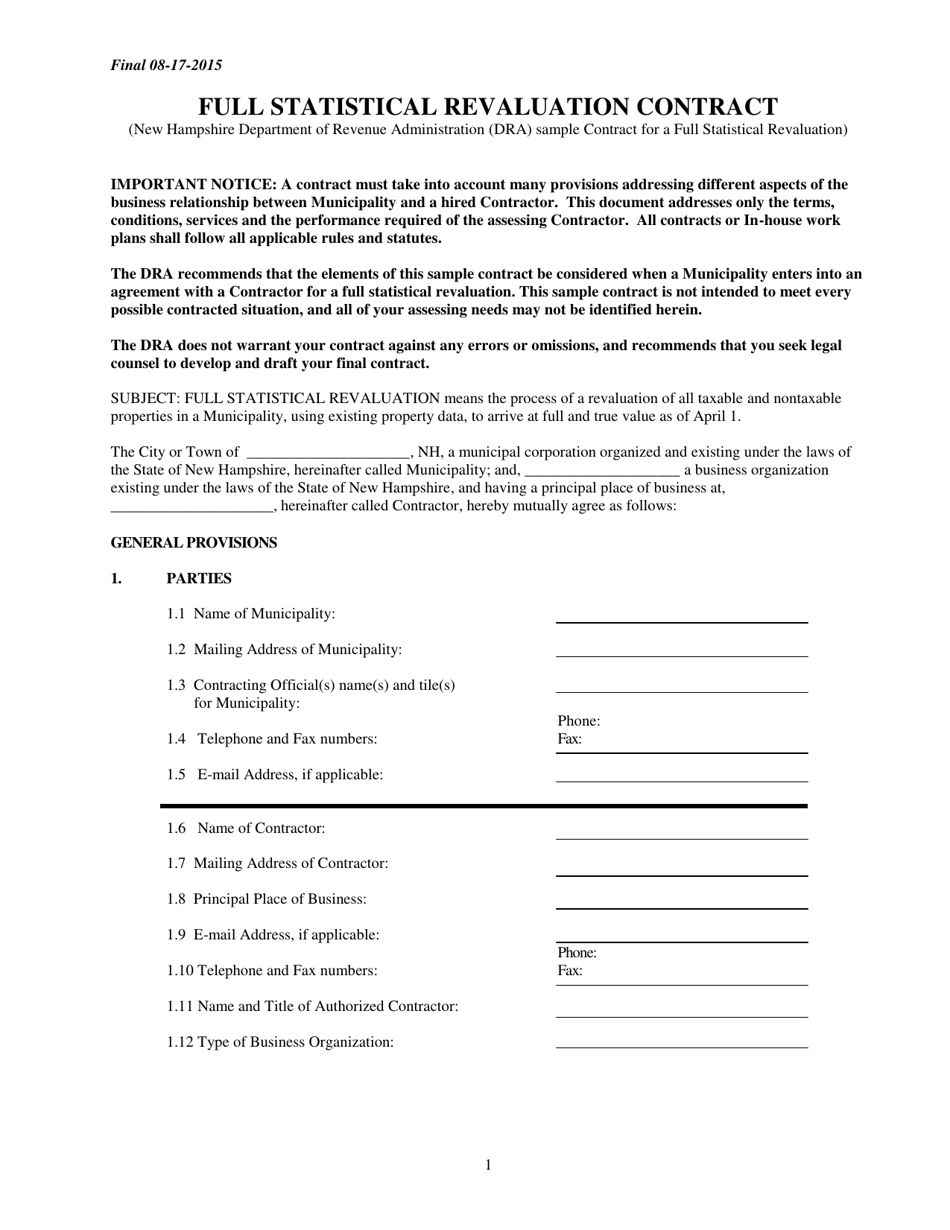

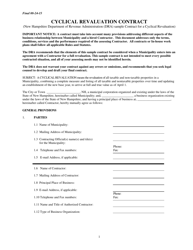

Full Statistical Revaluation Contract - New Hampshire

Full Statistical Revaluation Contract is a legal document that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire.

FAQ

Q: What is a Full Statistical Revaluation Contract?

A: A Full Statistical Revaluation Contract is an agreement between a municipality and a third-party appraisal company to conduct a comprehensive assessment of all properties within the municipality.

Q: Why would a municipality enter into a Full Statistical Revaluation Contract?

A: A municipality may enter into a Full Statistical Revaluation Contract to ensure that property assessments are accurate and up-to-date, as well as to comply with state laws regarding property valuation.

Q: What is the purpose of a Full Statistical Revaluation?

A: The purpose of a Full Statistical Revaluation is to determine the fair market value of all properties within a municipality, which is used to calculate property taxes.

Q: How often does a Full Statistical Revaluation occur?

A: The frequency of Full Statistical Revaluations varies by municipality, but they typically occur every several years to ensure that property assessments reflect current market conditions.

Q: Who conducts the Full Statistical Revaluation?

A: A third-party appraisal company with expertise in property valuation is typically hired by the municipality to conduct the Full Statistical Revaluation.

Q: How long does a Full Statistical Revaluation process take?

A: The duration of a Full Statistical Revaluation process depends on the size and complexity of the municipality's property inventory, but it typically takes several months to complete.

Form Details:

- Released on August 17, 2015;

- The latest edition currently provided by the New Hampshire Department of Revenue Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.