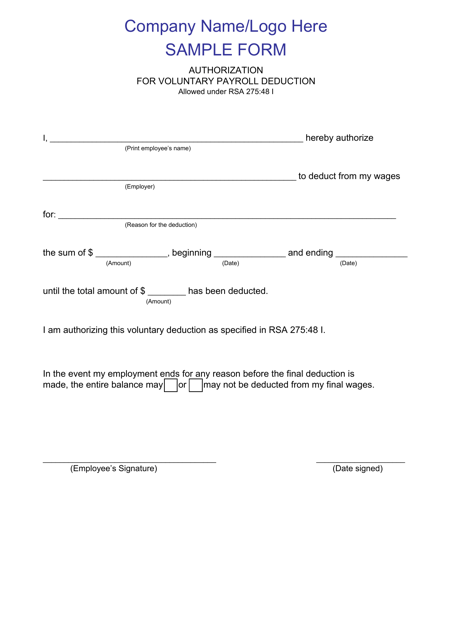

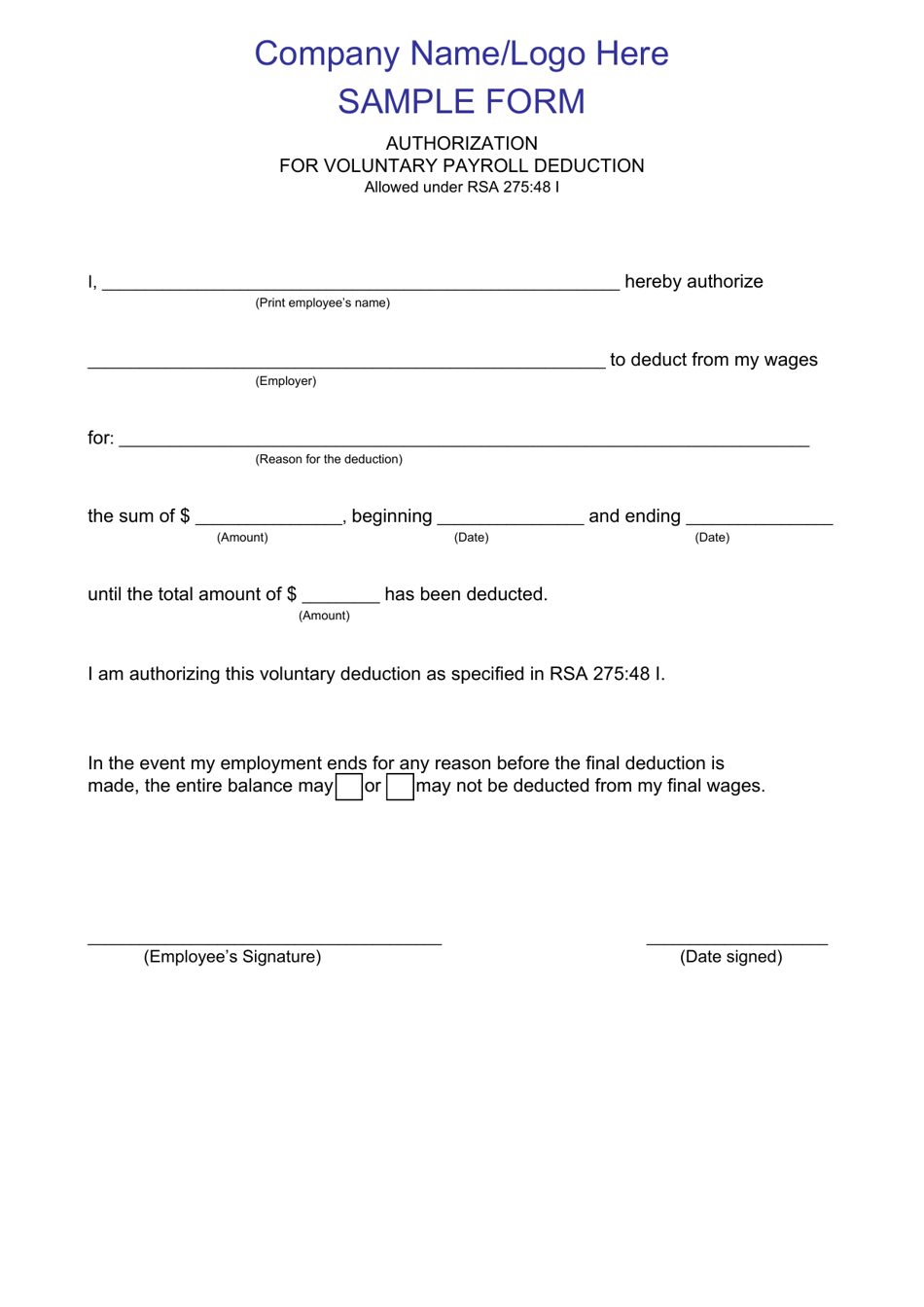

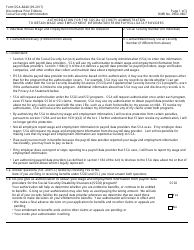

Authorization for Voluntary Payroll Deduction - New Hampshire

Authorization for Voluntary Payroll Deduction is a legal document that was released by the New Hampshire Department of Labor - a government authority operating within New Hampshire.

FAQ

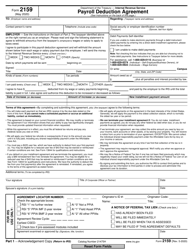

Q: What is an authorization for voluntary payroll deduction?

A: An authorization for voluntary payroll deduction is a form that allows an employee to request deductions from their paycheck for a specific purpose.

Q: Why would someone use an authorization for voluntary payroll deduction?

A: Someone might use an authorization for voluntary payroll deduction to contribute to a retirement plan, make charitable donations, or repay a loan.

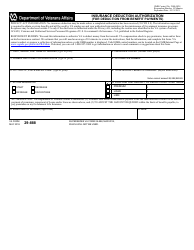

Q: Is an authorization for voluntary payroll deduction required by law in New Hampshire?

A: No, it is not required by law, but it is a common practice and provides a convenient way for employees to manage their finances.

Q: Can an employee choose how much to deduct from their paycheck with an authorization for voluntary payroll deduction?

A: Yes, an employee typically has the option to choose the amount they want to deduct from their paycheck with an authorization for voluntary payroll deduction.

Q: Can an employee cancel or change an authorization for voluntary payroll deduction?

A: Yes, an employee usually has the right to cancel or change an authorization for voluntary payroll deduction at any time.

Form Details:

- The latest edition currently provided by the New Hampshire Department of Labor;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Labor.