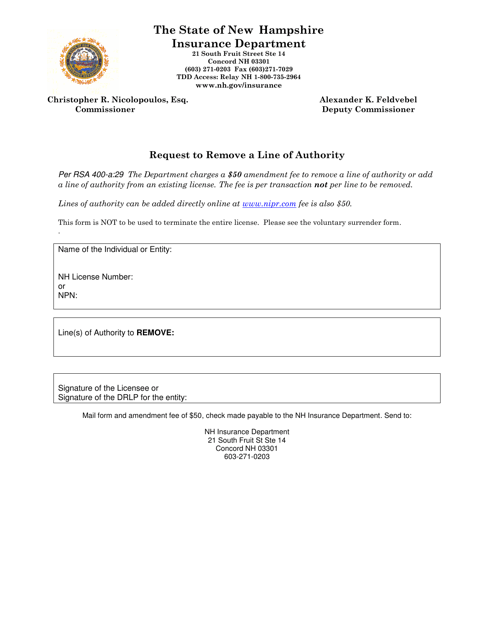

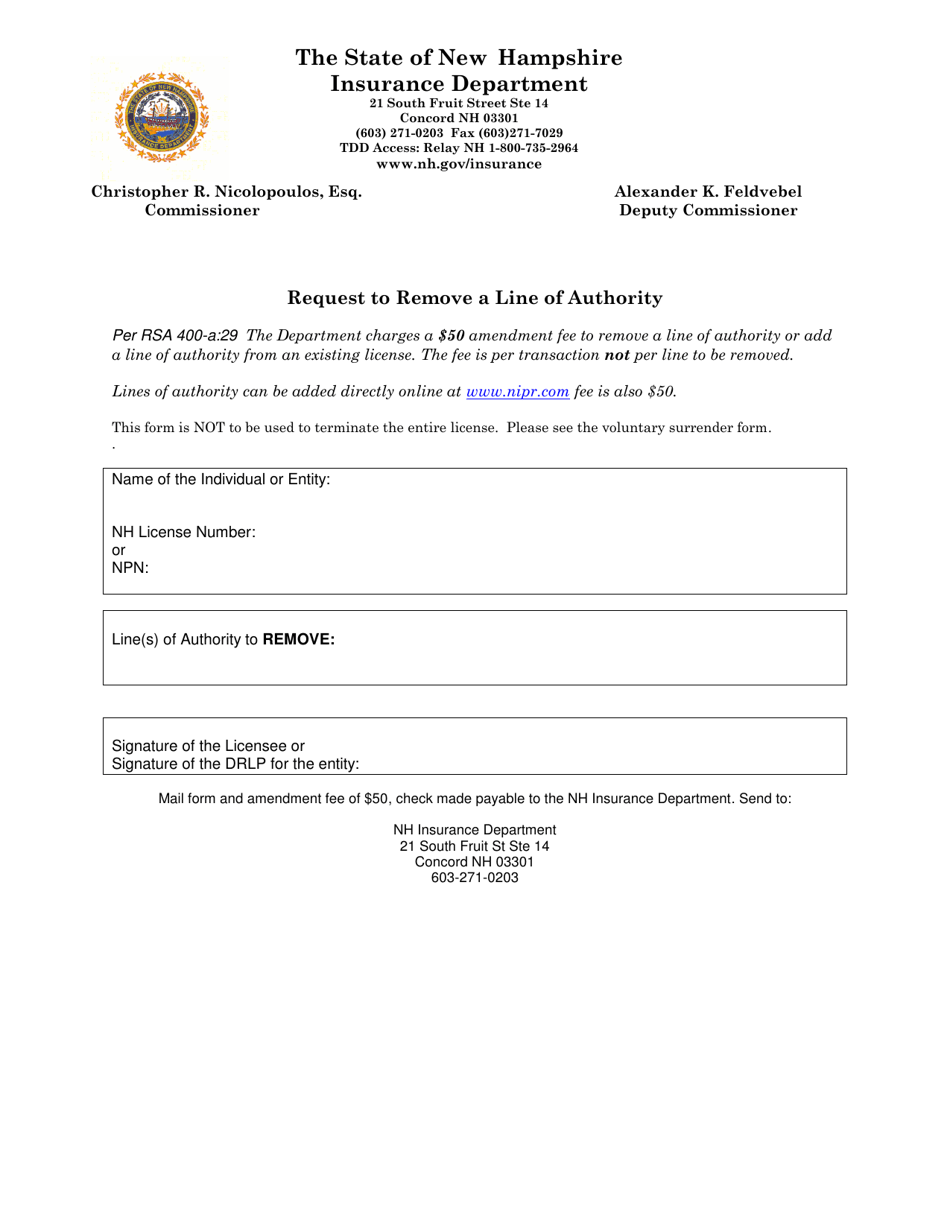

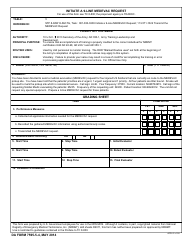

Request to Remove a Line of Authority - New Hampshire

Request to Remove a Line of Authority is a legal document that was released by the New Hampshire Insurance Department - a government authority operating within New Hampshire.

FAQ

Q: What is a Line of Authority in the insurance industry?

A: A Line of Authority refers to a specific type of insurance coverage that an insurance agent or company is licensed to sell.

Q: Why would someone want to remove a Line of Authority?

A: There are a few reasons why someone may want to remove a Line of Authority, such as no longer offering a specific type of insurance or a change in business focus.

Q: How can I remove a Line of Authority in New Hampshire?

A: To remove a Line of Authority in New Hampshire, you must submit a request to the New Hampshire Insurance Department. The request should include the reason for removing the Line of Authority and any necessary supporting documentation.

Q: Is there a fee to remove a Line of Authority in New Hampshire?

A: Yes, there is a fee associated with removing a Line of Authority in New Hampshire. The fee amount may vary depending on the specific circumstances and should be confirmed with the New Hampshire Insurance Department.

Q: How long does it take to remove a Line of Authority in New Hampshire?

A: The processing time for removing a Line of Authority in New Hampshire can vary. It is best to contact the New Hampshire Insurance Department for an estimate of the processing time.

Q: Can I reapply for a Line of Authority after it has been removed?

A: Yes, if you decide to offer the specific type of insurance again in the future, you can reapply for a Line of Authority by following the application process outlined by the New Hampshire Insurance Department.

Form Details:

- The latest edition currently provided by the New Hampshire Insurance Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New Hampshire Insurance Department.