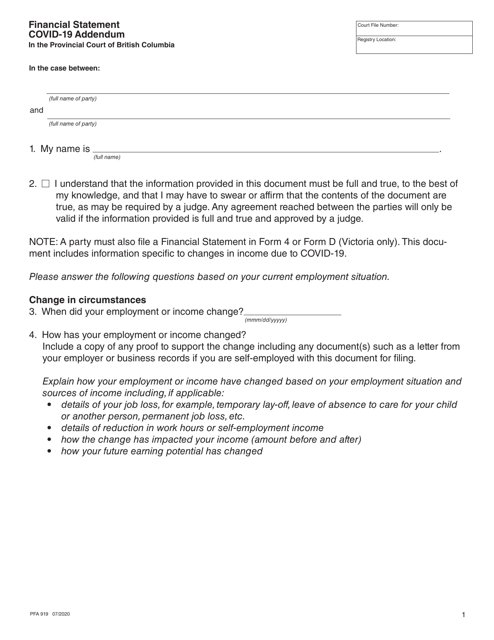

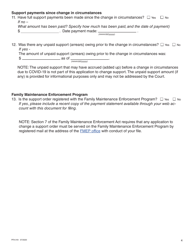

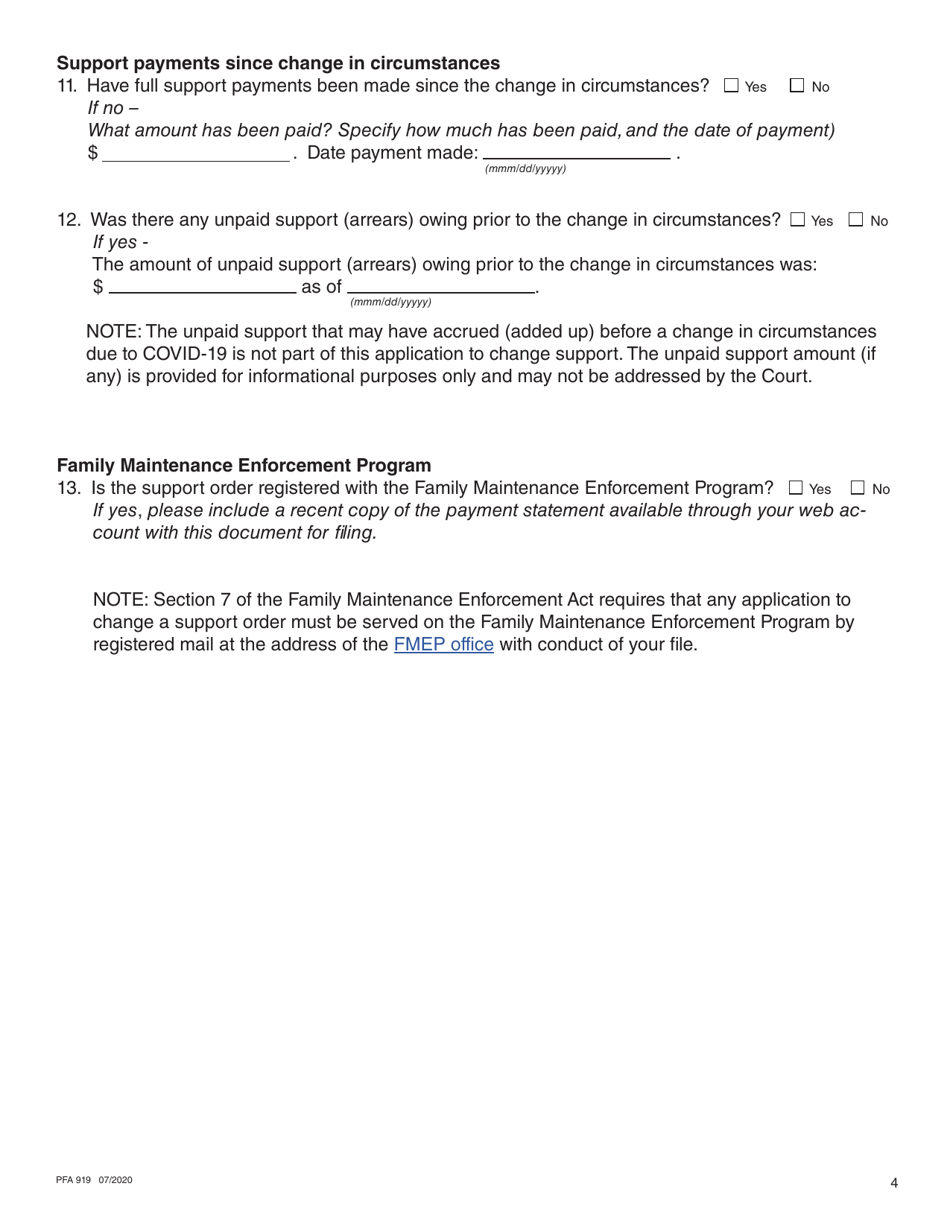

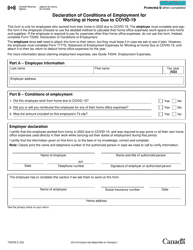

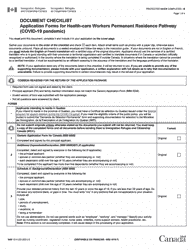

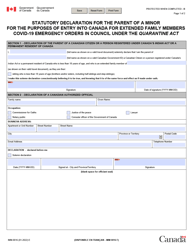

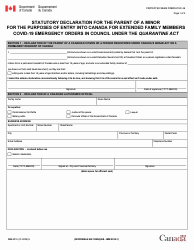

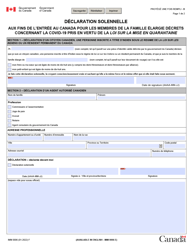

Form PFA919 Financial Statement Covid-19 Addendum - British Columbia, Canada

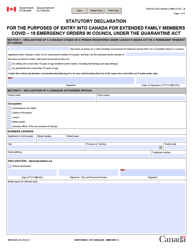

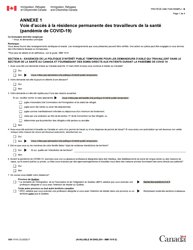

The Form PFA919 Financial Statement Covid-19 Addendum is a document used in British Columbia, Canada. It is used to provide additional financial information related to the impact of the Covid-19 pandemic on an individual or business's financial situation.

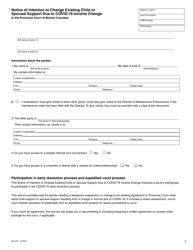

The Form PFA919 Financial Statement Covid-19 Addendum in British Columbia, Canada is typically filed by individuals who are going through a court process related to family law matters, such as divorce or child custody.

FAQ

Q: What is Form PFA919?

A: Form PFA919 is a financial statement addendum specifically related to the impact of COVID-19 in British Columbia, Canada.

Q: What does this addendum cover?

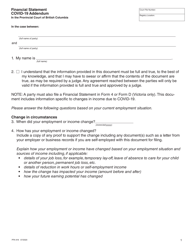

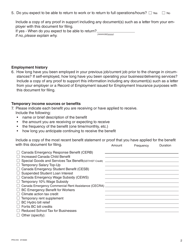

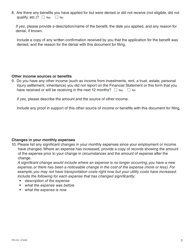

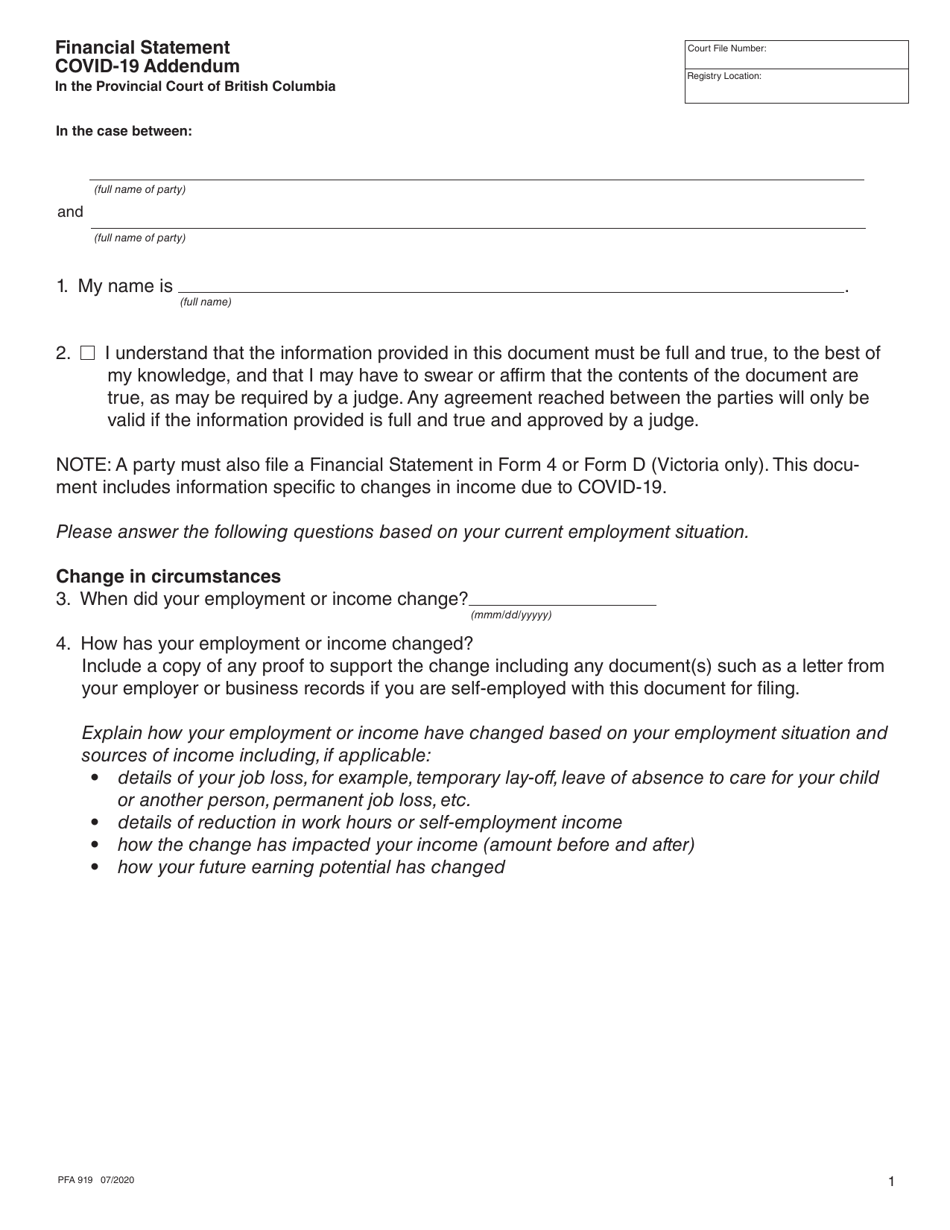

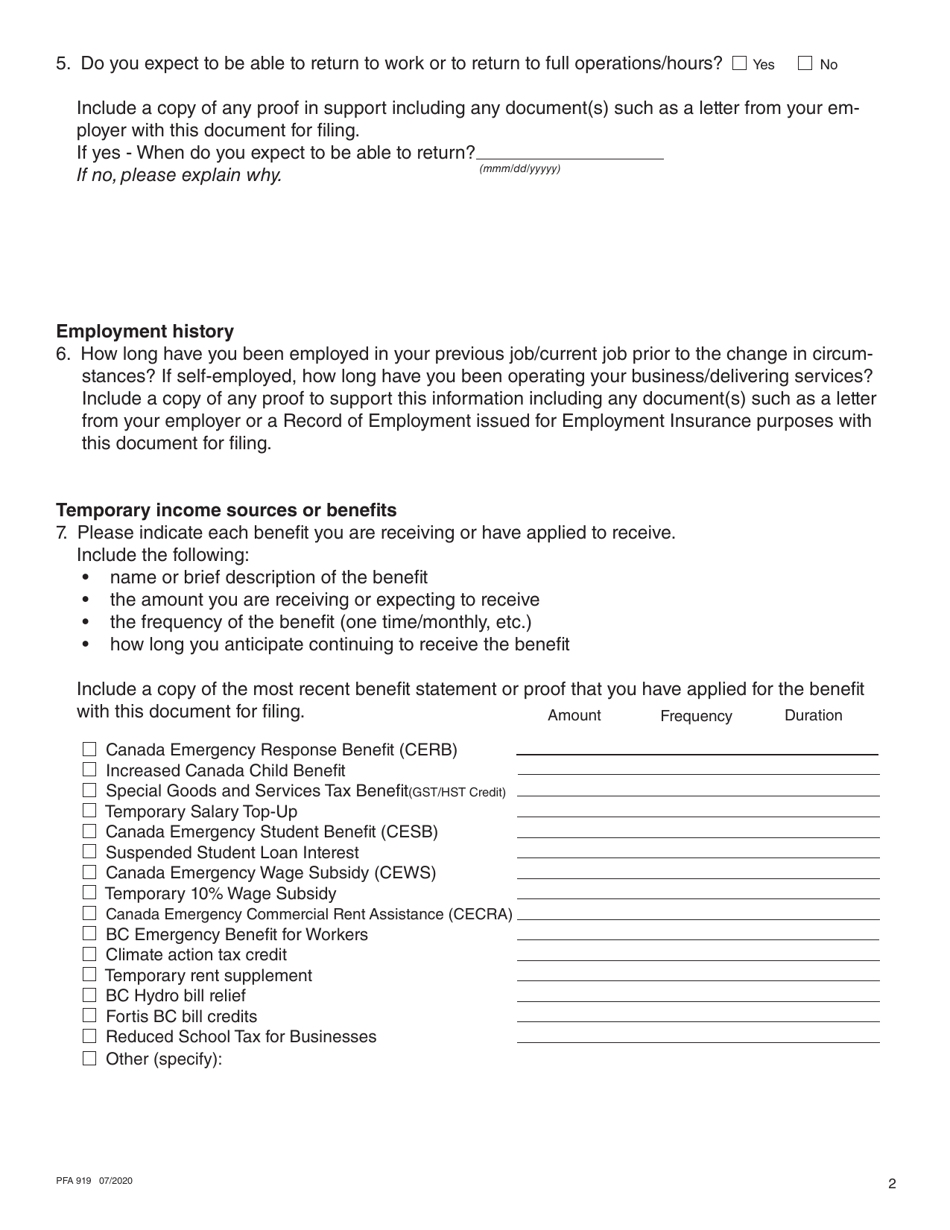

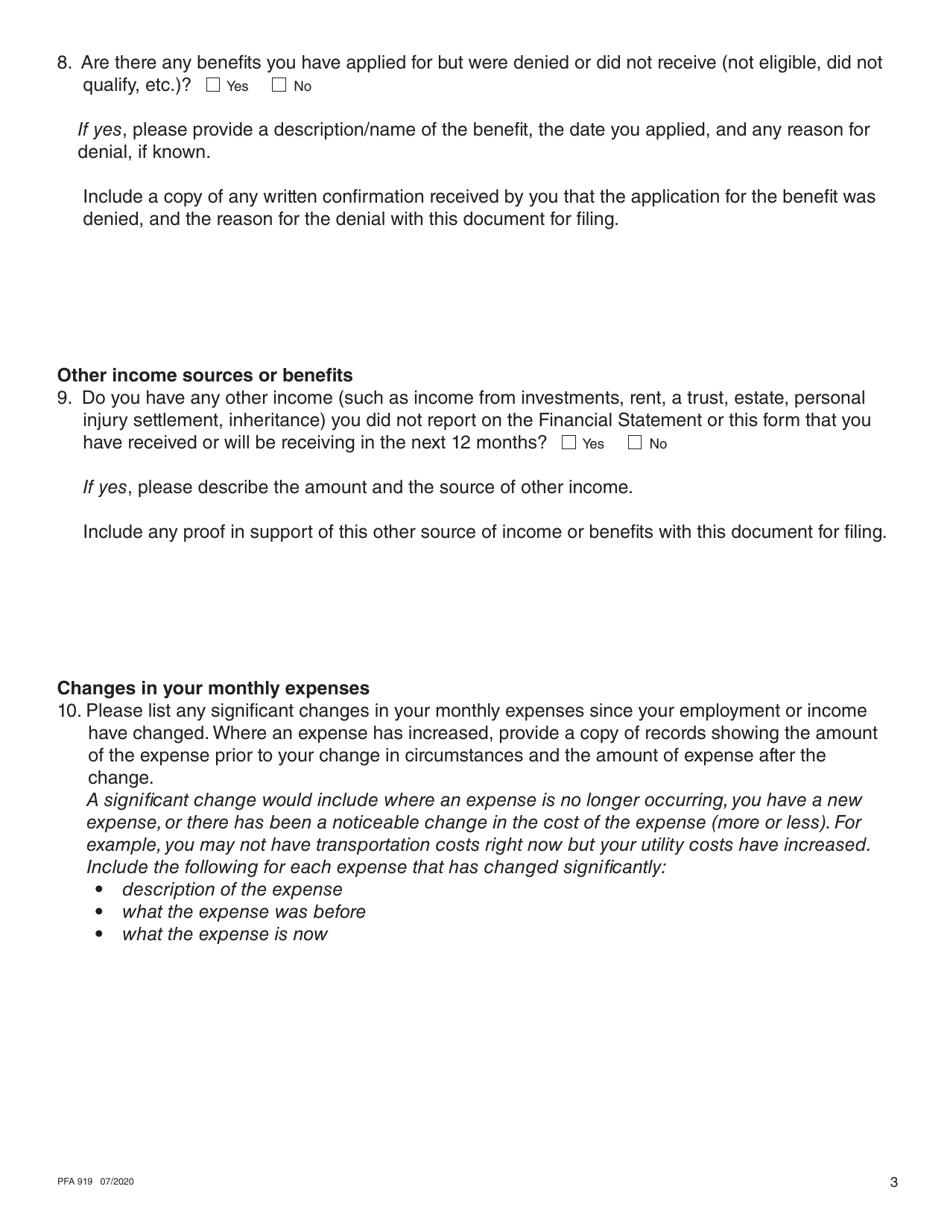

A: This addendum covers the financial impact of COVID-19, including changes to income, expenses, and other financial factors.

Q: Who needs to use Form PFA919?

A: Individuals or businesses in British Columbia who have been financially affected by COVID-19 may need to use Form PFA919.

Q: Do I need to submit Form PFA919 separately?

A: It depends on the specific instructions provided by the government agency. Some may require it to be submitted separately, while others may require it to be included with other forms or documents.

Q: What information do I need to provide in Form PFA919?

A: You will need to provide detailed information about the financial impact of COVID-19, including changes to income, expenses, and any other relevant financial factors.

Q: Are there any deadlines for submitting Form PFA919?

A: The deadlines for submitting Form PFA919 may vary depending on the specific instructions from the government agency. It is important to check the deadline and submit the form accordingly.

Q: Can I get assistance in completing Form PFA919?

A: Yes, you can seek assistance from a financial professional or contact the government agency for any guidance or support in completing Form PFA919.