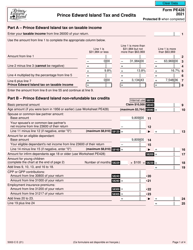

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5002-C (PE428)

for the current year.

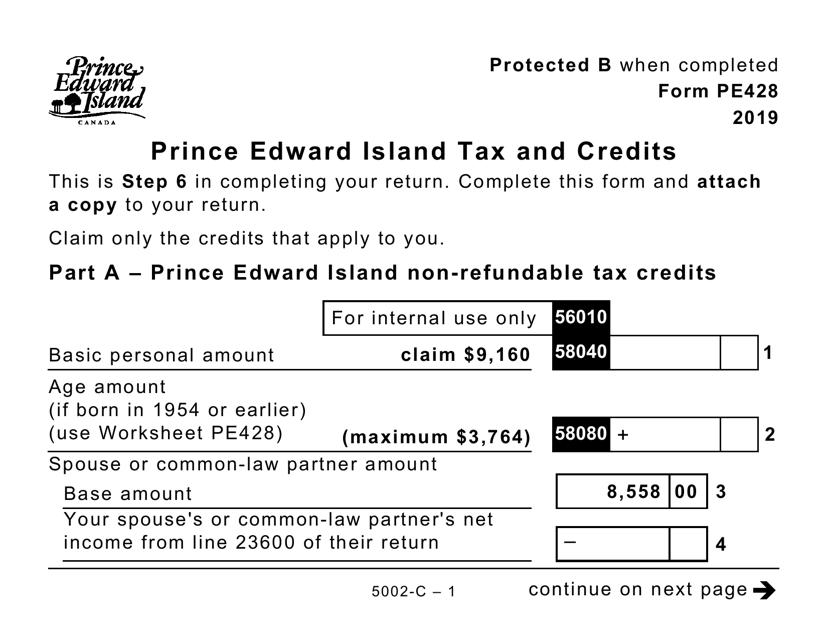

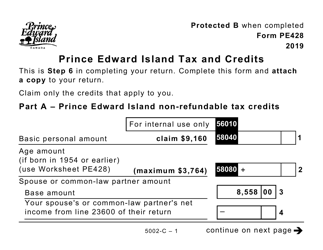

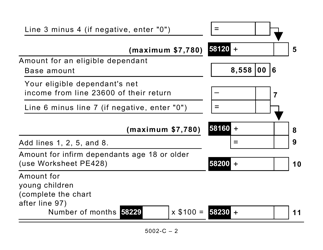

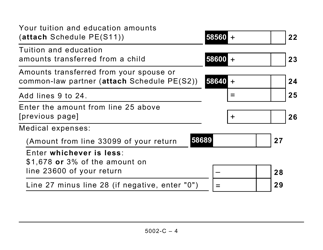

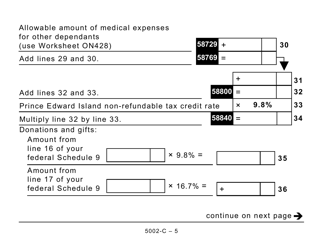

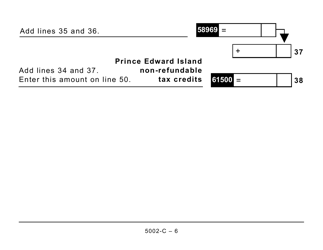

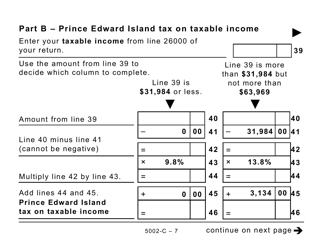

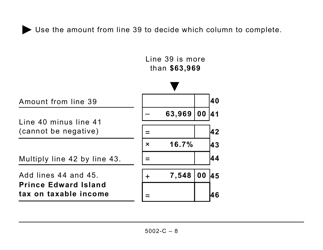

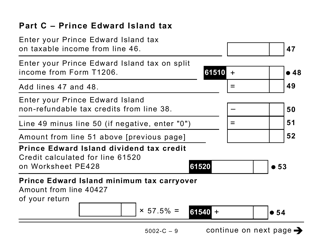

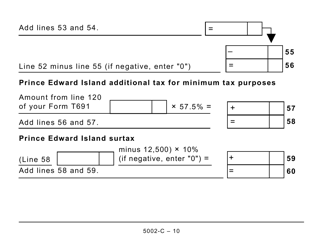

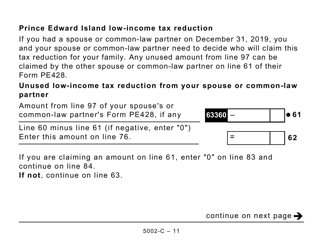

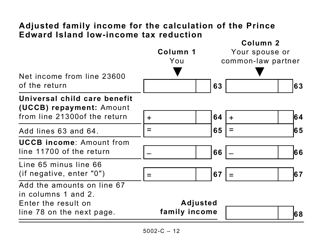

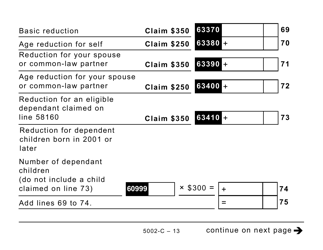

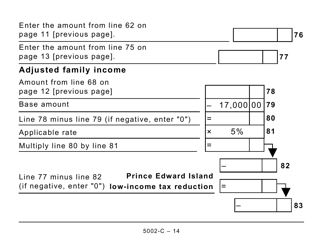

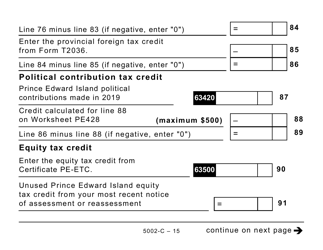

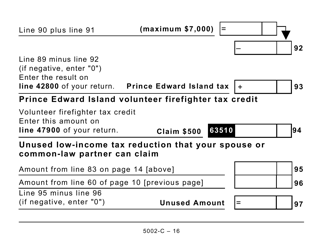

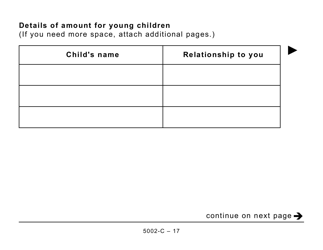

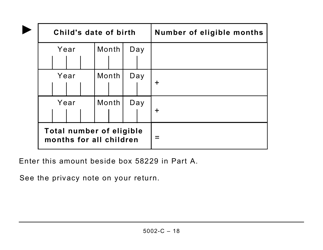

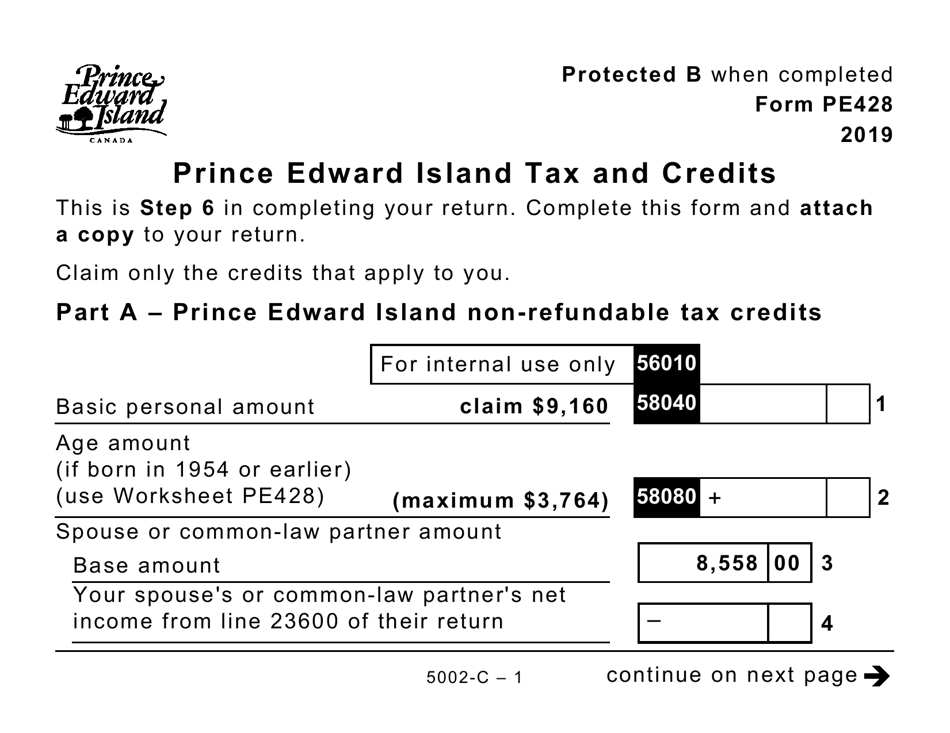

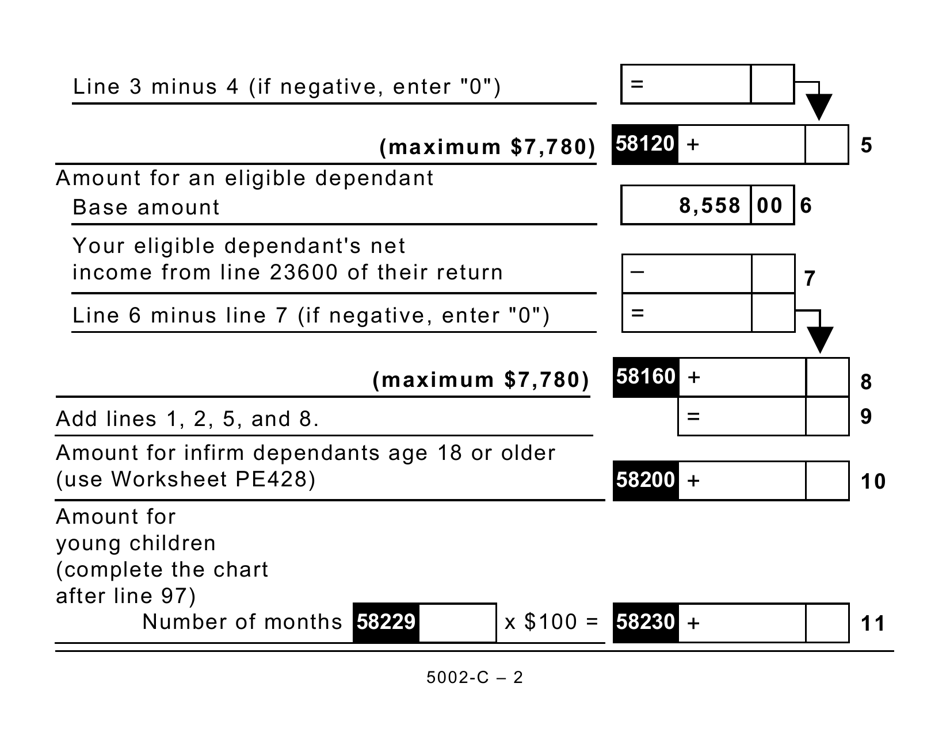

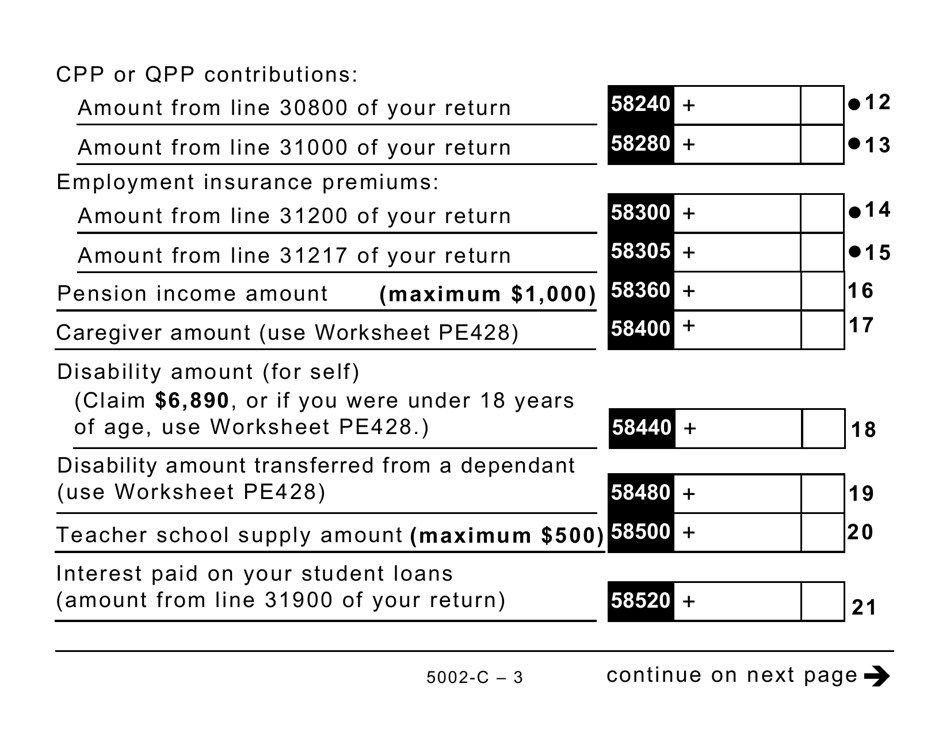

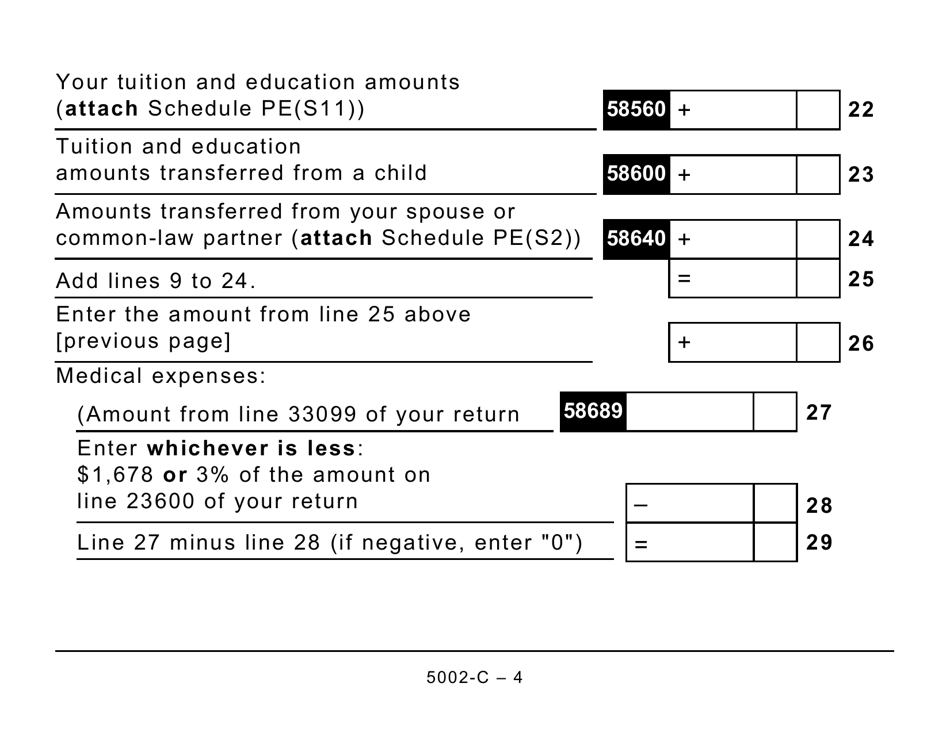

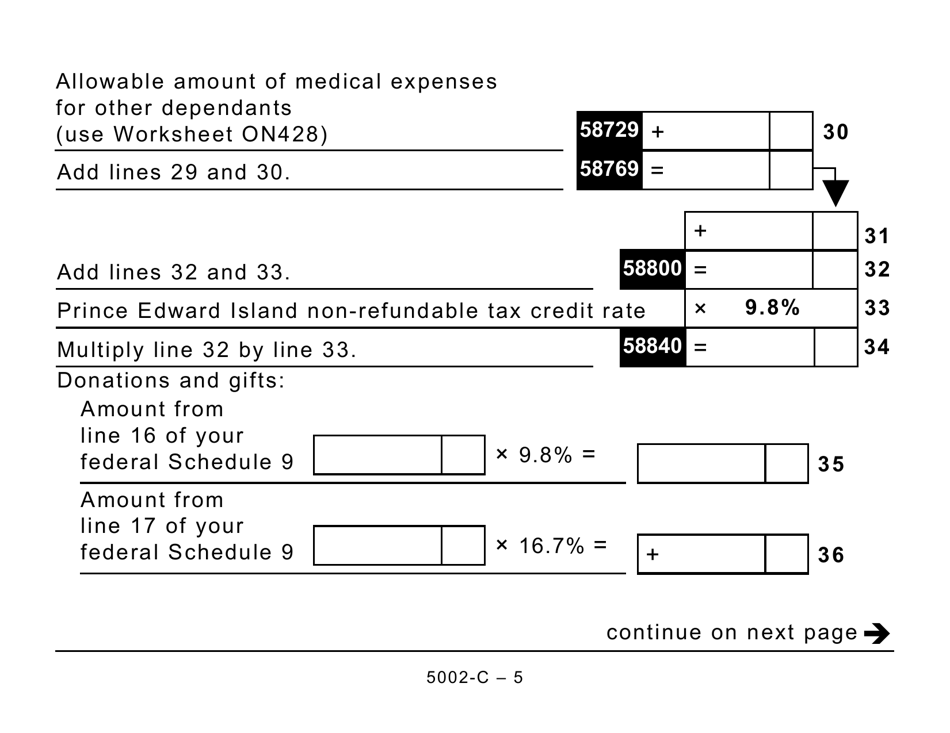

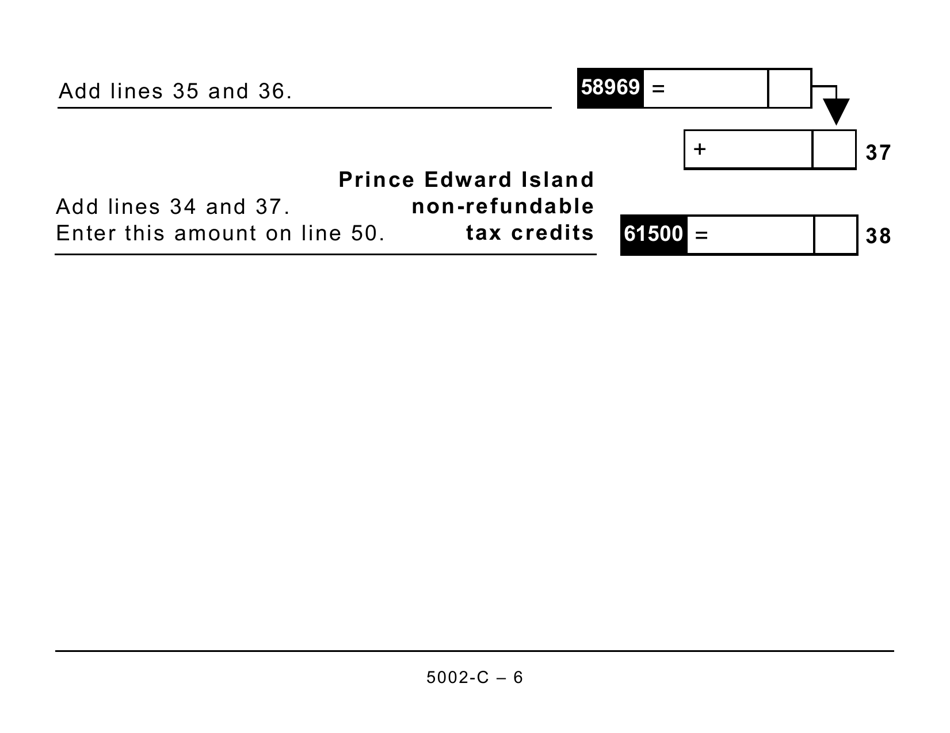

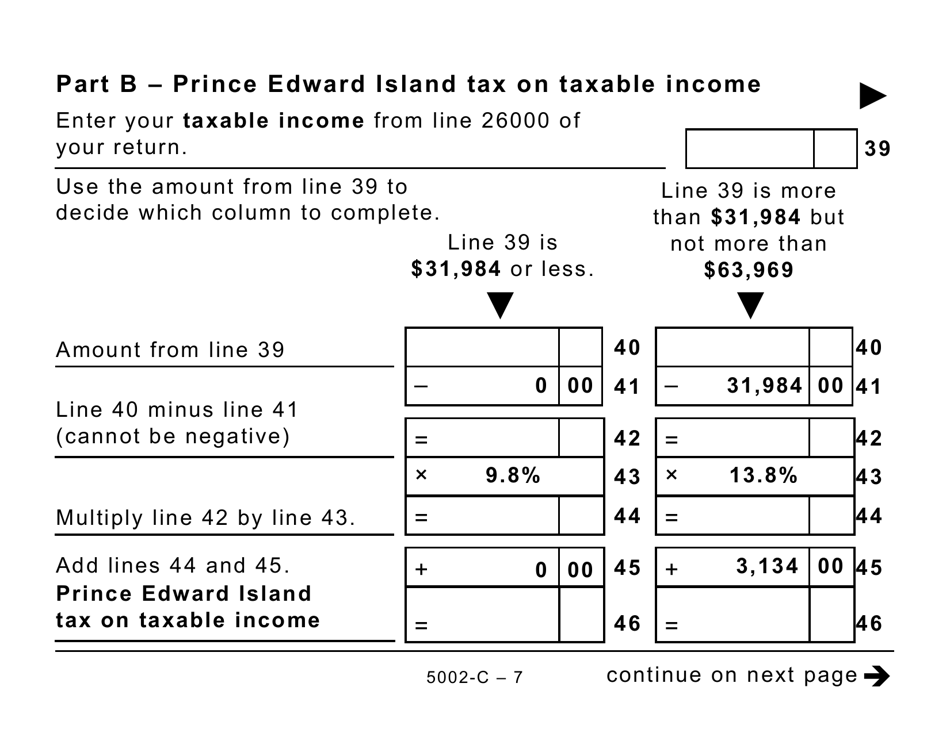

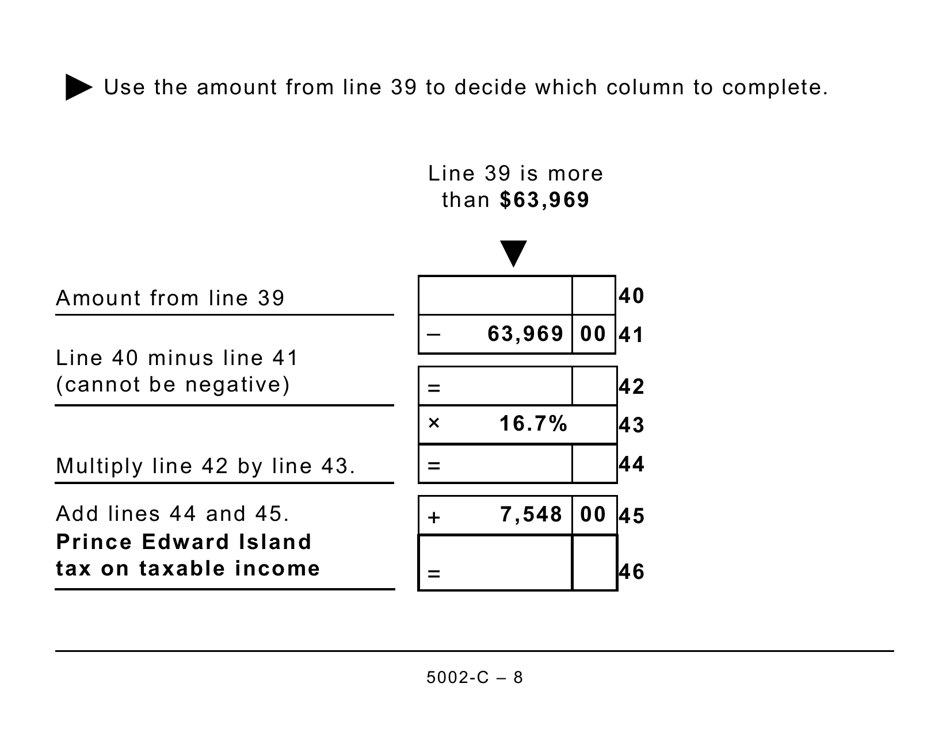

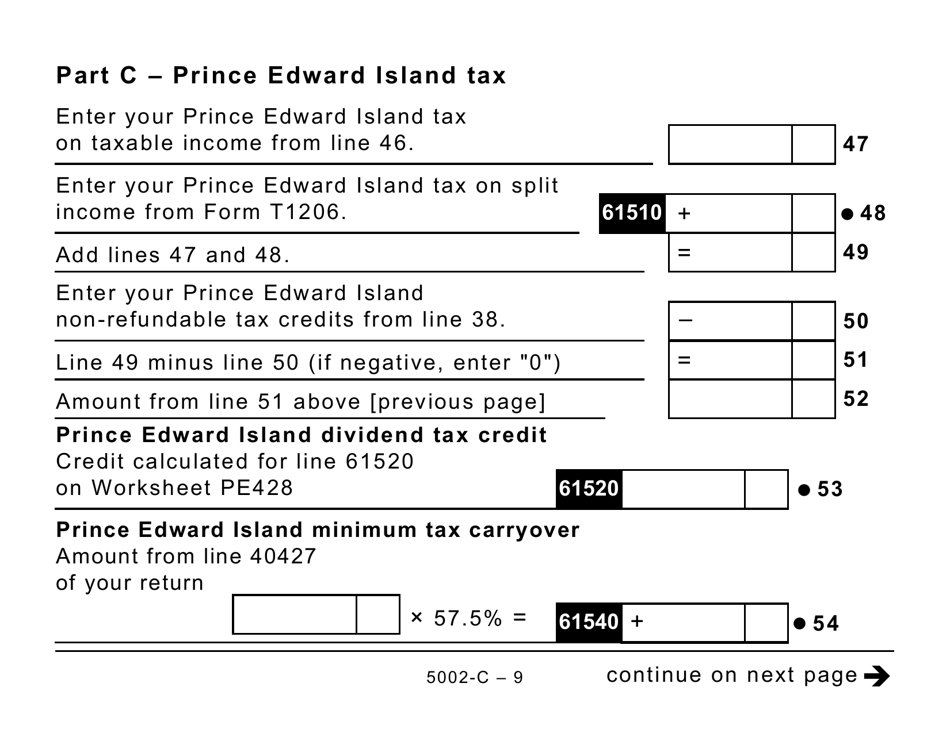

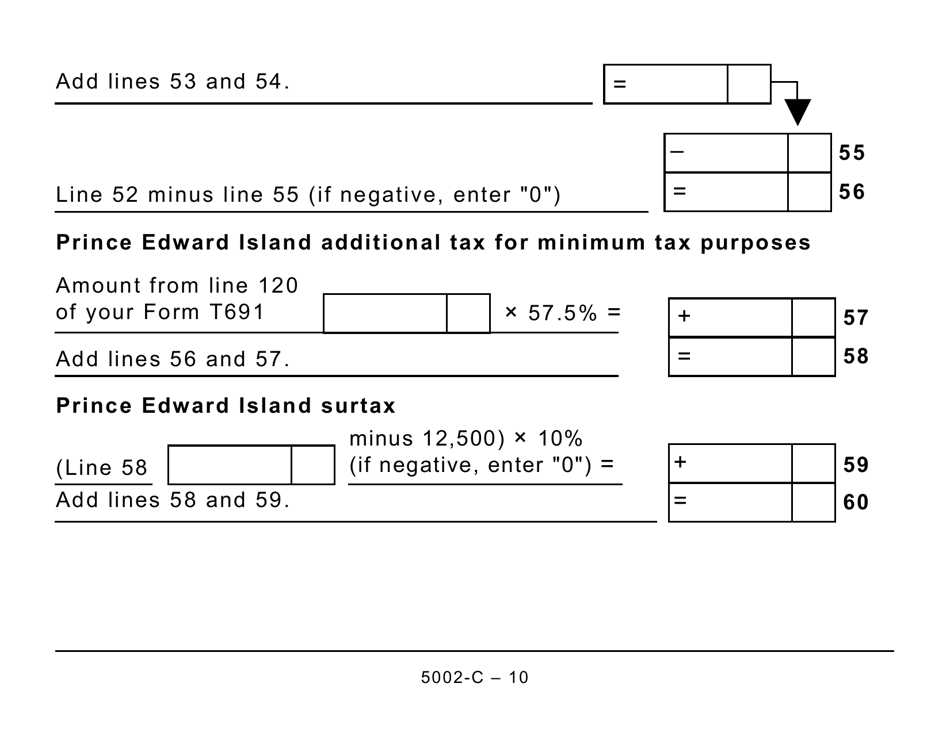

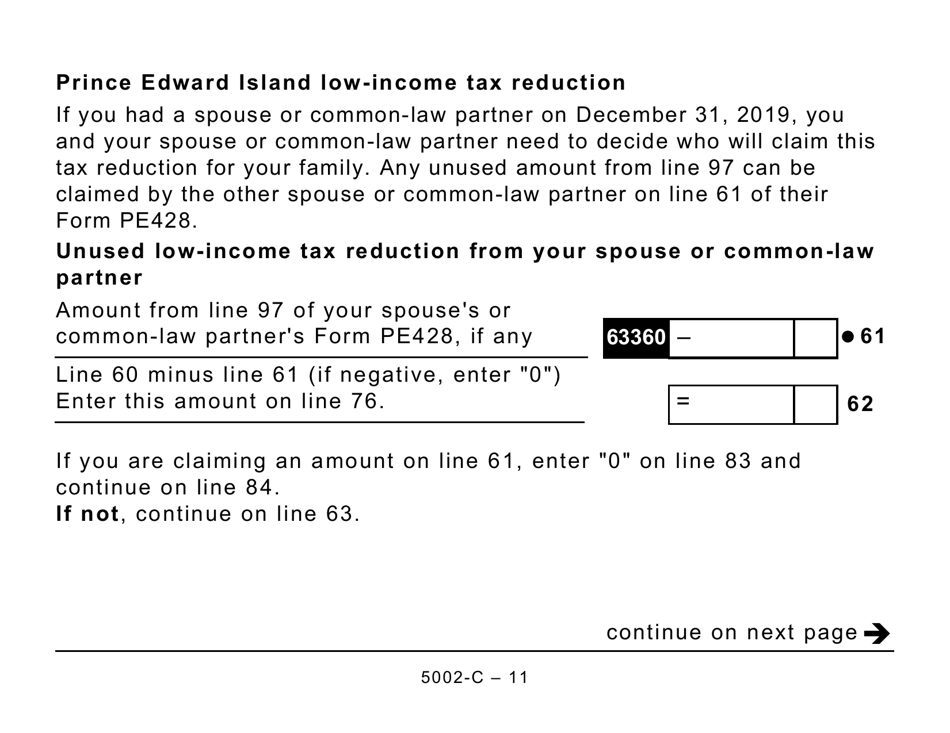

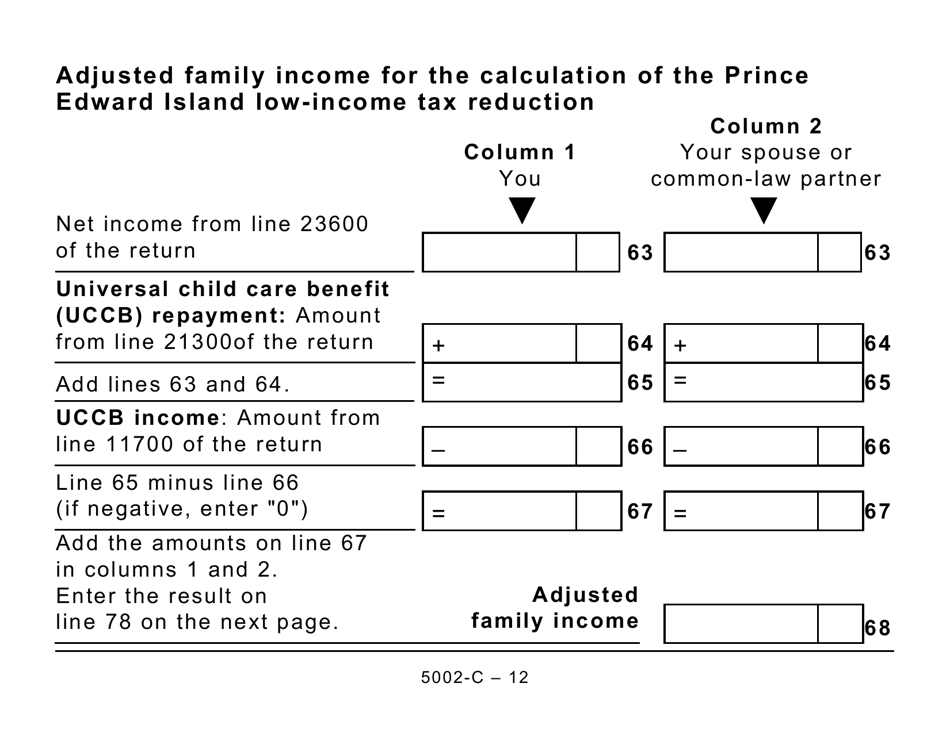

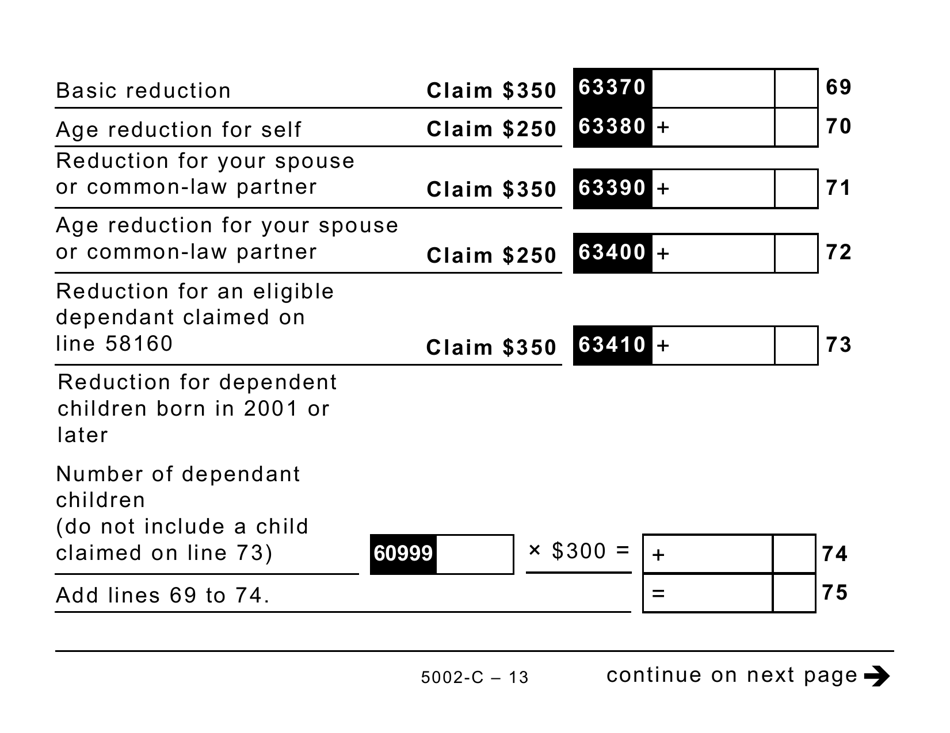

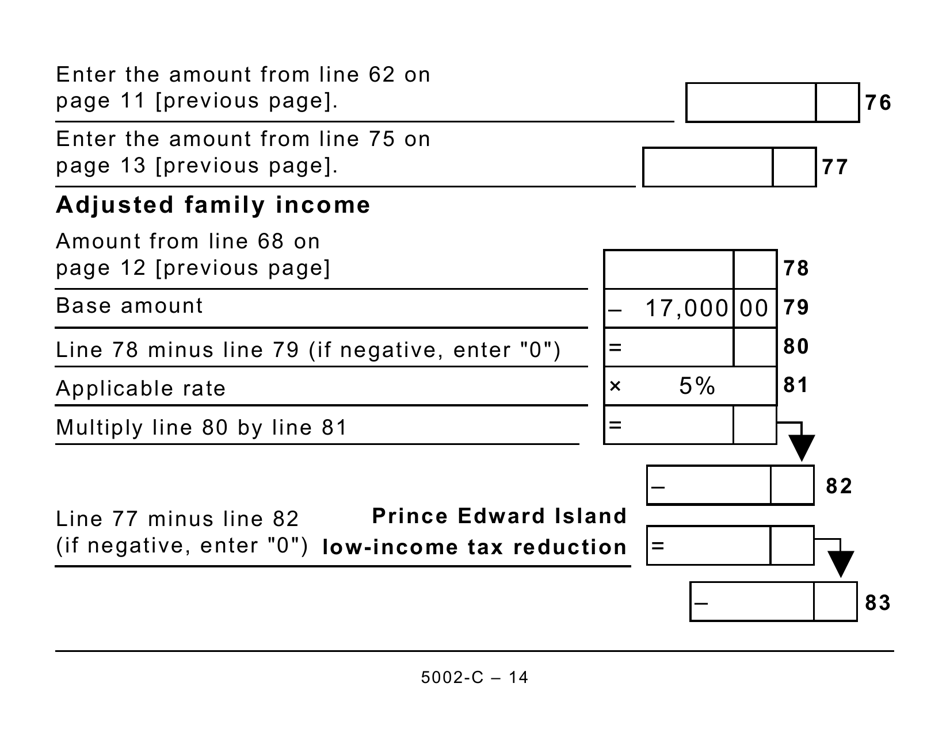

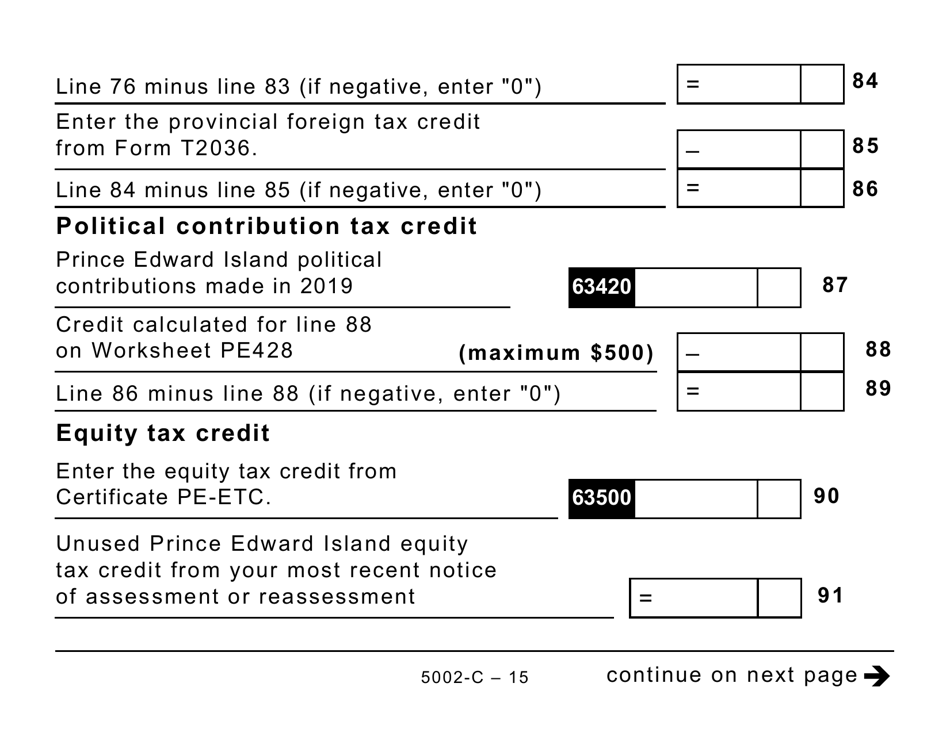

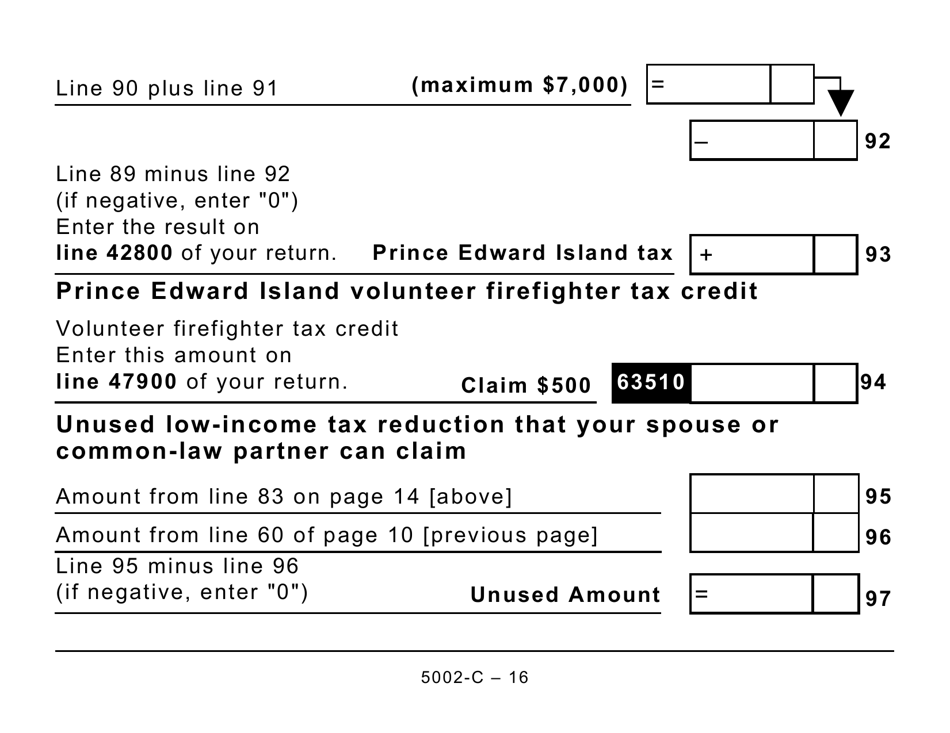

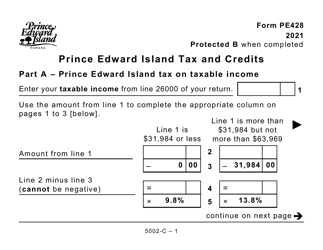

Form 5002-C (PE428) Prince Edward Island Tax and Credits (Large Print) - Canada

Form 5002-C (PE428) Prince Edward Island Tax and Credits (Large Print) is a tax form used in Canada specifically for filing taxes in Prince Edward Island. It is designed for individuals who require large print format due to visual impairments or other accessibility needs.

The Form 5002-C (PE428) Prince Edward Island Tax and Credits (Large Print) in Canada is usually filed by individual taxpayers who are residents of Prince Edward Island and need to report their tax information and claim credits.

FAQ

Q: What is Form 5002-C (PE428)?

A: Form 5002-C (PE428) is a tax form used for filing taxes in Prince Edward Island, Canada.

Q: What is the purpose of Form 5002-C (PE428)?

A: The purpose of Form 5002-C (PE428) is to report income and claim tax credits specific to Prince Edward Island.

Q: Is Form 5002-C (PE428) for individuals or businesses?

A: Form 5002-C (PE428) is for individuals, not businesses.

Q: When is the deadline for filing Form 5002-C (PE428)?

A: The deadline for filing Form 5002-C (PE428) is usually April 30th of each year.

Q: Are there any penalties for late filing of Form 5002-C (PE428)?

A: Yes, there may be penalties for late filing of Form 5002-C (PE428), so it is important to submit it on time.

Q: What if I need help with filling out Form 5002-C (PE428)?

A: If you need help with filling out Form 5002-C (PE428), you can seek assistance from a tax professional or contact the Prince Edward Island tax office.

Q: What should I do if there are errors on my submitted Form 5002-C (PE428)?

A: If you discover errors on your submitted Form 5002-C (PE428), you should contact the Prince Edward Island tax office to make corrections.

Q: Can I claim tax credits on Form 5002-C (PE428)?

A: Yes, Form 5002-C (PE428) allows you to claim tax credits specific to Prince Edward Island, such as the PEI Tax Credit for Volunteer Firefighters.