This version of the form is not currently in use and is provided for reference only. Download this version of

Form T777

for the current year.

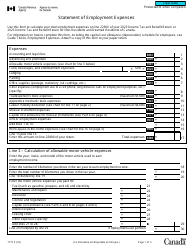

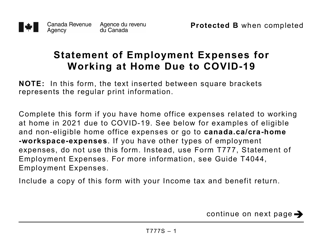

Form T777 Statement of Employment Expenses (Large Print) - Canada

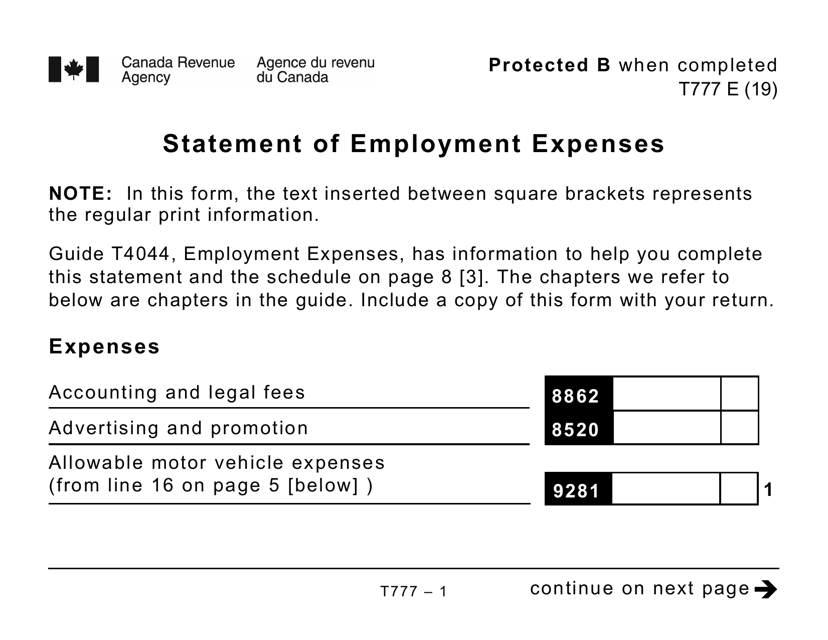

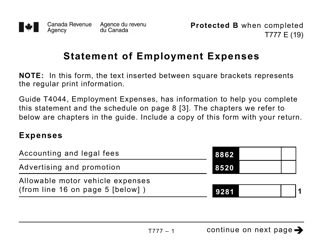

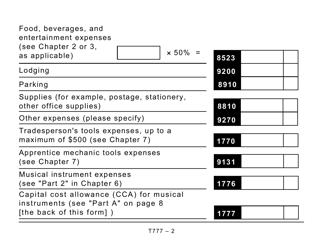

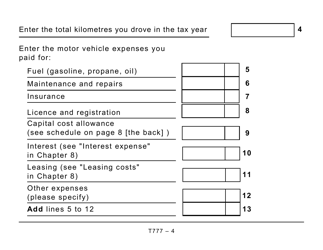

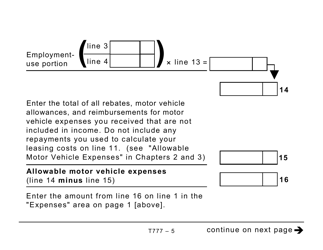

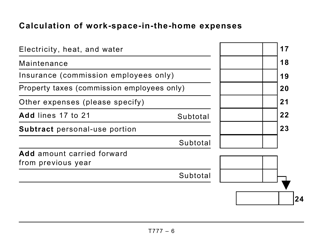

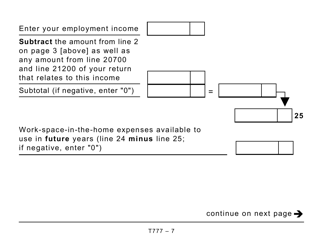

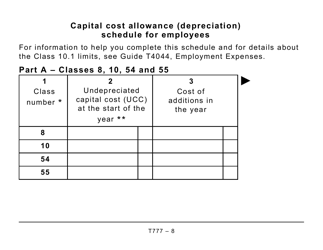

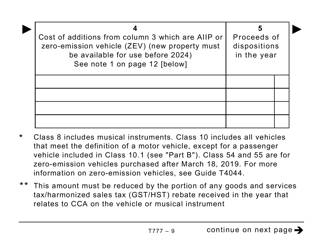

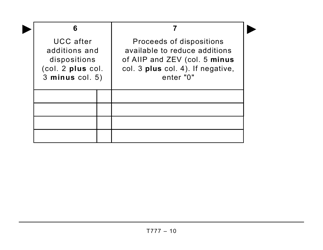

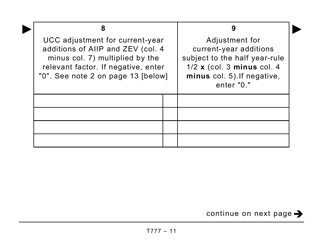

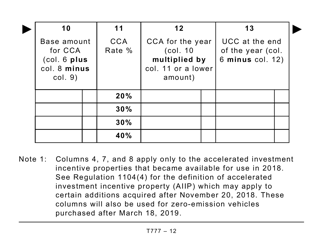

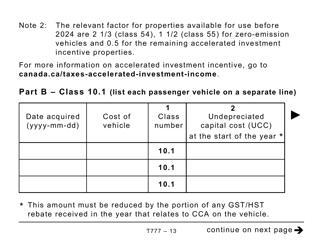

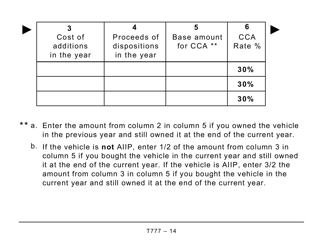

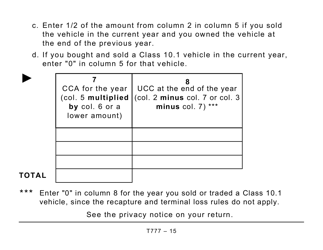

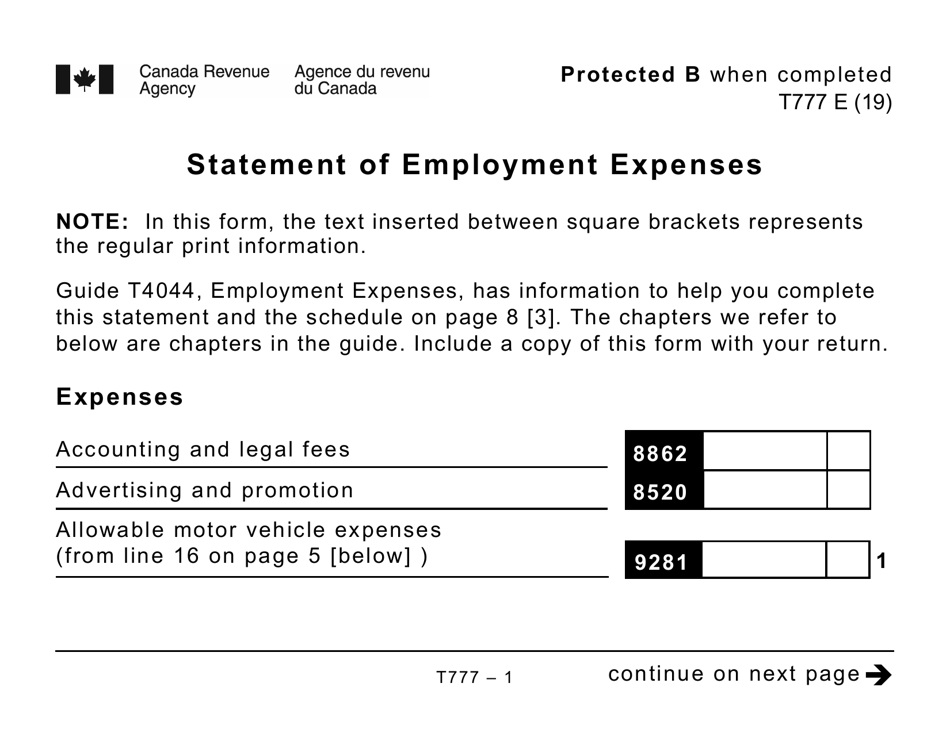

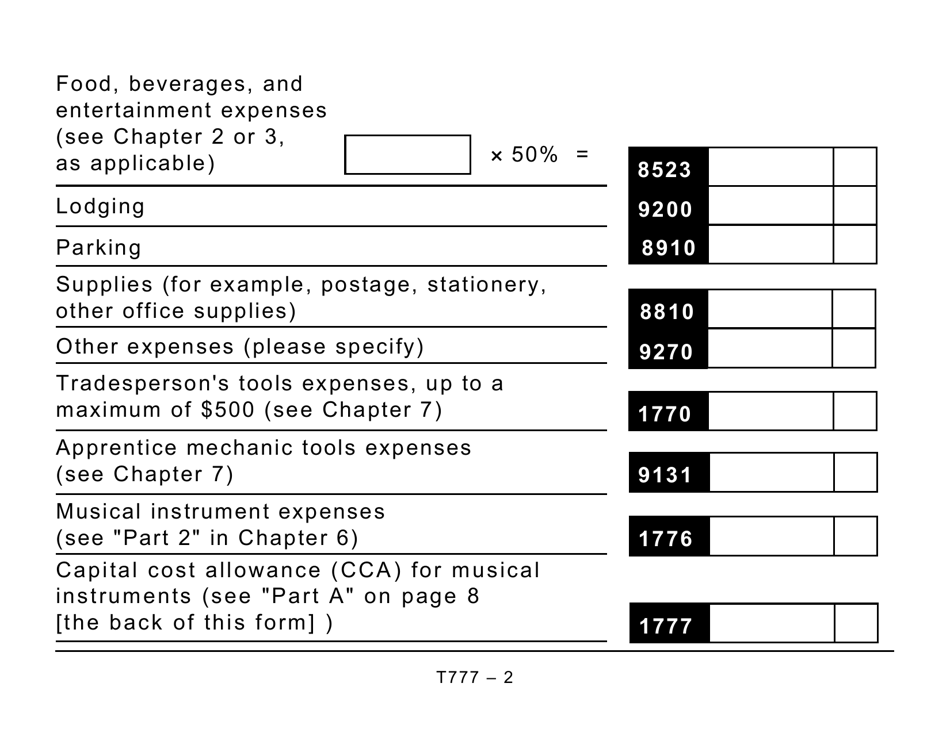

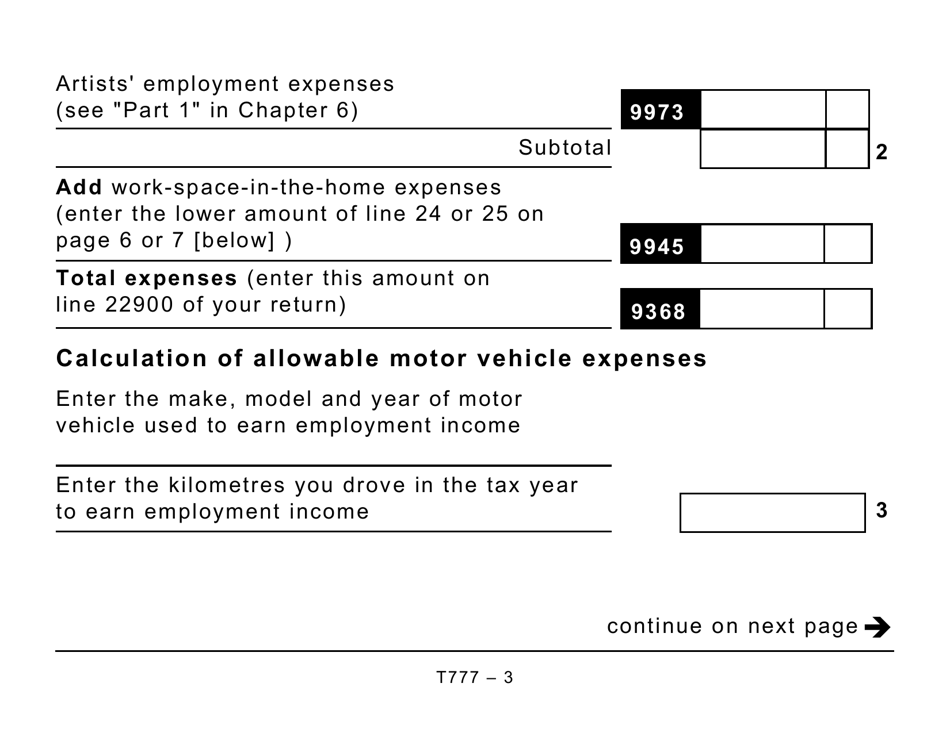

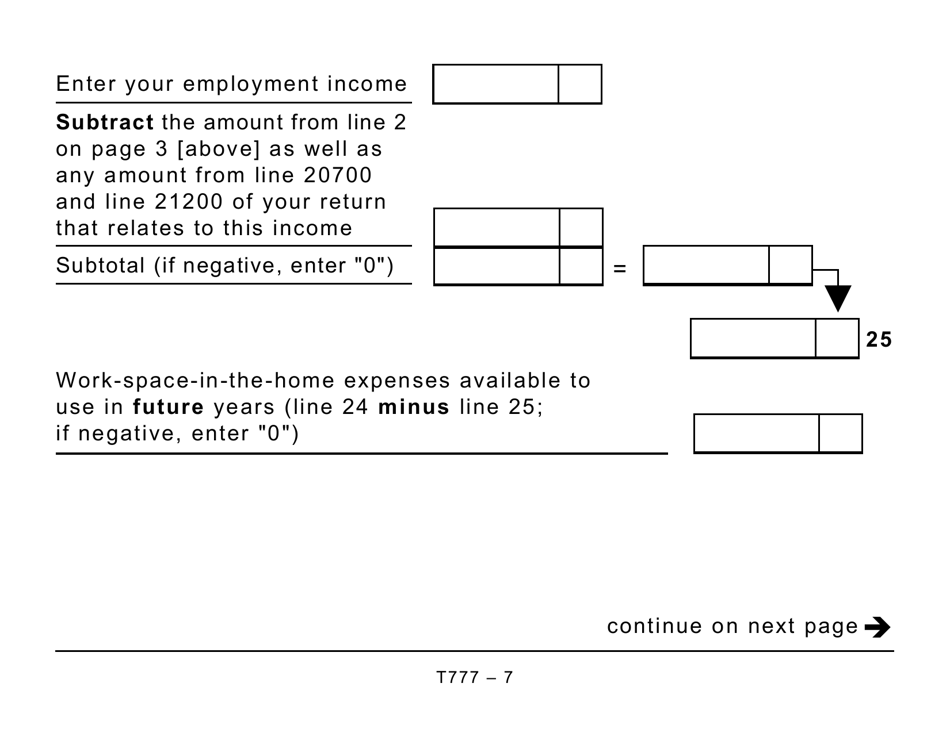

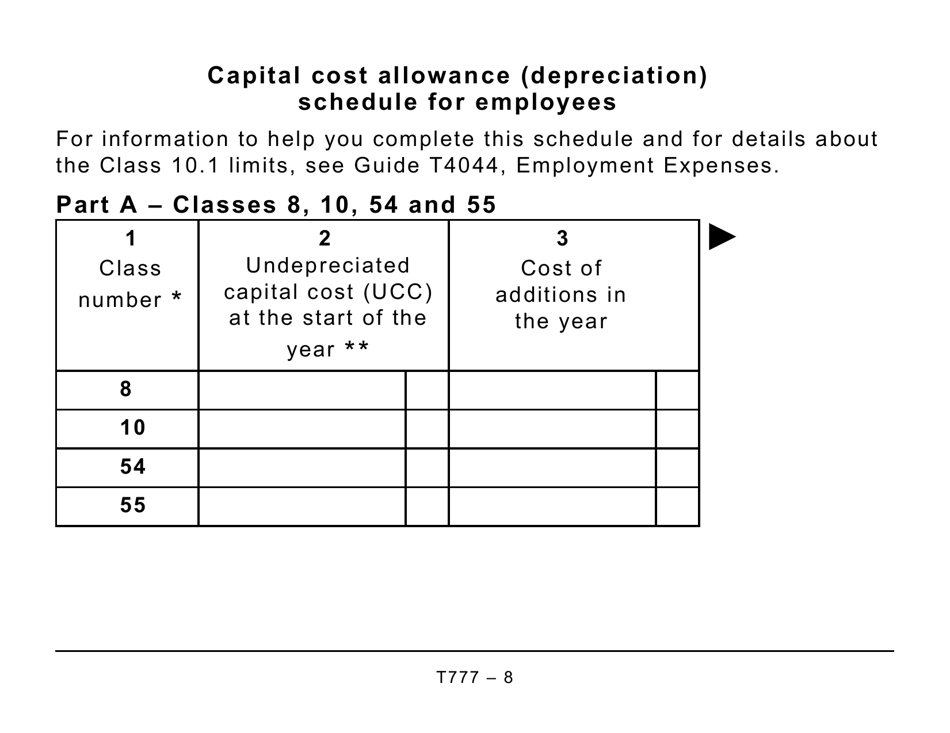

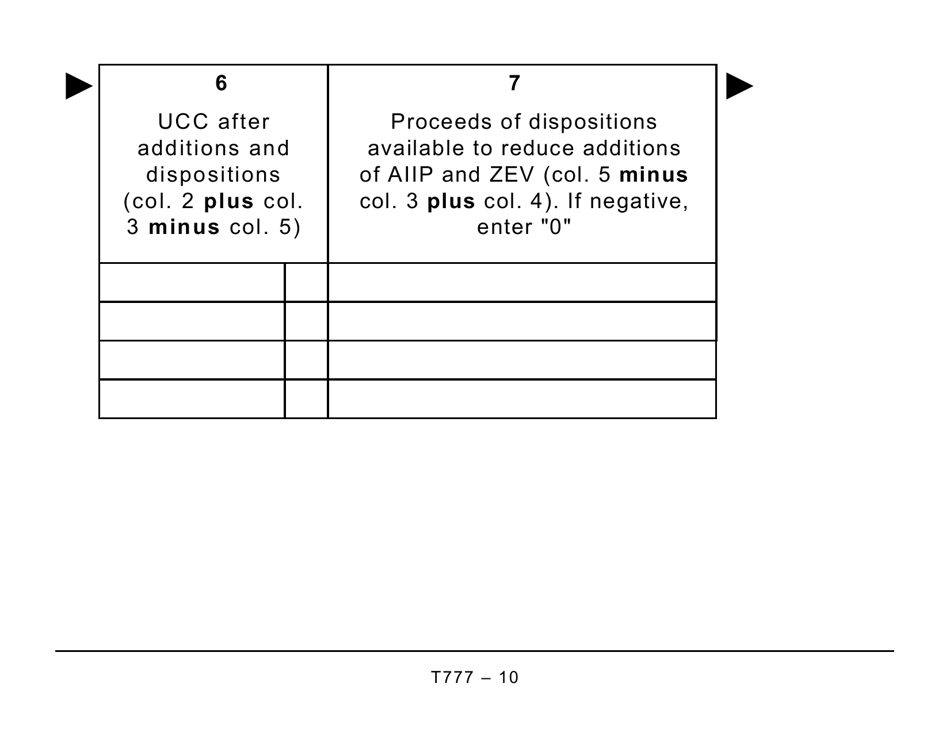

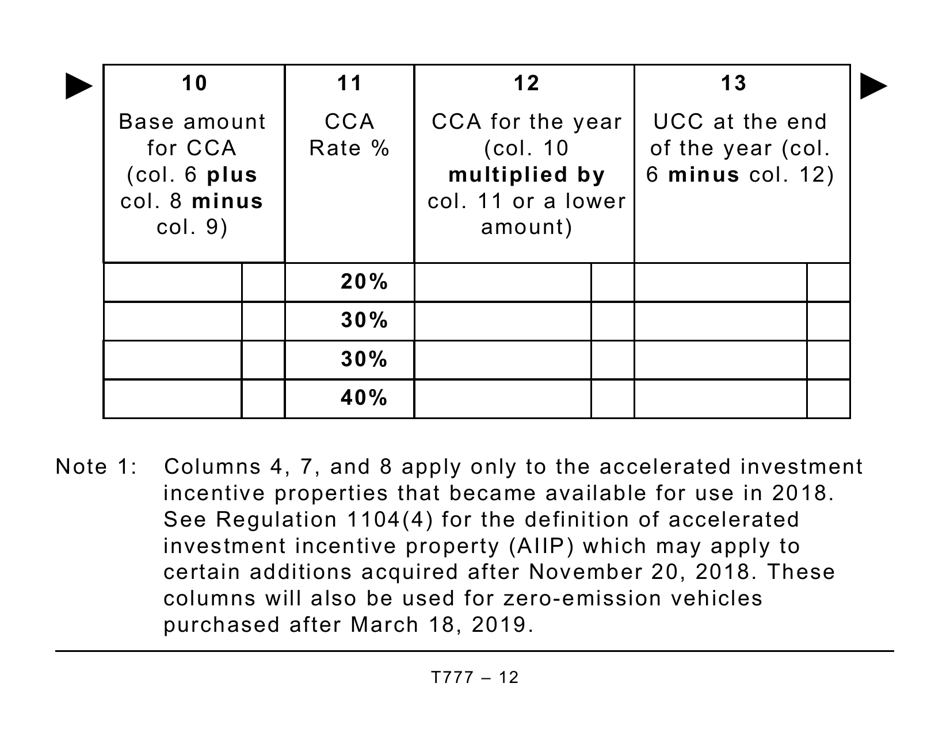

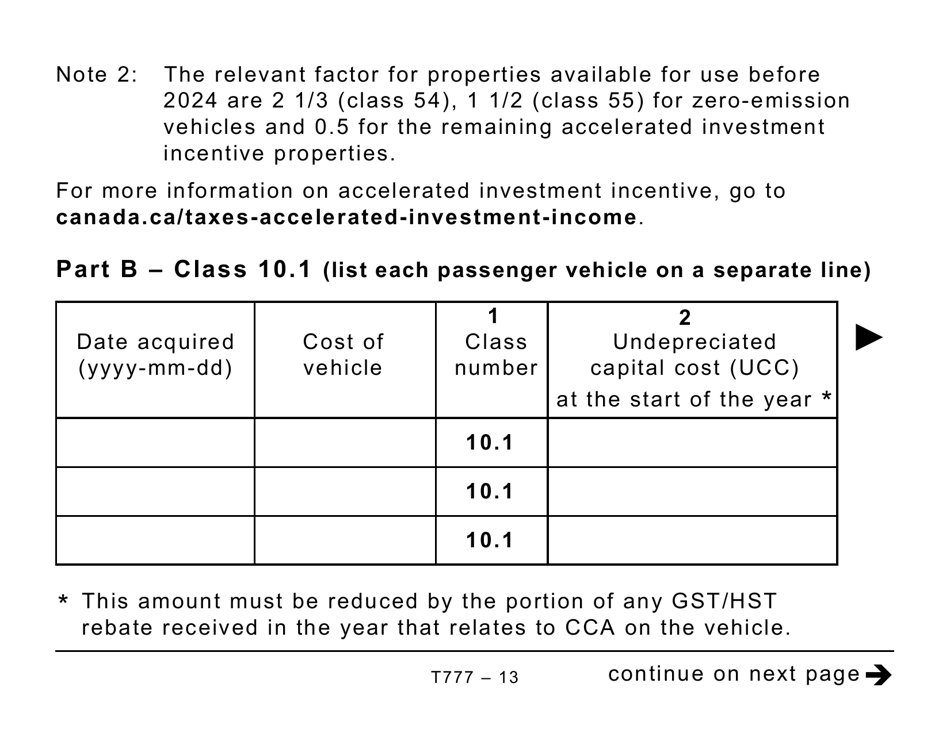

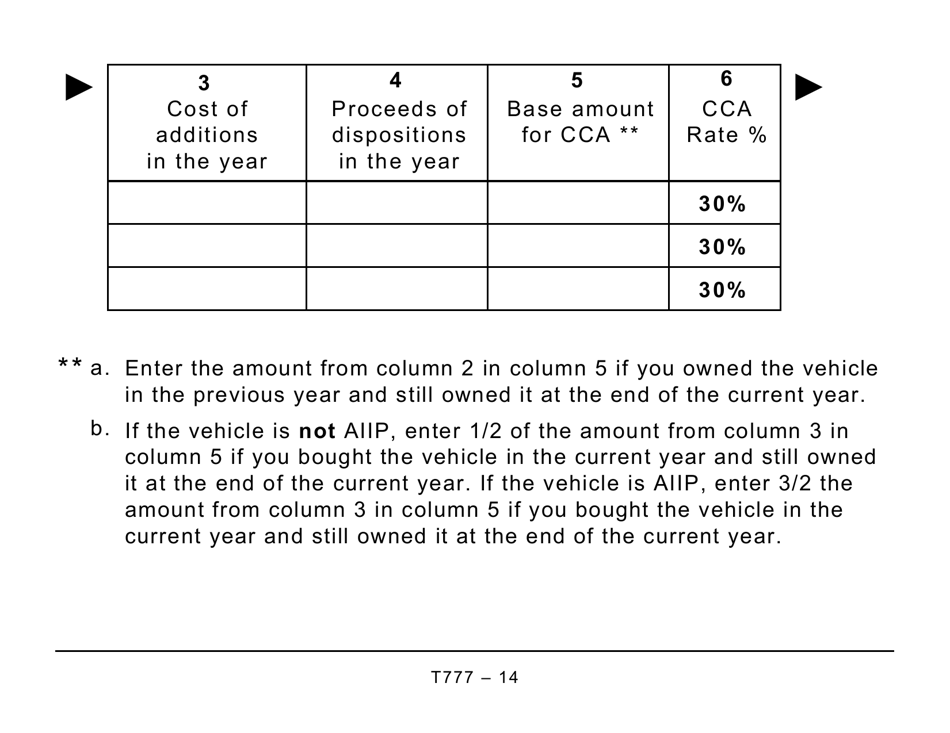

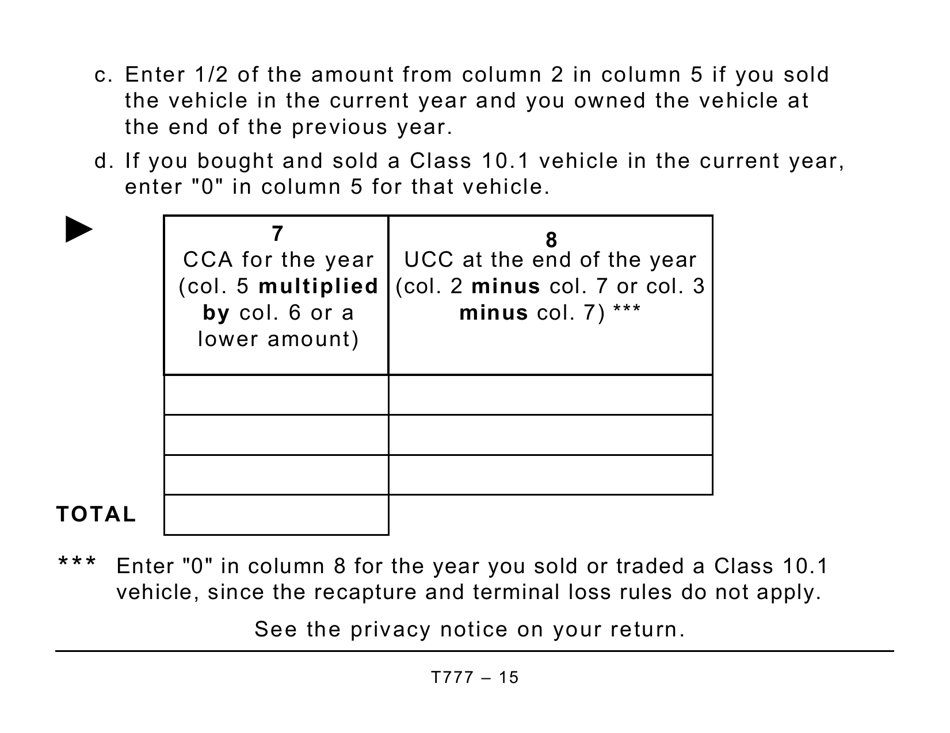

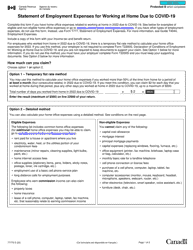

Form T777 Statement of Employment Expenses is a document used in Canada to report deductible employment expenses. It is used by individuals who incur expenses related to their employment that are not reimbursed by their employer. These expenses can include things like vehicle expenses, travel expenses, and professional dues. The form helps individuals claim these expenses and potentially reduce their taxable income.

The individual taxpayer in Canada files the Form T777 Statement of Employment Expenses (Large Print).

FAQ

Q: What is Form T777?

A: Form T777 is a statement of employment expenses in Canada.

Q: Who can use Form T777?

A: Form T777 is used by individuals who want to claim employment expenses on their tax return in Canada.

Q: What are employment expenses?

A: Employment expenses are expenses incurred by an individual while performing their employment duties, which can be deducted from their income for tax purposes.

Q: What information should be included in Form T777?

A: Form T777 requires the individual to provide details of the employment expenses they want to claim, including the types of expenses, amounts, and supporting documents.

Q: Is Form T777 available in large print?

A: Yes, Form T777 is available in large print for individuals who may require visual assistance.

Q: When should Form T777 be submitted?

A: Form T777 should be submitted along with the individual's annual tax return.

Q: Are there any restrictions on claiming employment expenses?

A: Yes, there are certain restrictions and criteria that must be met in order to claim employment expenses. It is recommended to consult the CRA or a tax professional for guidance.

Q: Can I claim all types of expenses as employment expenses?

A: Not all types of expenses can be claimed as employment expenses. Only expenses that are directly related to earning employment income and are not reimbursed by the employer may be eligible.

Q: What supporting documents should be kept for Form T777?

A: Individuals should keep supporting documents such as receipts, invoices, and other relevant proof of expenses in case of review or audit by the CRA.