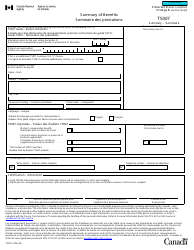

This version of the form is not currently in use and is provided for reference only. Download this version of

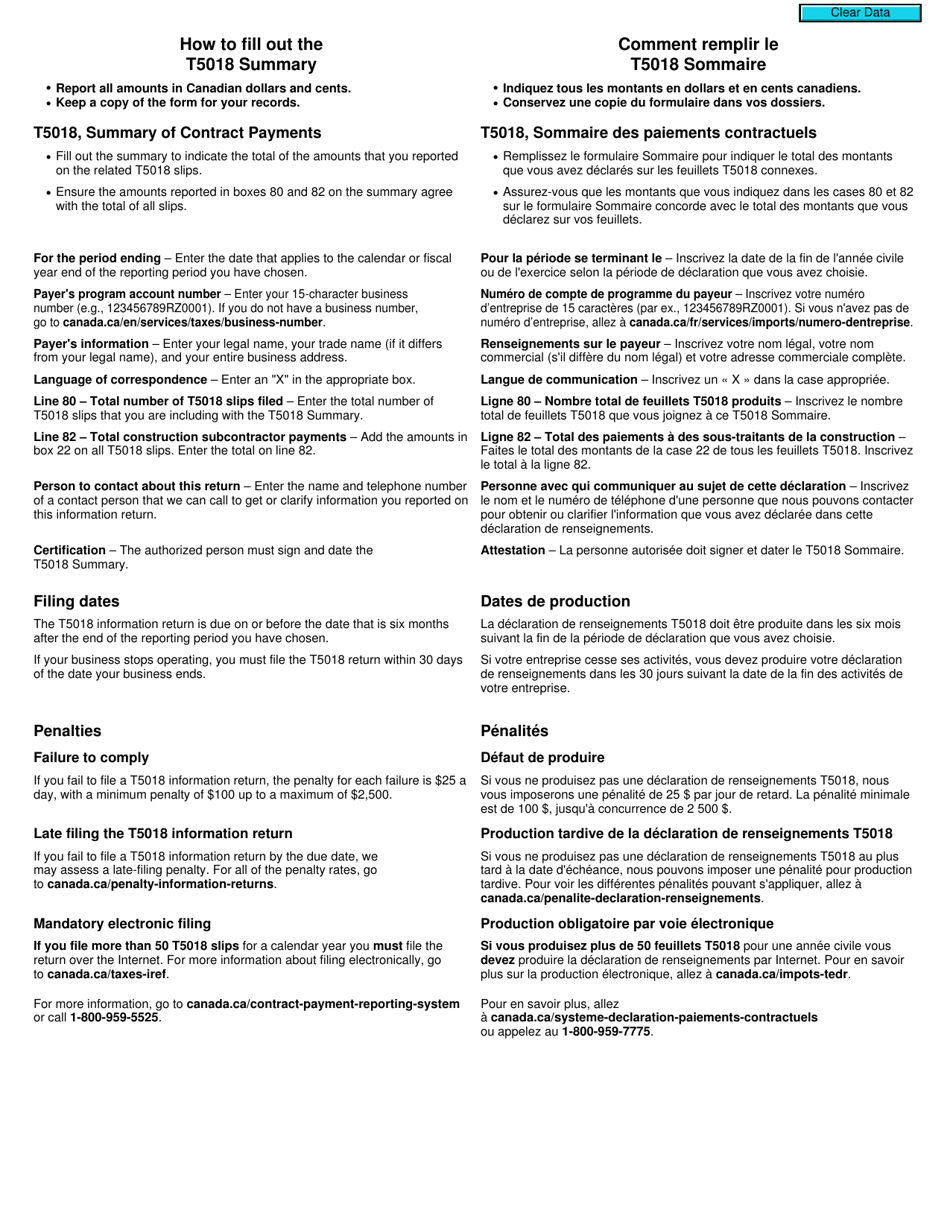

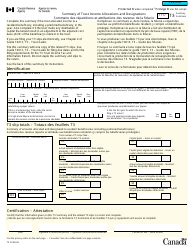

Form T5018 SUM

for the current year.

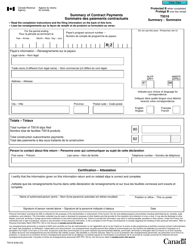

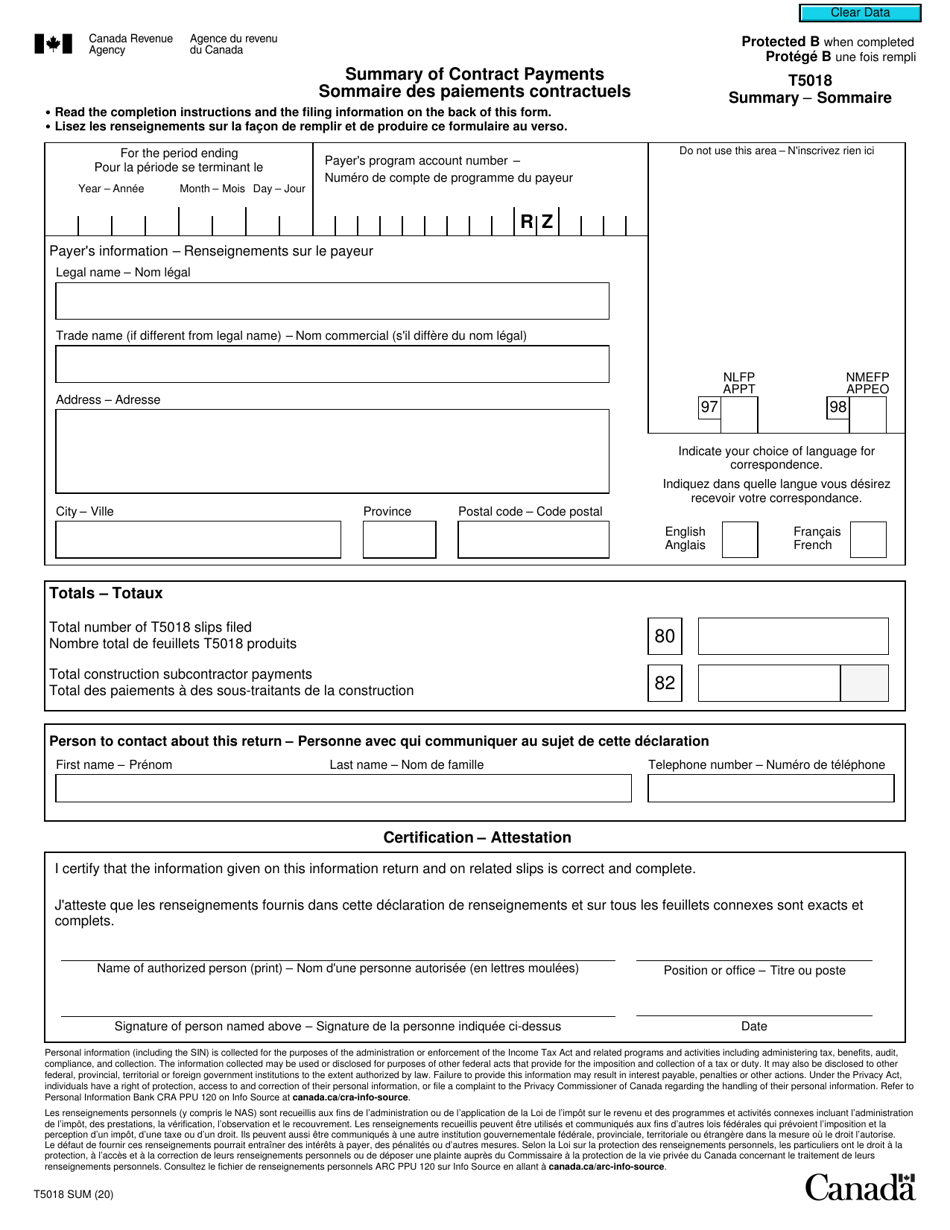

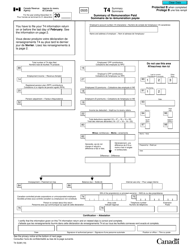

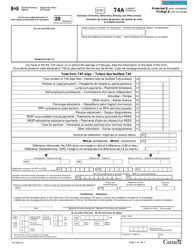

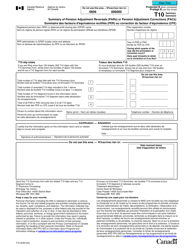

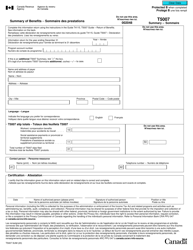

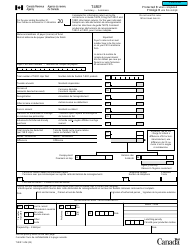

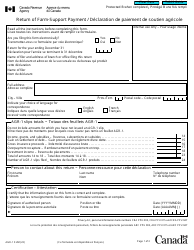

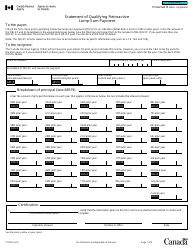

Form T5018 SUM Summary of Contract Payments - Canada (English / French)

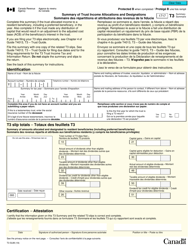

Form T5018 SUM Summary of Contract Payments is used in Canada to report information about payments made to subcontractors in the construction industry. It is filed by the individual or business who paid the subcontractor. The form provides details about the subcontractor's business, the total amount paid, and other relevant information for tax purposes. It helps the Canadian government track payments and ensure compliance with tax regulations in the construction industry.

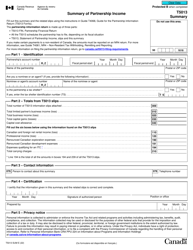

The contractors engaged in construction activities file the Form T5018 SUM Summary of Contract Payments in Canada.

FAQ

Q: What is Form T5018 SUM?

A: Form T5018 SUM is a summary of contract payments in Canada.

Q: Who needs to fill out Form T5018 SUM?

A: Contractors and sub-contractors in Canada need to fill out Form T5018 SUM.

Q: What information is required on Form T5018 SUM?

A: Form T5018 SUM requires information about the contractor, recipient, and the contract payments.

Q: When is Form T5018 SUM due?

A: Form T5018 SUM is due on or before the last day of February following the calendar year in which the contract payments were made.

Q: Are there any penalties for not filing Form T5018 SUM?

A: Yes, there are penalties for not filing Form T5018 SUM, including late filing penalties and failure to file penalties.

Q: Do I need to include Form T5018 SUM with my tax return?

A: No, you do not need to include Form T5018 SUM with your tax return. However, you must keep a copy for your records.