This version of the form is not currently in use and is provided for reference only. Download this version of

Form T3RET

for the current year.

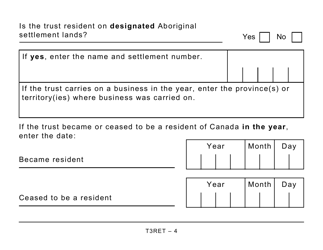

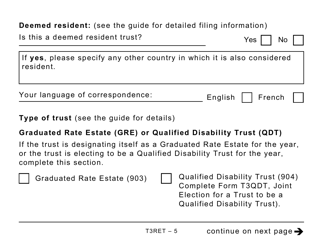

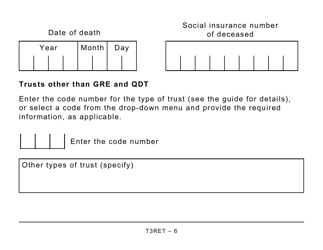

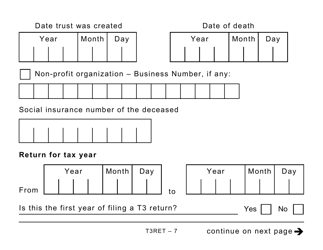

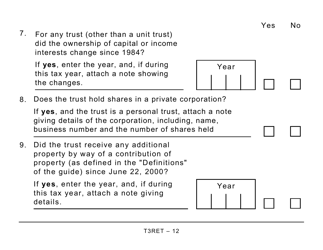

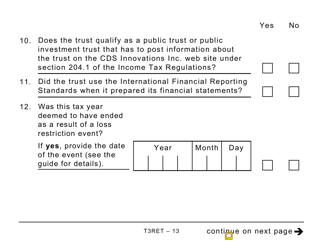

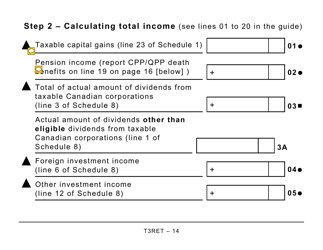

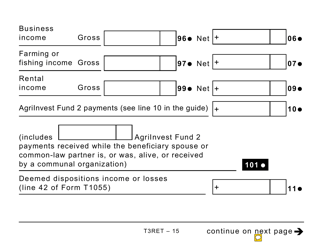

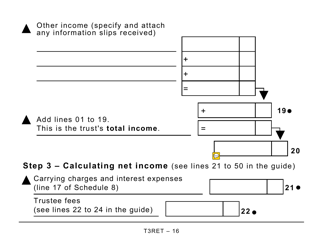

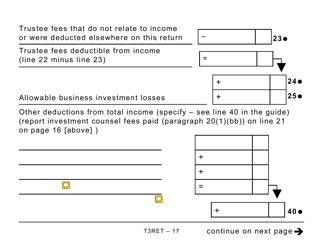

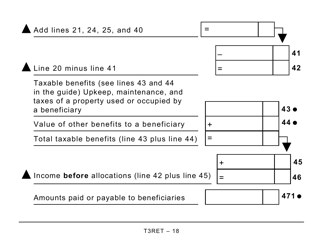

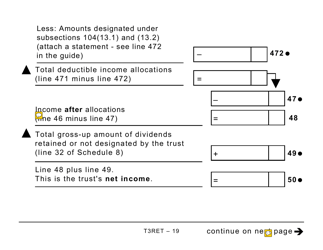

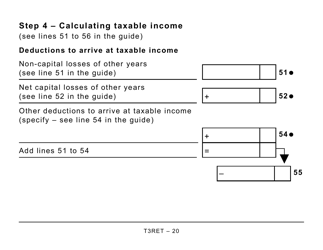

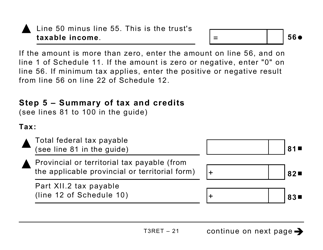

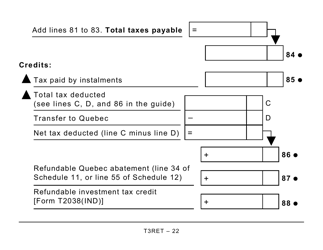

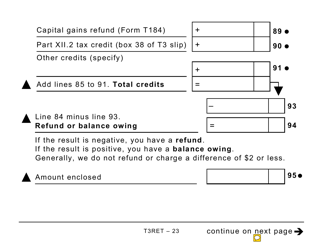

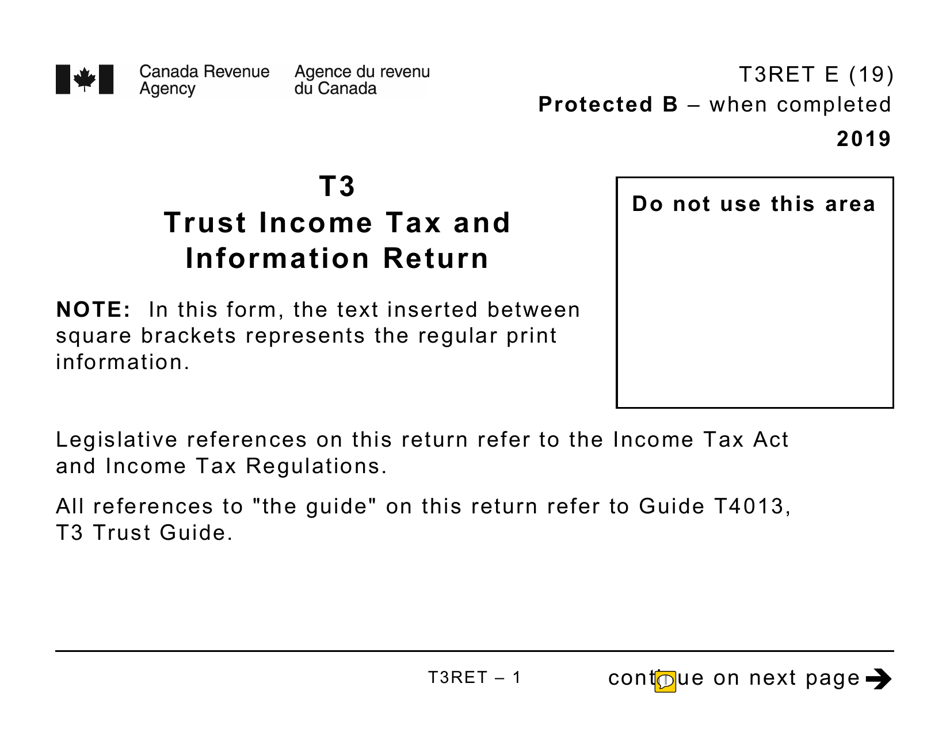

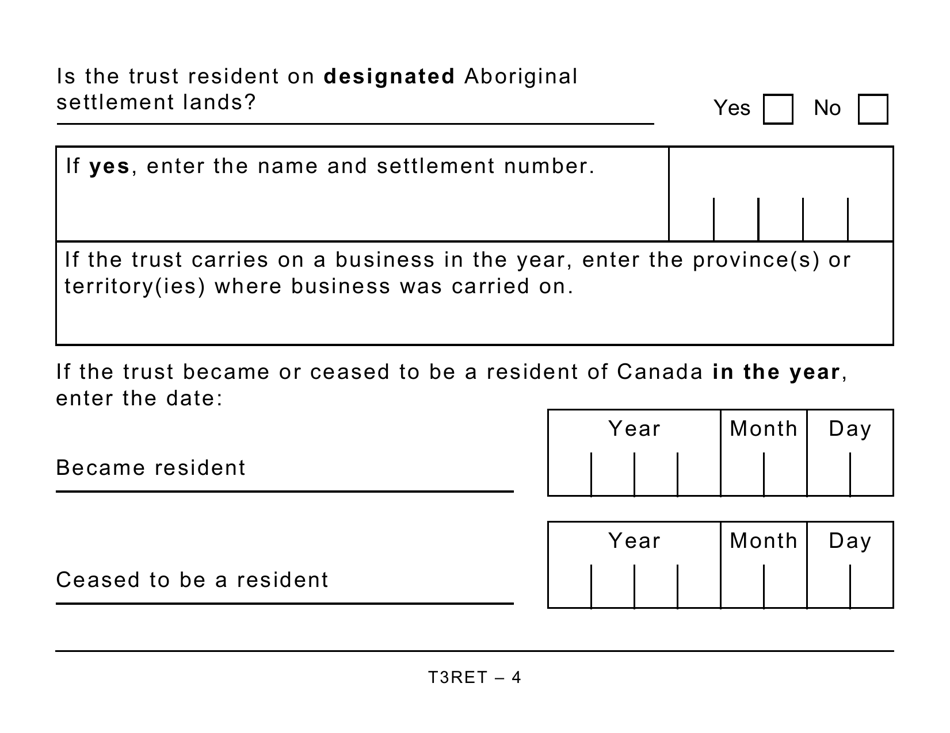

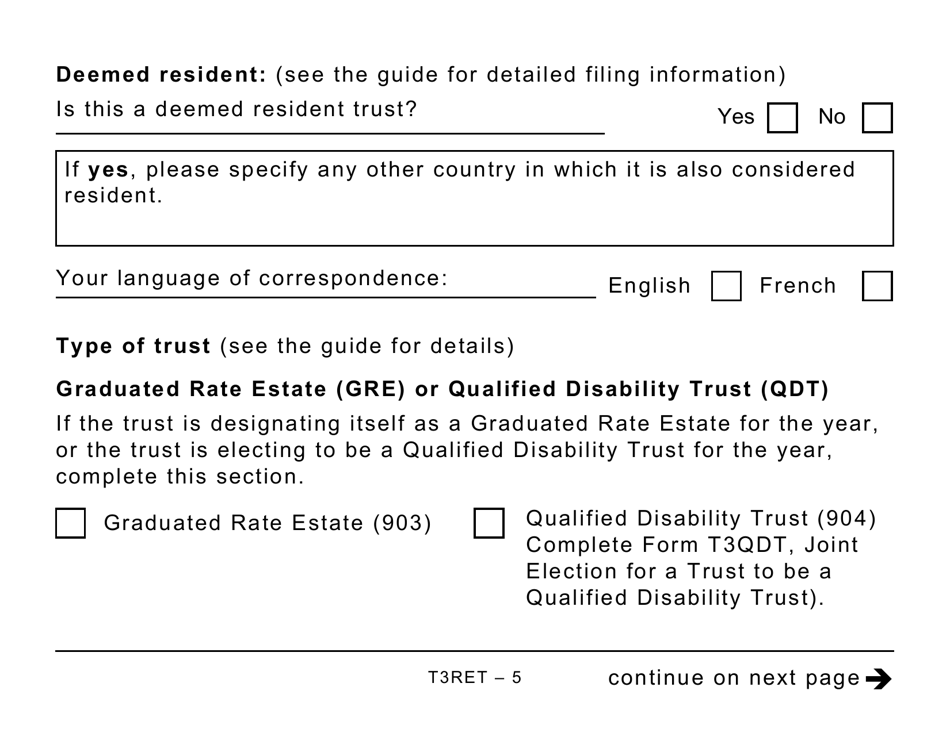

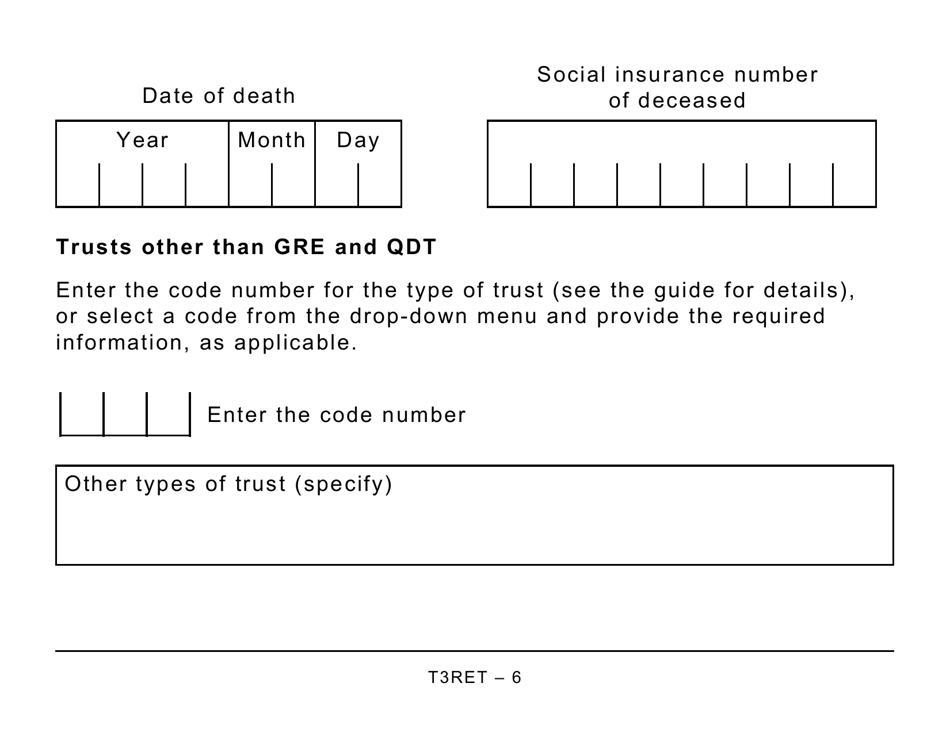

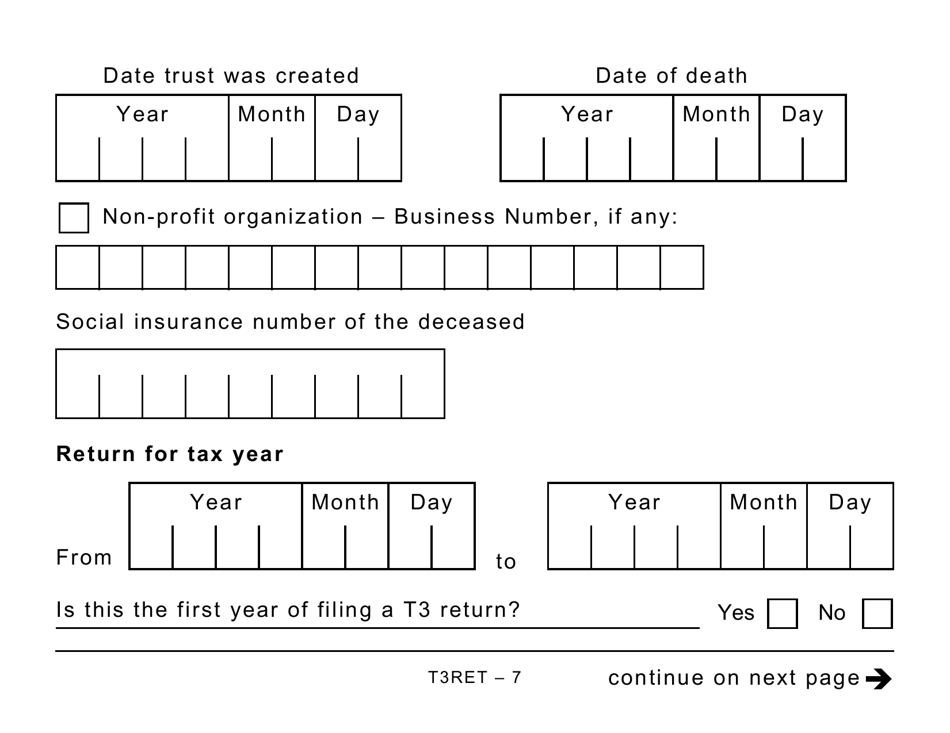

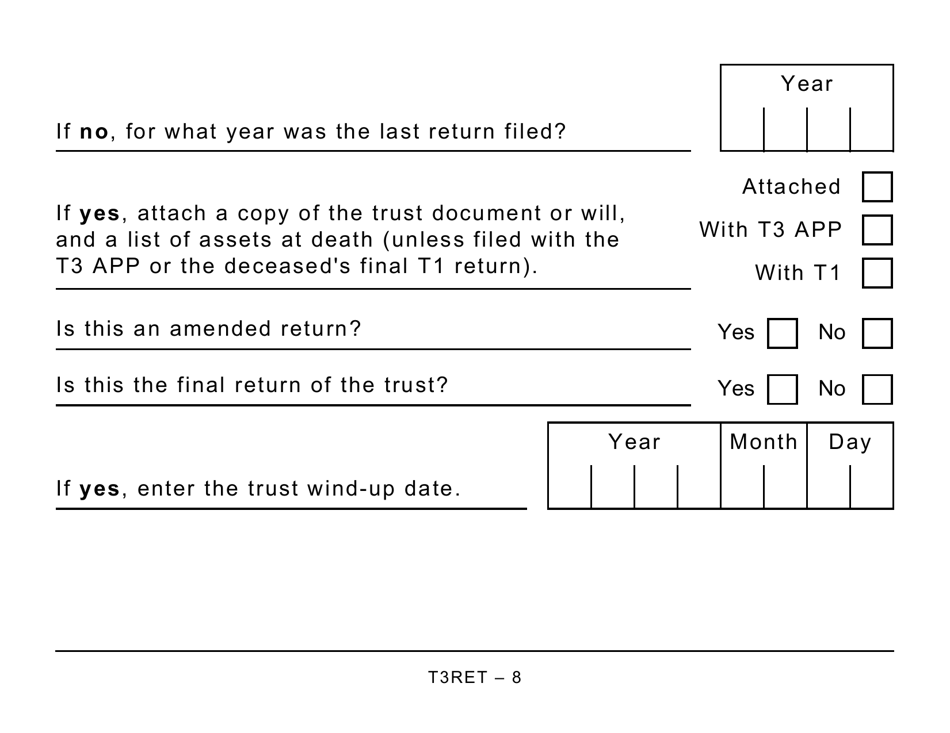

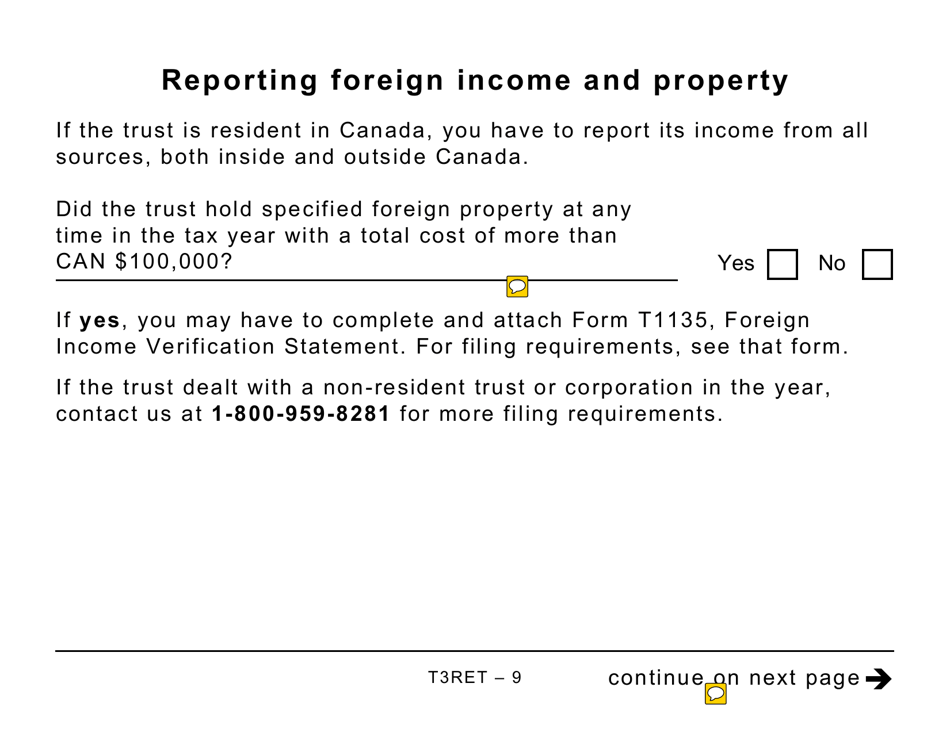

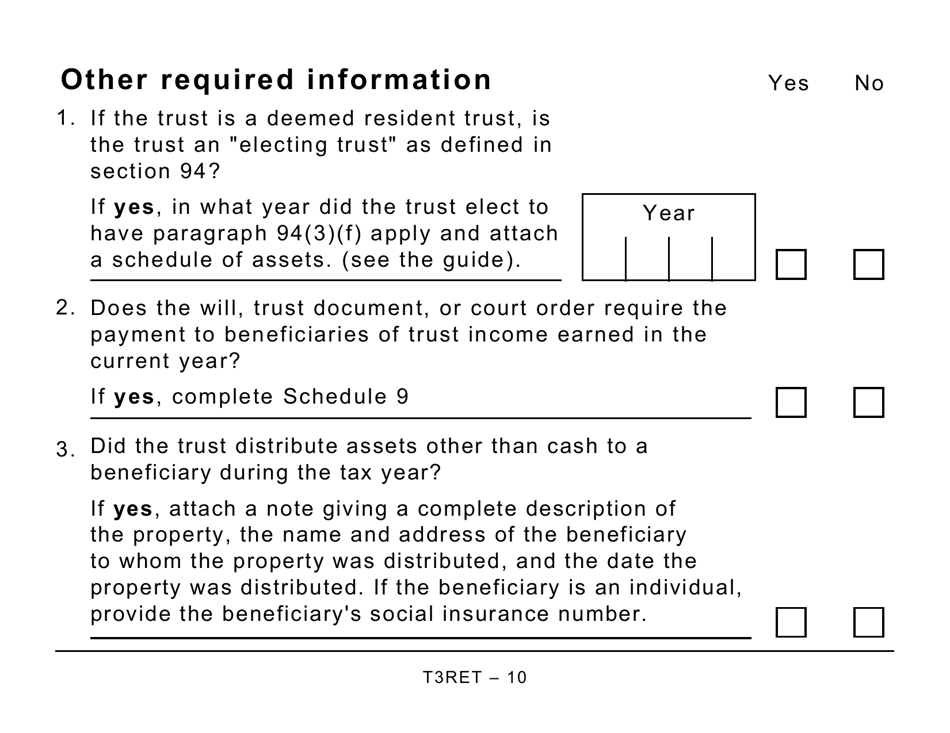

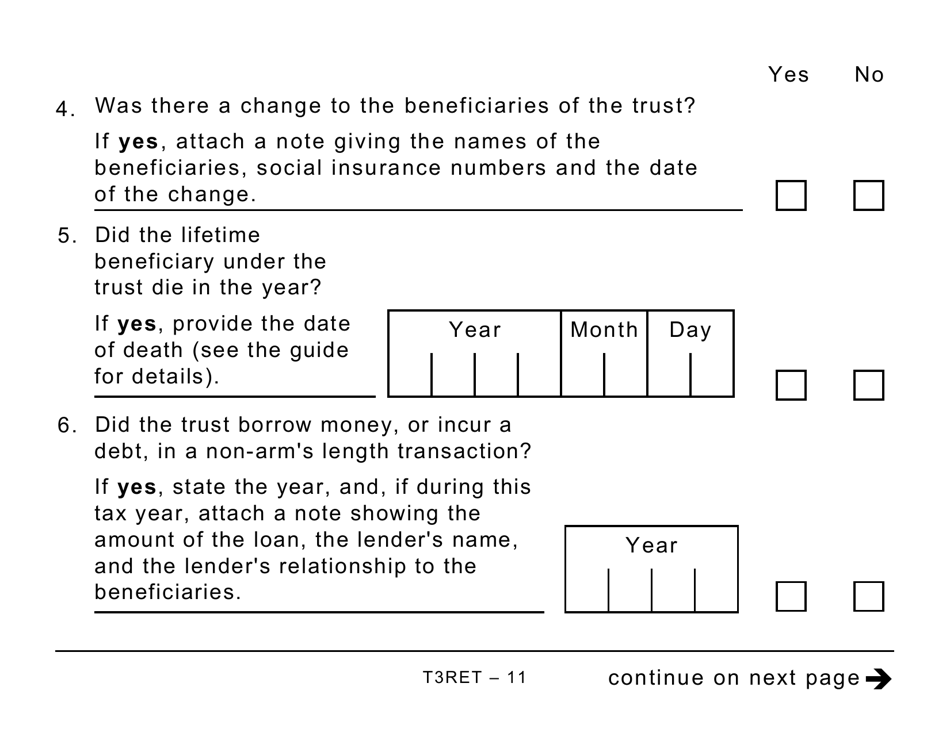

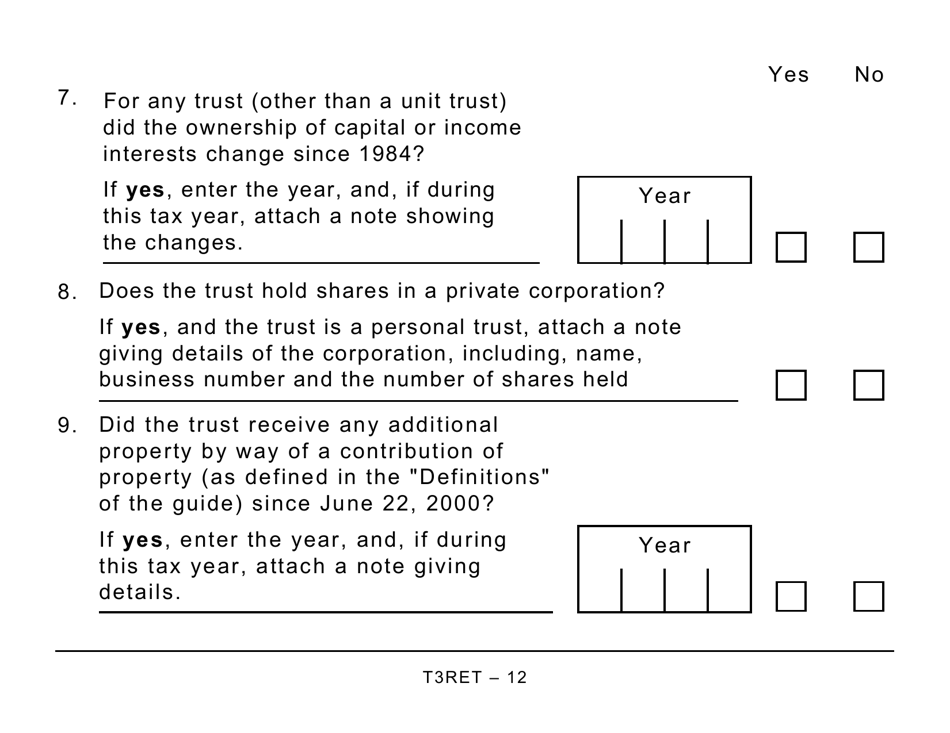

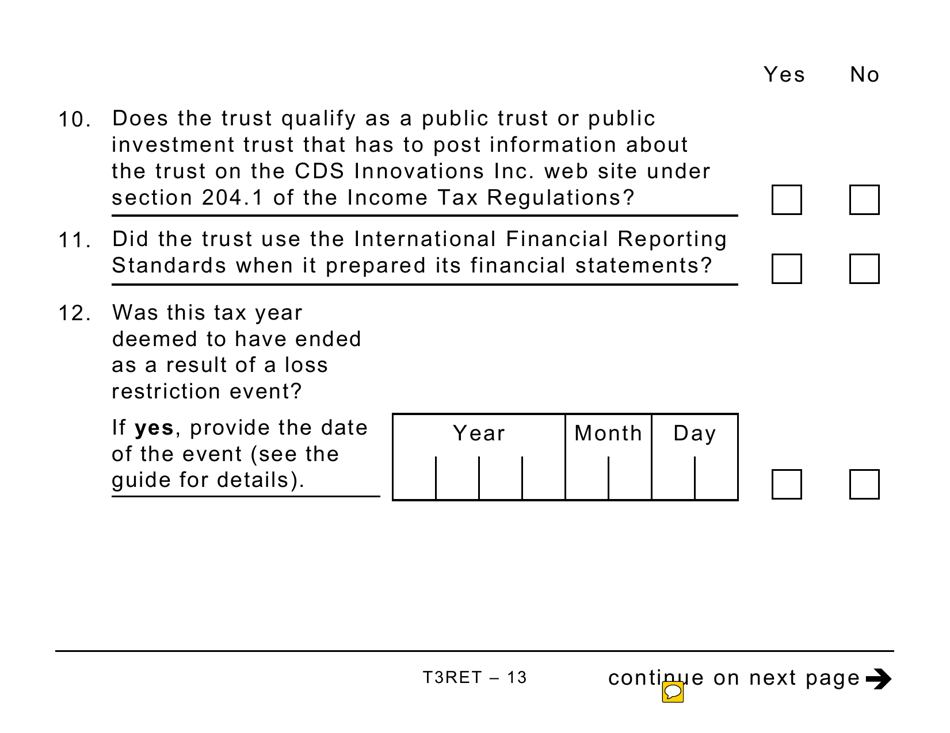

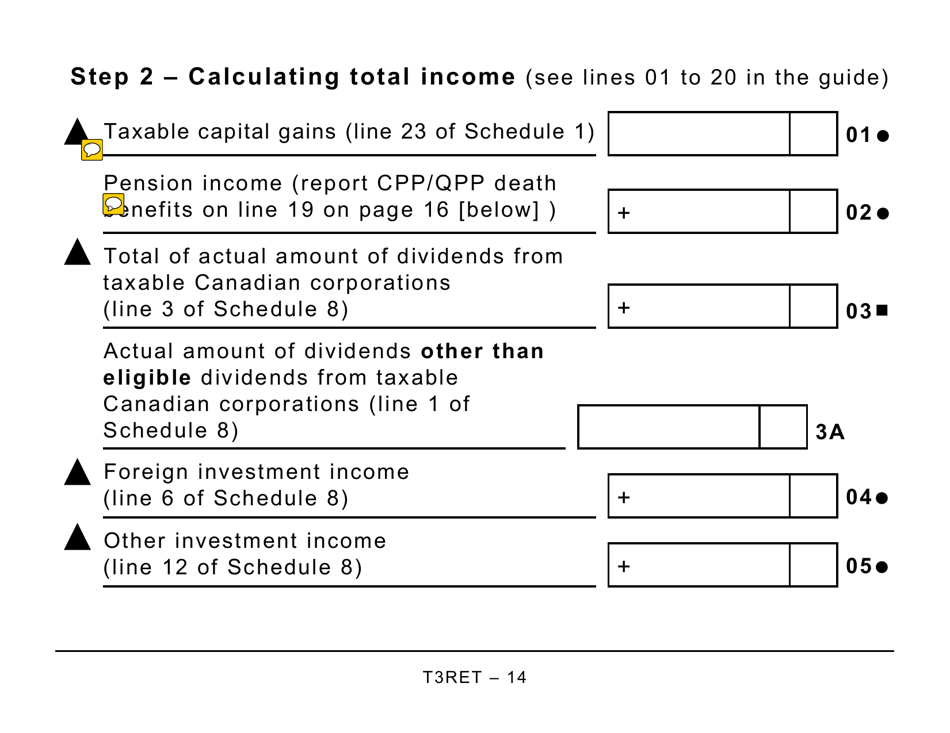

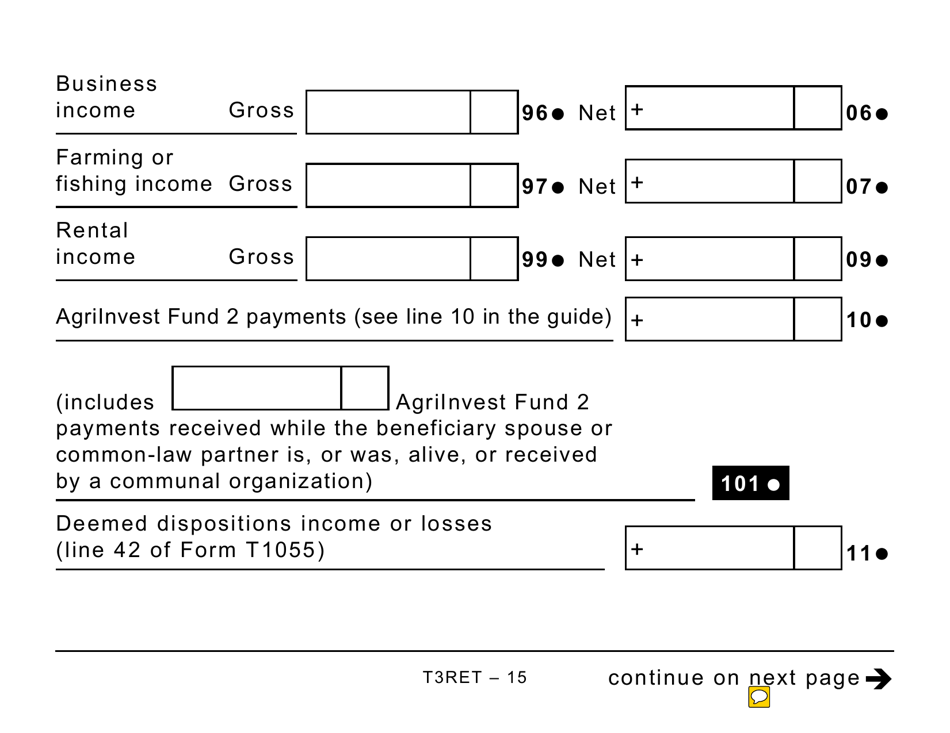

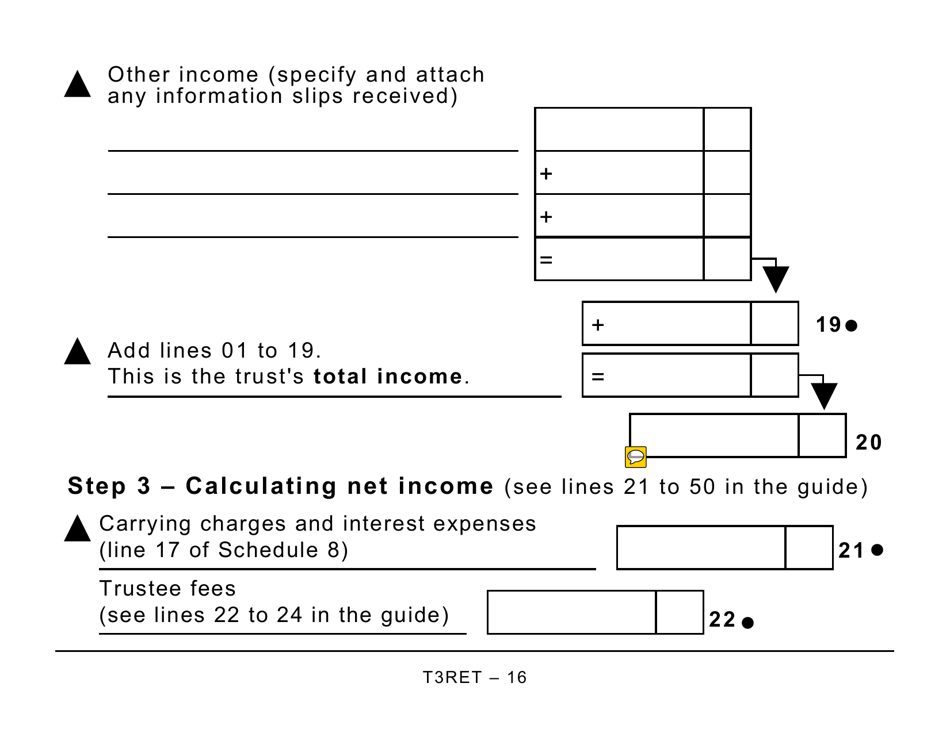

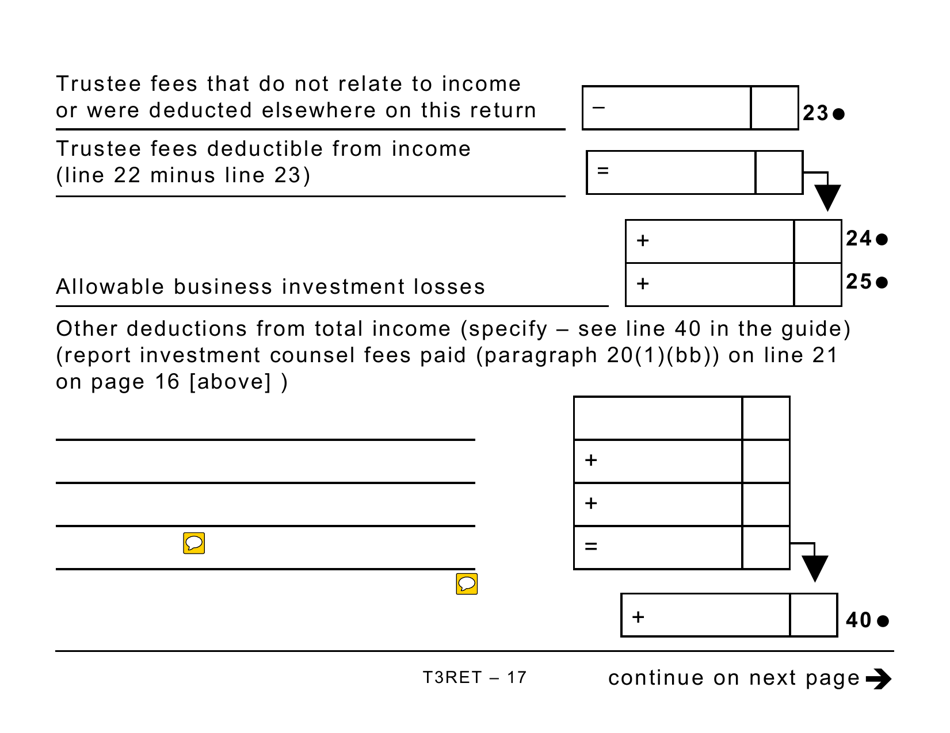

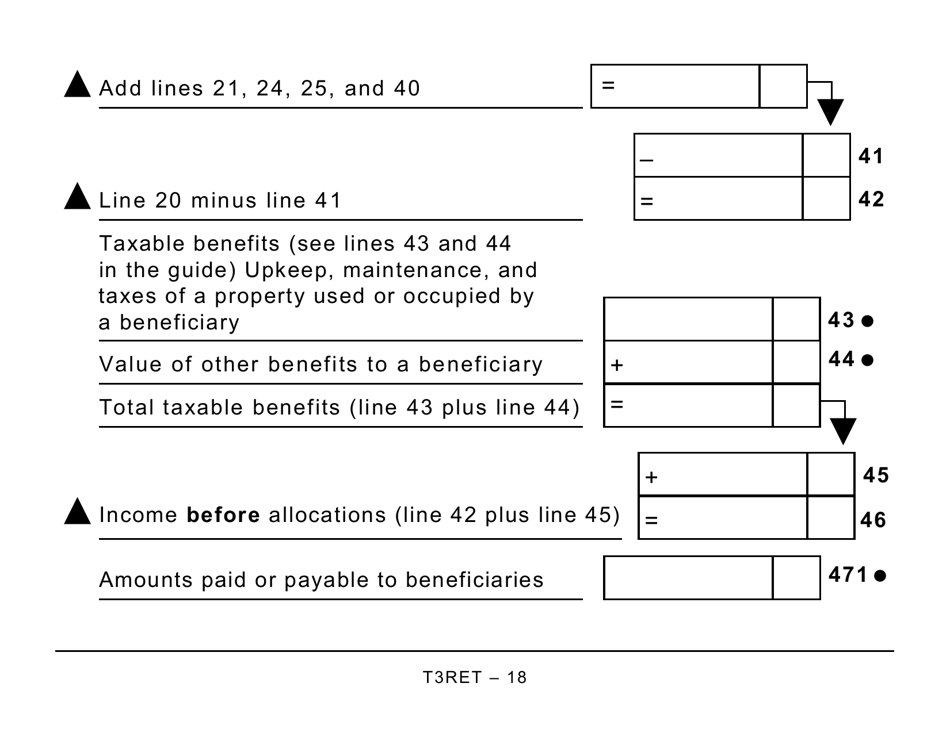

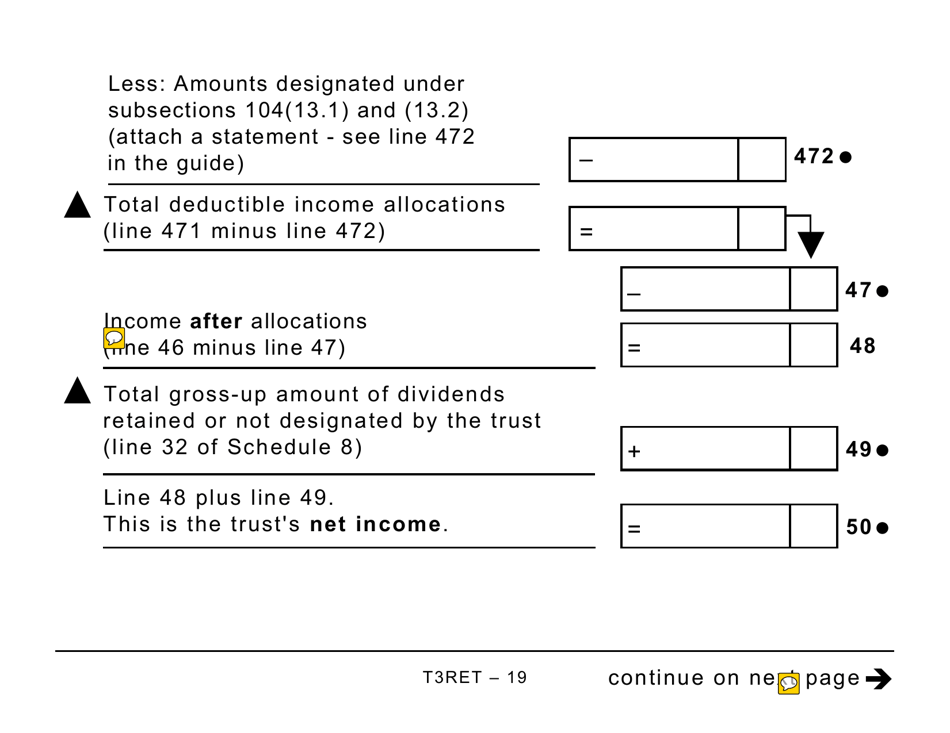

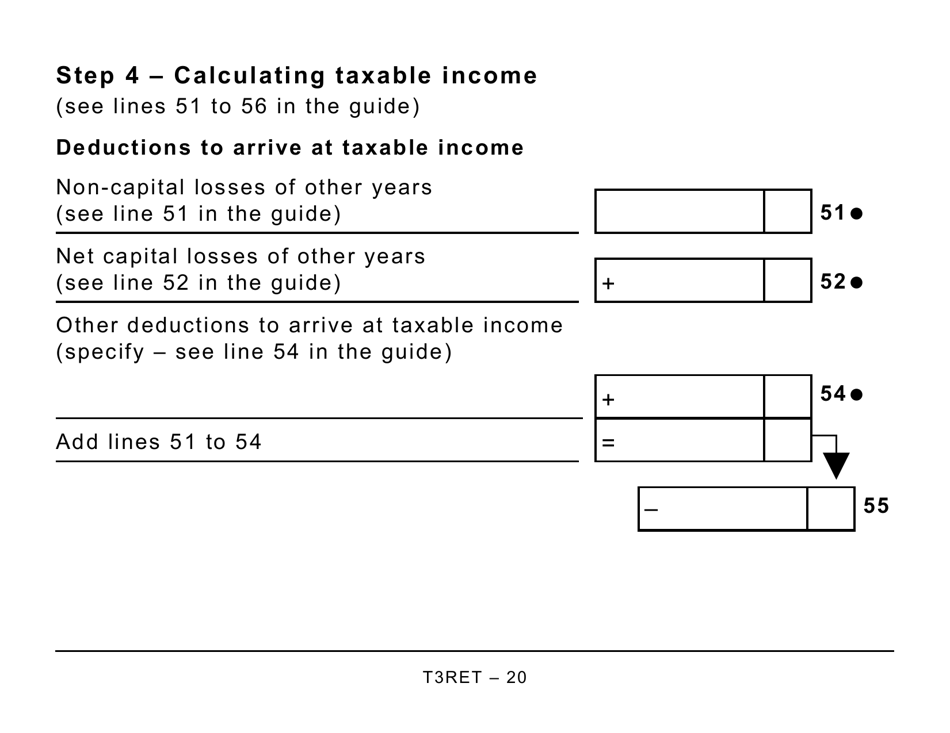

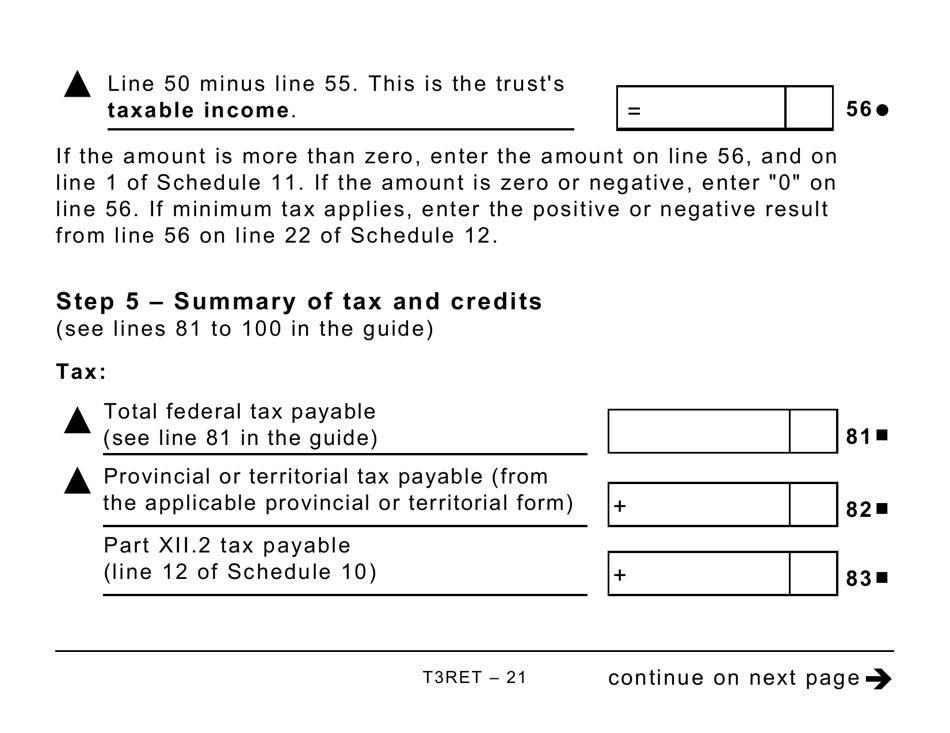

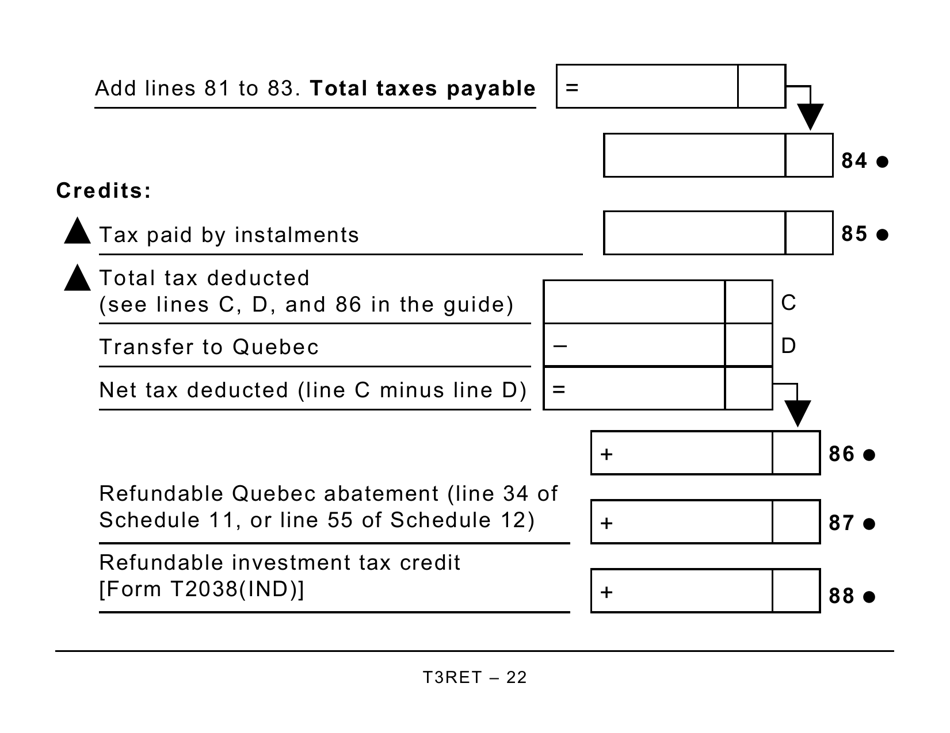

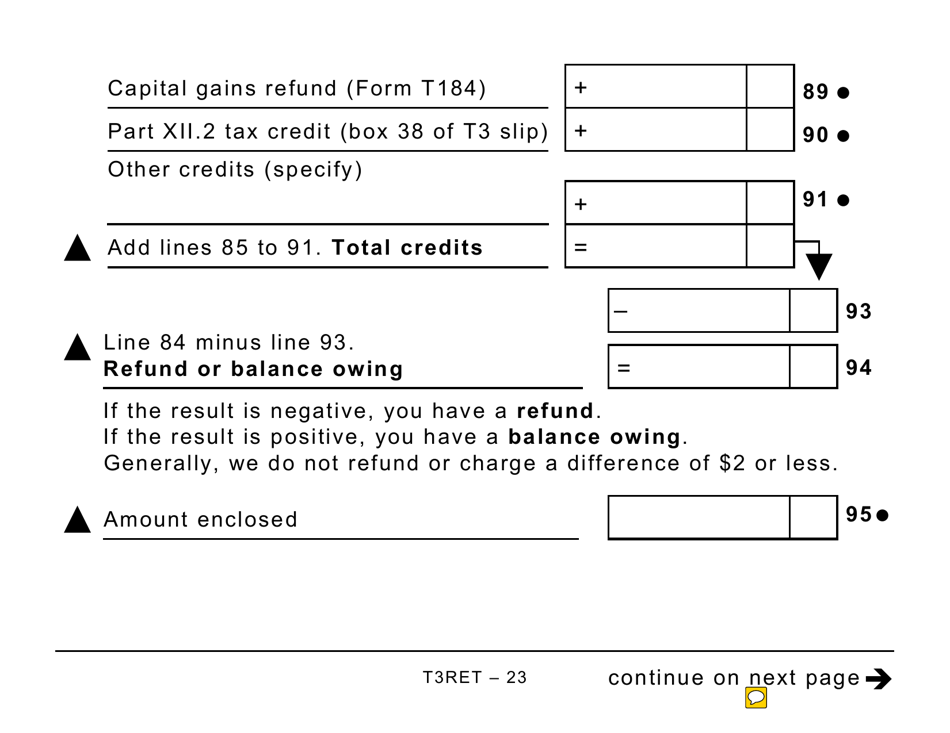

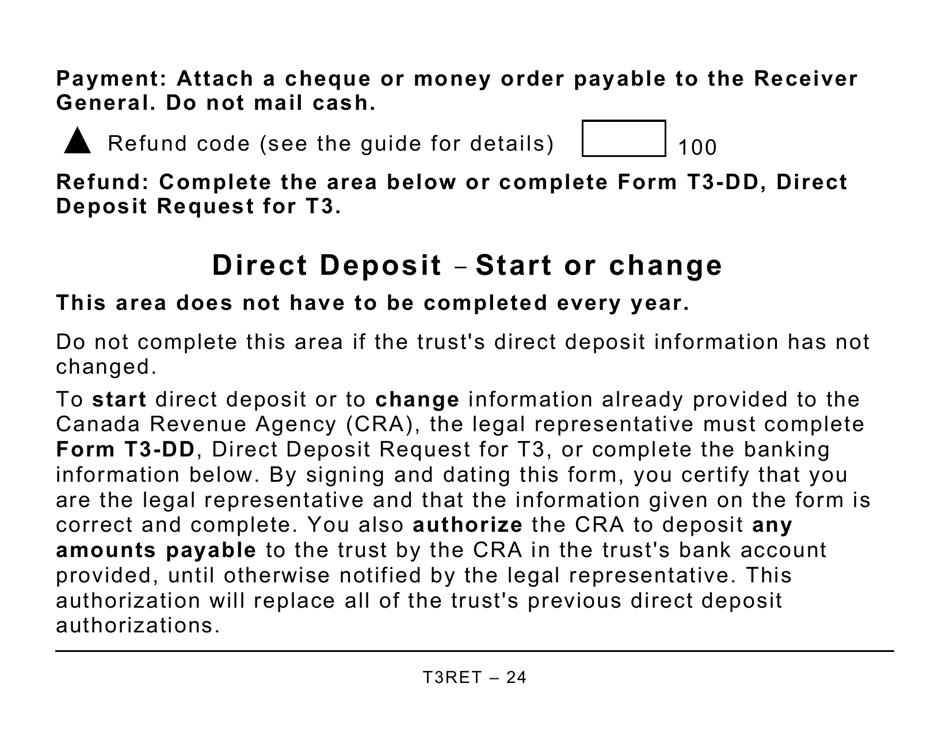

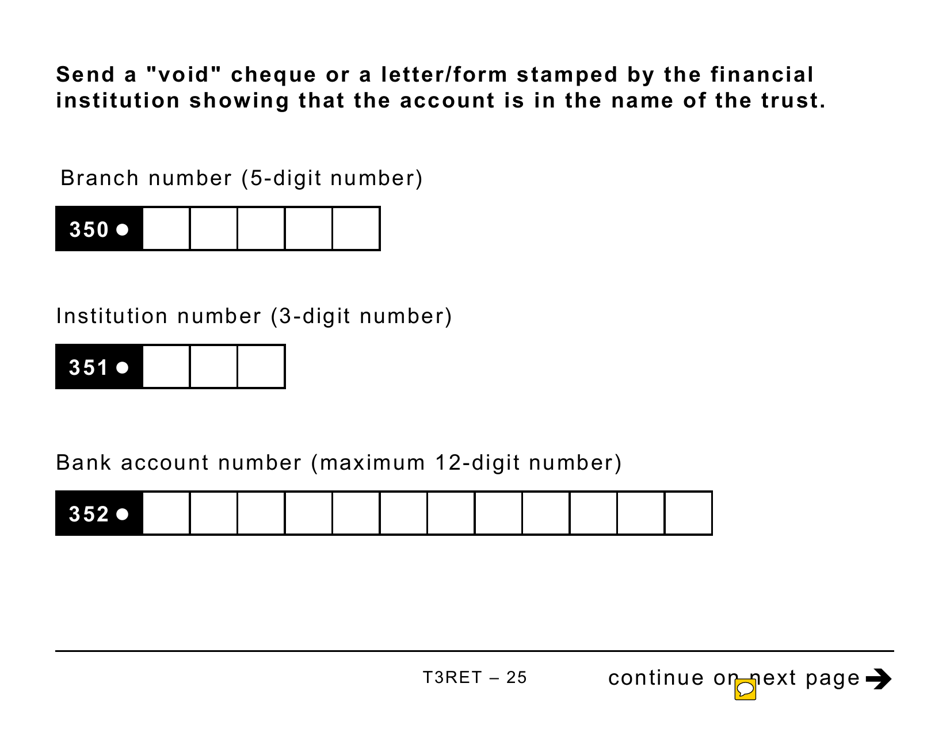

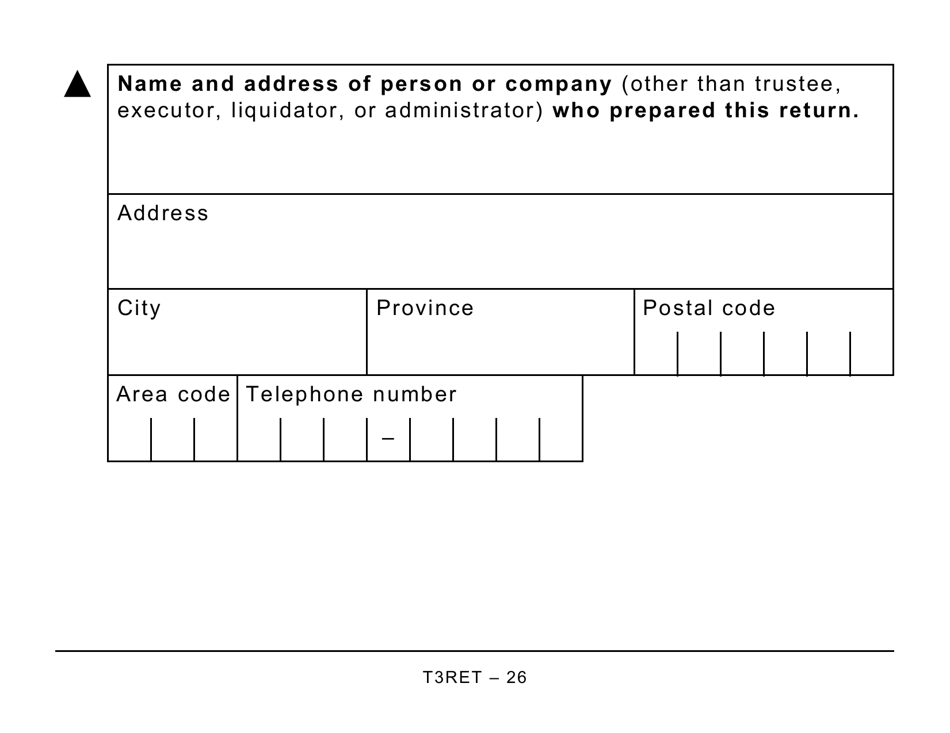

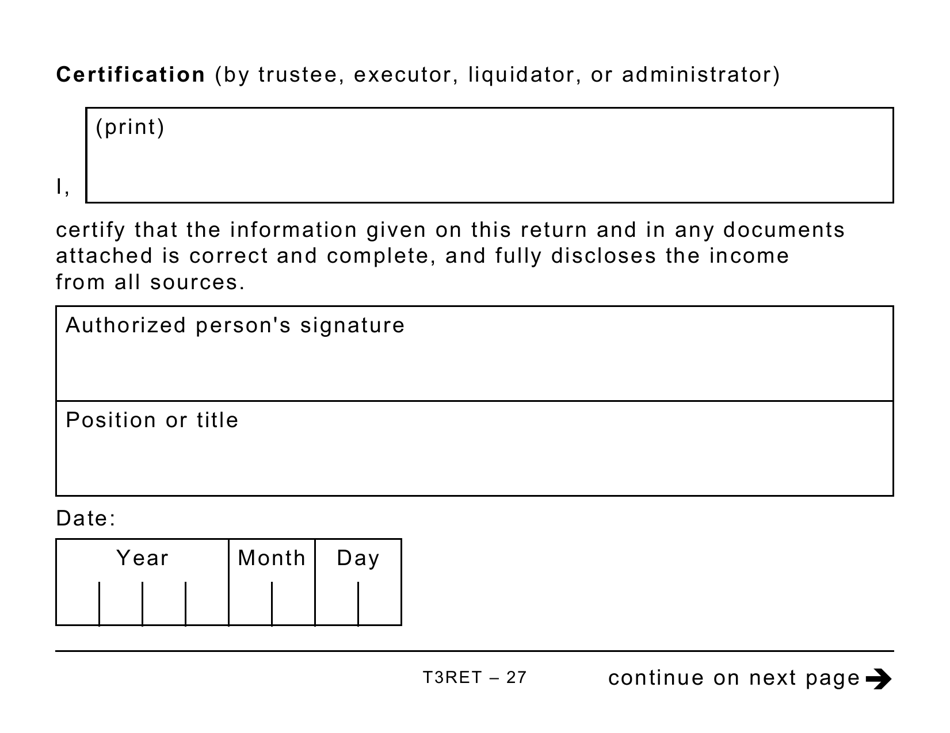

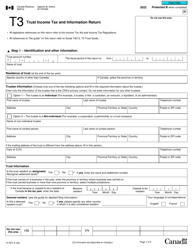

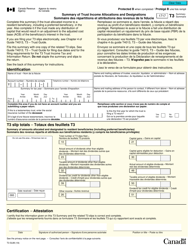

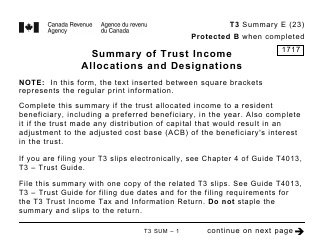

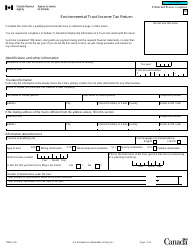

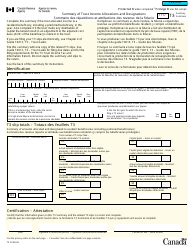

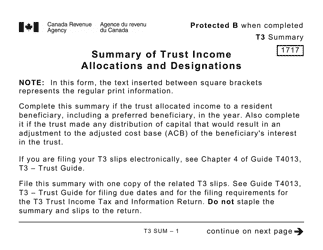

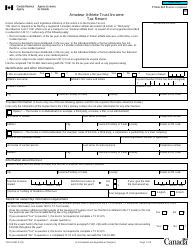

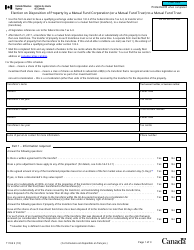

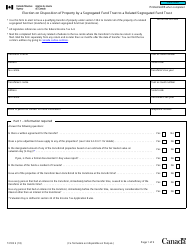

Form T3RET Trust Income Tax and Information Return (Large Print) - Canada

Form T3RET Trust Income Tax and Information Return (Large Print) in Canada is used for reporting the income and tax information of a trust. It is specifically for trusts that require a print size larger than the standard form size.

The Form T3RET Trust Income Tax and Information Return (Large Print) in Canada is usually filed by the trustee of the trust.

FAQ

Q: What is Form T3RET?

A: Form T3RET is the Trust Income Tax and Information Return form in Canada.

Q: Who needs to file Form T3RET?

A: Trusts in Canada that have income or taxable capital gains must file Form T3RET.

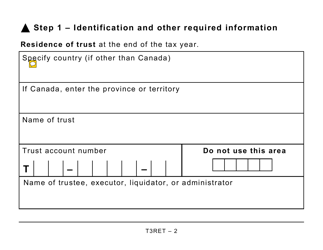

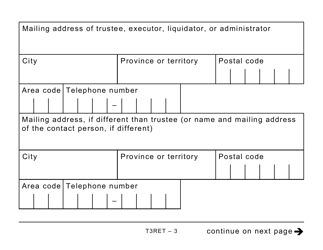

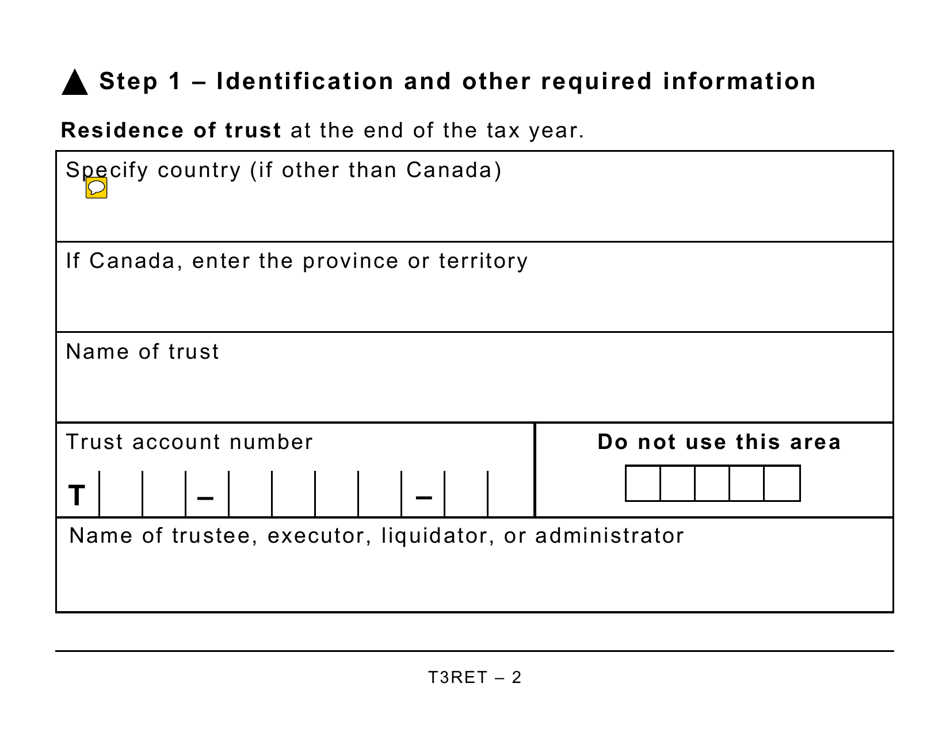

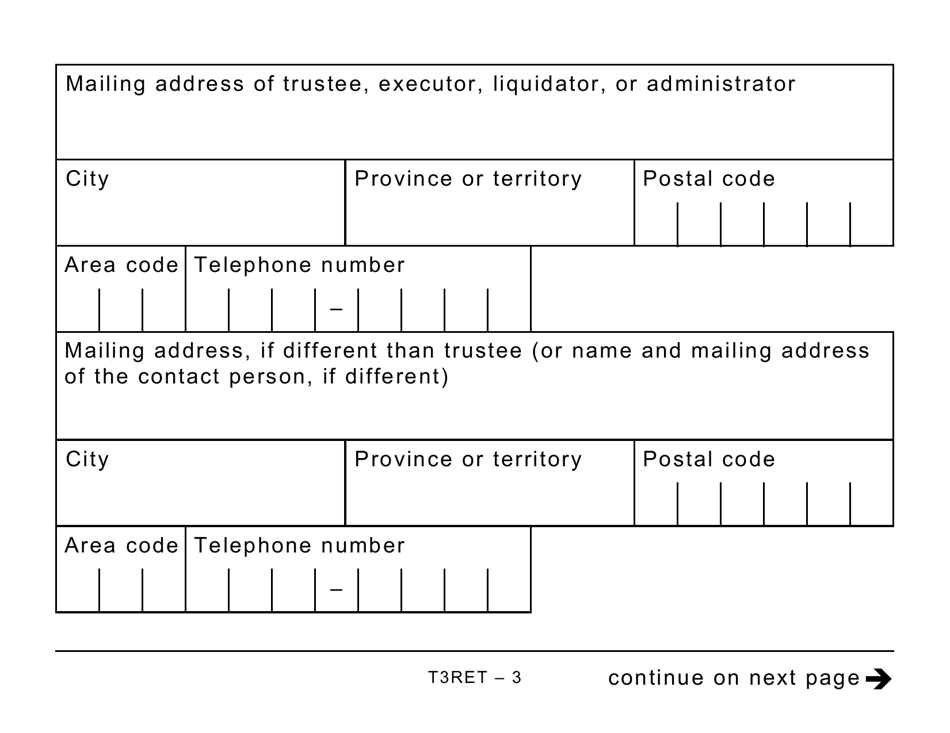

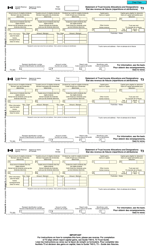

Q: What information is required on Form T3RET?

A: Form T3RET requires information about the trust's income, expenses, deductions, and tax liability.

Q: Is Form T3RET available in large print?

A: Yes, Form T3RET is available in large print for individuals with visual impairments.

Q: Is there a deadline to file Form T3RET?

A: Yes, the deadline to file Form T3RET is typically 90 days after the end of the trust's taxation year.

Q: Are there any penalties for late filing of Form T3RET?

A: Yes, there are penalties for late filing of Form T3RET, including possible late-filing penalties and interest charges.

Q: Do I need to provide supporting documents with Form T3RET?

A: Yes, you may need to provide supporting documents such as financial statements, receipts, and other relevant records.

Q: Can I file Form T3RET electronically?

A: Yes, you can file Form T3RET electronically through the CRA's My Account service or using certified tax software.

Q: Are there any specific instructions for completing Form T3RET?

A: Yes, the CRA provides instructions and guides to help you complete Form T3RET accurately.