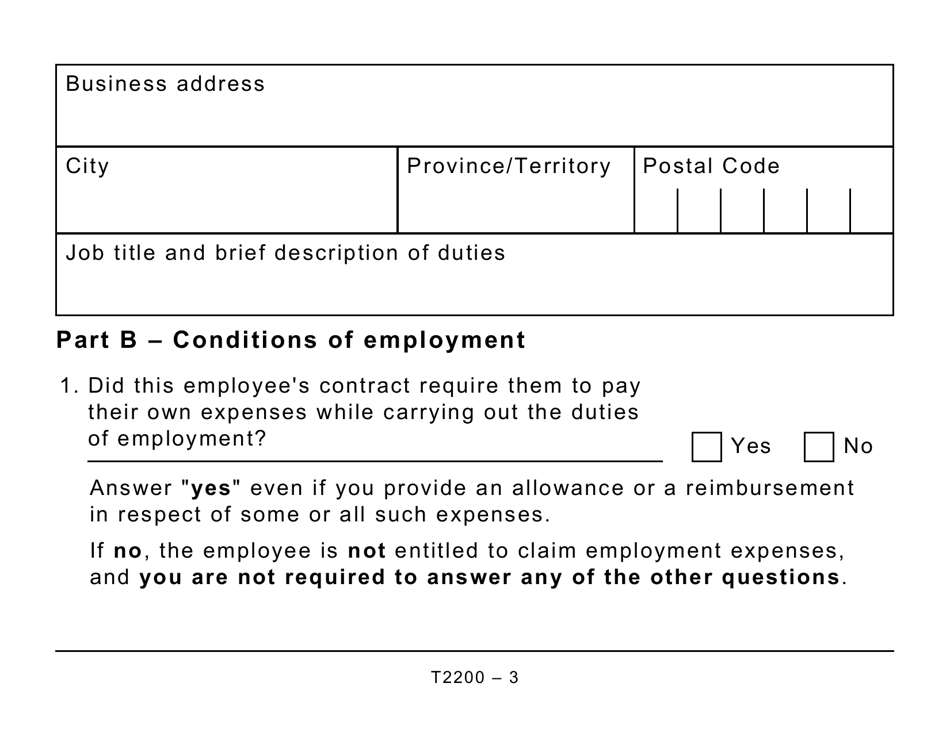

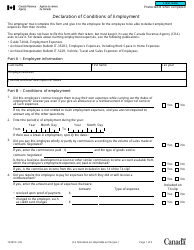

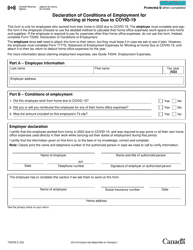

Form T2200 Declaration of Conditions of Employment - Large Print - Canada

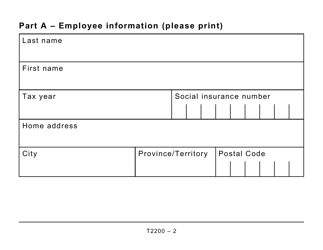

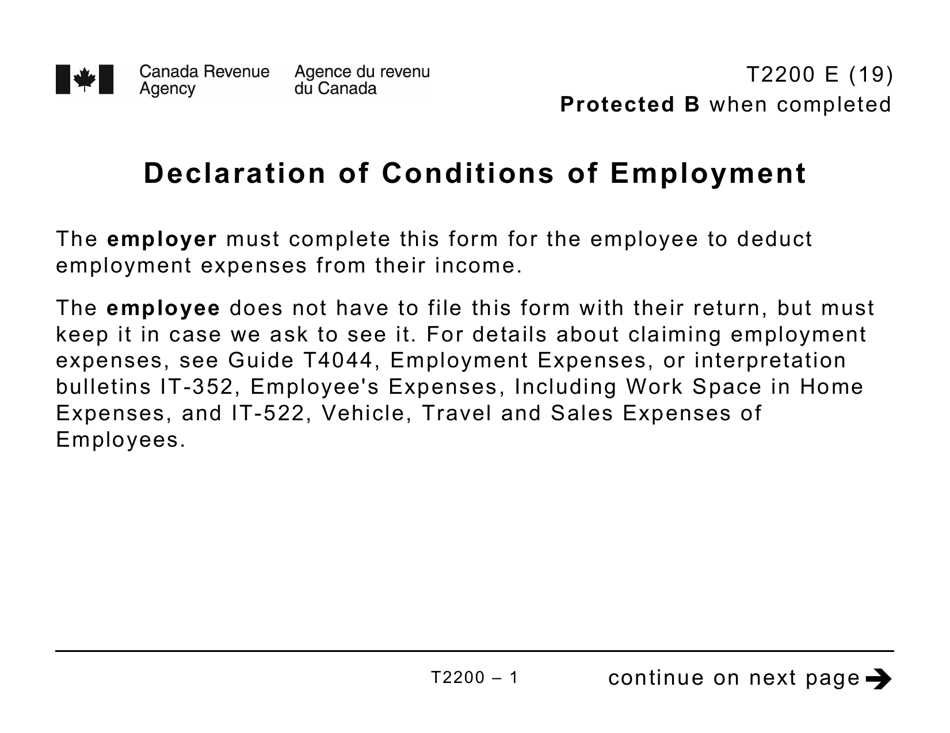

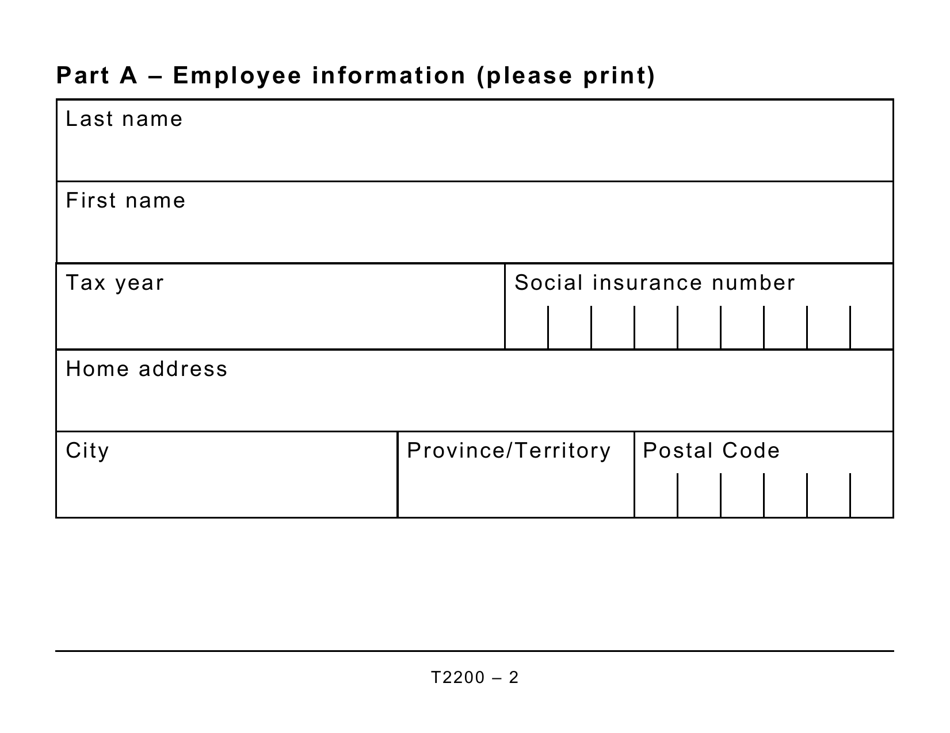

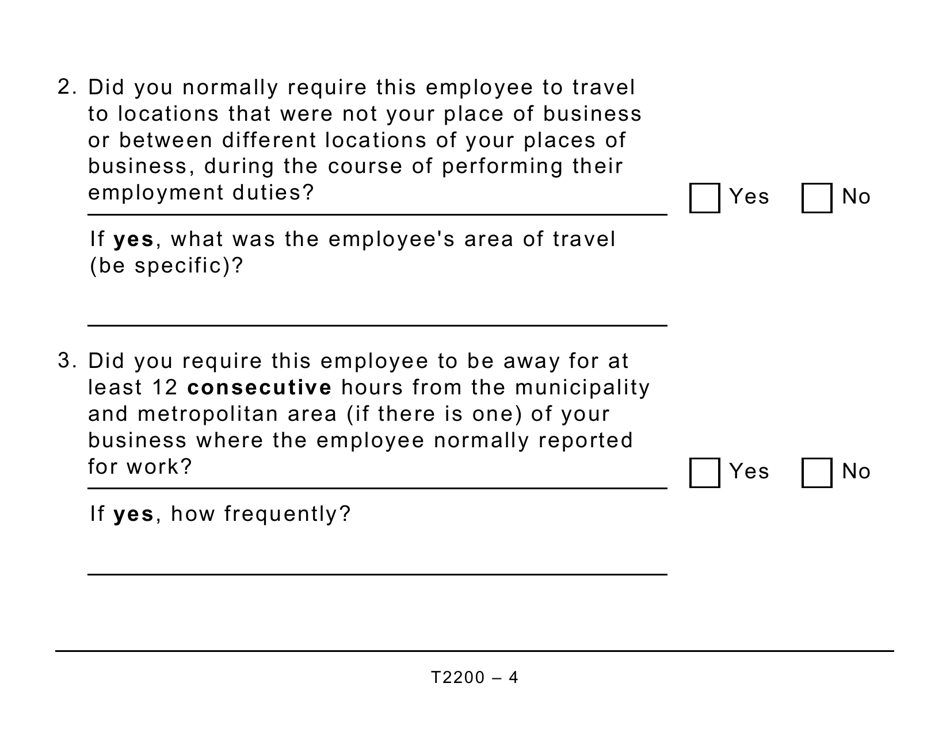

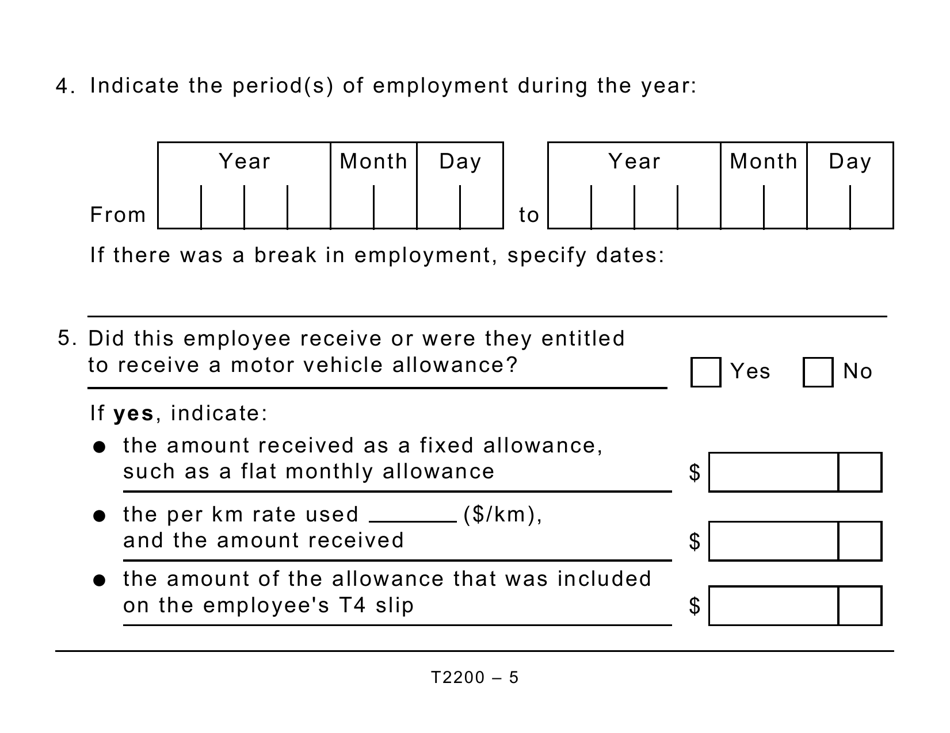

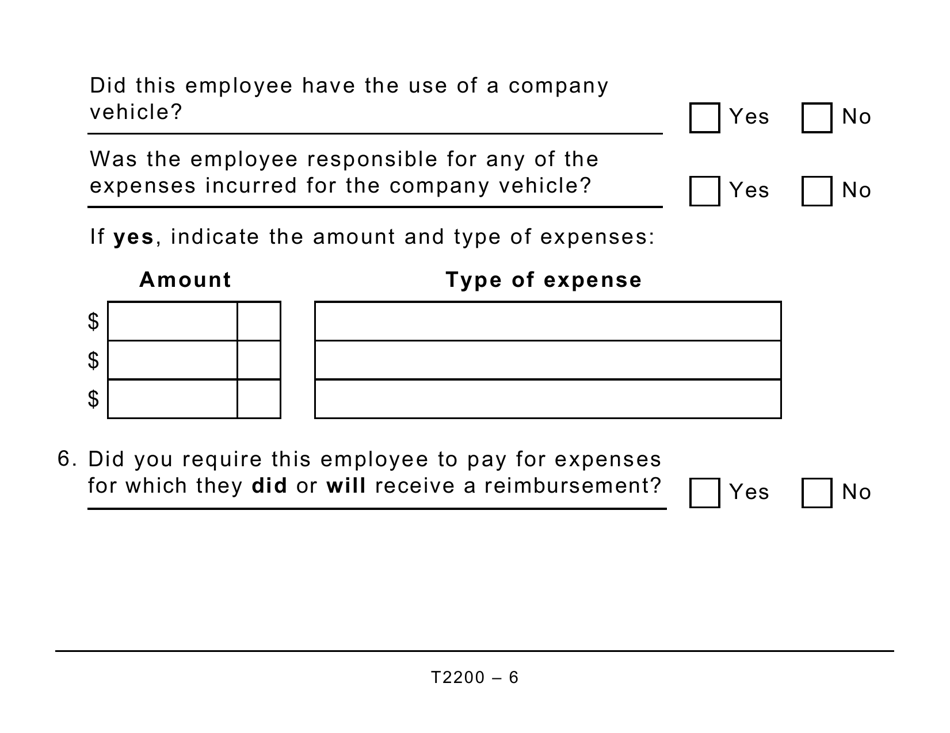

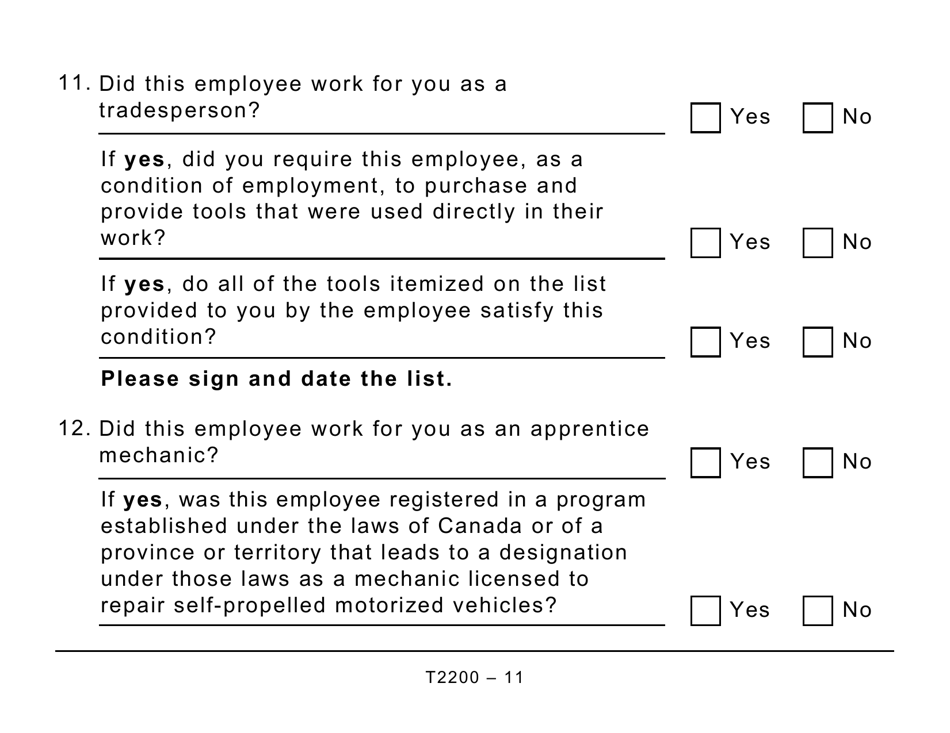

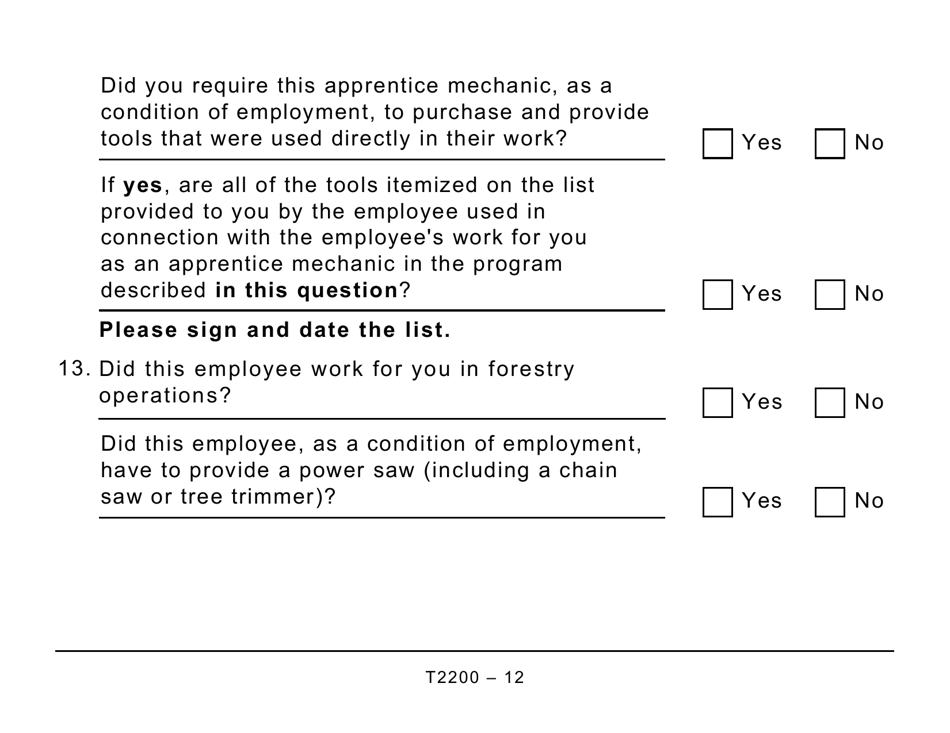

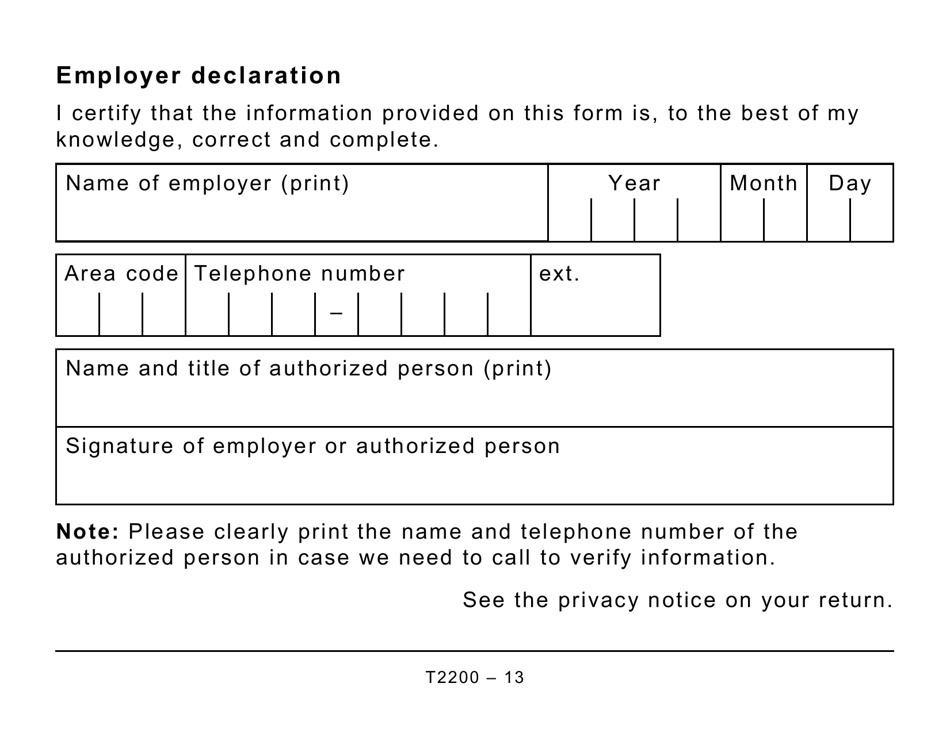

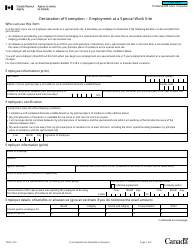

Form T2200 Declaration of Conditions of Employment - Large Print - Canada is a form used by employees in Canada to declare their eligibility for certain employment-related expenses, which can be deducted from their income tax. The large print version is designed to assist individuals with visual impairments. It allows employees to provide information about the expenses they incurred while carrying out the duties of their employment that were not reimbursed by their employer. The form is then submitted to the Canada Revenue Agency (CRA) along with the employee's income tax return.

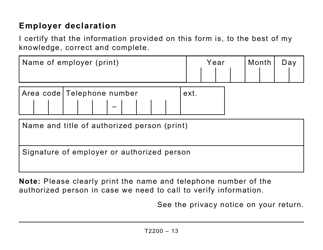

The Form T2200 Declaration of Conditions of Employment - Large Print in Canada is typically filed by employees who are required to deduct employment expenses from their income taxes. It should be completed and signed by the employer.

FAQ

Q: What is Form T2200?

A: Form T2200 is a declaration of conditions of employment in Canada.

Q: Who needs to fill out Form T2200?

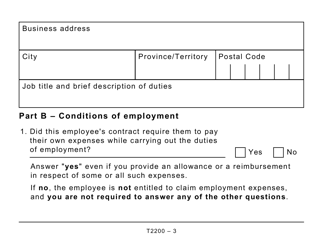

A: Employees who incur employment expenses that are not reimbursed by their employer may need to fill out Form T2200.

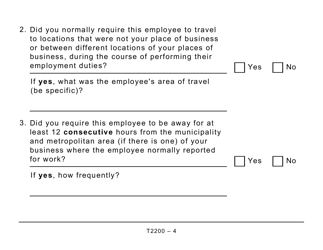

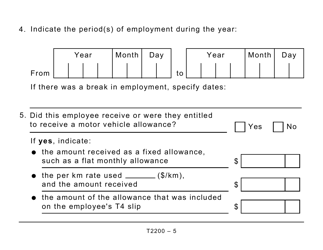

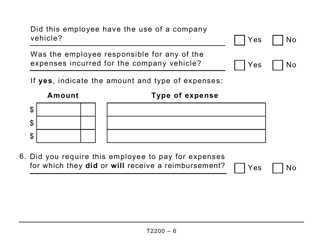

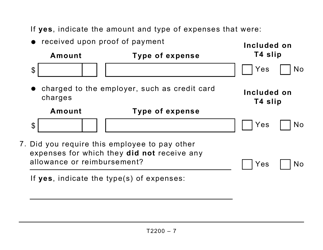

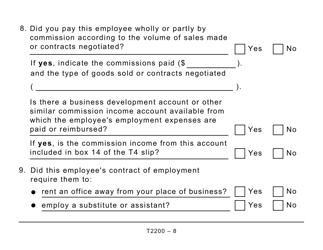

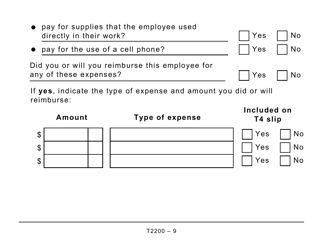

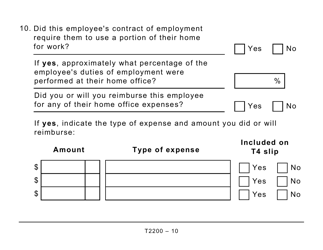

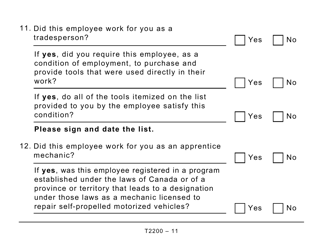

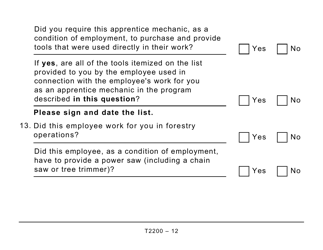

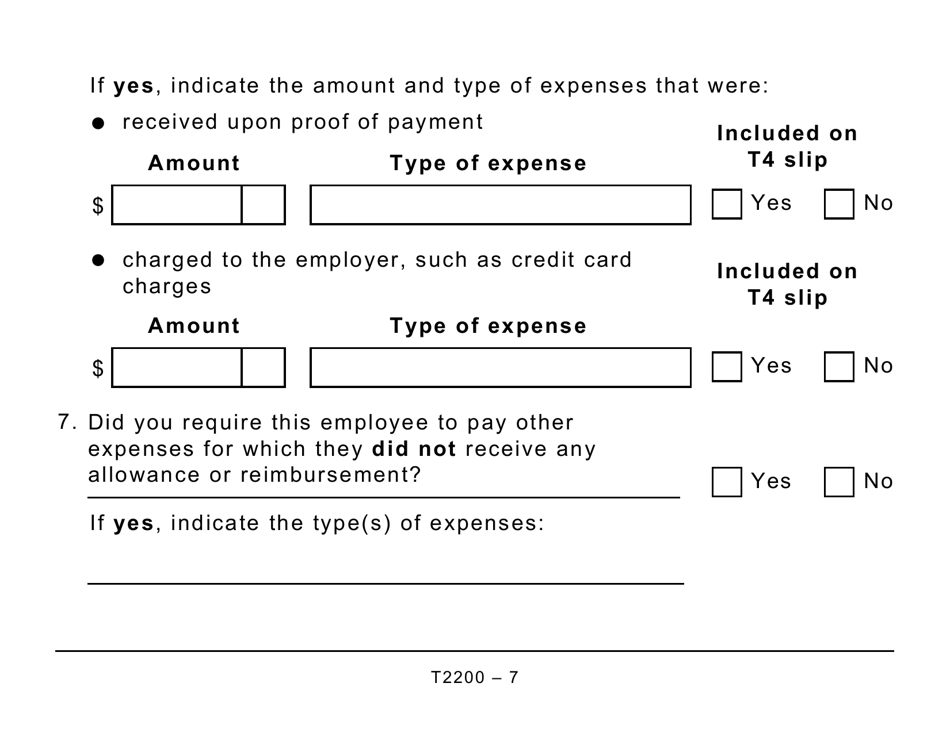

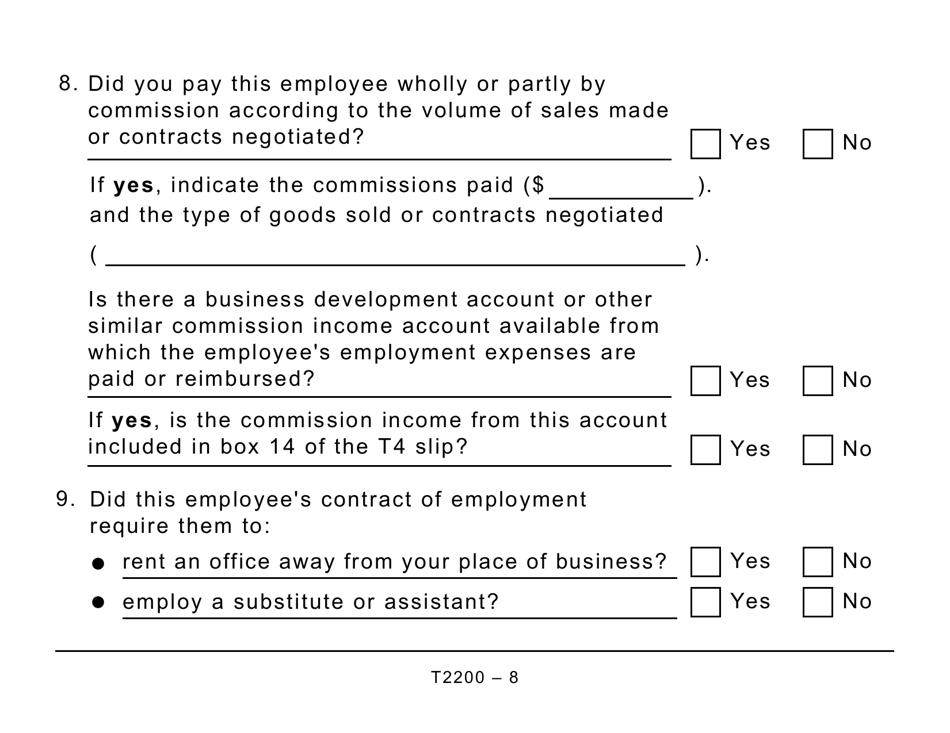

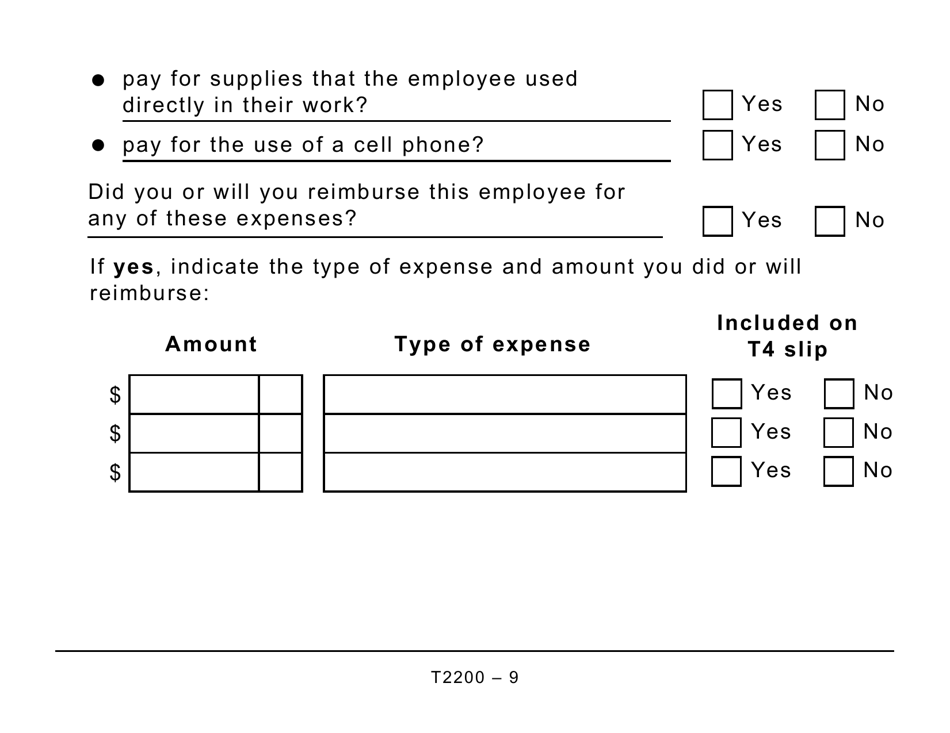

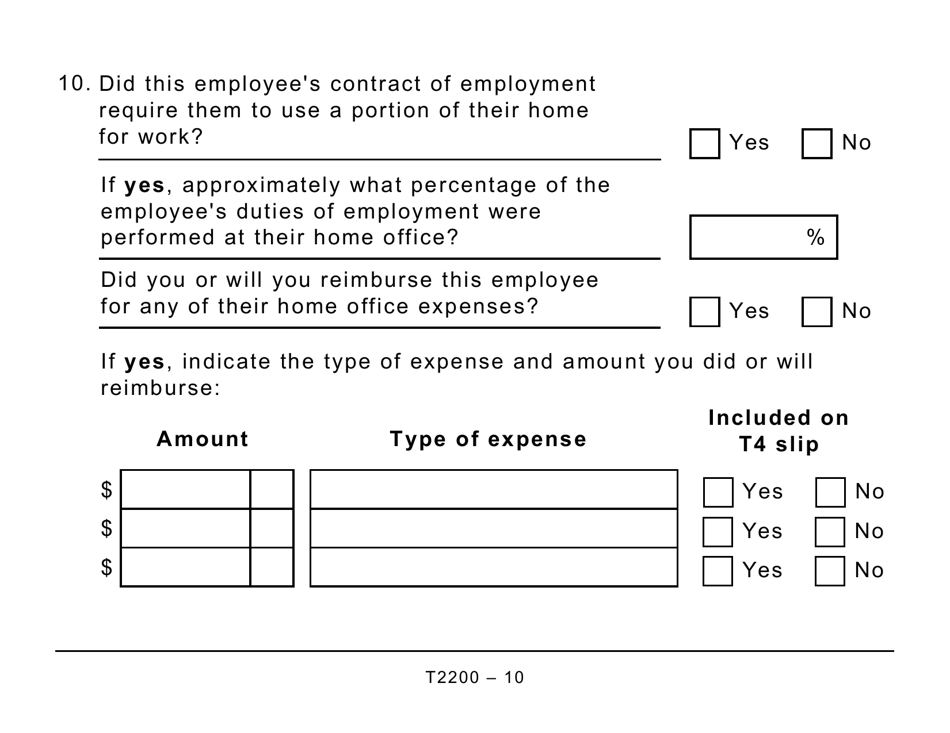

Q: What expenses can be claimed on Form T2200?

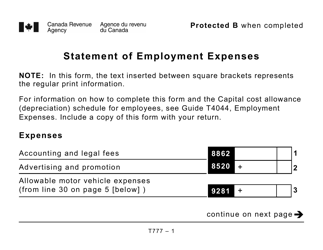

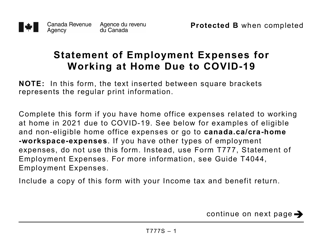

A: Expenses related to employment conditions, such as vehicle expenses, home office expenses, and supplies, can be claimed on Form T2200.

Q: When should Form T2200 be filled out?

A: Form T2200 should be filled out for each tax year that you incur eligible employment expenses.

Q: Do I need to submit Form T2200 with my tax return?

A: No, you do not need to submit Form T2200 with your tax return. However, you should keep it for your records in case the CRA requests to see it.

Q: Can I claim employment expenses without Form T2200?

A: No, in order to claim employment expenses on your tax return, you generally need to have a completed and signed Form T2200 from your employer.