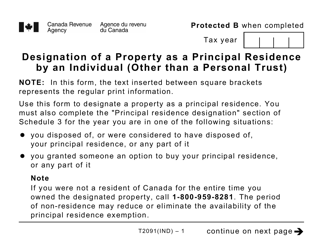

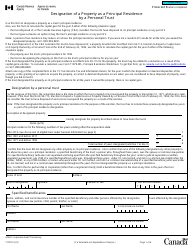

Form T2091 IND Designation of a Property as a Principal Residence by an Individual (Other Than a Personal Trust) (Large Print) - Canada

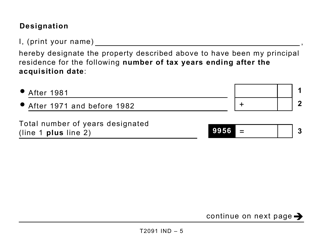

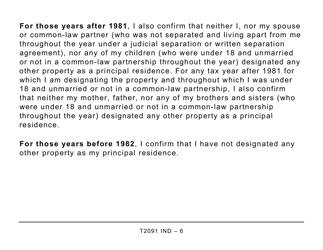

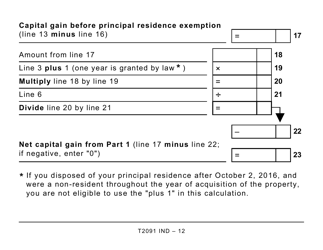

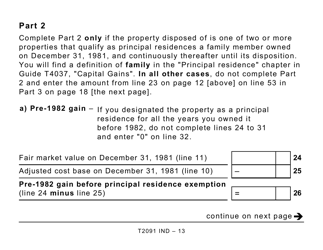

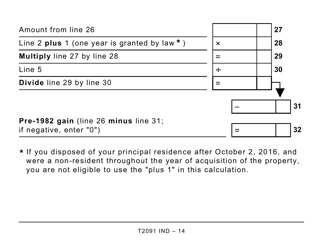

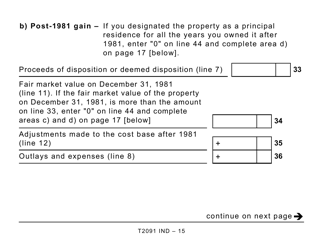

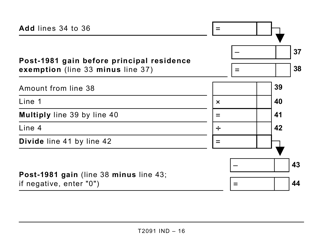

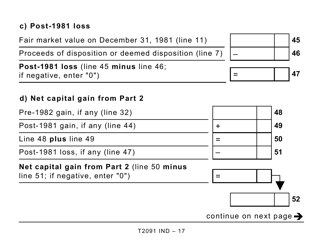

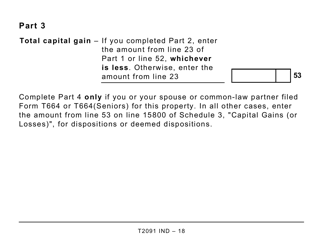

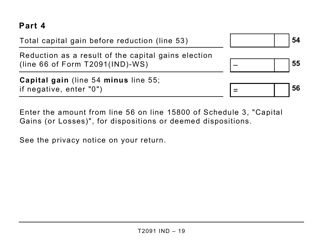

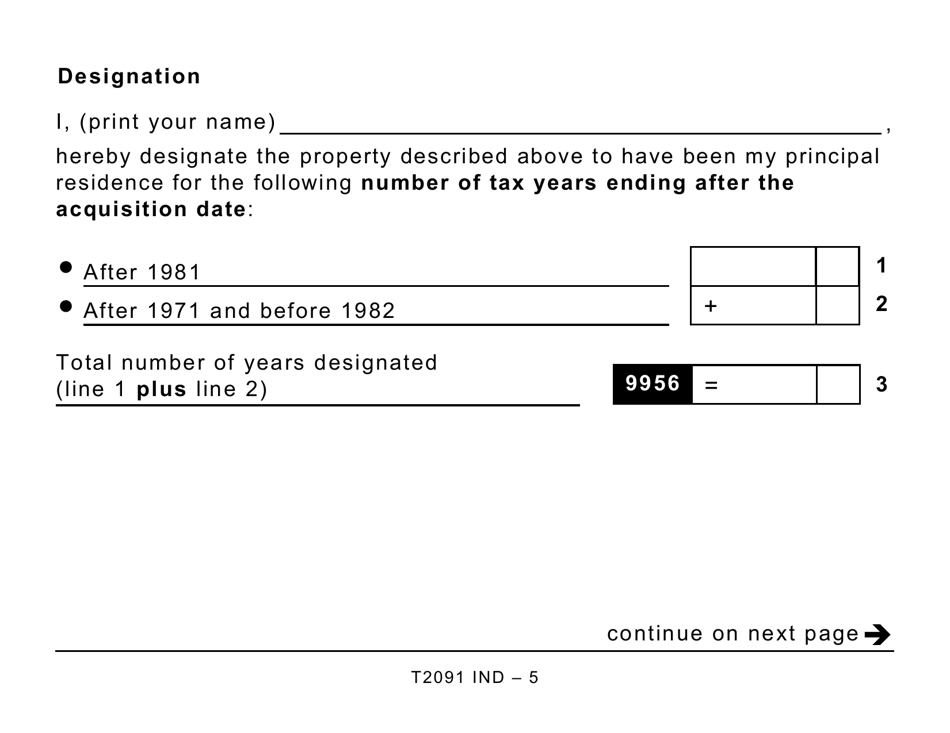

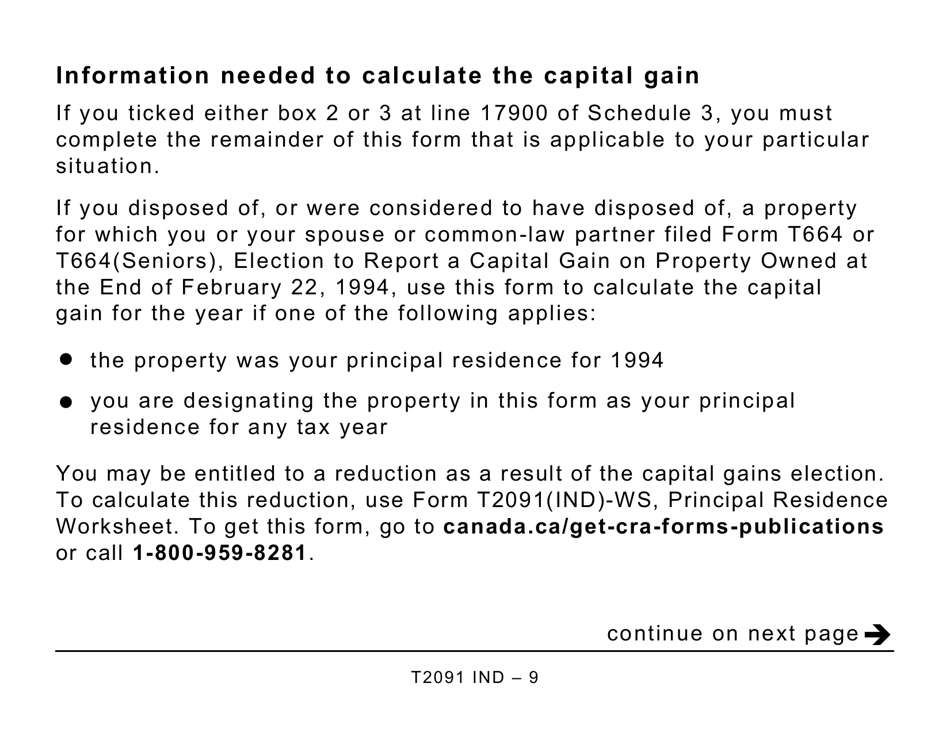

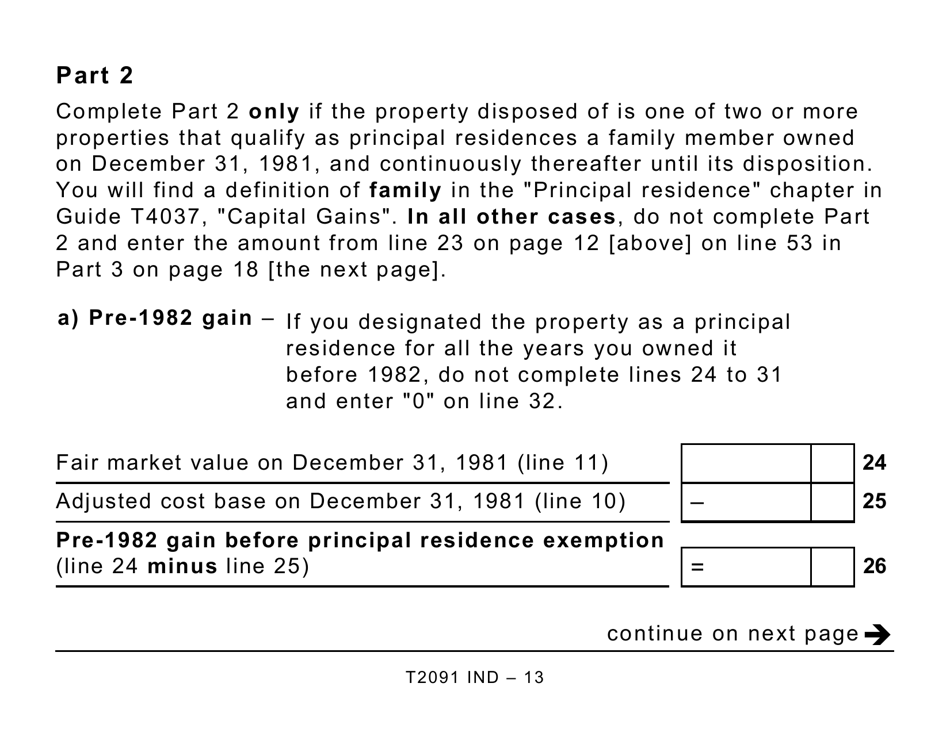

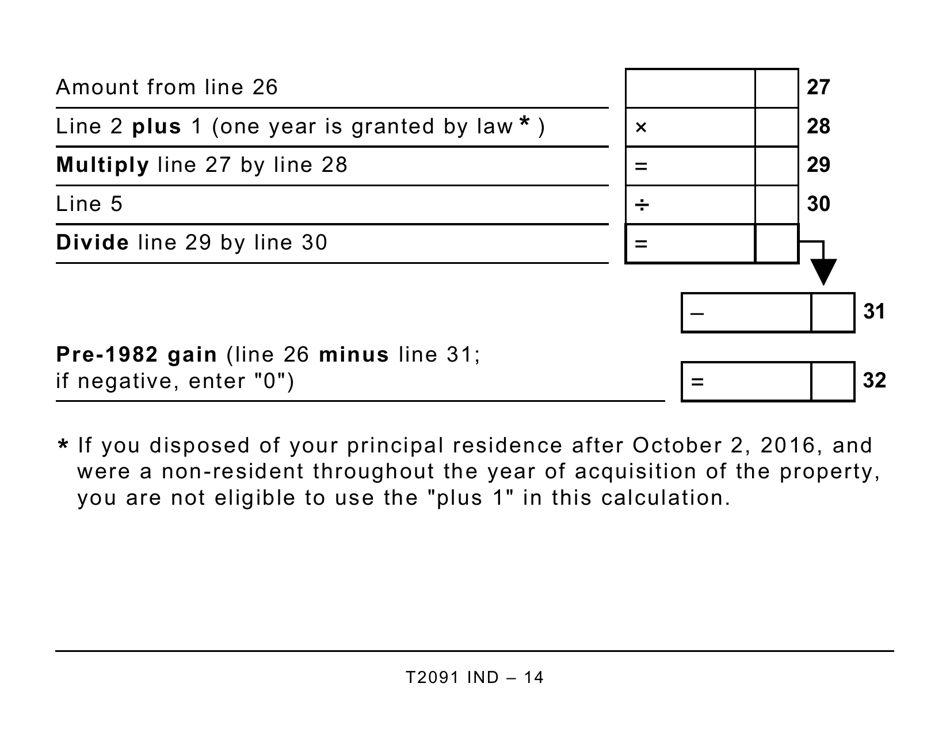

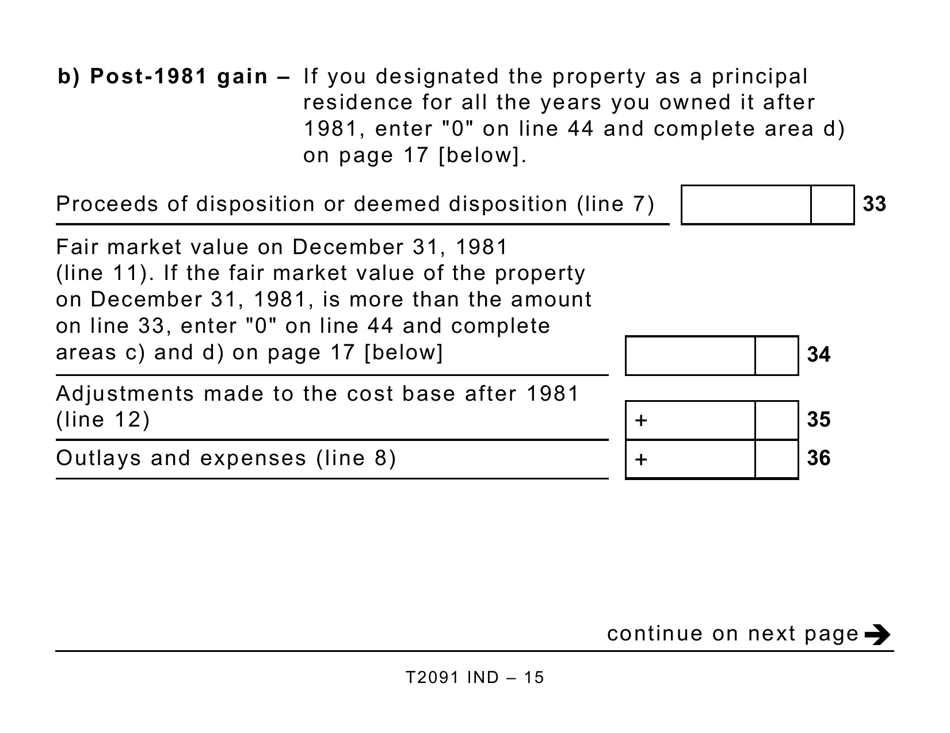

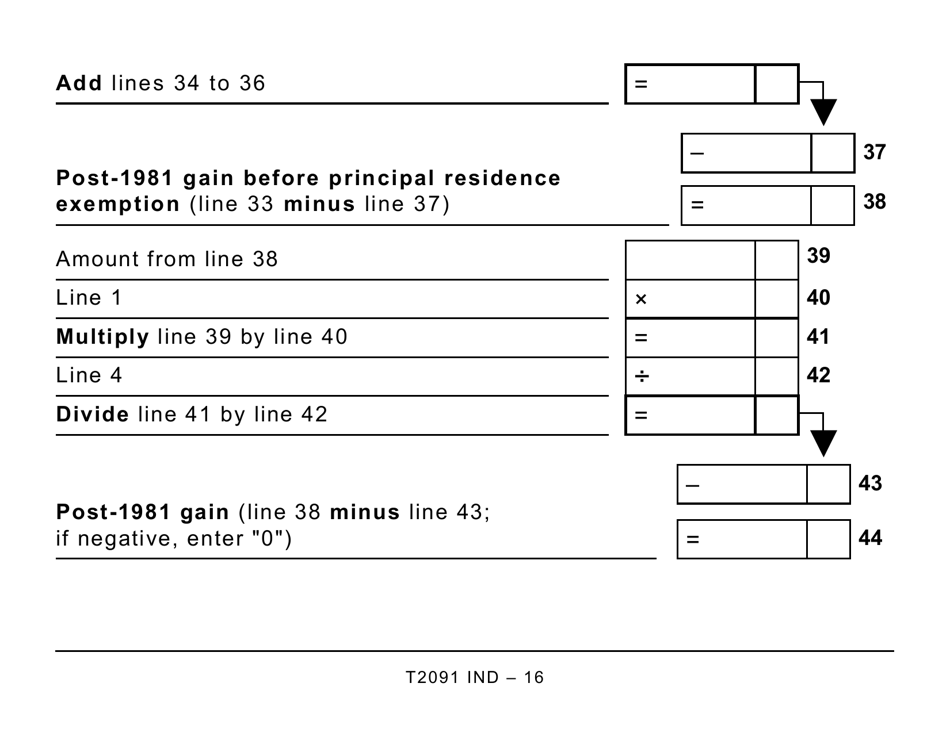

Form T2091 IND is used in Canada to designate a property as a principal residence by an individual. This form is specifically for individuals who are not personal trusts and require large print format. By completing this form, individuals can claim the principal residence exemption for capital gains tax purposes. This exemption allows individuals to avoid paying tax on the appreciation of their primary residence when it is sold.

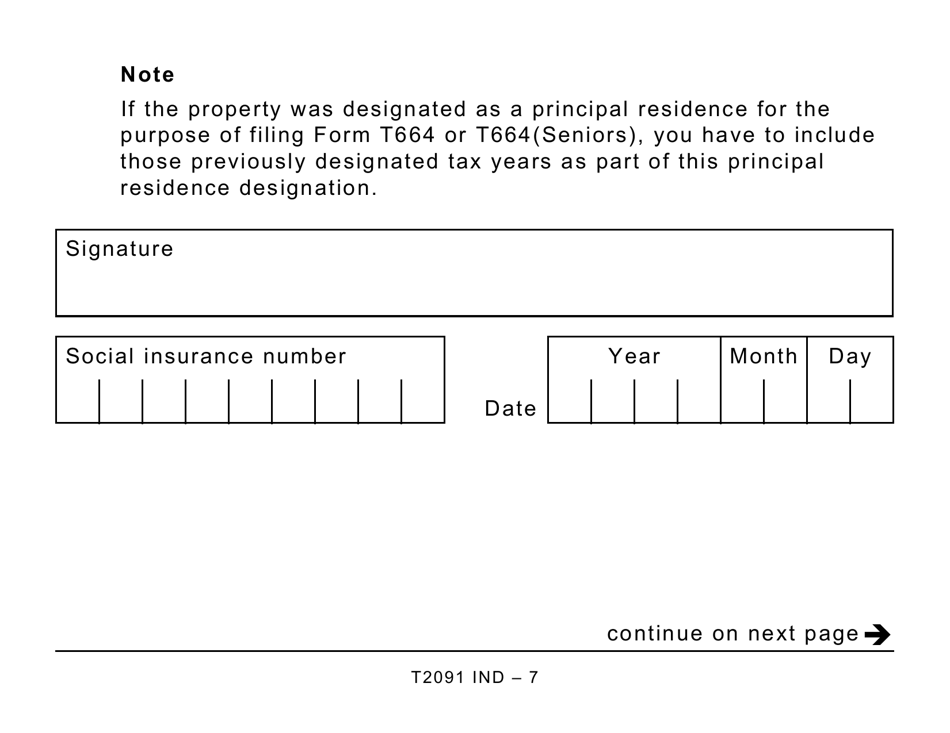

The Form T2091 IND, which is used to designate a property as a principal residence by an individual in Canada, is generally filed by the individual who is the owner of the property. This form is used to report any changes in designated principal residence status for tax purposes. Please note that if the individual is a personal trust, a different form may be required.

FAQ

Q: What is Form T2091 IND?

A: Form T2091 IND is a Canadian tax form that individuals use to designate a property as their principal residence.

Q: Who should use Form T2091 IND?

A: This form is used by individuals who are designating a property as their principal residence for tax purposes. It is not applicable to personal trusts.

Q: Can I use Form T2091 IND to designate any property as my principal residence?

A: Yes, you can use this form to designate any eligible property as your principal residence.

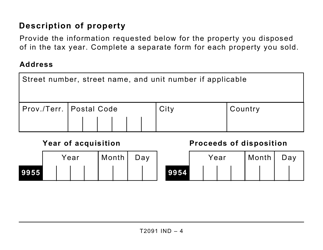

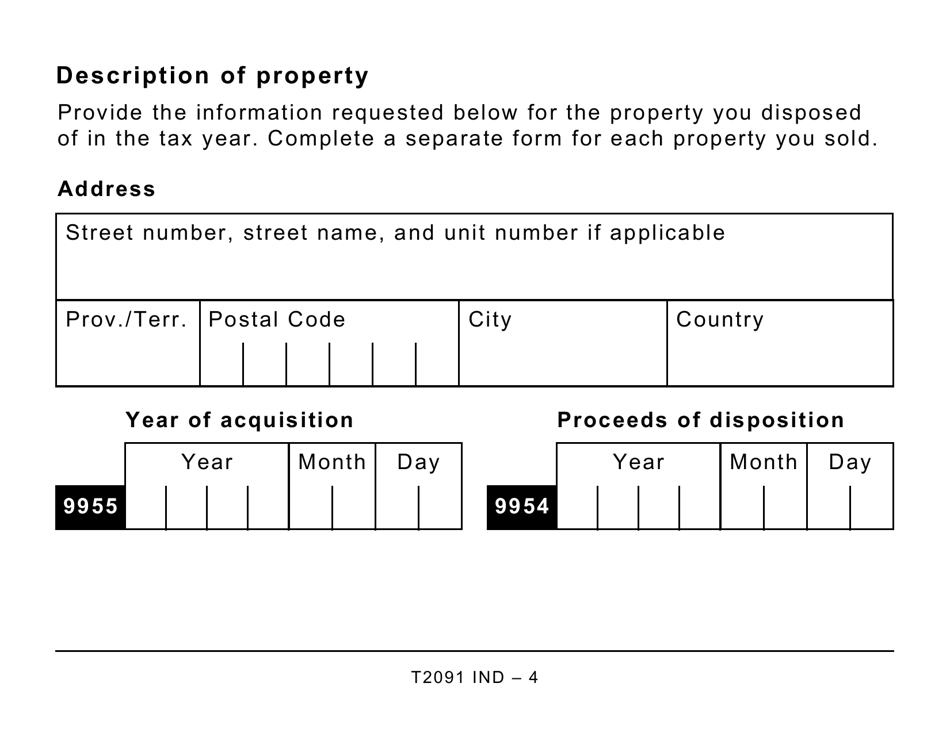

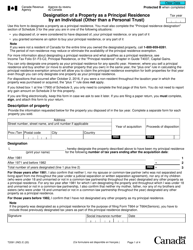

Q: What information is required on Form T2091 IND?

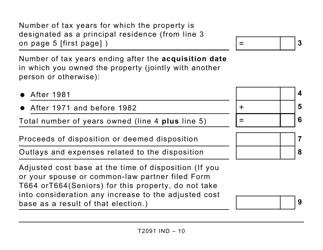

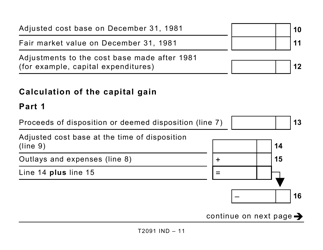

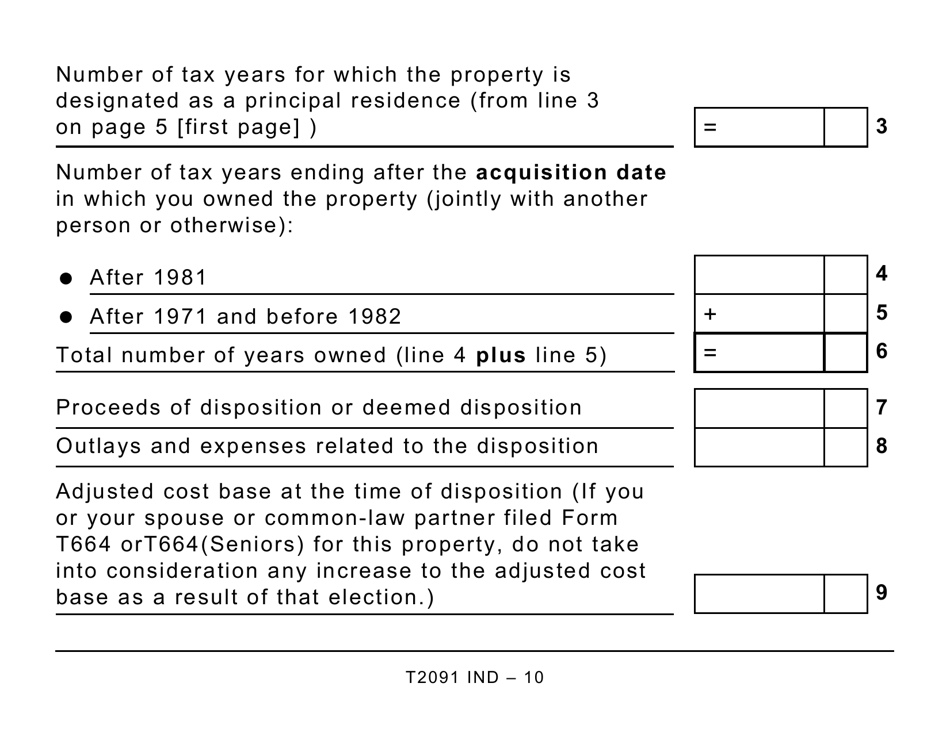

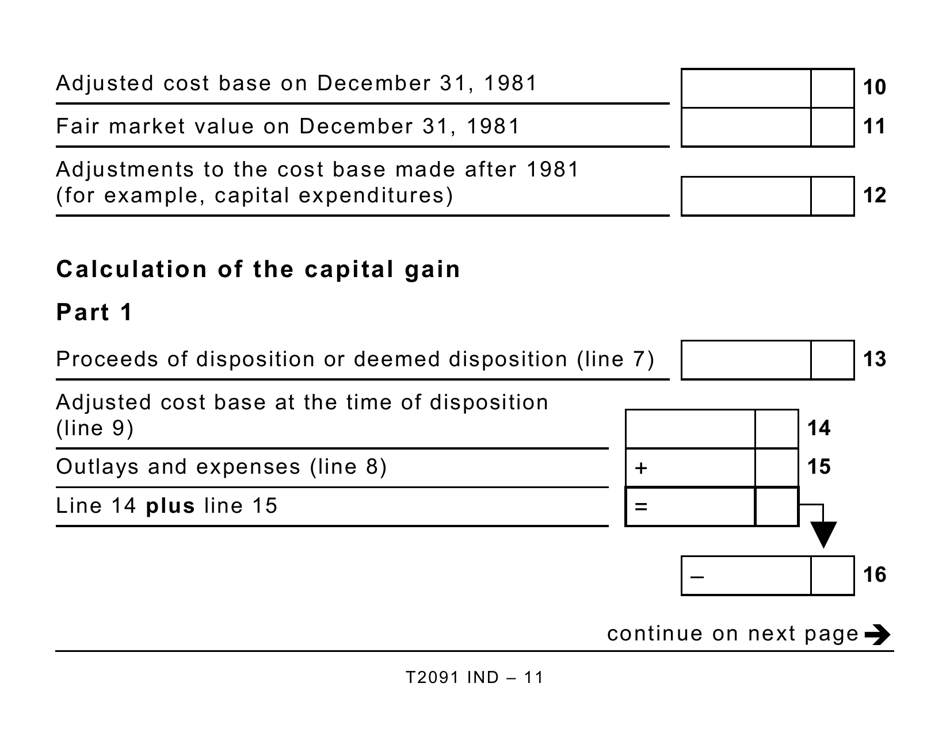

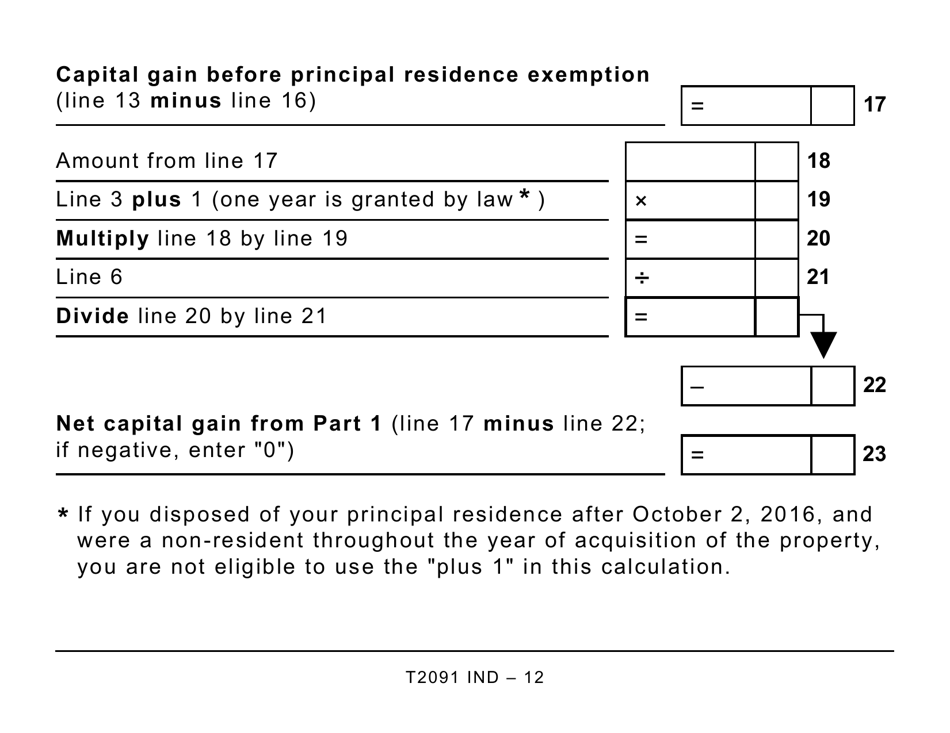

A: The form requires you to provide details about the property, such as the address, years of ownership, and the percentage of the property's use as a principal residence.

Q: Is there a deadline for filing Form T2091 IND?

A: You must file Form T2091 IND no later than the due date of your personal income tax return for the year in which you are designating the property as your principal residence.

Q: What happens if I don't file Form T2091 IND?

A: If you fail to file the form within the deadline, you may be subject to penalties or interest charges.

Q: Can I designate more than one property as my principal residence?

A: No, you can only designate one property as your principal residence for a given tax year. If you own multiple properties, you must choose which one to designate.

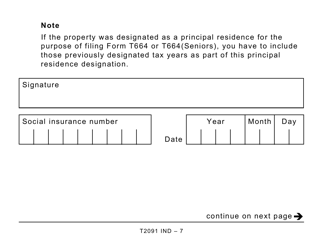

Q: Do I need to include Form T2091 IND with my tax return?

A: Unless specifically requested by the CRA, you do not need to submit the form with your tax return. However, you should keep it for your records in case of an audit or review.