This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC64

for the current year.

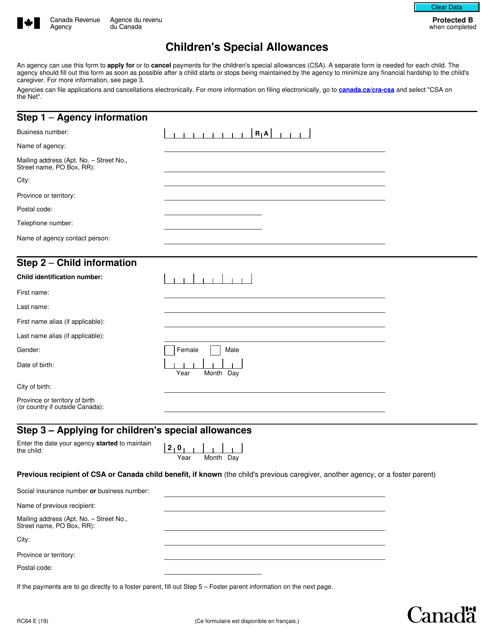

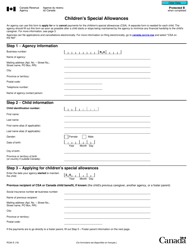

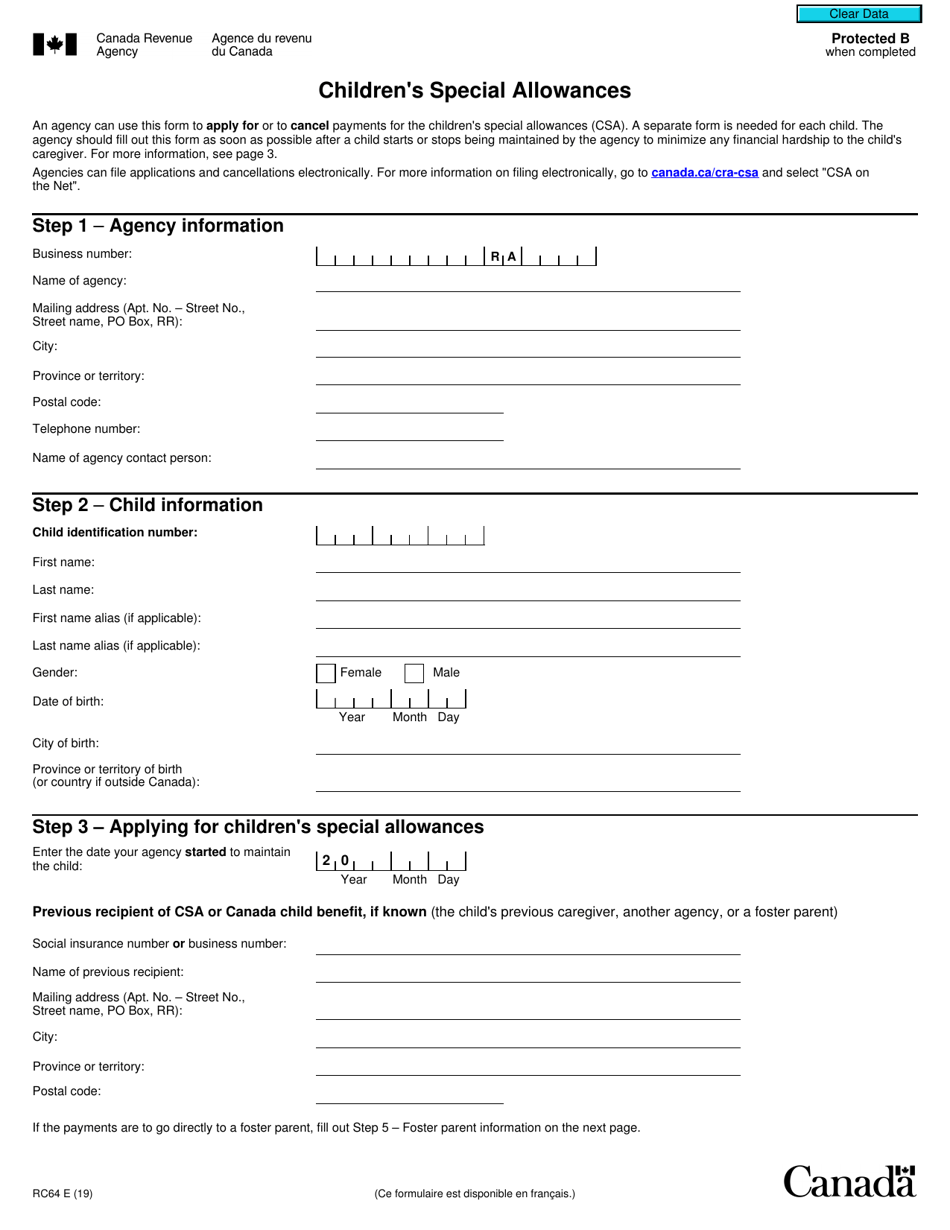

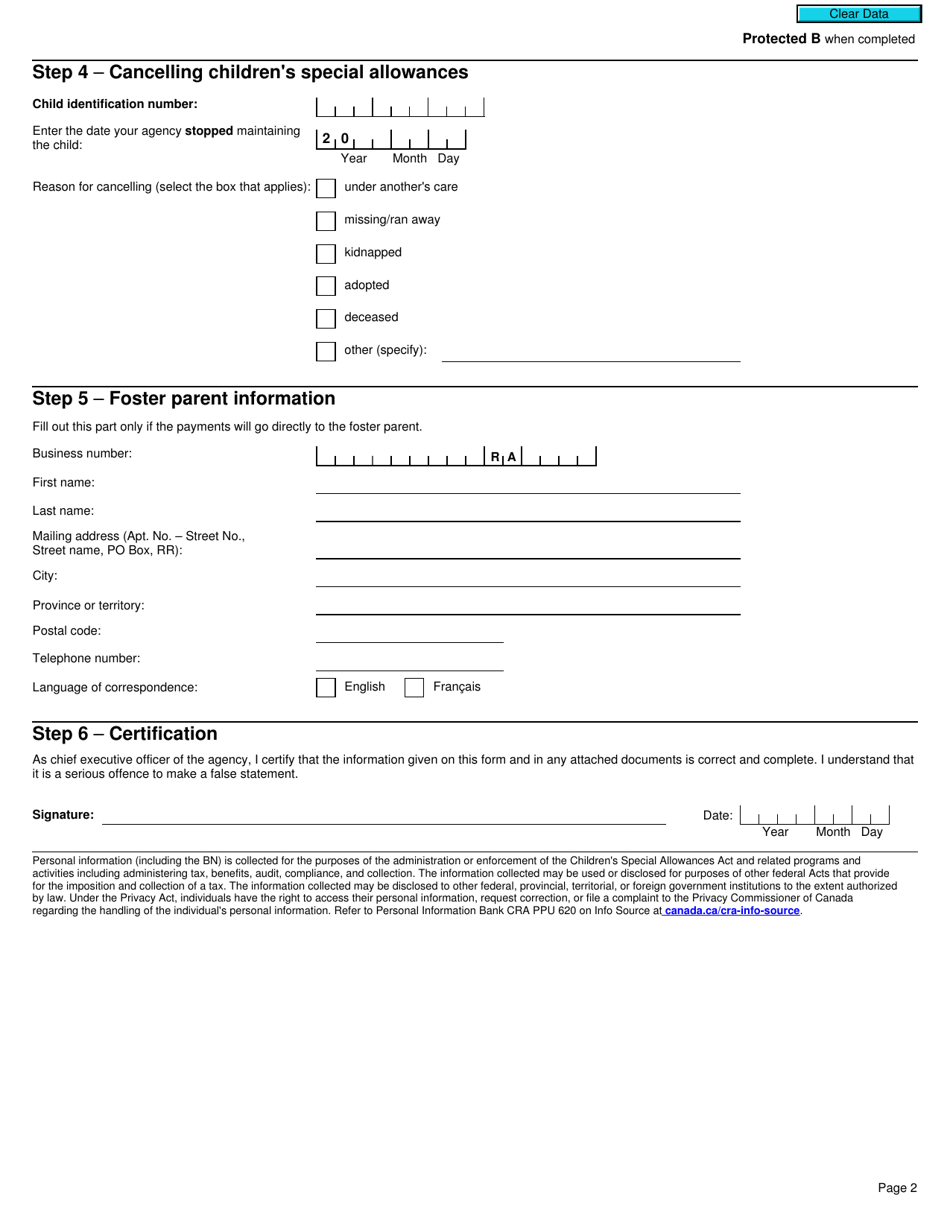

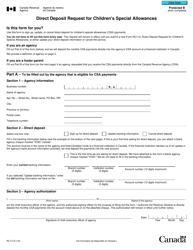

Form RC64 Children's Special Allowances - Canada

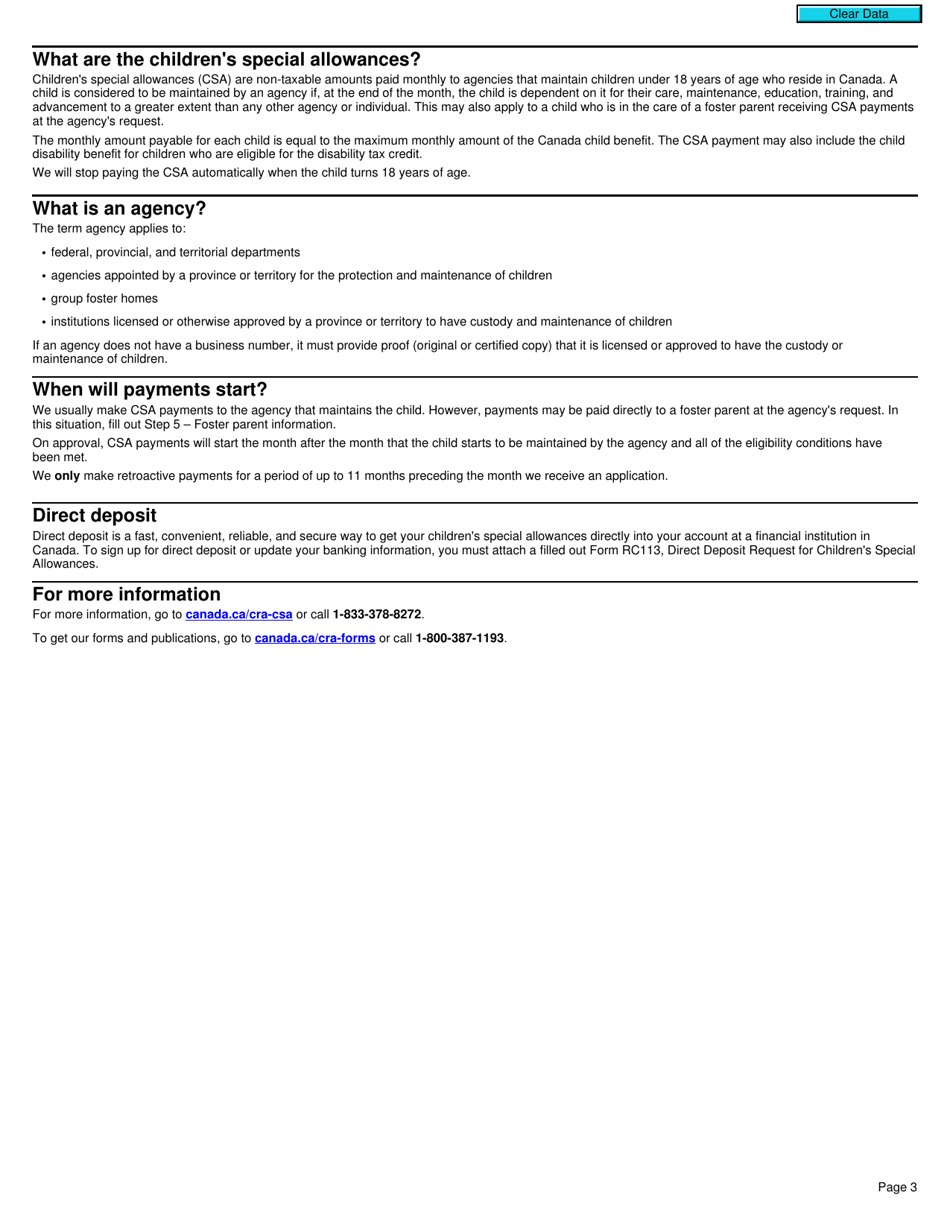

Form RC64 Children's Special Allowances in Canada is used to apply for the Children's Special Allowances (CSA) program. The CSA program provides financial assistance to eligible individuals who are caring for a child with a severe disability. The form is used to determine if the caregiver is eligible to receive this allowance.

The Form RC64 Children's Special Allowances in Canada is typically filed by the primary caregiver of the child.

FAQ

Q: What is Form RC64?

A: Form RC64 is a form used in Canada for applying for Children's Special Allowances.

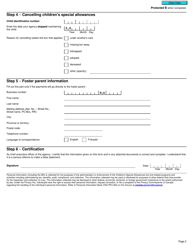

Q: What are Children's Special Allowances?

A: Children's Special Allowances are benefits provided by the Canadian government to the guardians of children with disabilities or certain medical conditions.

Q: Who is eligible for Children's Special Allowances?

A: Children who have a disability or a medical condition that requires constant care, supervision, or treatment may be eligible for Children's Special Allowances.

Q: How can I apply for Children's Special Allowances?

A: To apply for Children's Special Allowances, you need to complete Form RC64 and submit it to your local tax center or to the Canada Revenue Agency (CRA).

Q: What information do I need to provide on Form RC64?

A: On Form RC64, you will need to provide information about the child's disability or medical condition, as well as your personal and financial information.

Q: Is there a deadline to apply for Children's Special Allowances?

A: There is no specific deadline to apply for Children's Special Allowances. You can apply at any time.

Q: What documents do I need to include with Form RC64?

A: Along with Form RC64, you may need to include supporting documents such as medical certificates or reports that provide evidence of the child's disability or medical condition.

Q: How long does it take to process the application for Children's Special Allowances?

A: The processing time for the application can vary, but it generally takes several weeks to months.

Q: Will I receive retroactive payments if my application is approved?

A: If your application for Children's Special Allowances is approved, you may be eligible to receive retroactive payments for up to 11 months prior to the date you submitted your application.