This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC7245

for the current year.

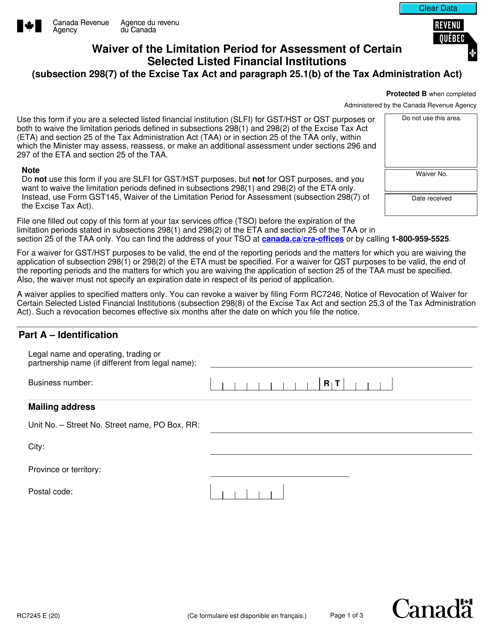

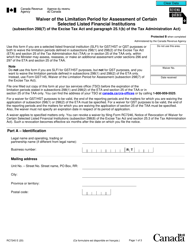

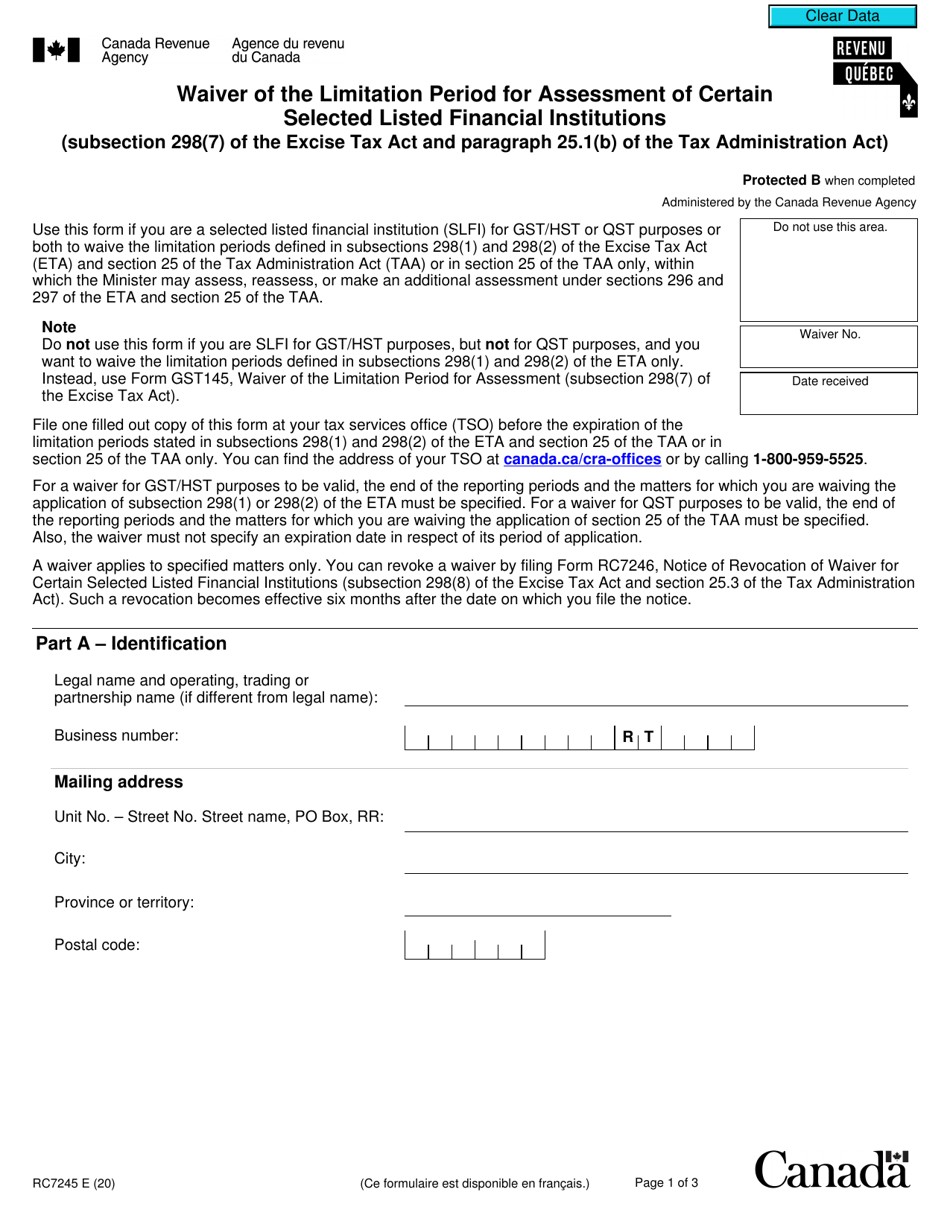

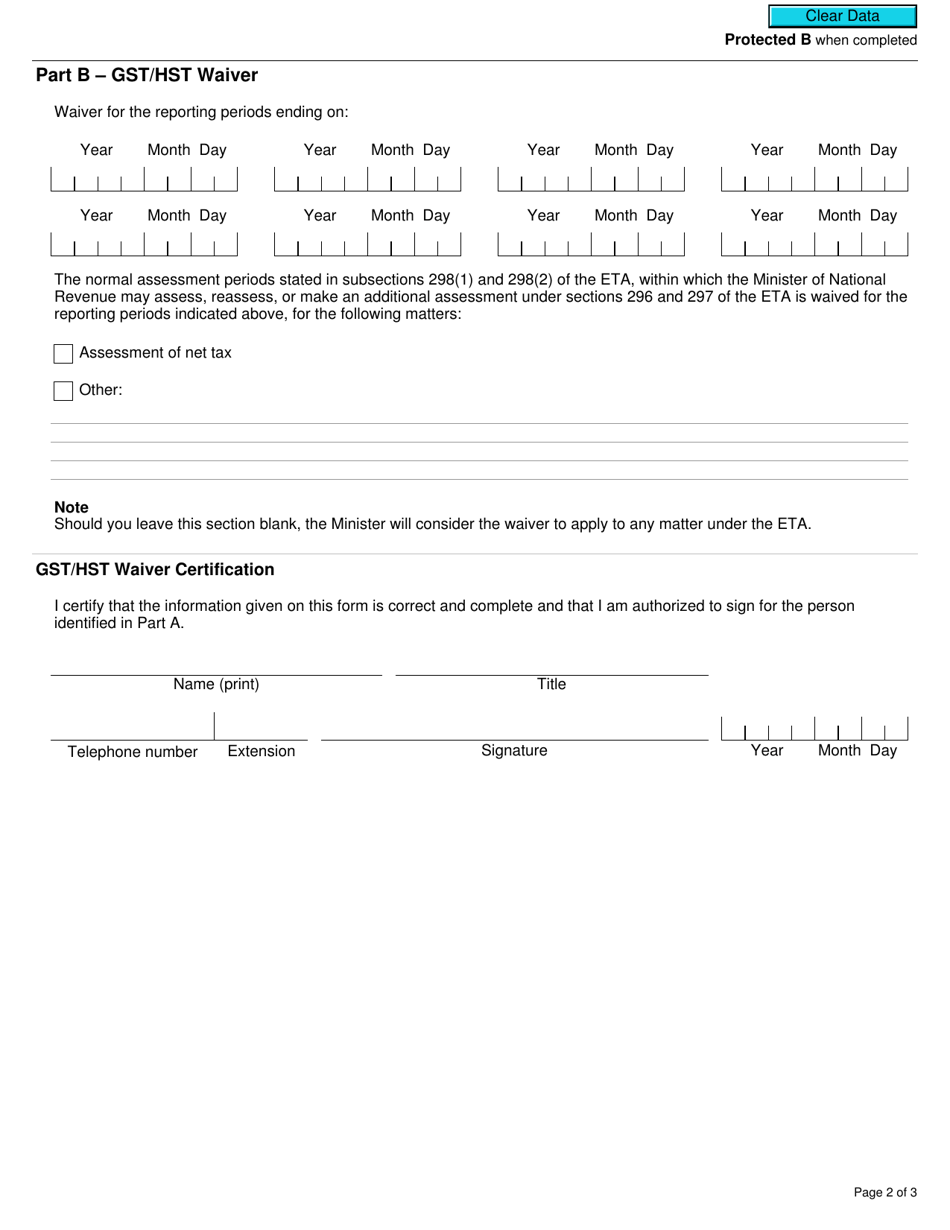

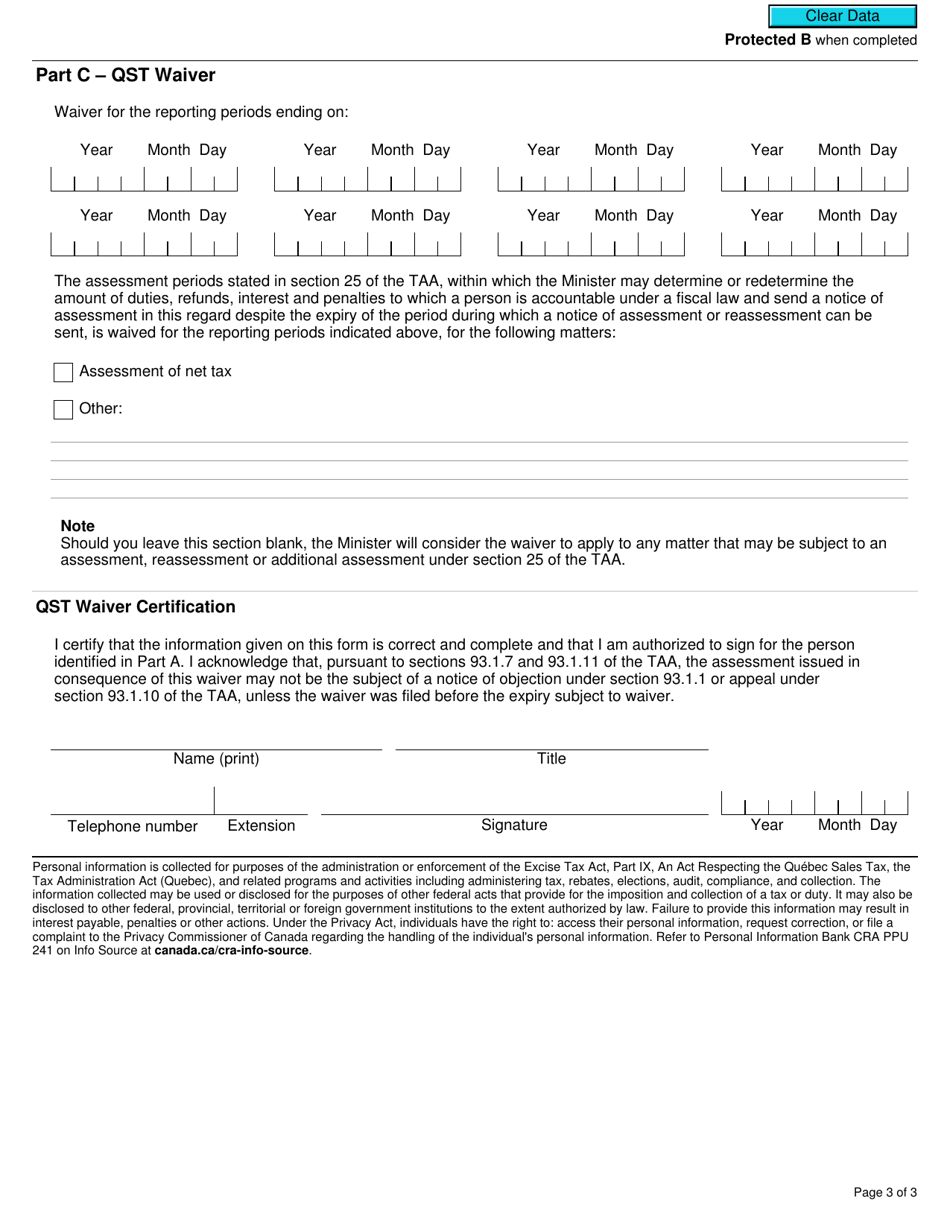

Form RC7245 Waiver of the Limitation Period for Assessment of Certain Selected Listed Financial Institutions (Subsection 298(7) of the Excise Tax Act and Paragraph 25.1(B) of the Tax Administration Act) - Canada

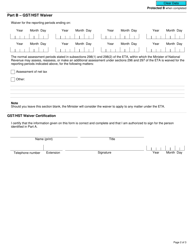

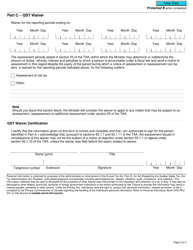

The Form RC7245 Waiver is used in Canada to waive the time limitation for assessing certain selected listed financial institutions for excise taxes. It is governed by Subsection 298(7) of the Excise Tax Act and Paragraph 25.1(B) of the Tax Administration Act.

The financial institutions referred to in the form would typically be responsible for filing the Form RC7245 Waiver of the Limitation Period in Canada. However, it is recommended to consult a tax professional or the Canada Revenue Agency for specific guidance.

FAQ

Q: What is Form RC7245?

A: Form RC7245 is a waiver of the limitation period for assessment of certain selected listed financial institutions in Canada.

Q: What is the purpose of Form RC7245?

A: The purpose of Form RC7245 is to waive the time limits for the Canada Revenue Agency (CRA) to assess certain listed financial institutions.

Q: Which acts apply to Form RC7245?

A: Form RC7245 applies to Subsection 298(7) of the Excise Tax Act and Paragraph 25.1(B) of the Tax Administration Act.