This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC7220-1

for the current year.

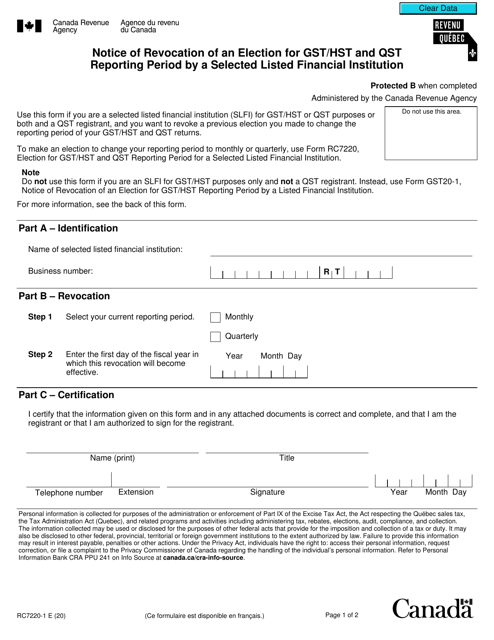

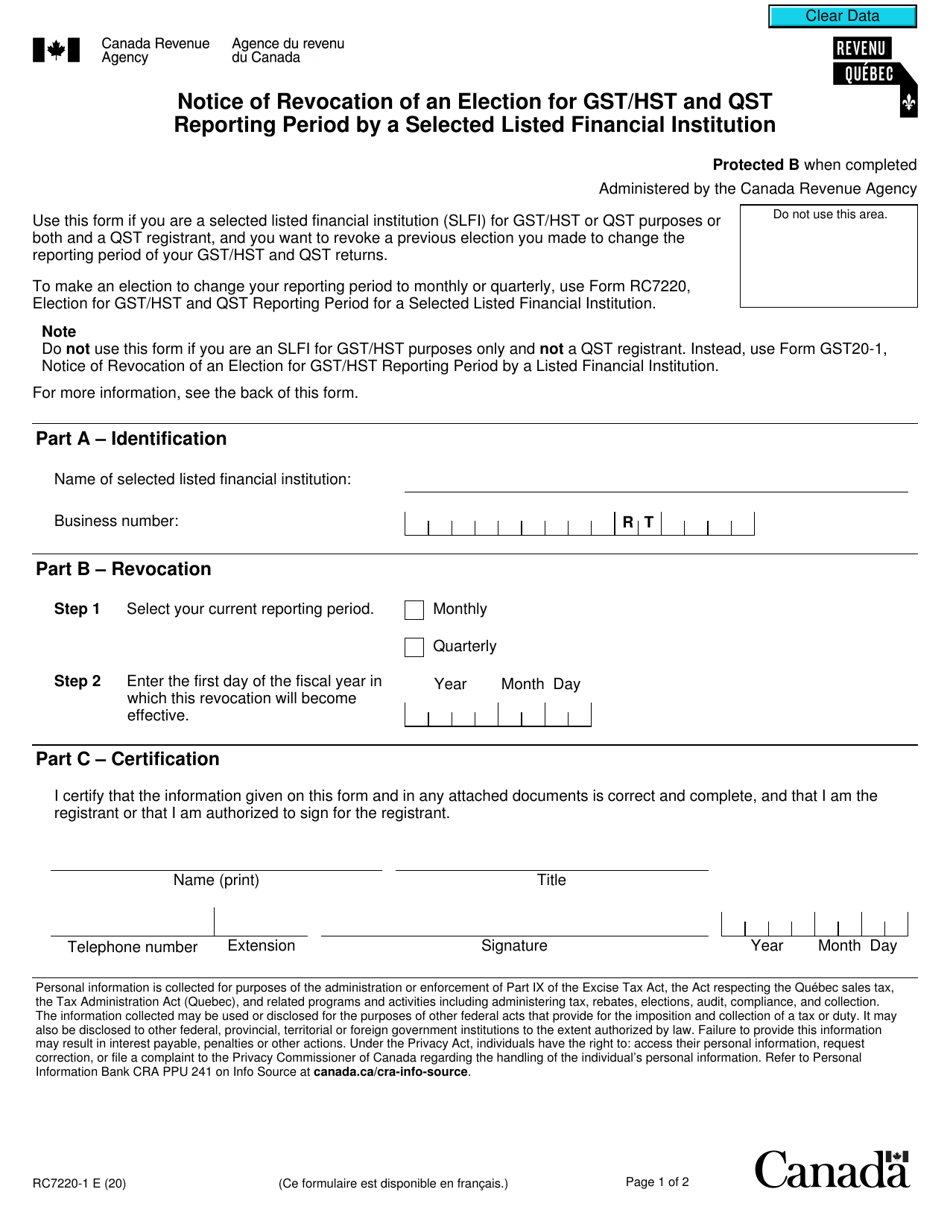

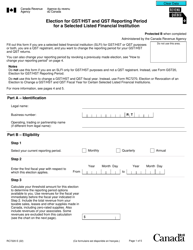

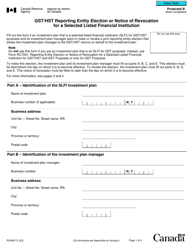

Form RC7220-1 Notice of Revocation of an Election for Gst / Hst and Qst Reporting Period by a Selected Listed Financial Institution - Canada

Form RC7220-1, Notice of Revocation of an Election for GST/HST and QST Reporting Period by a Selected Listed Financial Institution, is used in Canada when a selected listed financial institution wants to cancel their election to use a different reporting period for GST/HST and QST.

The selected listed financial institution in Canada files the Form RC7220-1 for the revocation of an election for GST/HST and QST reporting period.

FAQ

Q: What is Form RC7220-1?

A: Form RC7220-1 is a Notice of Revocation of an Election for GST/HST and QST Reporting Period by a Selected Listed Financial Institution in Canada.

Q: What is the purpose of Form RC7220-1?

A: The purpose of Form RC7220-1 is to notify the Canada Revenue Agency (CRA) about the revocation of an election for GST/HST and QST reporting period by a Selected Listed Financial Institution.

Q: Who needs to fill out Form RC7220-1?

A: Selected Listed Financial Institutions in Canada need to fill out Form RC7220-1 if they want to revoke an election for GST/HST and QST reporting period.

Q: What is GST/HST?

A: GST (Goods and Services Tax) and HST (Harmonized Sales Tax) are consumption taxes in Canada.

Q: What is QST?

A: QST (Quebec Sales Tax) is a provincial sales tax in the province of Quebec, Canada.