This version of the form is not currently in use and is provided for reference only. Download this version of

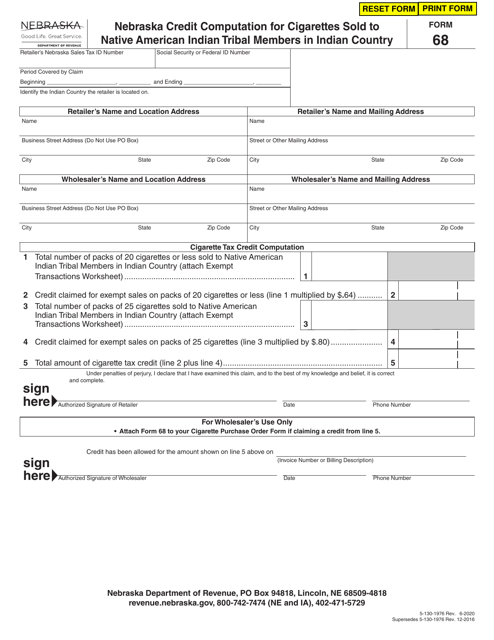

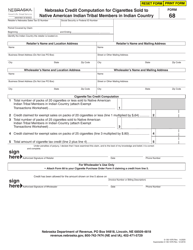

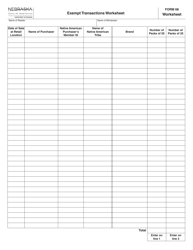

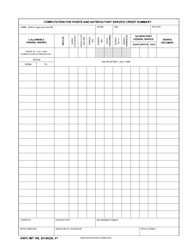

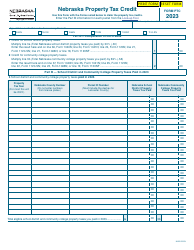

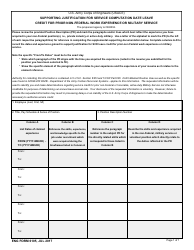

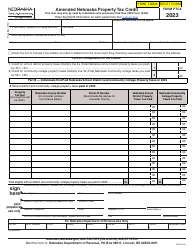

Form 68

for the current year.

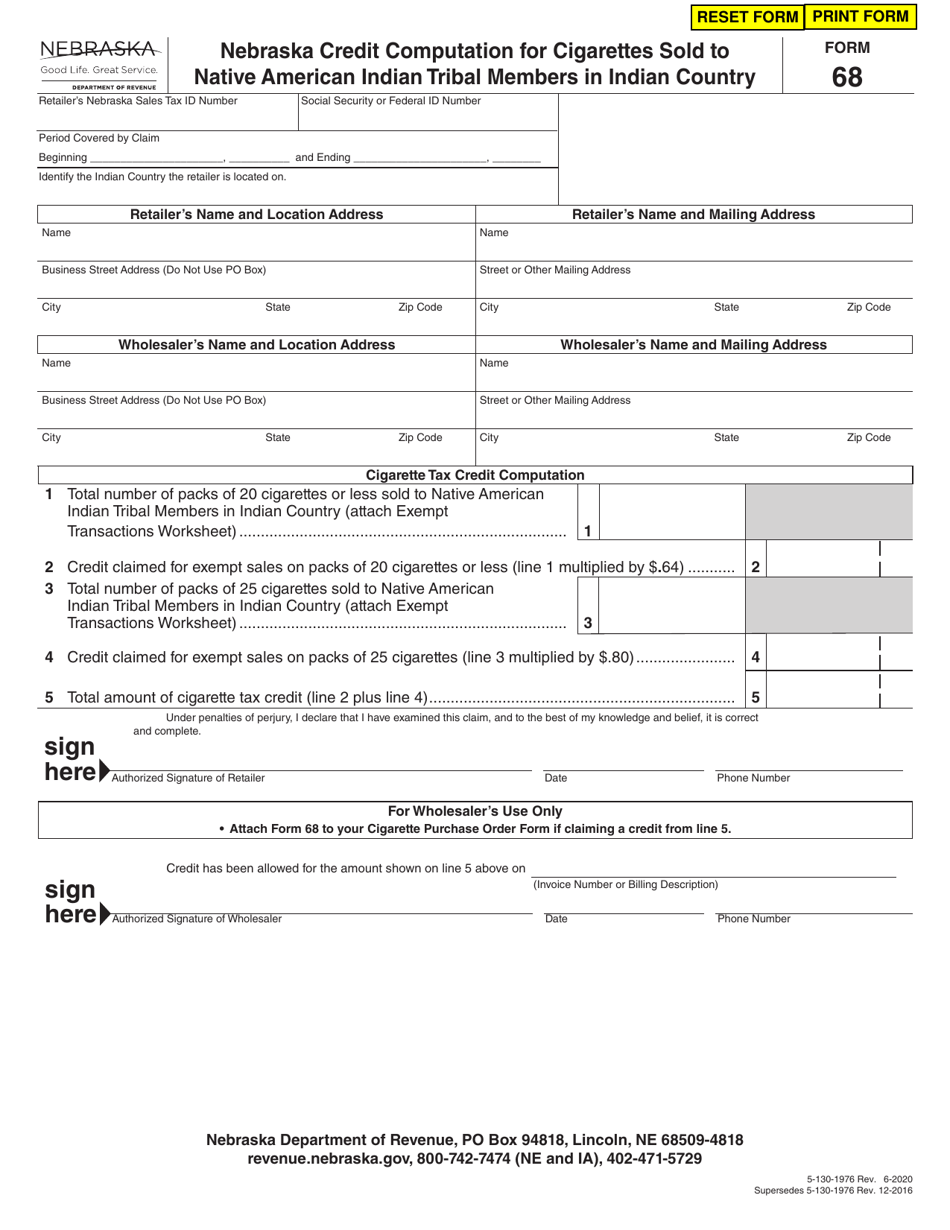

Form 68 Nebraska Credit Computation for Cigarettes Sold to Native American Indian Tribal Members in Indian Country - Nebraska

What Is Form 68?

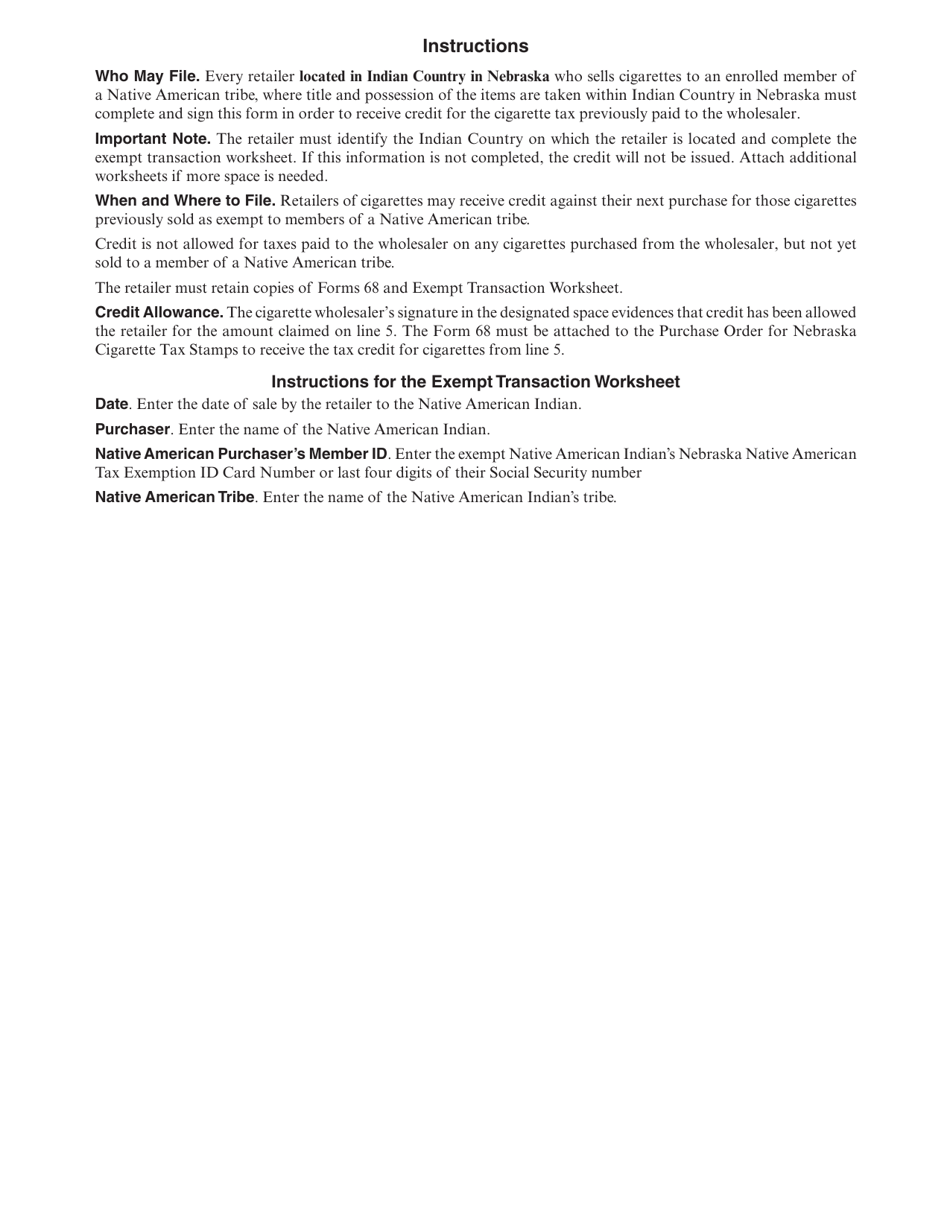

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 68 Nebraska Credit Computation?

A: It's a form used to calculate the credit for cigarettes sold to Native American Indian tribal members in Indian Country in Nebraska.

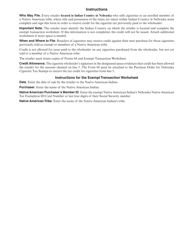

Q: Who is eligible to use Form 68 Nebraska Credit Computation?

A: Cigarette sellers who have made sales to Native American Indian tribal members in Indian Country in Nebraska.

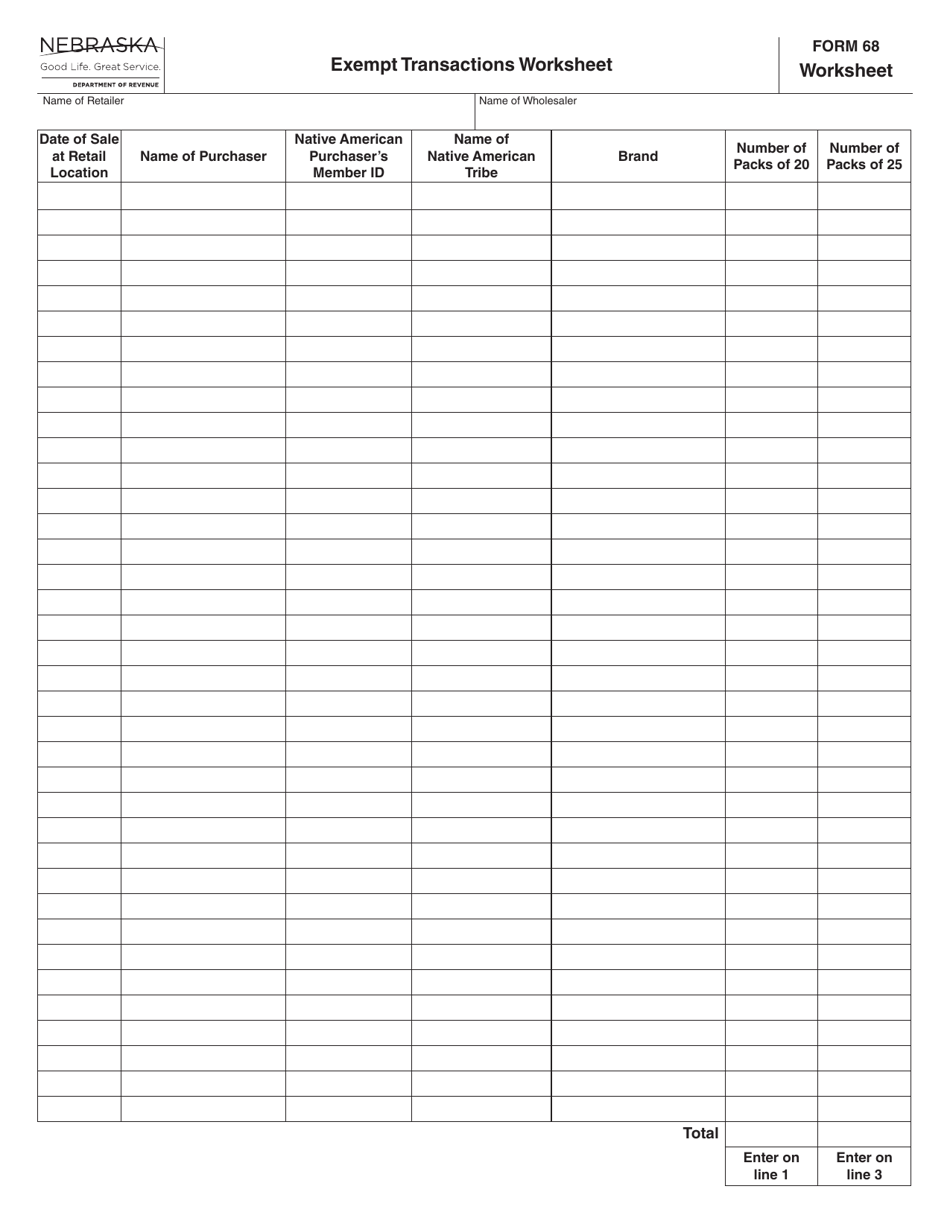

Q: How do I complete Form 68 Nebraska Credit Computation?

A: You need to provide the required information about your cigarette sales and calculate the credit amount based on the provided instructions.

Q: What is the purpose of the credit on Form 68 Nebraska Credit Computation?

A: The credit is provided as a reimbursement for state taxes paid on cigarettes sold to Native American Indian tribal members in Indian Country.

Q: When is the deadline to file Form 68 Nebraska Credit Computation?

A: The form should be filed annually and the deadline is typically April 15th of the following year.

Q: Are there any penalties for not filing Form 68 Nebraska Credit Computation?

A: Yes, failure to file the form or paying the required taxes can result in penalties and interest charges.

Q: Who should I contact if I have questions about Form 68 Nebraska Credit Computation?

A: You can reach out to the Nebraska Department of Revenue or consult a tax professional for assistance with the form.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 68 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.