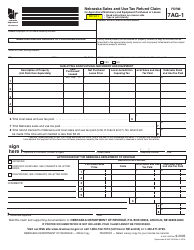

This version of the form is not currently in use and is provided for reference only. Download this version of

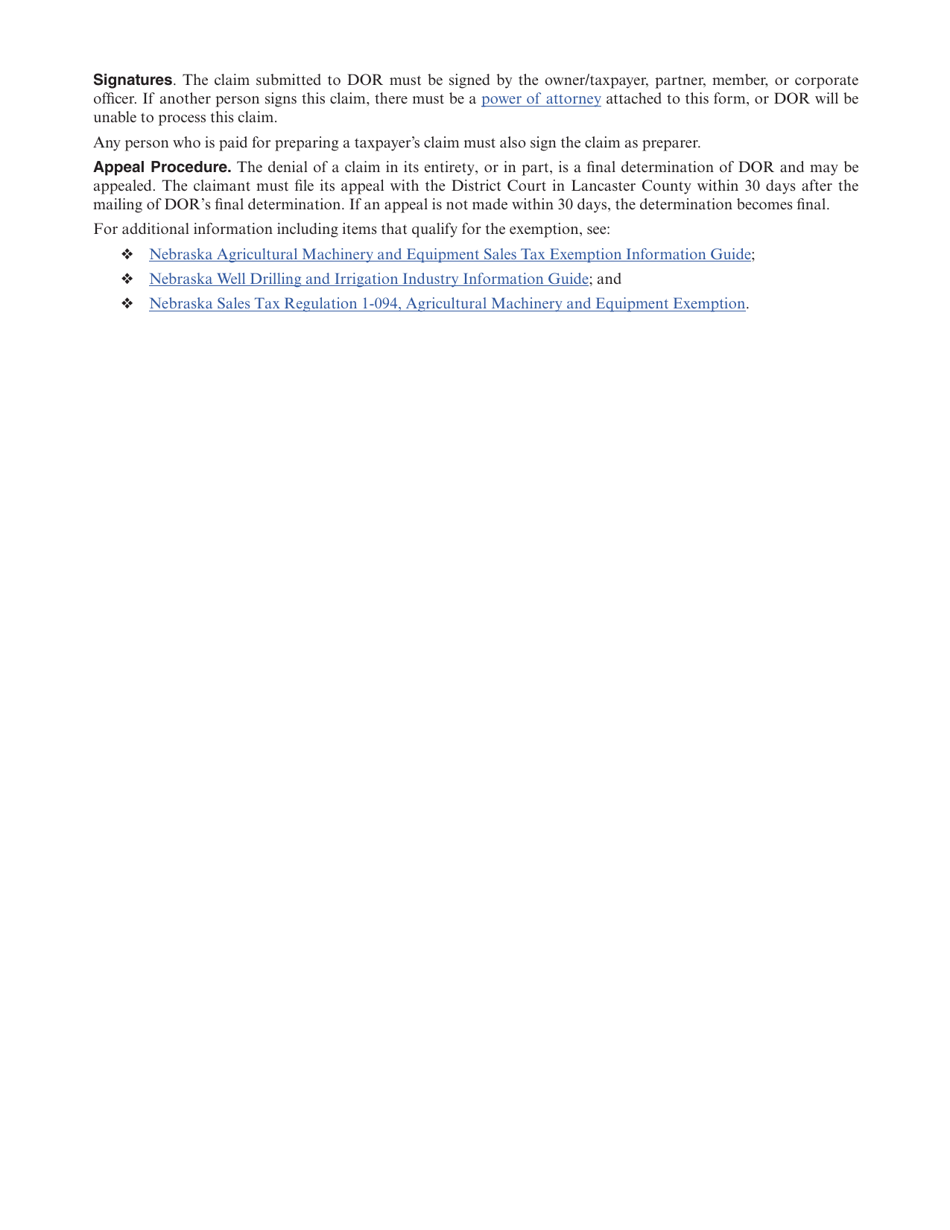

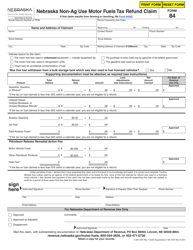

Form 7AG

for the current year.

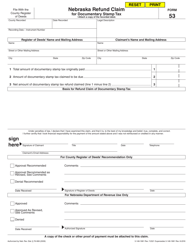

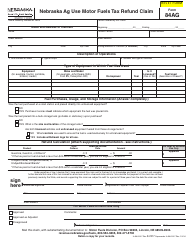

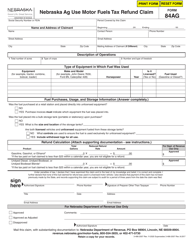

Form 7AG Nebraska Sales and Use Tax Refund Claim for Agricultural Machinery and Equipment Purchases or Leases - Nebraska

What Is Form 7AG?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 7AG?

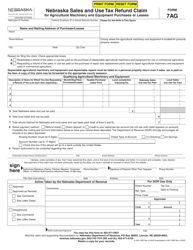

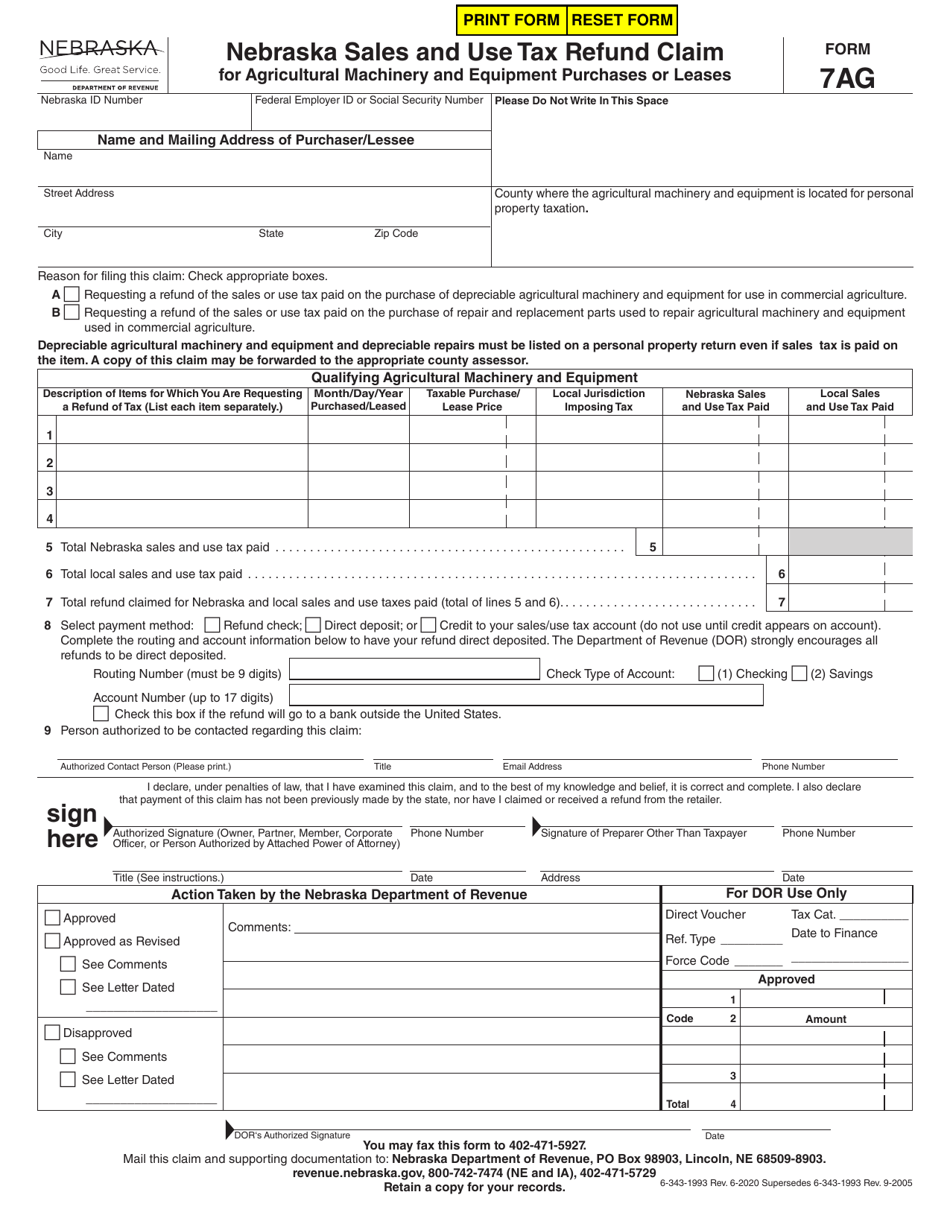

A: Form 7AG is a Nebraska Sales and Use Tax Refund Claim specifically for agricultural machinery and equipment purchases or leases.

Q: What is the purpose of Form 7AG?

A: The purpose of Form 7AG is to claim a refund for sales and use tax paid on qualifying agricultural machinery and equipment purchases or leases in Nebraska.

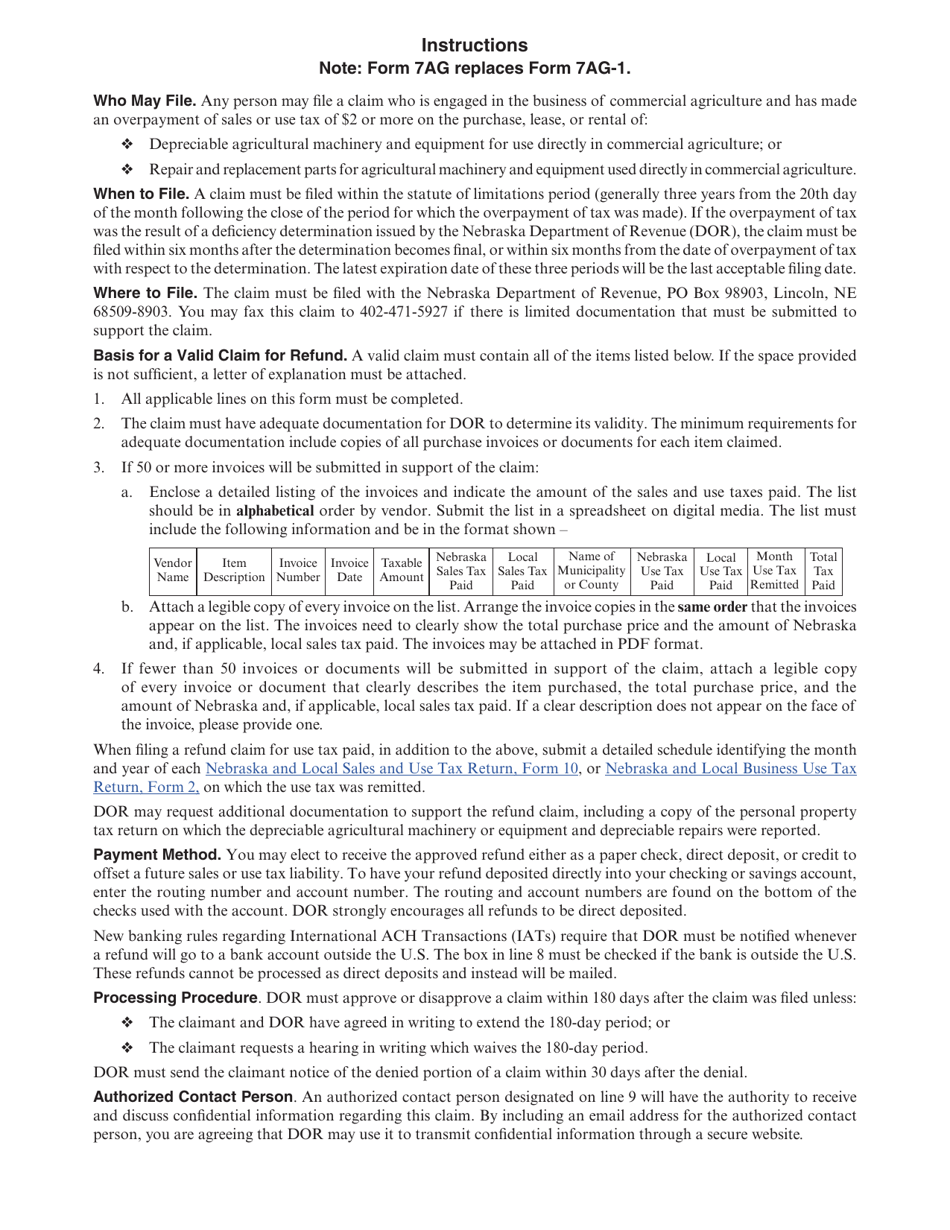

Q: Who is eligible to use Form 7AG?

A: Farmers, ranchers, and agricultural producers who have purchased or leased qualifying machinery and equipment for agricultural purposes in Nebraska are eligible to use Form 7AG.

Q: What types of agricultural machinery and equipment are eligible for a refund?

A: Qualifying machinery and equipment for agricultural purposes include tractors, harvesters, sprayers, irrigation equipment, and other similar equipment used in farming and ranching.

Q: What supporting documentation is required to submit with Form 7AG?

A: You will need to provide invoices or receipts for the purchases or leases of qualifying agricultural machinery and equipment, as well as any other required documentation specified on the form.

Q: Is there a deadline for submitting Form 7AG?

A: Yes, the deadline for submitting Form 7AG and claiming a refund for a specific calendar year is the following June 30th.

Q: Can I claim a refund for sales and use tax on other types of purchases?

A: No, Form 7AG is specifically for claiming refunds on agricultural machinery and equipment purchases or leases only. Other types of purchases may require different forms or procedures.

Q: What should I do if I have further questions or need assistance with Form 7AG?

A: If you have further questions or need assistance with Form 7AG, you can contact the Nebraska Department of Revenue directly for guidance and support.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 7AG by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.