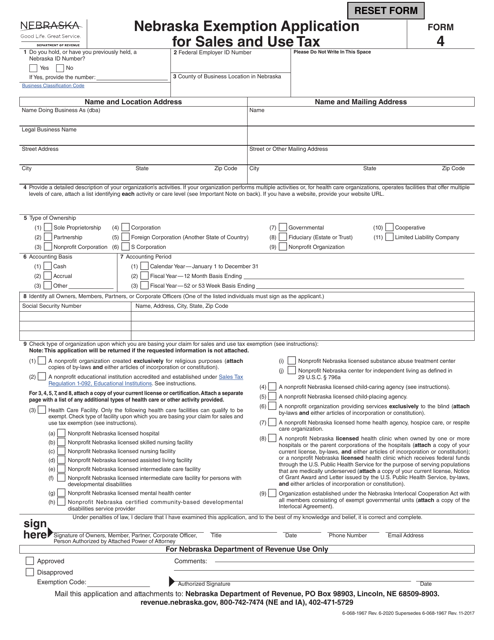

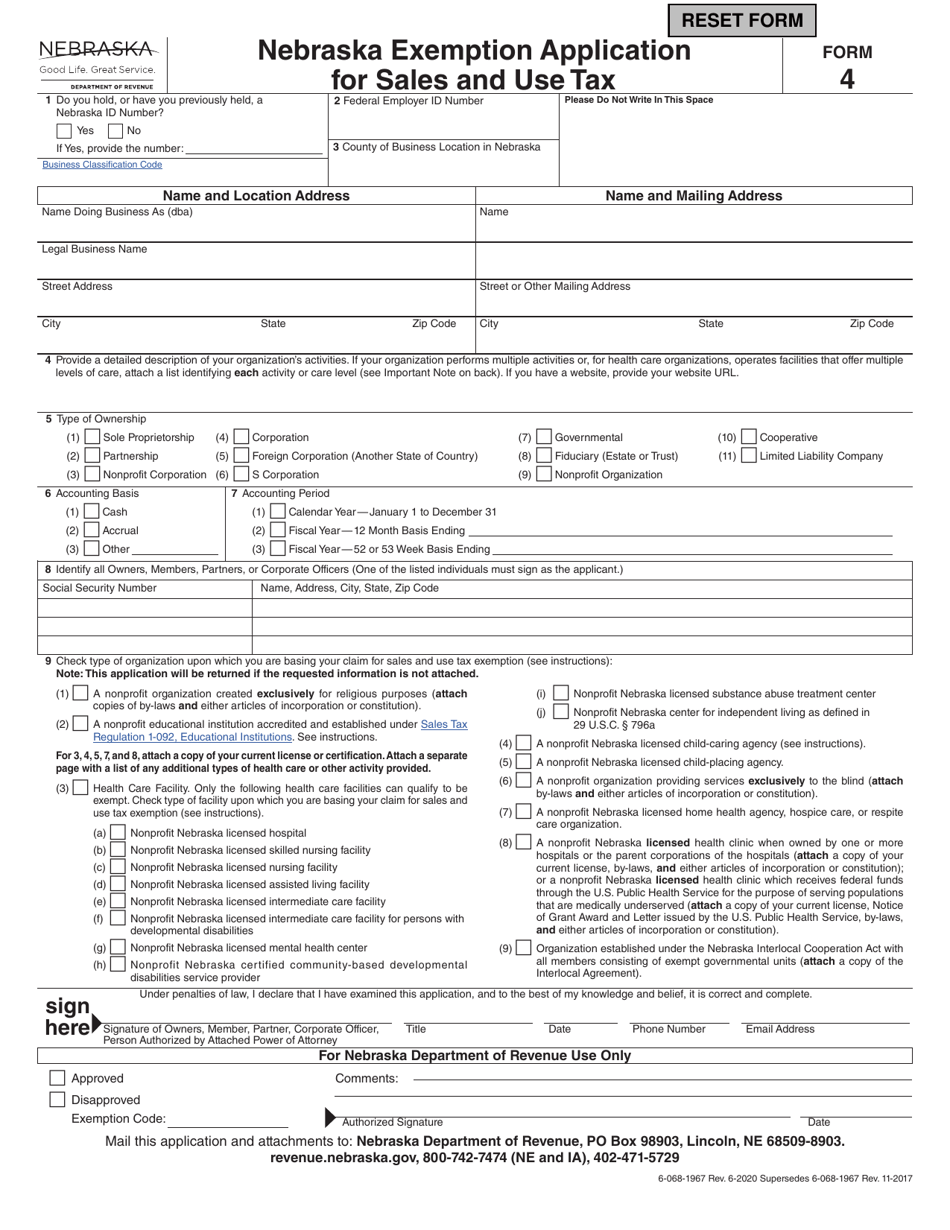

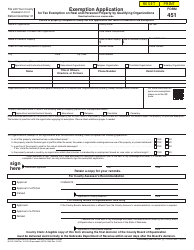

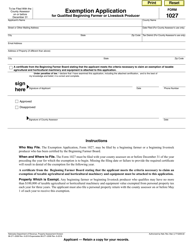

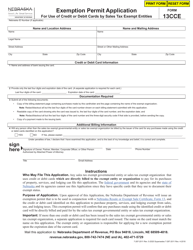

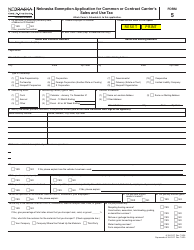

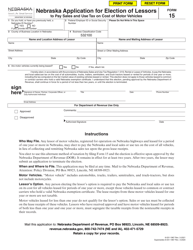

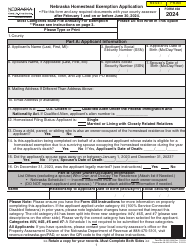

Form 4 Nebraska Exemption Application for Sales and Use Tax - Nebraska

What Is Form 4?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 4 Nebraska Exemption Application for Sales and Use Tax?

A: Form 4 is an application used in Nebraska to request exemption from sales and use tax.

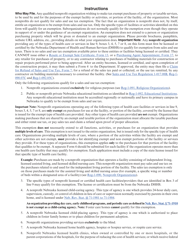

Q: Who should use the Form 4 Nebraska Exemption Application?

A: Businesses and organizations that qualify for sales and use tax exemption in Nebraska can use this form.

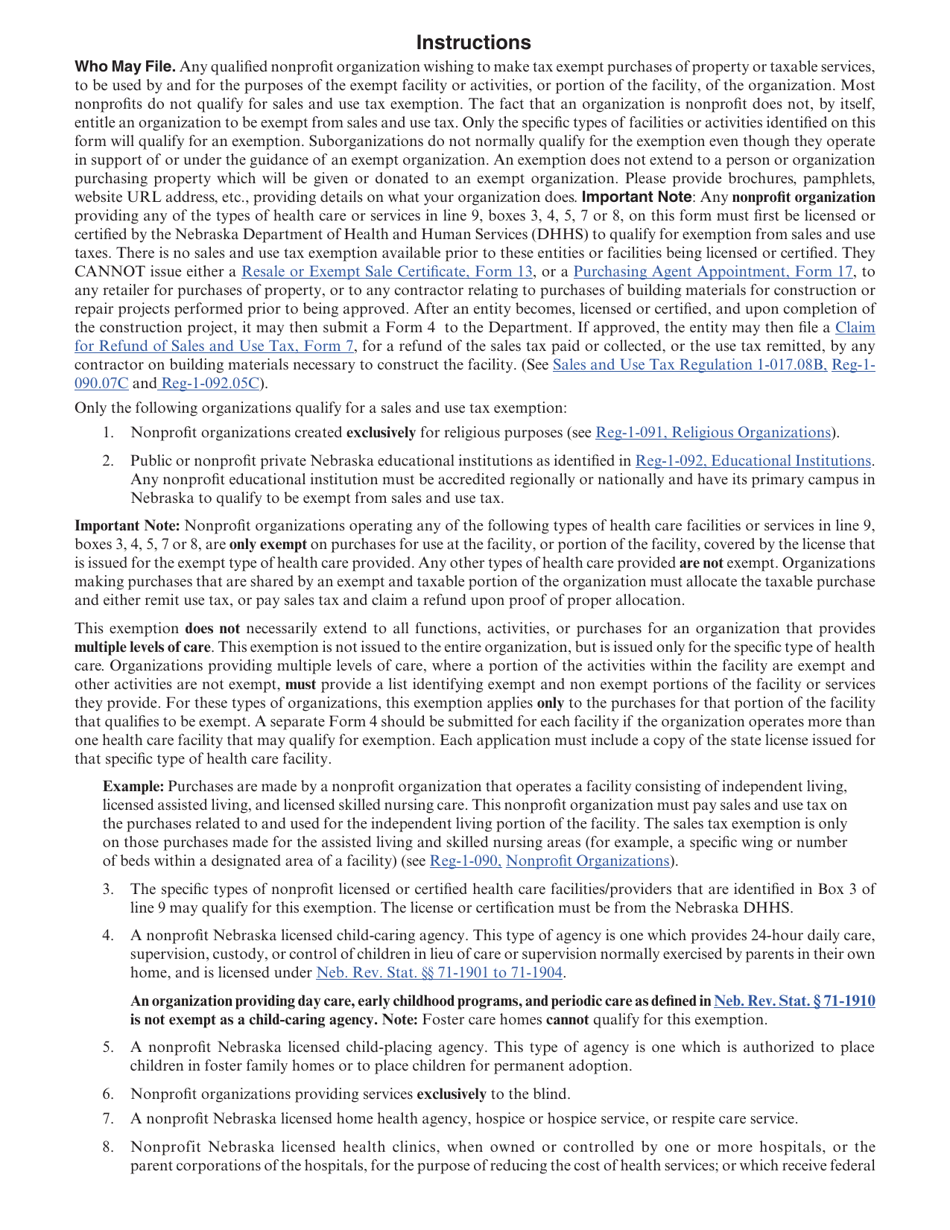

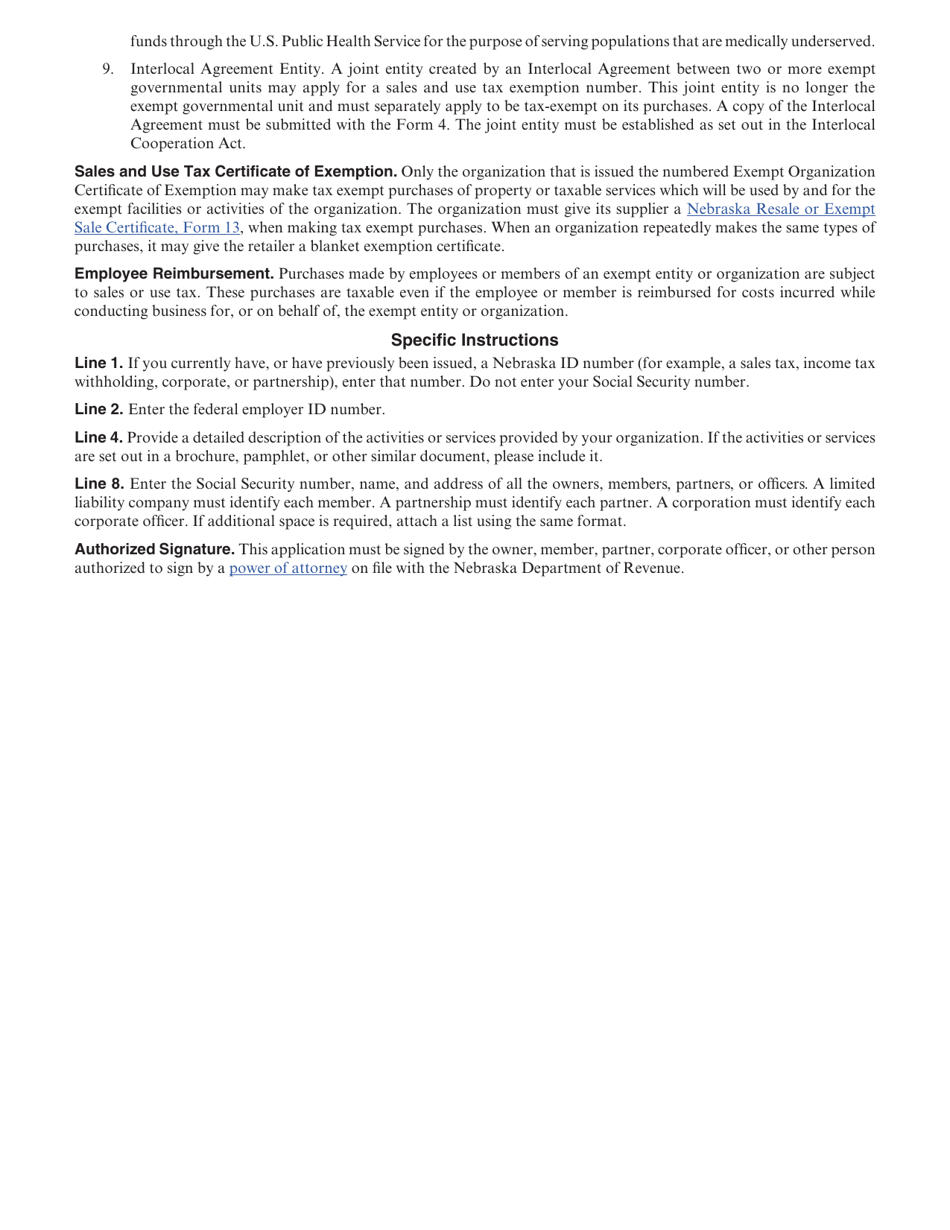

Q: What qualifies a business or organization for sales and use tax exemption in Nebraska?

A: Certain types of entities, such as non-profit organizations and government agencies, may qualify for exemption from sales and use tax in Nebraska.

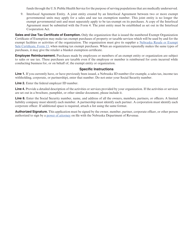

Q: How should I fill out the Form 4 Nebraska Exemption Application?

A: Carefully follow the instructions provided on the form and provide all the required information accurately.

Q: Is there a deadline for submitting the Form 4 Nebraska Exemption Application?

A: There is no specific deadline mentioned for submitting the Form 4 Nebraska Exemption Application. However, it is advisable to submit it as soon as possible.

Q: What should I do after completing the Form 4 Nebraska Exemption Application?

A: Submit the completed form to the Nebraska Department of Revenue for review and processing.

Q: Is there a fee for filing the Form 4 Nebraska Exemption Application?

A: No, there is no fee for filing the Form 4 Nebraska Exemption Application.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.