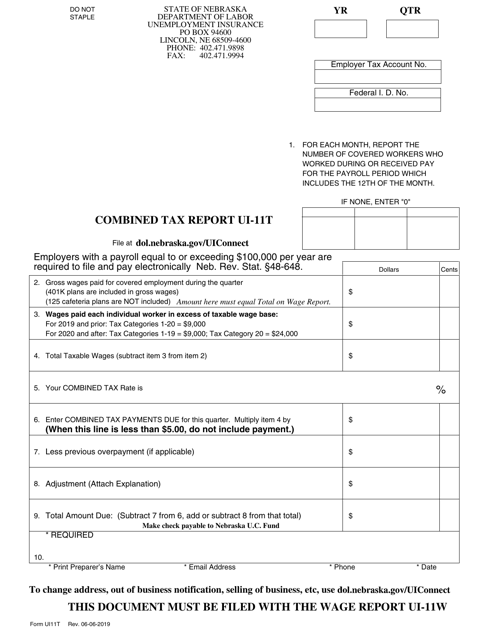

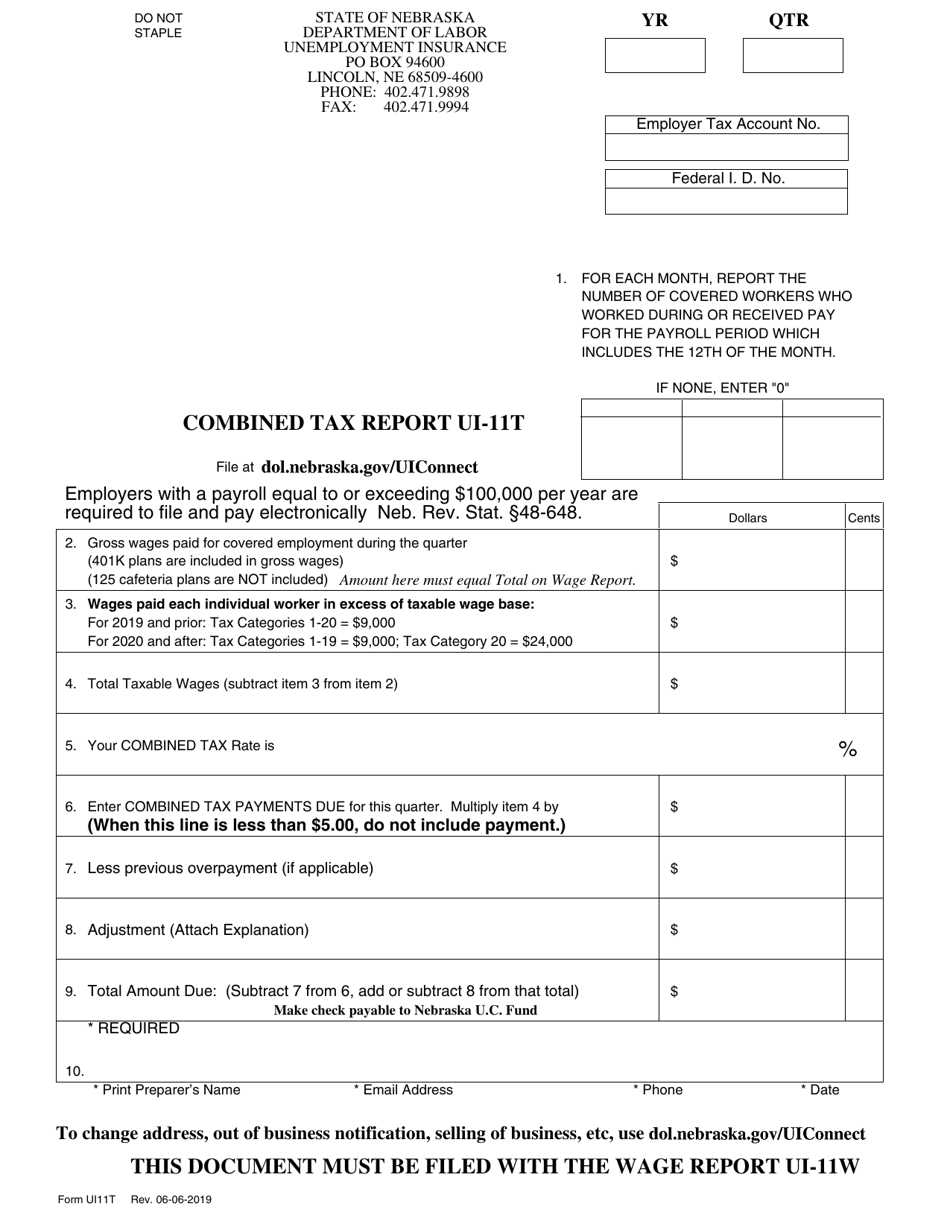

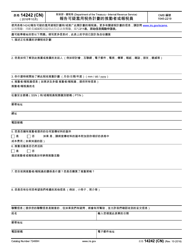

Form UI-11T Combined Tax Report - Nebraska

What Is Form UI-11T?

This is a legal form that was released by the Nebraska Department of Labor - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the UI-11T Combined Tax Report?

A: The UI-11T Combined Tax Report is a tax form used in Nebraska.

Q: Who needs to file the UI-11T Combined Tax Report?

A: Employers in Nebraska who have employees subject to unemployment insurance tax need to file the UI-11T Combined Tax Report.

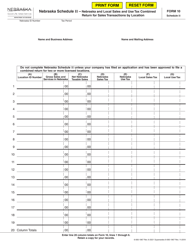

Q: What information is required on the UI-11T Combined Tax Report?

A: The UI-11T Combined Tax Report requires information on the number of employees, wages paid, and unemployment insurance taxes withheld.

Q: When is the deadline to file the UI-11T Combined Tax Report?

A: The deadline to file the UI-11T Combined Tax Report is usually the last day of the month following the end of the calendar quarter.

Q: Are there any penalties for late or incorrect filing of the UI-11T Combined Tax Report?

A: Yes, there may be penalties for late or incorrect filing of the UI-11T Combined Tax Report. It is important to file the report accurately and on time to avoid penalties.

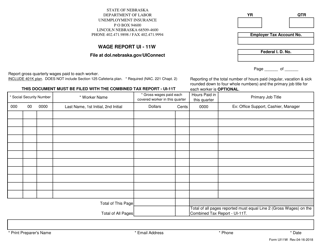

Q: Is there any additional documentation required to be submitted with the UI-11T Combined Tax Report?

A: Typically, no additional documentation is required to be submitted with the UI-11T Combined Tax Report. However, it is always recommended to review the instructions provided with the form to ensure compliance.

Q: What should I do if I have questions or need assistance with the UI-11T Combined Tax Report?

A: If you have questions or need assistance with the UI-11T Combined Tax Report, you can contact the Nebraska Department of Labor's Unemployment Tax Division.

Q: Is the UI-11T Combined Tax Report specific to Nebraska only?

A: Yes, the UI-11T Combined Tax Report is specific to Nebraska and is used to report unemployment insurance taxes for employees in the state.

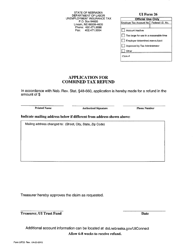

Q: Can the UI-11T Combined Tax Report be amended if there are errors?

A: Yes, the UI-11T Combined Tax Report can be amended if there are errors. You should file an amended report as soon as possible to correct any mistakes.

Q: What happens if I fail to file the UI-11T Combined Tax Report?

A: Failing to file the UI-11T Combined Tax Report or filing it late may result in penalties and interest charges.

Q: What is the purpose of the UI-11T Combined Tax Report?

A: The purpose of the UI-11T Combined Tax Report is to report and remit unemployment insurance taxes for employees in Nebraska.

Q: Is the UI-11T Combined Tax Report mandatory?

A: Yes, the UI-11T Combined Tax Report is mandatory for employers in Nebraska who have employees subject to unemployment insurance tax.

Q: Can I request an extension to file the UI-11T Combined Tax Report?

A: Yes, you may be able to request an extension to file the UI-11T Combined Tax Report. Contact the Nebraska Department of Labor for more information.

Q: Is the UI-11T Combined Tax Report available in other languages?

A: The UI-11T Combined Tax Report is typically available only in English. If you require assistance in another language, it is recommended to contact the Nebraska Department of Labor for guidance.

Q: Is there a fee to file the UI-11T Combined Tax Report?

A: There is generally no fee to file the UI-11T Combined Tax Report. However, there may be penalties for late or incorrect filing.

Q: Can I file the UI-11T Combined Tax Report manually by mail?

A: Yes, you can file the UI-11T Combined Tax Report manually by mail. However, electronic filing is recommended for faster processing.

Q: How long do I need to keep records related to the UI-11T Combined Tax Report?

A: It is recommended to keep records related to the UI-11T Combined Tax Report for at least four years.

Q: Are there any exemptions or exclusions from filing the UI-11T Combined Tax Report?

A: Exemptions or exclusions from filing the UI-11T Combined Tax Report may apply. It is recommended to review the instructions provided with the form or contact the Nebraska Department of Labor for more information.

Form Details:

- Released on June 6, 2019;

- The latest edition provided by the Nebraska Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form UI-11T by clicking the link below or browse more documents and templates provided by the Nebraska Department of Labor.