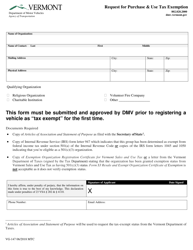

This version of the form is not currently in use and is provided for reference only. Download this version of

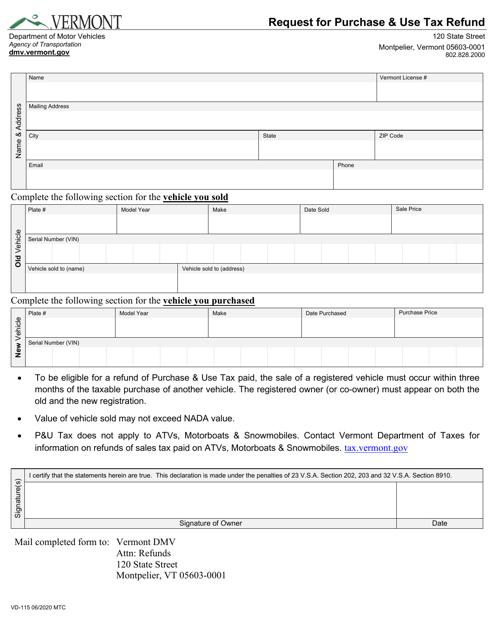

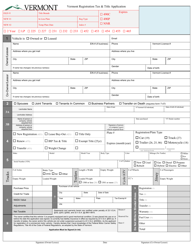

Form VD-115

for the current year.

Form VD-115 Request for Purchase & Use Tax Refund - Vermont

What Is Form VD-115?

This is a legal form that was released by the Vermont Department of Motor Vehicles - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form VD-115?

A: Form VD-115 is a Request for Purchase & Use Tax Refund form for Vermont.

Q: Who is eligible to use Form VD-115?

A: Individuals or businesses that purchased or used taxable items in Vermont and are seeking a refund of the sales or use tax paid can use Form VD-115.

Q: How do I request a purchase and use tax refund using Form VD-115?

A: To request a refund, complete Form VD-115 with accurate information about your purchases and attach any required documentation. Submit the form to the Vermont Department of Taxes.

Q: What information is required on Form VD-115?

A: You will need to provide details about your purchases, such as the date of purchase, vendor information, description of the taxable items, and the amount of tax paid.

Q: Are there any deadlines for submitting Form VD-115?

A: Yes, Form VD-115 must be filed within three years from the due date of the tax return on which the tax was originally paid.

Q: Are there any fees associated with filing Form VD-115?

A: No, there are no fees associated with filing Form VD-115.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Vermont Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VD-115 by clicking the link below or browse more documents and templates provided by the Vermont Department of Motor Vehicles.